This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 65,354 times.

According to the Tax Foundation, the state of Florida has been cited for decades as having one of the lowest tax burdens in the United States, due in part to not having a state income tax. However, Florida does have a sales tax, and calculating it requires knowing where in the state an item was purchased. Learn which taxes to apply to purchases and use reliable resources to make the task easier.

Steps

Determining Which Taxes to Apply

-

1Know the difference between Florida sales tax and use tax. While sales tax and use tax are related, they are defined differently.

- Sales tax is tax paid on a purchase or rental of an item within the state's borders. This tax is typically collected at the time of purchase by the seller, who in turn must report and pay it to the Florida Department of Revenue.

- Use tax is generally paid on purchases made out of state and brought or delivered into the state, including at physical locations outside the state, by mail order, or online, whether tax was charged at the time of purchase or not, at the correct Florida rate or not. (Items purchased tax-exempt with the intent to resell that are instead used for business or personal use are also assessed use tax.) Reporting and paying use tax is generally the responsibility of the purchaser.[1]

-

2Determine if sales taxes are charged on the sale. Florida residents do not need to pay sales taxes on intangible purchases, like investments. Sales tax is only charged on purchases of tangible products or some services.[2] Some tangible items, such as groceries, seeds, fertilizer, and prescription medicines, are exempt from Florida sales tax. Services that create or repair a product are taxable, but other services are not.

- For example, accountancy services and event planning are not taxable, but the sale of clothing is.

- If you are shipping your item, the shipping charge is also taxed.[3]

- For rentals of property for periods of under six months, another tax is charged. This "tourist development tax" is charged at a rate of 13 percent.[4]

- Prepared food is taxed at the higher rate of 9 percent.[5]

- Find a complete account of taxes charged in Florida here: http://floridarevenue.com/Pages/default.aspx

Advertisement -

3Understand the bracket method of calculating tax. It's important to note that Florida requires calculation of sales tax by the "Bracket" method. Therefore, you cannot simply compute 6% of the sale amount. You must round up the sales tax collected, according to the brackets published by the Florida Department of Revenue. This can result in a higher than 6% tax collection. [6] If you do not use the brackets to round the total up, or if you attempt to back-calculate sales tax (e.g. by dividing the sale total by 1.06%), you will likely undercalculate the amount of tax due, and risk being fined. You can find a list of sales tax brackets at http://dor.myflorida.com/taxes/taxesfees/Pages/tax_interest_rates.aspx. This page includes brackets for the various discretionary county surtax amounts.

-

4Understand the discretionary surtax. 55 of Florida's 67 counties charge a discretionary sales and use a surtax on items purchased within or delivered inside their borders. This surtax ranges from 0.5 to 1.5 percent, which is added to the state sales tax rate. Counties typically use discretionary taxes to pay for public improvements, like infrastructure or schools.[7]

-

5Assess whether or not discretionary taxes apply to the sale. The discretionary sales and use surtax applies only to the first $5,000 of the sales amount for sale or use (including rental and licensing) of any item of tangible personal property. "Tangible personal property" is defined as anything that can be seen, touched, or measured, including energy usage. This $5,000 cap does not apply to property rentals or services.[8]

Calculating Additional Tax Amounts

-

1Identify the purchaser's county and its surtax amount. The surtax amount charged depends on the surtax amount charged by the purchaser's county. Locate the purchaser and research their county to figure out how much of a surtax to add on to the sales tax percentage.

- A list of which Florida counties charge discretionary surtaxes and which don't is found on Form DR-15DSS, available online in PDF format at http://dor.myflorida.com/dor/forms/current/dr15dss.pdf. The list also includes the amount of the discretionary tax. This form is updated every November.

- Remember to check the Department of Revenue's website regularly to see if any counties have changed their surtax amounts.[9]

-

2Determine the surtax amount for an item sold by a Florida dealer. Items sold by Florida dealers are subject to sales tax and can be subject to a discretionary surtax if the purchaser's county charges one.

- If a Florida dealer in a county with a discretionary surtax sells to a purchaser in the same county, the surtax for that county is assessed on the purchase and added to the state sales tax rate.

- If a Florida dealer in a county without a discretionary surtax sells to a purchaser in a county with a discretionary surtax, the surtax for the purchaser's county is assessed on the purchase and added to the state sales tax rate.

- If a Florida dealer in a county with a discretionary surtax sells to a purchaser in a different county that has its own discretionary surtax, the surtax for the purchaser's county is assessed on the purchase and added to the state sales tax rate.

- If a Florida dealer sells to a purchaser in a county without a discretionary surtax, only the base state sales tax is charged on the purchase, regardless of whether the dealer's county assesses a discretionary surtax.[10]

-

3Find the surtax amount for an out-of-state dealer. Out-of-state dealers must also pay the discretionary surtax of the buyer's county.

- If an out-of-state dealer sells to a purchaser in a Florida county with a discretionary surtax, that surtax is assessed on the purchase.

- If an out-of-state dealer sells to a purchaser in a Florida county without a discretionary surtax, no surtax is assessed on the purchase.[11]

Calculating Sales Tax

-

1Start with the basic Florida state sales tax rate. The current Florida state sales tax rate is 6 percent, as reported on the state's website portal.[12]

-

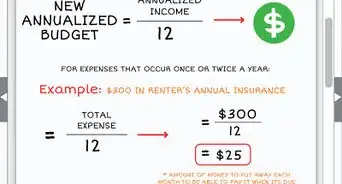

2Adjust the basic rate by the surtax amount. You will have to add the surtax amount to the basic sales tax rate to find the final sales tax rate. For example, in one of the eight counties with a 1.5 percent surtax, there would be a total of 7.5 percent sales tax charged (6 percent plus 1.5 percent).[13]

- If you sell all across the state and need an average tax amount to forecast your tax burden, the average sales tax amount statewide is 6.69 percent.[14]

-

3Multiply the adjusted tax rate by the purchase amount. This determines the amount of tax owed.

- When sales transactions fall in between whole dollar amounts, use the bracket system to calculate the tax between the whole dollar amounts. You can find a list of sales tax brackets at http://dor.myflorida.com/taxes/taxesfees/Pages/tax_interest_rates.aspx.

- You can use an online calculator to help you calculate Florida sales tax. One such calculator is located at http://www.calculator.net/sales-tax-calculator.html it allows calculating sales tax rates for Florida and 9 other states that have special tax jurisdictions within their borders.

-

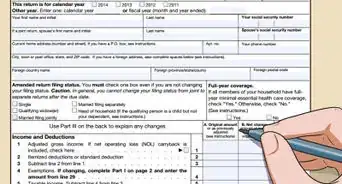

4Report sales tax. If you are the seller of the products on which the sales tax is charged, you must report and pay the sales tax. This can be done online by visiting the Florida Department of Revenue's website at http://dor.myflorida.com/dor/eservices/filepay.html. Alternately, you may purchase vendor software from a licensed vendor that will file your taxes and help you to pay them more easily. Software vendors can be found at http://floridarevenue.com/taxes/Documents/Fl_eFileVendor.pdf.[15]

- The state of Florida allows businesses that collect less than $20,000 per year in sales and use taxes to report and pay their taxes using a paper version of From DR-15: Sales and Use Tax Return. Higher amounts must be reported electronically, but the state encourages all taxpayers to report and pay online.

- Before you can collect and report sales tax, you are required to have a sales tax permit. You can file for this permit online with the Florida Department of Revenue. There is a $5 fee and you will receive your permit in about three days.[16]

- Florida sales taxes are to be filed and paid between the 1st and 20th of the month following the period in which they were collected and are late after that time.

References

- ↑ http://www.stateofflorida.com/taxes.aspx

- ↑ http://www.stateofflorida.com/taxes.aspx

- ↑ http://www.taxjar.com/states/florida-sales-tax-online/#is-what-youre-selling-even-taxable

- ↑ https://www.salestaxhandbook.com/florida

- ↑ https://www.salestaxhandbook.com/florida/sales-tax-exemptions

- ↑ http://dor.myflorida.com/taxes/taxesfees/Pages/tax_interest_rates.aspx

- ↑ http://dor.myflorida.com/Forms_library/current/dr15dssr15.pdf

- ↑ http://dor.myflorida.com/dor/taxes/discretionary.html

- ↑ https://www.salestaxhandbook.com/florida/sales-tax-changes

- ↑ http://dor.myflorida.com/dor/taxes/discretionary.html

- ↑ http://dor.myflorida.com/dor/taxes/discretionary.html

- ↑ http://www.stateofflorida.com/taxes.aspx

- ↑ http://www.stateofflorida.com/taxes.aspx

- ↑ https://www.salestaxhandbook.com/florida

- ↑ http://dor.myflorida.com/dor/taxes/discretionary.html

- ↑ https://www.salestaxhandbook.com/florida/sales-tax-permits