This article was co-authored by wikiHow staff writer, Hunter Rising. Hunter Rising is a wikiHow Staff Writer based in Los Angeles. He has more than three years of experience writing for and working with wikiHow. Hunter holds a BFA in Entertainment Design from the University of Wisconsin - Stout and a Minor in English Writing.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 244,512 times.

Learn more...

If you run a business in a country that uses value-added tax (VAT), then VAT numbers from manufacturers are an important part of your paperwork. While a regular consumer doesn’t need to worry about VAT, you may need a company’s VAT number to track payments and tax collection for products you sell. You’ll also use VAT numbers to file tax returns to the government. Even if you’re new to the value-added tax system, VAT numbers are easy to find once you know where to look. Keep reading for everything you need to know about VAT numbers, including how to locate and validate them.

Things You Should Know

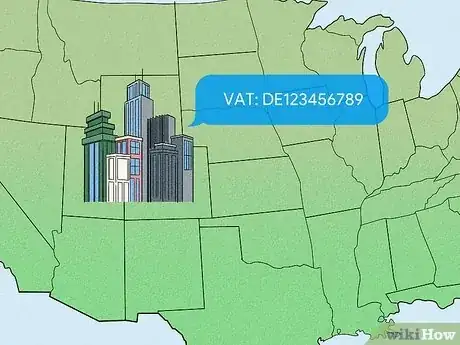

- Look at the company’s invoices, insurance forms, or tax documents for the VAT number. It will contain 2 letters and multiple digits.

- Try searching for the company on a VAT search engine to find their identification number.

- Contact the company directly and ask for their VAT number. You may need to submit a formal request to access the number.

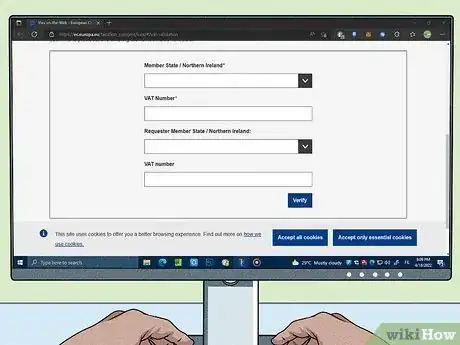

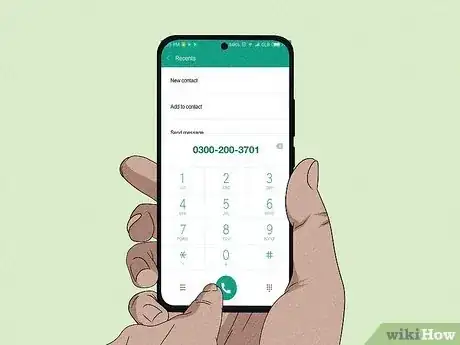

- Validate the VAT number with an online VAT validation tool, or by calling the country’s business or tax department.

Steps

Our Most Loved Articles & Quizzes

Community Q&A

-

QuestionWhat is the VAT number for the US?

wikiHow Staff EditorThis answer was written by one of our trained team of researchers who validated it for accuracy and comprehensiveness.

wikiHow Staff EditorThis answer was written by one of our trained team of researchers who validated it for accuracy and comprehensiveness.

Staff Answer wikiHow Staff EditorStaff AnswerThe United States doesn't use value-added tax or VAT numbers since states add individual sales tax. A company only needs a VAT number if they sell anything to countries that use value-added tax.

wikiHow Staff EditorStaff AnswerThe United States doesn't use value-added tax or VAT numbers since states add individual sales tax. A company only needs a VAT number if they sell anything to countries that use value-added tax.

References

- ↑ https://www.websecurity.digicert.com/content/dam/websitesecurity/digitalassets/desktop/pdfs/repository/VAT-formats.pdf

- ↑ https://ec.europa.eu/info/sites/default/files/file_import/eb015_en_2.pdf

- ↑ https://taxation-customs.ec.europa.eu/what-vat_en

- ↑ https://www.gov.uk/guidance/vat-online-marketplace-seller-checks

- ↑ https://europa.eu/youreurope/business/taxation/vat/check-vat-number-vies/index_en.htm

- ↑ https://www.gov.uk/government/organisations/hm-revenue-customs/contact/vat-online-services-helpdesk

- ↑ https://op.europa.eu/webpub/grow/factsheets/vat-for-companies/en/

- ↑ https://www.gov.uk/register-for-vat

- ↑ https://www.oecd-ilibrary.org/sites/1ca62ced-en/index.html?itemId=/content/component/1ca62ced-en