This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

This article has been viewed 30,717 times.

The federal government offers an Advance Premium Tax Credit to lower your monthly premiums if you purchase health insurance through the federal Marketplace or through a state health insurance marketplace. If you take the credit, you have to reconcile that credit on your taxes. If you used more credit than you were entitled to, you may end up owing taxes. However, if you used less credit than you were entitled to, you may get a refund. Fill out Form 8962 to reconcile your tax credit using the information on Form 1095-A.[1]

Steps

Reviewing Your Form 1095-A

-

1Wait to receive your Form 1095-A in the mail. If you purchased health insurance through the Marketplace and opted for advance payment of your tax credit to lower your premiums, you'll get a Form 1095-A from the Marketplace. You may receive the form as early as mid-January, but it should get there by mid-February at the latest.[2]

- If you've moved recently, check your address on your HealthCare.gov account and make sure it's the right one. Changing your address with your health insurance company won't necessarily change it with the Marketplace.

- You can also download and print the form from your HealthCare.gov account starting in mid-January.

-

2Contact the Marketplace Call Center if you don't get your form by mid-February. If you never receive your form and it isn't available for download on your HealthCare.gov account, call 1-800-318-2596 (TTY: 1-855-889-4325). This number is available 24 hours a day, 7 days a week, except on federal holidays.[3]

- If you are a small business owner who made health insurance available to your employees using the Marketplace, call 1-800-706-7893 (TTY: 1-888-201-6445).

Advertisement -

3Check your Form 1095-A for correctness. When you get your Form 1095-A, first look at Part III, Column B. If there is a "0" for any month that you or anyone in your household was on a Marketplace plan, the information on your form is incorrect.[4]

- Your form is also incorrect if there is a blank space for any month that you or anyone in your household was on a Marketplace plan.

- If you had changes in your household that you neglected to report to HealthCare.gov, such as if you got married or divorced, moved, or had a baby, your form may also be incorrect.

- If your form is incorrect, contact the Marketplace through your HealthCare.gov account or by calling the Marketplace Call Center. They'll update your information and send you a corrected form.

Tip: If you're bumping up against the deadline to file your tax return, you can also use the Tax Tool at https://www.healthcare.gov/tax-tool/#/ to get the information you'll need to fill out Form 8962.

-

4Download and print the Form 8962 and instructions for a paper return. If you're mailing in a paper tax return and you received advance payments of your health insurance premium tax credit, you'll need to file a completed Form 8962 with your regular tax return forms. The form may be available in packages of print forms, or you can access it on the IRS website.[5]

- You can download and print both the form and instructions at https://www.irs.gov/forms-pubs/about-form-8962. Double-check the year in the top right-hand corner of the form to make sure you're using the form for the correct tax year.

Tip: If you're using a tax preparation app, it will automatically fill out the form for you based on your answers to questions about your Marketplace coverage. Make sure you indicate that you purchased health insurance through the Marketplace.

Determining Your Annual and Monthly Contribution Amounts

-

1Provide your household income and household size. Part I of Form 8962 allows you to calculate the maximum possible premium assistance you were eligible for during the tax year. Start by providing your household income and modified AGI.[6]

- You'll need the instructions for Form 8962 to calculate the numbers for the first 3 lines of Form 8962.

-

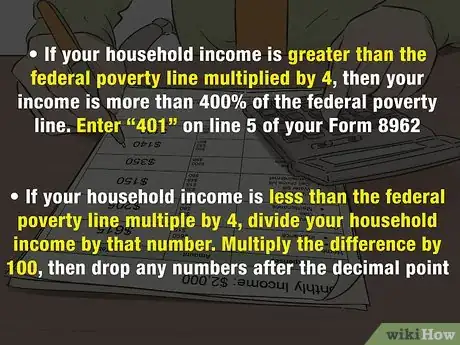

2Calculate your household income as a percentage of the federal poverty line. Use the federal poverty lines provided in the instructions for Form 8962. Then multiply the federal poverty line you used by 4.0. Compare that number to the number you provided on line 3 for household income.[7]

- If your household income is greater than the federal poverty line multiplied by 4, that means your income is more than 400% of the federal poverty line. Enter "401" on line 5 of your Form 8962.

- If your household income is less than the federal poverty line multiple by 4, divide your household income by that number. Don't round your answer. Multiply the difference by 100, then drop any numbers after the decimal point. For example, if the difference was 1.8545565, you would enter 185 on line 5 of Form 8962.

Tip: There are 3 different federal poverty lines used: 1 for the 48 contiguous states and the District of Columbia, 1 for Hawaii, and 1 for Alaska. Make sure you use the one that applies to the state where you lived during that tax year.

-

3Use your percentage to find your "applicable figure" on the table in the instructions. Use Table 2 in the instructions to determine which number you'll need to write on line 7. Check line 5 on your Form 8962, then locate that number on the first column in Table 2. The value across from it is your "applicable figure." Enter that value on line 7 of your Form 8962.[8]

- For example, if the number you entered on line 5 was "218," you would enter "0.0697" on line 7.

-

4Multiply your household income by your applicable figure to find your contribution amount. Use the household income amount you provided on line 3. Round the result down to the nearest dollar amount. This is the annual amount you're expected to contribute towards your health insurance premiums. Enter this amount on line 8a.[9]

- If you divide the amount on line 8a by 12, you'll get the monthly amount you're expected to contribute towards your health insurance premiums. Enter this amount on line 8b.

Reconciling Your Premium Tax Credit

-

1Allocate premium amounts and credits if necessary. If you were married and got divorced or legally separated during the year you're filing your return, you need to split the premiums paid between you and your former spouse. Allocating the premiums is also necessary if you and your spouse are filing separate returns, even if you're still married. Only include the percentage allocated to you on your Form 8962.[10]

- For example, if you and your spouse divorced and have no dependents, you would split everything 50/50 (assuming you both had Marketplace coverage).

- If you had dependents, on the other hand, the premiums would be allocated according to which spouse is claiming the dependents. Your allocation would still be 50/50 if you and your spouse have 2 children and are each claiming 1 dependent. If you were claiming both of the dependents, on the other hand, you would allocate 75% of the premium amounts and credits to yourself and 25% to your former spouse.

Tip: If you and your spouse divorced or legally separated at any time during the tax year, you are considered divorced or legally separated for the entirety of the tax year.

-

2Enter your enrollment premiums. Part II, column (a) on Form 8962 lists the health insurance premium for each month of the year. This amount is the total cost of the premiums for your health insurance policy – not the amount you actually paid. Copy this information directly from Form 1095-A, Part III, column A.[11]

- The annual total amount found on line 33 of your 1095-A goes on line 11 of your Form 8962. The monthly amounts listed on lines 21-32 of your 1095-A go on lines 12-23 of your Form 8962.

-

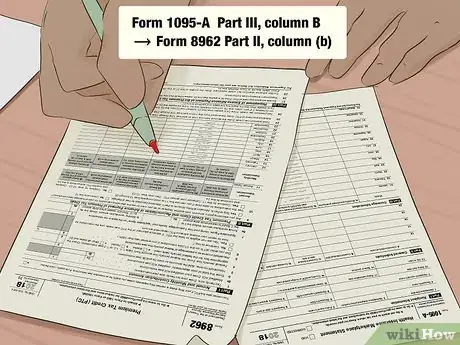

3Provide the amounts for the second-lowest-cost silver plan premium. On Part II, column (b) of your Form 8962, copy the amounts provided in Part III, column B of your Form 1095-A. if you used the Tax Tool, enter the amounts you generated there.[12]

- On Form 1095-A, copy the annual amount on line 33 to line 11 on your Form 8962. Copy the monthly amounts provided on lines 21-32 to lines 12-23 on your Form 8962.

-

4List the amounts you received in advance payments. The advance payments of your tax credit that you used to offset your premium payments are listed in Part III, column C of your Form 1095-A. Copy these amounts into Part II, column (f) of your Form 8962.[13]

- Use the annual amount listed on line 33 of your Form 1095-A on line 11 of your Form 8962. Then enter the monthly amounts listed on lines 21-32 of your Form 1095-A to complete lines 12-23 of column (f) on your Form 8962.

-

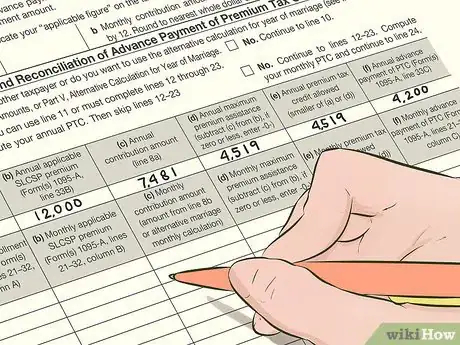

5Determine the maximum premium assistance you were allowed. In Part II, column (c) of your Form 8962, enter the amounts you calculated for annual and monthly contribution amounts in Part 1 of the same form. Then subtract those amounts from the amounts you listed in column (b). Enter the results in column (d).[14]

- If you subtract column (c) from column (b) and get a zero or a negative number, simply enter "-0-" all the way down the column.

-

6Fill in the annual premium tax credit allowed. There should be one blank column left in your table under Part II of your Form 8962. Look at the amounts in column (a) and the amounts in column (d). Fill column (e) with whichever of those 2 amounts is the smallest.[15]

-

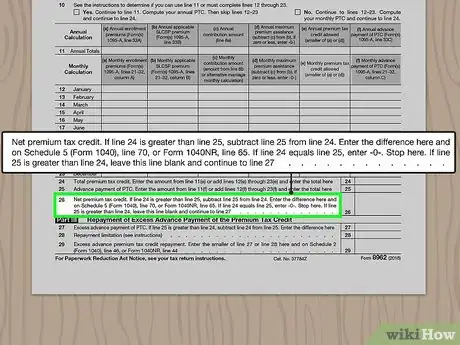

7Compare the tax credit allowed to your total advance payments. Use the annual total on line 11 or the sum of lines 12-23 in column (e) as the total tax credit you were allowed for the year. Enter that total on line 24. Then provide the annual total of advance payments you received on line 25. If line 25 is smaller than line 24, subtract line 25 from line 24 and enter the difference on line 26. You are done with the form. If line 25 is larger than line 24, skip line 26 and go to Part III of Form 8962.[16]

- If line 24 and line 25 are equal, enter a "-0-" and stop.

Tip: If you enter a number on line 26, copy that number onto Form 1040, Schedule 5, line 70, or Form 1040NR, line 65.

-

8Calculate the excess advance payment you need to repay, if necessary. If line 25 on your Form 8962 is larger than line 24, you may have to repay some of the excess tax credit payments that were made to you in advance. To start, subtract line 24 from line 25 and enter the difference on line 27 of the form.[17]

- Check the instructions for Form 8962 to find the repayment limitation amount you need to copy onto line 28 of the form. The repayment limitation amounts are included in Table 5 of the instructions.[18]

- Compare lines 27 and 28. Enter the smaller of the two on line 29.

Tip: If you enter a number on line 29, copy it onto Form 1020, Schedule 2, line 46, or Form 1040NR, line 44.

References

- ↑ https://ttlc.intuit.com/community/health-care/help/the-irs-is-requesting-form-8962/00/27409

- ↑ https://www.healthcare.gov/taxes-reconciling/

- ↑ https://www.healthcare.gov/contact-us/

- ↑ https://www.healthcare.gov/tax-form-1095/#slcsp

- ↑ https://www.healthcare.gov/taxes-reconciling/

- ↑ https://www.irs.gov/pub/irs-pdf/f8962.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/f8962.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/f8962.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/f8962.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/i8962.pdf

- ↑ https://www.healthcare.gov/taxes-reconciling/

- ↑ https://www.healthcare.gov/taxes-reconciling/

- ↑ https://www.healthcare.gov/taxes-reconciling/

- ↑ https://www.irs.gov/pub/irs-pdf/f8962.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/f8962.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/f8962.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/f8962.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/i8962.pdf