This article was co-authored by Gina D'Amore. Gina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

This article has been viewed 48,308 times.

When you're setting up direct deposit or automatic bill payments, you'll need your bank account's routing number. If you don't have a check handy, you'll need to look elsewhere for this useful 9-digit number. Have your money sent to the right bank by knowing how to find a routing number through an Internet search or by contacting your bank.

Steps

Performing an Internet Search

-

1Type the name of your bank and "routing number" into a search engine. Routing numbers aren't specific to individuals like account numbers, so you can find them online. Open an Internet browser on your computer or smartphone and type the terms into the search bar.

-

2Open your bank's website. You can find the most trustworthy routing number information on the bank's official website. If you don't see the bank's website in the search results, choose a credible financial website.

- Selecting another bank's webpage won't help you since their information is usually specific to their account holders only.

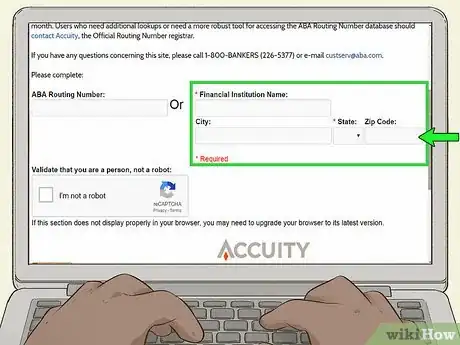

- A credible financial website, such as the American Bankers Association, is most likely to provide true information. The American Bankers Association developed the routing number system.

Advertisement -

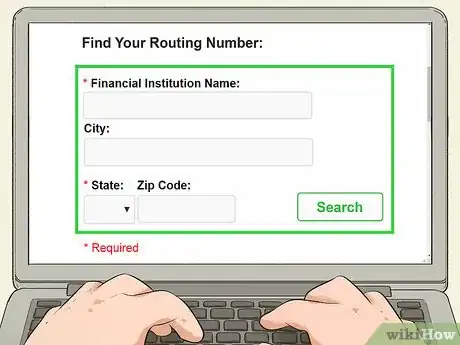

3Locate the correct state on the webpage. On the bank's official website or reliable financial website, choose the state where you, or someone else, opened the account. This may be different from the state where you currently live.

- Some webpages ask you to choose a state from a dropdown menu, then display the routing number. Other pages have a chart listing each state with their coordinating routing numbers next to them.

Finding a Routing Number on Your Online Account

-

1Type the name of your bank into a search engine. Keep in mind that some banks have branches in other countries. The United States is the only country that uses routing numbers assigned by the American Bankers Association, so be sure you choose the U.S. site for your bank.[1]

- If you know your bank's web address, you can type it directly into your search bar to visit its homepage.

-

2Log in to your online account. There is usually a place on a bank's homepage to log in to a user's account. Input your username, email or account number and your password.

- If you've forgotten your login information, click on the link asking if you've forgotten your username or password. Follow the instructions to retrieve or change your login information to access your account.

- The safest way to access your online bank account is through your personal device on a secure network. A secure network's web address begins with "https" rather than "http." Avoid using a public computer to access sensitive information like your bank account.[2]

-

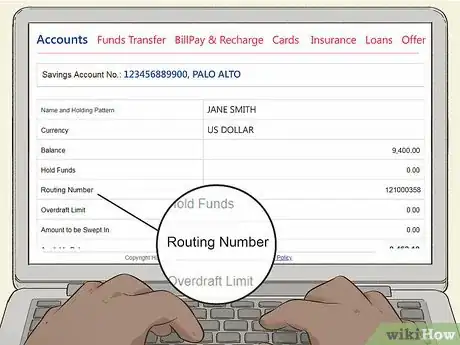

3Navigate to your personal user account. Bypass any ads or messages that you may encounter to view your account. If you have multiple accounts, click on the one whose routing number you are trying to find.

-

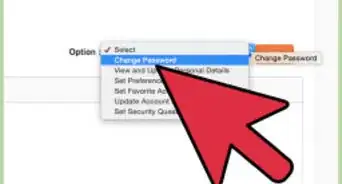

4Click on your account information section. Locate an icon with your name in the top left or right corners of the webpage. This is usually where you'll find your account information, messages and settings.

- The section where you'll find your routing number and other account information vary by bank. You may be able to find your routing number by clicking on Account Information, My Profile or other sections in this area.[3]

-

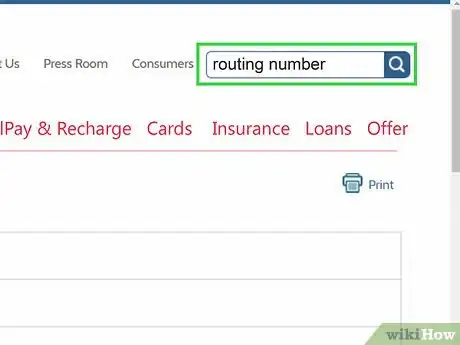

5Type "routing number" into the search bar on your bank's website. Some banks don't include routing numbers in individual online accounts. If you can't find your routing number by logging into your account, use the website's search bar.[4]

- You can usually find the search bar near the top of any webpage or on the homepage. It may have an icon of a magnifying glass next to it.

- Scroll through the search results to find a link to a page about routing numbers.

-

6Look for the state where you opened the account. If the page includes a chart listing U.S. states and their routing numbers, locate the state where you opened the account. You may also need to input your account number or other information to populate the routing number.

Contacting Your Bank

-

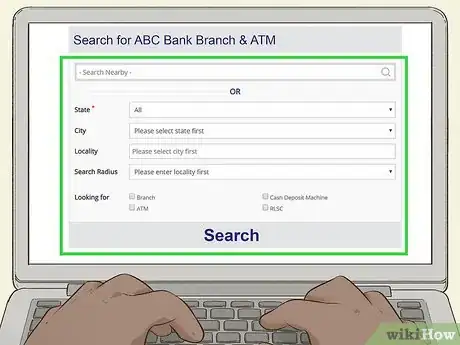

1Find the phone number for your local branch. On the bank's official website, click on Locations or Branches. Input your address or zip code to find the branch nearest you and its phone number.

- If you don't have Internet access, use the phone number on the back of your debit card.

-

2Have your debit card or bank account number close at hand. The representative may want to verify that the account for which you want the routing number is with their bank.[5]

- Debit cards don't contain account numbers, but a banker can use them to verify your other accounts.

- If you don't have a debit card and need a routing number for a savings account, locate your account number on a bank statement.

-

3Provide the representative with your information. A banker may ask for the account number to pull up your information. You may be able to simply provide the state where you opened the account.

- If you can't remember in which state you opened the account, ask the representative to double check. They will be able to find the state in which you made the original application for your account.

-

4Visit your local bank branch if you don't feel comfortable giving information over the phone. Search online to find the location of the nearest branch, and make note of its business hours. Banks close on national holidays and may not be open on Sundays.

- Routing numbers are public information, so you may not need any identification. However, to ensure you're receiving the right routing number, have your debit card on you so a teller can verify your state.

Expert Interview

Thanks for reading our article! If you'd like to learn more about finding the routing number, check out our in-depth interview with Gina D'Amore.

References

- ↑ https://wallethub.com/edu/routing-number/14293/

- ↑ https://economictimes.indiatimes.com/slideshows/investments-markets/8-tips-to-use-internet-banking-safely/how-can-i-tell-if-a-web-page-is-secured/slideshow/55115407.cms

- ↑ https://www.encyclopedia.com/articles/how-to-find-a-routing-number-without-a-check/

- ↑ https://wallethub.com/edu/routing-number/14293/

- ↑ https://www.encyclopedia.com/articles/how-to-find-a-routing-number-without-a-check/

- ↑ https://wallethub.com/edu/routing-number/14293/

- ↑ https://www.bankrate.com/banking/routing-number-on-check-how-does-it-work/