This article was co-authored by wikiHow staff writer, Travis Boylls. Travis Boylls is a Technology Writer and Editor for wikiHow. Travis has experience writing technology-related articles, providing software customer service, and in graphic design. He specializes in Windows, macOS, Android, iOS, and Linux platforms. He studied graphic design at Pikes Peak Community College.

The wikiHow Tech Team also followed the article's instructions and verified that they work.

This article has been viewed 335,042 times.

Learn more...

You probably make most of your financial transactions electronically, which makes it hard to track your spending. Fortunately, your bank keeps a record of all of your transactions for you, so all you need to do is check your balance. The easiest way to monitor your bank balance is to use online banking through your bank’s website or app. However, you can also check your balance at any ATM or at a local branch of your bank.

Steps

Using Online Banking

-

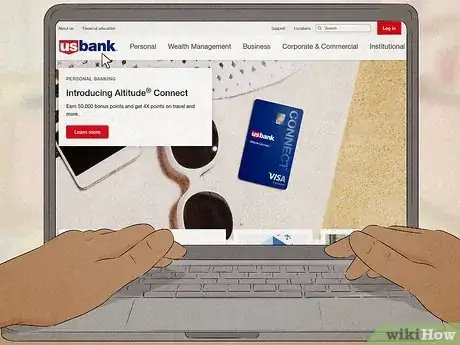

1Go to your bank’s website on your computer or phone. To find the website, type the name of your bank into your Internet browser’s search bar. Then, click on the link to the website to open up the page.[1]

- Make sure the URL starts with "https:" so you know the connection is secure.

- Do not access your bank information from any public computer or computer that you are not familiar with.

Variation: Download your bank’s mobile app to your smartphone or tablet if one is available. Look for the app in the app store or Google Play Store. This will make it easy for you to check your balance anytime.

-

2Create an account using your account information if you don't have one. Click on the link that says “create an account” or “register.” Then, fill in all of the boxes to create an account. You’ll likely need to enter your account number, routing or sorting number, name, date of birth, and email address. Additionally, you’ll create a user name and password.[2]

- If you don’t see a link to create an account, select “log in” and look for “create an account” below the log in boxes.

- If you already have an online banking account, skip this step and log in to your existing account.

- Some banks may require you to call or visit a bank branch to begin online banking.

- When creating a password for your bank, be sure to use a strong, unique password. The password should be at least 8 characters long and contain, upper and lowercase letters, numbers, and special characters. It should be a unique password that you have not used with any other application. You can use a password manager to create strong and unique passwords for all your apps and store them securely.

Advertisement -

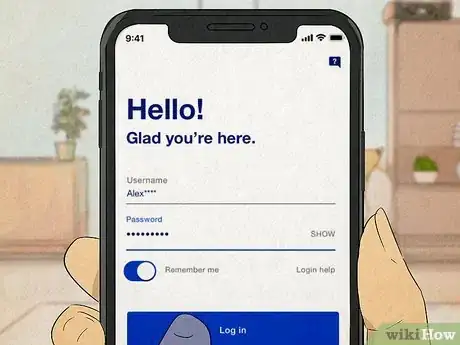

3Log in to online banking with your username and password. Type your username and password into the correct boxes on the screen to log in. Then, answer the security questions if they’re required.[3]

- Make sure that the “remember me” option isn’t checked if you’re using a public computer.

- It’s common for banking websites to ask you security questions if you’re logging in for the first time or using an unknown computer.

-

4Click on your account summary to see your balance. Look for a tab that says something like “account summary” or “checking account.” Click on this link to see your account balance and recent transactions.[4]

- Quickly read over the listed transactions to make sure nothing is missing.

Warning: Some debits may not show up right away, so your balance may not always be accurate. For instance, checks, automatic payments, and third-party payments can take awhile to post to your account.[5]

-

5Log out of your account when you’re finished. Typically, bank websites will automatically log you out after a certain amount of time, which is usually 30 minutes. However, it’s best to manually log yourself out so that no one can access your banking information. Click the “log out” button to end your online banking session.[6]

Using a Mobile App

-

1Download and install your bank's mobile app. Most popular banks, including, Bank of America, Wells Fargo, Chase, Capital One, and USAA, all have mobile banking apps. These apps can be used to check your account balance, transfer money, pay bills, and sometimes even deposit checks. Use the following steps to download and install your bank's mobile app to your smartphone or tablet:

- Open the Google Play Store on Android, or the App Store on iPhone or iPad.

- Tap the Search tab (iPhone and iPad only).

- Enter the name of your bank in the search bar.

- Tap GET or Install next to your banks mobile app.

-

2Open your bank's mobile app and register a new account. Once the mobile banking app is finished downloading, tap the app's icon to open it and then select the option to Register, Create an account or something similar. The registration process is different from one mobile banking app to the next. Generally, you will need to read and agree to the terms of service. Answer all the questions to verify your identity. Be sure to have your account number and routing or sort number (or credit card) ready to enter. Then create a username and password, as well as a security question incase your forget your password, or log in on a different device.

- If you have already created an online banking account through your bank's website, you may be able to log in to the mobile app using the username and password you used to register for online banking.

- Some mobile banking apps require you to create a PIN you can use to log in. You may also be able to use your fingerprint scanner, TouchID, or FaceID to sign in.

- When creating a password for your bank, be sure to use a strong, unique password. The password should be at least 8 characters long and contain, upper and lowercase letters, numbers, and special characters. It should be a unique password that you have not used with any other application. You can use a password manager to create strong and unique passwords for all your apps and store them securely.

-

3Open your mobile banking app and log in. Once you have registered an account with your mobile banking account, you can log in using your username and password. Tap the mobile bank app icon, and then select the option to Log In, Sign In or similar. Enter your username and password and then tap Sign In, Log In or similar.

- Some mobile banking apps require you to enter a PIN or use your fingerprint or FaceID to log in every time you open the app.

-

4Select the option to view your bank accounts. This will generally be the home page that opens when you log in to the app. If not, tap the option that says Accounts, Summary, Bank Info, "My [Bank Name]", or something similar. This should display all the bank accounts you have with your bank.

-

5Tap the account you want to check. If you have multiple bank accounts with the same bank (such as a checking and savings account), you will need to tap whichever bank account you want to check. The balance should be displayed at the top along with a list of all your recent transactions.

- Bank balances may not be 100% up-to-the-minute accurate. If you've made recent transactions, it may take up to 24 hours for them to be reflected on your mobile banking app.

- Be careful when accessing your bank account when traveling. Try to avoid accessing your bank account when using public Wi-Fi. If you absolutely need to access your bank account, be sure to use a VPN.

Going to an ATM

-

1Find an ATM in-person or using your phone. You can usually check your balance at any ATM, even if it’s not owned by your bank. Look for an ATM at local bank branches, grocery stores, gas stations, and some retail locations. At the bank, there should be an outside ATM that's available 24 hours a day and an inside ATM that's available during business hours. At other locations, they're typically located in either the front or the back of the store.

- Many banks have a drive-up ATM that you can use without getting out of your car.

- It’s best to use ATMs that are indoors because they’re less likely to be tampered with by thieves. However, it’s usually safe to use outdoor ATMs, so don’t worry if that’s your only option.

Tip: If you go to your bank’s ATM, you likely won’t need to pay a fee to check your balance. However, you may need to pay a fee if you go to another bank’s ATM.

-

2Insert your debit card into the ATM. Check the diagram on the machine to find out which side the card’s strip needs to be on. Then, slide your card into the machine’s card slot. Leave the card in during the transaction or pull it out, depending on how the machine works.

-

3Type in your personal identification number (PIN) code. This is the 4-digit number you received or set up when you got your debit card. Type it in using the keypad, then select enter.

- If someone is waiting to use the ATM after you, cover the keypad so they can’t see what you enter.

-

4Select the option to view your bank balance. Most machines will display all of your banking options. Choose the one that says “balance.” Then, select the type of receipt you want.

- It may display your balance on the screen. However, some machines only show your balance on your receipt.

-

5Take the receipt that shows your account balance. You can typically get a paper receipt or e-receipt. This will show you your current balance.

- If the machine displays your balance on the screen, you might choose not to get a receipt.

-

6Log out of the machine. Some machines log you out automatically, but others let you select another option. To make sure your account information stays safe, push the button to log out or to complete your transaction.

- Make sure you also take your card back if you haven’t already. If the machine holds your card while you complete your transaction, it will slowly eject from the card slot once you complete your transaction.

Visiting the Bank

-

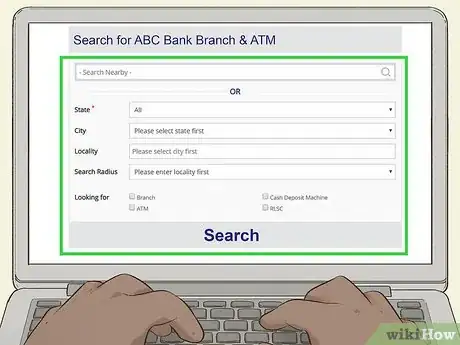

1Go into a branch of your bank. Find the bank branch closest to you by searching online. Then, visit the branch so you can talk to a bank teller.[7]

- If you open your phone’s map app, it’ll easily find the branch closest to your current location.

Tip: You may be able to call your bank to check your balance. However, banks commonly require you to go in person so they can verify your identity.

-

2Tell the bank teller that you need to check your balance. You may need to wait in line to talk to a teller. When it’s your turn, go to the window and ask for your bank balance.[8]

- Typically, the bank tellers will be at a big desk in the center of the bank’s interior. If you can’t find it, ask an employee for help.

-

3Provide your account number or debit card and a photo ID. The bank teller will ask for your account identification information. Provide your account number or debit card so they can look up your account. Then, give them your photo ID card to prove you’re the account holder.[9]

- You can typically use any government-issued ID card. The teller will likely ask to see it to protect your account from someone posing as you.

-

4Get a receipt from the teller, which will show your balance. The teller may print out a receipt for you, but they might just write out your balance. Take the receipt with you when you leave.[10]

- The receipt may have your account information on it, so don’t just leave it at the bank.

Community Q&A

-

QuestionMy card is not working. How I can check my account balance without net banking?

DonaganTop AnswererCall or visit your bank.

DonaganTop AnswererCall or visit your bank. -

QuestionHow do I find out the balance on a debit card?

DonaganTop AnswererYour card balance is the same as the balance in your linked account. Inquire at the bank or on their website.

DonaganTop AnswererYour card balance is the same as the balance in your linked account. Inquire at the bank or on their website. -

QuestionHow can I check my account balance without my debit card?

EricTop AnswererYou can check your account balance using mobile banking, online banking, telephone banking, calling your bank, or stopping into your bank.

EricTop AnswererYou can check your account balance using mobile banking, online banking, telephone banking, calling your bank, or stopping into your bank.

Warnings

- Make sure you’re protecting your bank account information so that no one can steal it. Only log into your account on a secure device and hide your PIN number while you’re using an ATM.⧼thumbs_response⧽

References

- ↑ https://pocketsense.com/check-debit-card-balance-atm-24152.html

- ↑ https://onlinebanking.nationwide.co.uk/Registration/CustomerSelfRegistration/SelectAccountType

- ↑ https://pocketsense.com/check-debit-card-balance-atm-24152.html

- ↑ https://pocketsense.com/check-debit-card-balance-atm-24152.html

- ↑ https://www.forbes.com/sites/laurengensler/2016/07/13/online-bank-account-balance-overdraft-fees/#2cc8f24b1ec6

- ↑ https://www.forbes.com/sites/laurengensler/2016/07/13/online-bank-account-balance-overdraft-fees/#2cc8f24b1ec6

- ↑ https://pocketsense.com/check-debit-card-balance-atm-24152.html

- ↑ https://pocketsense.com/check-debit-card-balance-atm-24152.html

- ↑ https://pocketsense.com/check-debit-card-balance-atm-24152.html

About This Article

To check your bank balance online, go to your bank’s website and log in with your username and password. Once you're logged into your account, click on “Account Summary" to review your electronic statement, which includes your current balance and recent transactions. When you're done, make sure to logout as an added security measure. Alternatively, check your balance by inserting your debit card into an ATM and follow the prompts, like inputting your PIN, to access your account. Then, scroll through the menus until you find the option "Check Balance” to view your information. To learn how to check your bank balance in person at your bank, keep reading!