This article was co-authored by Alan Mehdiani, CPA. Alan Mehdiani is a certified public accountant and the CEO of Mehdiani Financial Management, based in the Los Angeles, California metro area. With over 15 years of experience in financial and wealth management, Alan has experience in accounting and taxation, business formation, financial planning and investments, and real estate and business sales. Alan holds a BA in Business Economics and Accounting from the University of California, Los Angeles.

There are 8 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 396,085 times.

Property taxes are taxes that are usually assessed locally by municipalities to raise operating revenue for the city or town. In some cases, states can also levy property taxes. Property taxes are usually levied on any piece of privately-owned real estate, from empty lots to houses, based on the assessed value of the property.[1] They can also be levied on possessions like cars, but often according to different rules. If you own these types of property, knowing how to calculate your property tax liability is an important skill for financial planning.

Steps

Calculating Property Tax for Real Estate

-

1Find the assessed value of the property being taxed.[2] When it comes to real estate, property taxes are almost always based on the value of the land. The more valuable the land, the higher the property taxes. Because the value of land can change over time, so can your property tax liability, even if your local government does not specifically change the tax rate. To start finding your property tax liability, you need to know how much the land you own is worth.

- Property values are usually determined by a local or county assessor — someone whose job is specifically to do this. To find the value of your residence, you can contact your local assessor's office or else your local tax authority.

- Note that many assessors have tools online that will allow you to look up your property's value based on your address. The assessor's office for Santa Clara Country in California has a great example of this sort of tool.[3]

- You can also sometimes get home value estimates from financial institutions. For example, Chase Bank offers a free online home value tool.

-

2Add the value of the land and improvements to get the total value. The value of a piece of land is usually determined by two things: the value of the land itself and the value of whatever is built on the land (i.e., its improvements.) To find the total value of your property, you'll need to add these two values together. Usually, the local assessor can provide both pieces of information.

- For example purposes, let's find the property taxes for a house in ABC County, USA. The county assessor values the land at $357,000, mainly due to its close proximity to a vibrant, bustling downtown area and the convenience of two nearby freeways. The assessor values the house itself at $307,000. Adding these two values, the total value of our property is 357,000 + 307,000 = $664,000. In the next few steps, we'll use this value to find our property taxes.

Advertisement -

3Find the current local government's tax rate. Property tax is generally assessed as some percentage of the property's current value. This tax rate can (and does) vary over time depending on the needs of the taxing agency — for instance, if your county has a budget shortfall, it may raise the tax rate to make ends meet. Thus, up-to-date information is crucial.[4]

- Like your assessed property value, you can usually get this information from your local tax authority. For example, in Santa Clara County, California, tax rate summaries are available online for free.[5]

- Many municipalities apply the tax rate "per mill", or per $1,000 in assessed value. Don't let this confuse you — one mill is just 1/10 of one cent.[6] For practical purposes, we can say that 10 mill of something is the same as 1%. E.g., a 20 mill levy on $100,000 would equal 2% of $100,000, or $2,000.

- For the purposes of our example, let's say that ABC County has a 10 mill levy on our property. This amounts to 1% of our property's total value.

-

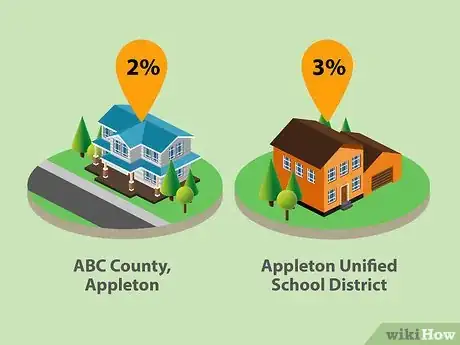

4Find the property tax rates for other local agencies. The local government isn't the only organization that relies on property tax revenues. Other organizations that serve the local community often require their own share of property taxes. Notably, most public school districts get the majority of their revenue from local property taxes — about 77% in 2007, the most recent year that data is available. Cities, towns, and other local entities may also require property taxes.

- In our example, let's say that the city of Appleton, where we live in ABC County, has its own 20 mill (2%) property tax and that the Appleton Unified School District levies its own property tax at a 30 mill rate (3%).

-

5Add your tax rates up. When you know all of the different property taxes that you will have to pay, finding your total liability is fairly easy. Start by adding up the different tax rates to get one total property tax rate that you'll need to pay.

- In our example, since we owe a 1% property tax to the county, 2% to the city, and 3% to the school district, we owe, in total, 1 + 2 + 3 = 6%

-

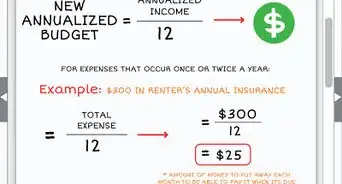

6Multiply by your property value. Take your total property tax rate and multiply it by the value of the property you are dealing with. The answer you get is the amount of money you owe in property tax.[7]

- Don't forget that, to multiply a percentage, you must either first change the percentage back to its decimal form or else divide your answer by 100.

- In our example, our total property tax rate is 6% and our property is worth $664,000. To find the amount we owe in taxes, we multiply 0.06 × $664,000 = $39,840.

Finding Personal Property Taxes for Possessions

-

1Determine which possessions will be taxed. In addition to the "property tax" that most people are familiar with for homes and real estate, there can sometimes be other forms of property tax for other forms of property. These taxes on a person's possessions are called personal property taxes and are usually calculated differently than the home property taxes above.

- The exact properties that will be subject to tax vary greatly from state to state and locality to locality. You can usually learn which forms of property can be taxed from your local tax authority. For example, in California, the Board of Equalization provides online documents covering this topic.[8]

-

2Find the tax or fee for each possession. Unlike home property taxes, many personal property taxes are not dependent on the value of the item being taxed (though some are.) A great example of this are taxes on cars in the form of registration renewal/tab fees: no matter whether you drive a brand-new luxury sedan or an ancient pickup truck with 200,000 miles on it, you must pay the same amount of money to renew your license plate tabs and keep driving legally.

- Many tax authorities will have information available online that can help you find your personal property taxes. For instance, this site lists car tax calculators for the states that offer them (scroll down to see the list.)

- For example, let's say that we want to buy a car in ABC County USA. Based on the state and local tax codes, we determine that we need to pay two expenses: a single one-time registration tax based on the value of the car and a recurring yearly fee to get our license tabs. If the car is worth $20,000 the registration tax rate is 1.5%, and the license tabs fee is $50, we'll owe 20,000 × 0.015 + 50 = 300 + 50 = $350.

-

3Don't forget intangible possessions. Personal property taxes aren't just applied to real, tangible property — they can also extend to things like stocks, bonds, mutual fund shares, and so on. While some forms of personal property tax (like the vehicle registration fee example above) are quite common, taxes on intangible property can vary greatly from state to state, so check your local tax authority for more information.

- Sometimes, beneath a certain value, intangible property will be tax free. For instance, before 2007 in Florida, the first $250,000 of property (including most intangibles) was not subject to tax.[9]

- In our example, let's say that, in addition to our car, we also have $300,000 of trusts that are eligible to be taxed. If the first $200,000 is tax-free in our state and, after that, the tax is 50 cents per $100 (0.5%) we'll need to pay 100,000 × 0.005 = $500.

-

4Total your fees and taxes. Once you know all of your personal property tax liabilities, just add them up to determine the total amount of money that you owe. As mentioned above, these sorts of taxes can vary greatly from place to places, so what you pay may not be similar to what someone living somewhere else pays.

- In our example, if we don't have any other personal property tax liabilities besides our car and our trusts, we'll simply need to pay 350 + 500 = $850.

Expert Q&A

Did you know you can get expert answers for this article?

Unlock expert answers by supporting wikiHow

-

QuestionHow do you appeal property taxes?

Alan Mehdiani, CPAAlan Mehdiani is a certified public accountant and the CEO of Mehdiani Financial Management, based in the Los Angeles, California metro area. With over 15 years of experience in financial and wealth management, Alan has experience in accounting and taxation, business formation, financial planning and investments, and real estate and business sales. Alan holds a BA in Business Economics and Accounting from the University of California, Los Angeles.

Alan Mehdiani, CPAAlan Mehdiani is a certified public accountant and the CEO of Mehdiani Financial Management, based in the Los Angeles, California metro area. With over 15 years of experience in financial and wealth management, Alan has experience in accounting and taxation, business formation, financial planning and investments, and real estate and business sales. Alan holds a BA in Business Economics and Accounting from the University of California, Los Angeles.

Certified Public Accountant The process of filing the appeal will vary from county to county. I would say start by reviewing your assessment notice to first ensure that all the data is correct. Next, I would look to see if you can find recently sold real estate comps in your area, meaning comparable homes to the one that you're in that will give you a comparative value. If you find that homes that are comparable to yours are assessed for much less, you may have grounds for challenging your assessment based on the fact that it's not consistent with the way that the other homes were assessed.

The process of filing the appeal will vary from county to county. I would say start by reviewing your assessment notice to first ensure that all the data is correct. Next, I would look to see if you can find recently sold real estate comps in your area, meaning comparable homes to the one that you're in that will give you a comparative value. If you find that homes that are comparable to yours are assessed for much less, you may have grounds for challenging your assessment based on the fact that it's not consistent with the way that the other homes were assessed.

References

- ↑ Alan Mehdiani, CPA. Certified Public Accountant. Expert Interview. 9 July 2020.

- ↑ Alan Mehdiani, CPA. Certified Public Accountant. Expert Interview. 9 July 2020.

- ↑ https://www.sccassessor.org/index.php/online-services/property-search/real-property

- ↑ Alan Mehdiani, CPA. Certified Public Accountant. Expert Interview. 9 July 2020.

- ↑ https://www.sccgov.org/sites/controller/property-tax-apportionment/Pages/property-tax-rate-book.aspx

- ↑ http://www.investopedia.com/articles/tax/09/calculate-property-tax.asp

- ↑ Alan Mehdiani, CPA. Certified Public Accountant. Expert Interview. 9 July 2020.

- ↑ http://www.boe.ca.gov/proptaxes/pdf/pub29.pdf

- ↑ http://www.cga.ct.gov/2007/rpt/2007-r-0197.htm

About This Article

To calculate property tax, find out the value of the land and the value of whatever is built on the land by contacting your local assessor's office. Add those values together to get the total value. Next, find the current local government's tax rate and the property tax rates for other local agencies. Add all of the tax rates up to get one total property tax rate, then multiply that by the value of the property to calculate property tax! For tips on finding personal property taxes for your possessions, read on!