This article was co-authored by Gina D'Amore. Gina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

This article has been viewed 230,351 times.

Due to the increase in electronic payments, most banks are set up to transfer money from one institution to another. The ease, cost and delay of transfer vary greatly depending upon your banks’ service. There are also third party companies that can handle transfers for you. Which method is right for you can vary based on how long you are willing to wait for the transfer to post and how much money you are willing to spend in fees.

Steps

Transferring Money Using the Automated Clearing House

-

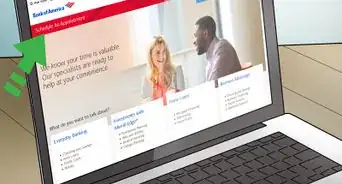

1Contact your bank. Automated Clearing House (ACH) payments fall into one of two categories: debit and credit payments. Transferring money between bank accounts is considered a debit and can be completed fairly quickly. Different banks sometimes have different ACH payment procedures that you will need to follow in order to transfer your money. ACH payments are extremely common and are used in different forms to direct deposit paychecks, pay bills online and transfer money between accounts.[1]

- Tell your bank you would like to execute an ACH transfer and they will walk you through the steps if you would like to do it over the phone.

- Banks often charge fees for ACH transfers. The fee is usually under ten dollars, but ensure you find out exactly what the fees will be.

-

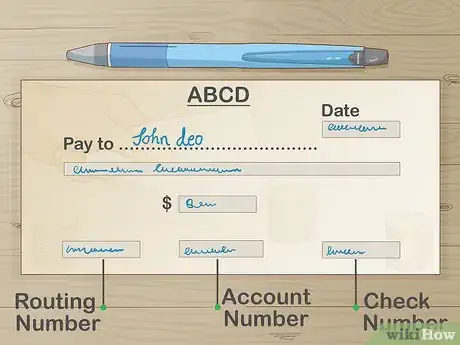

2Gather the pertinent bank information. You will need, at minimum, the bank account and routing number of the account you wish to transfer money to. You can find these numbers on the bottom of a check you have for the receiving account. The account number is on the bottom right and the routing number is on the left. If you are sending the money to someone else, you will need to get this information from them.[2]

- Routing numbers are often available online. The routing number is an identifier for the bank your account is in, so try looking on their webpage to locate it.

- You will also likely need the name of the person on the account you are transferring the money to if it isn’t your own account.

- Be careful when sharing any banking information with other people. Do not provide your account numbers to people you do not have sufficient reason to trust.

Advertisement -

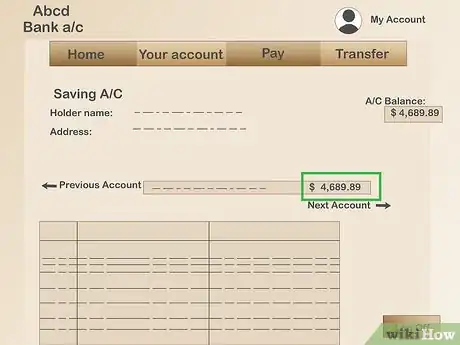

3Ensure you have sufficient funds in your account. An ACH transfer can overdraw your account if the funds are not available, which may incur overdraft fees from your bank. Before executing an ACH transfer, be sure to verify that you have the money in your account.

- Make sure any deposits you need to make the transfer have cleared.

- Ensure there are no outstanding debits that haven’t posted yet that could bring your balance below the amount you are transferring.

-

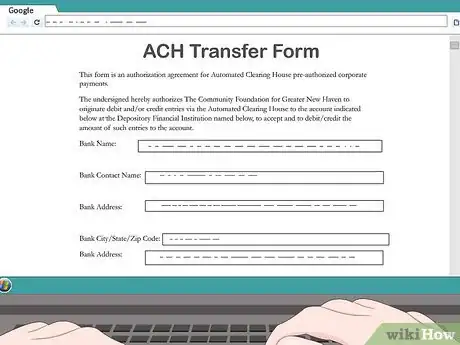

4Fill out the transfer online, at the bank, or over the phone. Many banks with online banking allow you to complete ACH transfers simply by filling out an online form, but you may prefer speaking to someone over the phone or in person. Regardless of the method you use to convey the information, you will need to provide your own account information and the recipient account and routing number. Make sure to specify how much you would like to transfer.[3]

- Many banks allow you to set up automatic, recurring ACH transfers for recurring bills or transfers to a savings account.

-

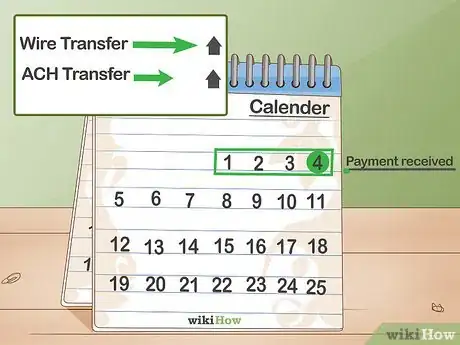

5Wait one to three days for the transfer to post. ACH transfers are slower than wire transfers, but usually cost less. It can take up to three business days for the money to reach the recipient account. The time and day you send the money can affect how long it takes for the funds to arrive. Submitting an ACH transfer late in the day may mean the process won’t begin until the following day and weekends do not count as business days. As a result, using an ACH transfer late on a Friday can mean waiting up to five days to receive the funds (longer if there are any holidays).[4]

- Remember that weekends and federal holidays do not count as business days.

- If the money does not post in the other account within three days, contact the sending bank to see if there has been an issue with the transfer.

Sending Money Via Wire Transfer

-

1Contact your bank. Wire transfers are quick and secure, but different banks often have slightly different procedures required to execute them. Contact your bank to find out what their procedure is and how much they charge for wire transfers.

- You can use the wire transfer to transfer money from one bank account to the next.

- Make sure to ask about the fees associated with the wire transfer.

- Ask what specific information your bank requires to execute a wire transfer.

-

2Ensure you have the necessary funds. A wire transfer can be one of the more expensive options when transferring money between bank accounts. Make sure you have enough money in the sending account to cover the transfer as well as the cost associated with executing it, otherwise your account may be overdrawn and you may incur additional fees.[5]

- Expect to pay around $25 to transfer money to another bank account domestically.

- Transferring money to an international account will likely cost more than $40.

- Recipient accounts sometimes also charge a fee to receive a wire transfer. These fees usually range from $8 to $10.

-

3Complete a wire transfer form. Some banks allow you to complete the wire transfer form online or over the phone, but you may also choose to fill one out in person at a branch location. Your wire transfer form will require the sending and receiving accounts and routing numbers as well as the amount you intend to transfer.[6]

- You can find the account and routing numbers on a check. The routing number is on the bottom left, and the account number is on the right.

- Ensure you have these numbers written clearly and accurately otherwise the money will not be transferred to the right account.

-

4Provide required forms of identification. Depending on how you complete a wire transfer, different forms of identification may be required to verify your identity. If you complete the form online, your log in information may be sufficient. When completing a wire transfer over the phone, you may be asked a few questions to verify your identity such as your date of birth and social security number. In person, you can simply provide a photo ID.[7]

- Be prepared to offer proof of your identity that is appropriate for the method you are using to complete the wire transfer form.

- Some banks may ask you to establish a pin or code word to use over the phone. You will need to provide that as well as your personal information.

-

5Wait for the transfer to post. Wire transfers are often extremely quick and can post to the new account within just a few hours. Be aware that the time of day you request the transfer can affect how quickly it posts to another account, as they may not be processed over the weekend.[8]

- International wire transfers can take up to a few days to post, whereas domestic ones often post the same day.

- If the money does not post within a day, contact the sending bank to ensure there were no issues.

Using a Third Party Service to Transfer Money Online

-

1Choose a company to use to transfer your funds. There are a number of companies that can help you transfer money from one bank account to another. Two common ones are Western Union and PayPal. Companies usually require that you establish an account with them and pay a fee for transfer service. Depending on the company, the recipient may also be required to establish an account.

- Ensure you have enough money in the transferring account to cover the transfer as well as any fees associated with the transfer service.

- You may need the recipient bank account and routing number, or you may be required to provide the recipient’s account information for the company you are using to conduct the transfer.

-

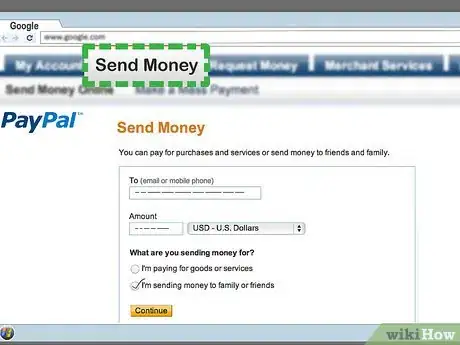

2Use PayPal to transfer money. PayPal is a web-based company that allows you to send and receive funds online. If you already have a PayPal account that is tied to your bank account, this process can be fairly simple, if not, both you and the recipient of the funds will need to establish accounts. If you and the recipient both have PayPal accounts, the transfer will be free. PayPal transfers can be completed the same day, but the recipient may have to wait three to four days to transfer the money from their PayPal account to their bank account.[9]

- Simply click on “send money to a friend” on the top of the page.

- Type the e-mail address or phone number of the recipient of the funds transfer, then provide the amount to transfer. Click next when you are done.

- Review the information and click “send.”

-

3Use Western Union to transfer money. You can use Western Union to transfer funds in much the same way as PayPal, though Western Union is most often used to transfer money internationally. You will need to create a Western Union account in order to transfer funds using their service. The recipient will not need a Western Union account if you transfer money to a bank account. The fee Western Union charges is based on the amount you transfer and the location of the recipient bank. Western Union transfers can take up to three business days.[10]

- Click on “start transaction” within your Western Union profile.

- Enter the recipient bank account, routing number and name.

- Choose “bank transfer” as your payment method and indicate the amount you want to transfer.

- Review the information you have filled out and click “send.”

Community Q&A

-

QuestionCan I transfer funds using a debit card?

Community AnswerBanks cannot do transfers through debit cards. However, there are multiple ways to do a transfer through the account that the card is linked to, and the information on the card.

Community AnswerBanks cannot do transfers through debit cards. However, there are multiple ways to do a transfer through the account that the card is linked to, and the information on the card. -

QuestionMy husband is out of the country. Can he transfer money out of his account to mine, in different banks?

Community AnswerNo, he can't. He'll need to make a bank cheque, do a telegraphic transfer, or use Internet Banking. (Note that the first two options typically have fees associated with them.) He can speak to the bank the funds are coming from for help with it.

Community AnswerNo, he can't. He'll need to make a bank cheque, do a telegraphic transfer, or use Internet Banking. (Note that the first two options typically have fees associated with them.) He can speak to the bank the funds are coming from for help with it. -

QuestionMy father died, how will we get the money from his account?

PreuxFoxTop AnswererYou will need to bring paperwork to the bank proving that your father has passed and that you have the legal right to access the account. You could call your bank to find out what exactly they need in this situation; in the US, you will probably need a copy of the death certificate, and a copy of the will or other legal document showing that you are the rightful recipient of the funds. If you bring these documents into a local branch of your bank, they should be able to assist you. This situation may take some time to resolve, so try to do it at a time when you won't be rushing off to another appointment.

PreuxFoxTop AnswererYou will need to bring paperwork to the bank proving that your father has passed and that you have the legal right to access the account. You could call your bank to find out what exactly they need in this situation; in the US, you will probably need a copy of the death certificate, and a copy of the will or other legal document showing that you are the rightful recipient of the funds. If you bring these documents into a local branch of your bank, they should be able to assist you. This situation may take some time to resolve, so try to do it at a time when you won't be rushing off to another appointment.

References

- ↑ https://wallethub.com/edu/ach-payment/11932/

- ↑ https://wallethub.com/edu/ach-payment/11932/

- ↑ https://wallethub.com/edu/ach-payment/11932/

- ↑ https://wallethub.com/edu/ach-payment/11932/

- ↑ https://www.nerdwallet.com/blog/banking/what-is-a-wire-transfer/

- ↑ https://www.nerdwallet.com/blog/banking/what-is-a-wire-transfer/

- ↑ https://www.nerdwallet.com/blog/banking/what-is-a-wire-transfer/

- ↑ https://www.nerdwallet.com/blog/banking/what-is-a-wire-transfer/

- ↑ https://www.paypal.com/selfhelp/article/FAQ1684

About This Article

To transfer money from one bank to another, start by gathering the information you’ll need to transfer the funds, like the routing and account numbers of the account you’re sending money to. These can be found at the bottom of a check, or through online banking. Then, fill out an Automated Clearing House form to complete the transfer, which can be done online, over the phone, or at the bank. Finally, wait 1 to 3 business days for the transaction to complete, and always make sure you have sufficient funds to avoid overdraft fees. To learn how to transfer your money with sites like PayPal or Western Union, read on!