This article was co-authored by Gina D'Amore. Gina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

There are 11 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 2,057,528 times.

It's really important to know how much an item is going to cost before you purchase it. It's not as easy as just looking at the price tag; sales tax must be calculated in order to determine the total cost. Sales tax rates are increasing, which makes the tax impact on a purchase more significant. Use these tips to learn how to calculate sales tax on your retail purchases.

Steps

Calculating Total Cost

-

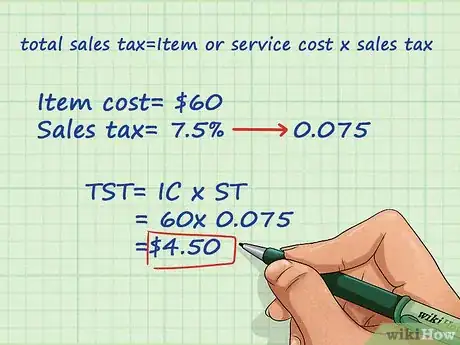

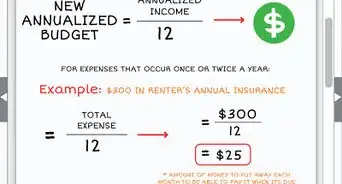

1Multiply the cost of an item or service by the sales tax in order to find out the total cost. The equation looks like this: Item or service cost x sales tax (in decimal form) = total sales tax. Add the total sales tax to the Item or service cost to get your total cost.[1]

Calculating Sales Tax

Change the sales tax into decimal form. For instance:7.5% sales tax becomes .075 in decimal form

3.4% sales tax becomes .034 in decimal form

5% sales tax becomes .05 in decimal formFormula: Item or service cost x sales tax (in decimal form) = total sales tax.

Sample calculation: $60 (item cost) x .075 (sales tax) = $4.50 total sales tax -

2

Examples

-

1Try this example. You're buying a basketball in the state of Colorado, where sales tax is 2.9%.[3] The basketball costs $25. How much is the total cost of the basketball, including sales tax?

Solution

Convert the percentage sales tax into decimal form: 2.9% becomes .029.

Multiply it out: $25 x .029 = $.73, or $25.73 total cost -

2Try another example. You're buying groceries in the state of Mississippi, where the sales tax is 7%. The grocery bill costs $300. How much is the total cost of the grocery bill, including sales tax?

Solution

Convert the percentage sales tax into decimal form: 7% becomes .07.

Multiply it out: $300 x .07 = $21, or $321 total cost -

3Try a third example. You're buying a car in the state of Massachusetts, where sales tax is 6.25%.[4] The car costs $15,000. How much is the total cost of the car, including sales tax?

Solution

Convert the percentage sales tax into decimal form: 6.25% becomes .0625.

Multiply it out: $15,000 x .0625 = $937.5, or $15,937.5 total cost

Other Information

-

1Know that some American states do not have sales tax. These states currently include:[6]

- Delaware

- New Hampshire

- Montana

- Oregon

- Alaska

-

2Know that states levy different taxes for different goods. A state or district, such as District of Columbia, may have a general sales tax of 6%, but set the tax rate on liquor and prepared food at 10%.[7]

- New Hampshire, for example, has no general sales tax but still taxes restaurants, food services, hotels, room rentals, and motor vehicle rentals at 9%.[8]

- Massachusetts, for example, only starts counting sales tax associated with clothing when the bill exceeds $175. So if you buy under $175 worth of clothing in Massachusetts, the state government won't tax it.[9]

-

3Be sure to check with your local state and city when calculating sales tax. We don't often talk of "city sales tax," but it's there.[10] Most people, however, just lump it in with state sales tax. If you want to know exactly how much money you'll pay in taxes for a certain item,check your local state and city tax lawsfor more information

- Each city has its own tax, and it depends on where it's shipping to and where it's shipping from.

Glossary of Sales Tax Terms

Expert Q&A

-

QuestionDoes Amazon pay sales tax for sellers?

Gina D'AmoreGina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

Gina D'AmoreGina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

Financial Accountant Amazon does not pay the merchant sales tax—they collect it and give it to the appropriate state and city. It's very complicated! As a seller, it helps a lot call a sales tax agency to assist you with paying your sales tax.

Amazon does not pay the merchant sales tax—they collect it and give it to the appropriate state and city. It's very complicated! As a seller, it helps a lot call a sales tax agency to assist you with paying your sales tax. -

QuestionHow do I add 6% sales tax to an amount?

Community AnswerMultiply the amount x 1.06. This will give you the total amount, including the tax. The "1" is 100% of the item cost, and the ".06" is the tax rate of 6%. For example, you buy a screw driver set for $10.00 and the sales tax rate is 6%. $10.00 x 1.06 = $10.60. This is your total, including tax.

Community AnswerMultiply the amount x 1.06. This will give you the total amount, including the tax. The "1" is 100% of the item cost, and the ".06" is the tax rate of 6%. For example, you buy a screw driver set for $10.00 and the sales tax rate is 6%. $10.00 x 1.06 = $10.60. This is your total, including tax. -

QuestionCan 6% be written as 0.0600?

Community Answer6% would be 0.06, all you do is move the decimal two spaces to the left. For example 6% sales tax on an item would be calculated by multiplying the total cost by the decimal form of the percentage. Say the total cost was $30.00, it would be calculated as 30 x 0.06 = 1.8 then add the quotient to the original cost.

Community Answer6% would be 0.06, all you do is move the decimal two spaces to the left. For example 6% sales tax on an item would be calculated by multiplying the total cost by the decimal form of the percentage. Say the total cost was $30.00, it would be calculated as 30 x 0.06 = 1.8 then add the quotient to the original cost.

References

- ↑ https://www.patriotsoftware.com/accounting/training/blog/how-to-calculate-sales-tax/

- ↑ https://www.taxjar.com/guides/sales-tax-guide-for-consumers/#how-is-sales-tax-calculated

- ↑ http://www.colorado.gov/cs/Satellite/Revenue/REVX/1178305433490

- ↑ http://www.mass.gov/dor/individuals/taxpayer-help-and-resources/tax-guides/salesuse-tax-guide.html

- ↑ https://sciencing.com/how-to-calculate-sales-tax-backwards-from-total-13712245.html

- ↑ https://www.investopedia.com/articles/personal-finance/112415/5-states-without-sales-tax.asp

- ↑ http://www.taxrates.com/state-rates/washington-dc/

- ↑ https://www.revenue.nh.gov/assistance/tax-overview.htm#meals-rental

- ↑ https://www.mass.gov/guides/sales-and-use-tax#apparel-fabric-goods

About This Article

To figure out sales tax on an item, you’ll need to know your local sales tax rate. You can easily find this information by searching online for the sales tax rate in your city and state. Once you know the tax rate in your area, convert the sales tax rate from a percent to a decimal by moving the decimal point two places to the left. Then, multiply the resulting number by the list price of an item to figure out the sales tax on that item. So, let’s say you’re buying something that costs $27.95, with a local tax rate of 8%. You’d multiply 27.95 by .08, giving you a sales tax amount of $2.24. Add that amount to the price of the item to find your total cost with tax. In this case, the total would be $30.19. But what if you already know the total cost of an item after taxes, and you want to figure out the tax rate based on that? To do this, subtract the list price of the item from the total after taxes. This will give you the amount of sales tax you paid. Then, divide the tax amount by the list price. Move the decimal point in the resulting number 2 spaces to the right to get the tax rate as a percentage. For instance, if the list price is $72.50, and you paid $75.05, then you paid $2.55 in taxes. 2.55 divided by 72.50 is 0.035, which means the tax rate is 3.5%. For more information on how to calculate sales tax, including some examples, scroll down!