This article was co-authored by Gina D'Amore. Gina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

There are 12 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 41,715 times.

You might want to transfer an IRA if you find a bank with more attractive rates, want to consolidate your finances, or if your broker switches firms. While making a transfer involves some attention to detail, it’s a relatively simple process. Open an IRA account with your new bank, fill out a transfer instruction form, then allow 3 to 5 business days to complete the transfer. If you’re converting a traditional IRA to a Roth IRA, you’ll need to take a few extra steps to manage your tax liability.

Steps

Opening a New IRA

-

1Choose between a traditional IRA and Roth IRA. If you don’t already have another IRA with another institution, you’ll have to open a new account before making a transfer. You’ll need to factor in your overall financial plan when you choose a new IRA.[1]

- If you currently hold a Roth IRA, you’ll need to open a Roth IRA with your new bank. You can’t transfer or roll over a Roth IRA to a traditional IRA.[2]

- If you currently have a traditional IRA, opening a traditional IRA with the new bank is probably your best option, especially if you’re in a higher tax bracket or close to retirement. Contributions to a traditional IRA aren’t taxed. You’ll pay taxes on distributions you collect from the account after you retire, and you’ll likely fall into a lower tax bracket during retirement.

- If you’re in a low tax bracket and expect to pay higher taxes later in life or during retirement, it might be best to open a new Roth IRA. Your contributions to a Roth IRA will be taxed at your current, low tax rate. You won’t have to pay taxes on distributions you collect during retirement when you might have a higher tax rate.

- Keep in mind you’ll need to pay taxes if you transfer untaxed funds from a traditional IRA to a Roth IRA. If your tax rate is currently under 20 percent, but you expect to pay 25 percent during retirement, paying taxes on a Roth conversion might save money in the long run.[3]

-

2Look for a provider with low fees and strong investment options. Check online for reviews and consumer reports. Choose a new bank with low or no annual fees, low-cost investment options (such as no-transaction fee mutual funds), and excellent customer service.[4]

- Some banks also match contributions for a limited period (such as the first 3 years) or offer other incentives. Make sure these incentives won’t be canceled out by high portfolio management fees.[5]

- Paying higher ongoing fees by even a fraction of a percent can cost thousands over the life of your IRA.[6]

- It's also important to check the minimum investment needed before deciding on a financial institution.

Advertisement -

3Ask your old bank and potential new providers about transfer fees. Both banks will charge you transfer fees and are required to disclose those fees in advance. When you shop around for a new bank, compare potential provider’s fees. Ask your current bank how much they’ll charge, and make sure switching justifies the cost.[7]

- For instance, a new bank might offer lower portfolio management costs that, in the long-term, will justify paying transfer fees.

-

4Verify that your assets are transferable. Ask a potential new provider if any of your assets might be non-transferable. If you can’t transfer an asset, you might have to liquidate it, which will incur tax liability. You might be able to leave non-transferable assets with your old bank, but you’ll incur fees if you don’t make contributions to the old IRA.[8]

- Non-transferable assets might include securities sold only by your old firm or mutual funds not available at a new firm.

- If you have a sizable non-transferable asset, liquidating it might push you into a higher tax bracket, and leaving it in an inactive account could be an unreasonable expense. If necessary, you should reconsider making the transfer or try to find a firm that can facilitate the transfer.

-

5Consult your broker if they’re moving to a new firm. When a broker or investment adviser switches companies, they often ask clients to transfer accounts to their new firm. If this is the case, make sure switching firms is in your best interest.[9]

- Ask them why they’re moving to a new firm and if they receive any compensation for convincing you to transfer accounts. Discuss rates, fees, and other financial incentives to make the switch. Don’t forget to verify that your assets are transferable.

-

6Contact the new bank to open a new account. Once you’ve settled on a new bank, visit their website, call them, or visit them in person to create a new IRA account. The process is simple and similar to opening a bank account.[10]

- You can’t start a direct transfer without first opening an account with a new firm.

Making a Direct Transfer

-

1Make a transfer instead of a rollover. After opening the new IRA, you should transfer your old IRA instead of rolling it over to the new account. In a transfer, funds go directly from the old firm to the new firm and are not taxable.[11]

- If you roll over funds, your old bank sends you a check, and you’ll have 60 days to deposit the funds into a new IRA. If you don’t deposit the money on time, you’ll have to report the entire sum as taxable income and, if you’re under 59 1/2 years old, you’ll incur an additional 10 percent penalty.

-

2Consult your new bank if you need to reallocate investment funds. An IRA isn’t an investment; it’s more like a savings account that holds your investments. It might be advantageous to reallocate your investments after switching banks. Ask your broker or investment adviser if you should make any changes to your portfolio.[12]

- For example, your new bank might have broader investment options with higher annual returns and lower or no transaction fees.

- Keep in mind you need to transfer the old IRA in full in order to avoid tax liability. You can’t withdraw cash from the old IRA, transfer the remaining sum, use the withdrawn funds to purchase new assets, then deposit those new assets into your new IRA account. You would need to pay taxes on those withdrawn funds based on your current tax bracket, plus applicable penalties.[13]

-

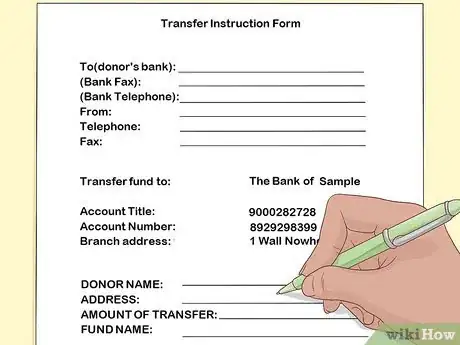

3Send a transfer instruction form (TIF) to your new bank. Fill out a TIF to start the transfer process. You can submit the form online on your new firm’s website. You’ll need to provide your identifying information, old account information, transfer amount, transfer date, and other details.[14]

- If you’re going through a divorce, you might need to transfer part of an IRA to a new account in your name or in your former spouse’s name. If so, specify the transfer amount you or your former spouse is entitled to instead of the IRA’s total value.[15]

-

4Follow up with both banks during the transfer process. After you submit the TIF, the new bank will request a transfer from your old bank. The old bank will send a list of assets to the new bank, who then approve the transfer.[16]

- The transfer process should take 3 to 5 business days. During that time, call both banks periodically to check your progress.

- The transfer can only be rejected if your assets aren’t transferable or aren’t in compliance with your new firm’s policies. If you verified that your assets are transferable beforehand, you shouldn’t run into any difficulties.

-

5Compare your statements after completing the transfer. After completing the transfer, wait for your new firm to send your first monthly statement. When you receive it, compare it with the last statement you received from your old bank. Verify that your numbers match and that all of your assets were transferred correctly.[17]

- If you see any discrepancies, call your old and new banks for an explanation. If necessary, contact the compliance directors of both banks. If they don’t provide a satisfactory answer, contact the Securities and Exchange Commission at http://www.sec.gov.

Managing a Roth Conversion

-

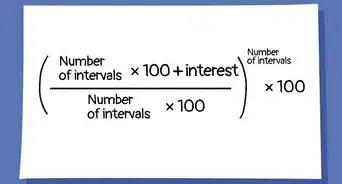

1Figure out your tax liability before transferring funds into a Roth IRA. Converting a traditional IRA to a Roth IRA makes financial sense in some circumstances. It’s a good move if you have losses or deductions that balance out the tax liability incurred by the conversion. However, if the conversion would push you into a higher tax bracket and you don’t have extra funds to cover higher taxes, transferring to a Roth IRA probably isn’t wise.[18]

- If your contributions to your traditional IRA were deducted from your paycheck as pre-tax income, they weren’t taxed. When you transfer your traditional IRA to a Roth IRA, you’ll need to pay taxes on those funds based on your current tax bracket.

- Never withdraw money from your traditional IRA to cover your tax liability. The money you use from the old IRA to pay your tax liability would be counted as ordinary income, which would further increase your incurred taxes.

-

2Verify that you can make a direct transfer to a Roth IRA. You should be able to directly transfer funds from a traditional IRA to a Roth IRA using the same steps as transferring one traditional IRA to another. Call your old and new banks to make sure. Some firms can only transfer funds to a new Roth IRA indirectly, or by mailing you a check.[19]

- If your old bank has to send you a check, make sure you deposit the funds into your new Roth IRA within 60 days. Any funds from the traditional IRA not deposited into the Roth IRA will incur additional taxes and penalties.[20]

-

3Report the transfer on your next income tax return. You’ll need to fill out form 8606 to report the conversion on your next income tax return. Any untaxed portion of your old traditional IRA that was transferred to your new Roth account will be taxed based on your current tax bracket.[21]

- You may be required to start paying estimated taxes in advance at the time of the conversion.[22]

References

- ↑ https://www.nerdwallet.com/blog/investing/roth-or-traditional-ira-account/

- ↑ https://www.irs.gov/pub/irs-tege/rollover_chart.pdf

- ↑ https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-iras#Rollovers%20and%20Roth%20Conversions

- ↑ https://www.nerdwallet.com/blog/investing/the-best-ira-account-providers/

- ↑ https://money.com/ira-rollover-free-money-watch-out/

- ↑ https://www.sec.gov/oiea/investor-alerts-bulletins/ib_fees_expenses.pdf

- ↑ https://www.helpwithmybank.gov/get-answers/bank-accounts/bank-fees/faq-bank-accounts-bank-fees-05.html

- ↑ https://www.sec.gov/oiea/investor-alerts-bulletins/ib_transferaccount.html

- ↑ https://www.sec.gov/oiea/investor-alerts-bulletins/ib_transferaccount.html

- ↑ https://www.nerdwallet.com/blog/investing/how-and-where-to-open-an-ira/

- ↑ https://www.sec.gov/oiea/investor-alerts-bulletins/ib_transferaccount.html

- ↑ https://www.nerdwallet.com/blog/investing/how-and-where-to-open-an-ira/

- ↑ https://www.investopedia.com/articles/retirement/06/rollovermistakes.asp

- ↑ https://www.sec.gov/oiea/investor-alerts-bulletins/ib_transferaccount.html

- ↑ https://www.irs.gov/publications/p590a#en_US_2016_publink1000230658

- ↑ https://www.sec.gov/oiea/investor-alerts-bulletins/ib_transferaccount.html

- ↑ https://www.sec.gov/oiea/investor-alerts-bulletins/ib_transferaccount.html

- ↑ https://www.irs.gov/publications/p590a#en_US_2016_publink1000231030

- ↑ https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-iras#Rollovers%20and%20Roth%20Conversions

- ↑ https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-iras#Rollovers%20and%20Roth%20Conversions

- ↑ https://www.irs.gov/publications/p590a#en_US_2016_publink1000231030

- ↑ https://www.irs.gov/publications/p590a#en_US_2016_publink1000230658