This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 12,500 times.

Under an agreement with the IRS, TurboTax and other tax software companies offer a Free File Program that allows you to use their software to file your federal taxes for free. However, the free file program may be difficult for you to find on your own. If you file your taxes on the regular TurboTax page, you may end up being charged a fee to use the service. Make sure you qualify, then go directly to the website for the TurboTax Free File Program. That way, you can be certain that you won't be charged by TurboTax to file your federal taxes.[1]

Steps

Qualifying to Free File

-

1Determine what kind of tax return form you need to file. The TurboTax Free File Program supports most tax return forms. However, you can only use the program for individual taxes, not business or corporate taxes.[2]

- If you're self-employed, you likely can still use the program unless you've organized your business as an LLC or corporation.

-

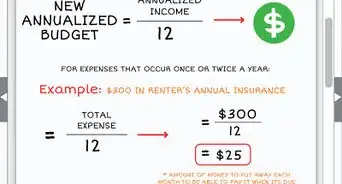

2Check your adjusted gross income (AGI). The TurboTax Free File Program is available of taxpayers who have an adjusted gross income of $34,000 or less, regardless of your age. If your income hasn't increased substantially since last year, you can check the AGI on last year's tax return.[3]

- If you didn't file taxes last year, or can't access last year's return, you can do a rough calculation of your AGI. Figure out your total income for the year, typically available on your W2 or your last pay stub for the year. Subtract any alimony payments and contributions to retirement accounts to get your AGI.[4]

- If you're self-employed, you can also deduct half of the self-employment taxes you paid over the course of the year.

Tip: If you're active duty military, you can use the TurboTax Free File Program if you have a family income of up to $66,000 for the year.

Advertisement -

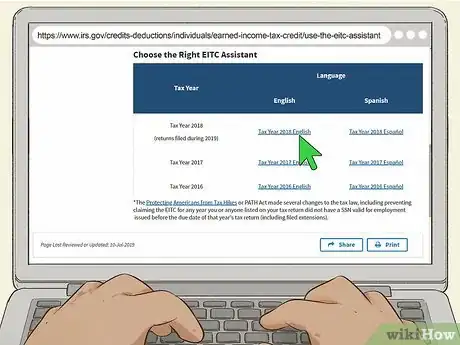

3Figure out if you qualify for the Earned Income Tax Credit (EITC). Even if you don't meet the income requirements, you may still be able to use the TurboTax Free File Program if you are eligible to receive the EITC.[5]

- You can use the IRS's EITC Assistant at https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit/use-the-eitc-assistant to find out if you qualify for this tax credit. If you got the credit last year, you likely continue to qualify for it as long as there haven't been any significant changes to your income or household size.

Tip: You can also use the tool provided by TurboTax at https://turbotax.intuit.com/taxfreedom/ to figure out if you qualify to file your federal taxes for free using the TurboTax Free File Program.

Using the Free File Program

-

1Gather the documents you'll need to file your taxes. Before you get ready to do your taxes, go ahead and get all the documents you have that are related to your income, payments, and any deductions you might be able to take. Keep those documents handy so you can provide the information to TurboTax when asked. Some documents you might need include:[6]

- A copy of last year's tax return

- W2s showing your annual wages

- 1099s showing self-employment income, dividend income, or interest income

- A 1095A if you got your health insurance on the government marketplace

- All receipts for deductible expenses related to your small business or self-employment

-

2Navigate directly to the TurboTax Free File Program website. If you simply search online for TurboTax, you'll likely end up on the regular page, which means you could end up paying to file your taxes. Instead, go directly to https://turbotax.intuit.com/taxfreedom/.[7]

- There is also a link to the TurboTax Free File Program on the IRS website at https://apps.irs.gov/app/freeFile/.

-

3Create an Intuit account or sign into an existing account. If you've used TurboTax in the past, you can use the same account for the Free File Program. You don't need to create a separate account. If you've never used TurboTax before, enter a valid email address and come up with a username and password for your account.[8]

- Log into your email account so you can quickly verify your email. You won't be able to start your tax returns until you've verified your email.

Tip: Even if you've never used TurboTax before, you may still have an existing account if you've used another Intuit product, such as Quicken or QuickBooks.

-

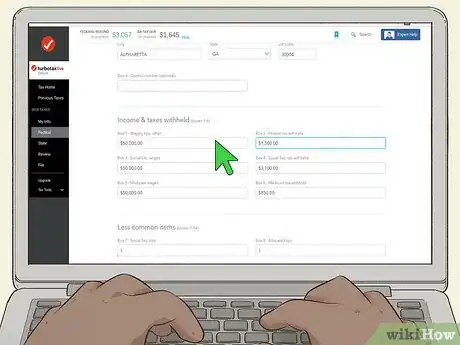

4Answer questions to complete your tax forms. The TurboTax website will ask you a series of questions about your work and income in the past year. The answers you provide will be used to fill out your tax returns for you.[9]

- If you've used any edition of TurboTax in the past, a lot of your information will be automatically filled in by the website. Double-check this information and make sure it's correct, especially if you've moved or changed jobs.

-

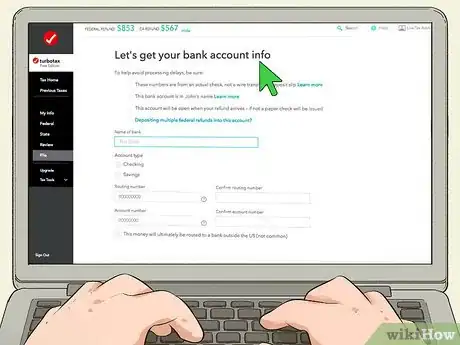

5Choose how you want to receive your refund. If you've overpaid your taxes over the course of the year, you are entitled to a refund of the amount you overpaid. While you can choose to have the IRS mail you a check, you can also have the refund direct-deposited into your checking or savings account.[10]

- If you choose direct deposit, you will need to provide the routing number and account number for your bank account.

Tip: Even though you can file your return for free, TurboTax may charge a fee to process the direct deposit of your refund. This amount would be taken out of your total refund.

-

6Complete your state return if necessary. If your state has income taxes, you can use TurboTax to file your state return for free. If you qualified to file your federal return for free, you automatically qualify to file your state return for free.[11]

- Much of the information on your state return will be auto-populated by TurboTax based on the information you provided for your federal return.

- If you are eligible for a refund on your state taxes, it will be processed using the same method you chose for your federal refund.

References

- ↑ https://www.propublica.org/article/turbotax-deliberately-hides-its-free-file-page-from-search-engines

- ↑ https://turbotax.intuit.com/taxfreedom/

- ↑ https://apps.irs.gov/app/freeFile/

- ↑ https://turbotax.intuit.com/tax-tips/irs-tax-return/what-is-adjusted-gross-income-agi/L2C6rCEit

- ↑ https://turbotax.intuit.com/taxfreedom/

- ↑ https://www.irs.gov/e-file-providers/what-you-need-to-get-started

- ↑ https://turbotax.intuit.com/taxfreedom/

- ↑ https://myturbotax.intuit.com/sign-up/

- ↑ https://blog.turbotax.intuit.com/turbotax-news/turbotax-free-edition-free-federal-free-state-free-to-file-42200/