This article was co-authored by wikiHow staff writer, Eric McClure. Eric McClure is an editing fellow at wikiHow where he has been editing, researching, and creating content since 2019. A former educator and poet, his work has appeared in Carcinogenic Poetry, Shot Glass Journal, Prairie Margins, and The Rusty Nail. His digital chapbook, The Internet, was also published in TL;DR Magazine. He was the winner of the Paul Carroll award for outstanding achievement in creative writing in 2014, and he was a featured reader at the Poetry Foundation’s Open Door Reading Series in 2015. Eric holds a BA in English from the University of Illinois at Chicago, and an MEd in secondary education from DePaul University.

There are 13 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 21,428 times.

Learn more...

If the balance of your arrears (the money you owe for child support) reaches a certain threshold, your state’s child support program may reach out the federal government and ask them to intercept your tax refund and apply it towards your balance. This program is known as the Federal Tax Refund Offset Program, and it’s run by the Bureau of Fiscal Services wing of the IRS. Since you can’t petition the federal government to ignore the request, preventing this from happening in the first place is the only way to get your tax refund. We’ll walk you through everything you need to know regarding whether your refund is at risk, and if so, how you can beat the clock and pay your arrears down to get your tax refund.

Steps

Assessing the Situation

-

1Look online to find your state’s threshold for interception. The only way to find out is to look up the laws where you live. Most states will have a threshold they list somewhere online. If they don’t have unique requirements, assume it’s the federal standard for interception: $150 in arrears if you’re under the Temporary Assistance for Needy Families program, and $500 if you’re not getting help from TANF.[1]

- If you are under the threshold for interception, you can rest easy that you’re going to get your tax refund.

- In many states, the threshold is one month of child support plus the $150 or $500, depending on whether you’re in the TANF program. For example, if your monthly payment is $250, and you aren’t in the TANF program, you’d need to owe $400 for this to happen.[2]

-

2Contact your local child support program to see if they’re applying for offset. They aren’t keeping this whole process a secret from you, so ask if you aren’t sure your tax refund will be intercepted. Contact your state’s human services or child support program and ask about whether your arrears are going to be sent to the BFS (Bureau of Fiscal Services) to be offset.[3]

- You can contact your state child support program at any time to ask about this. They won’t penalize you or anything. Ideally, contact them 3-6 months before you have to pay your taxes and then call them again whenever you pay off enough to get under the threshold.

- They’ll only be able to 100% confirm whether your refund will be intercepted or not after you’ve filed your taxes for the fiscal year.

Advertisement -

3Get started on a solution ASAP if they do want to take your refund. It can take time to satisfy your state when it comes to proving you’re under the threshold, so don’t put this off. Once the state submits a request to the Federal Offset Program, there isn’t anything you can do to prevent your tax refund from being applied to the arrears you owe. Since it’s impossible to know when this will happen, aim to resolve this as quickly as possible.[4]

- You will get a notice in the mail letting you know your tax refund will be intercepted (usually 60 days before it happens). Once you get this notice, there isn’t anything you can do.

Pursuing Legal Recourse

-

1Come to a joint agreement with your ex if they’re amicable. Ask your ex to file an uncontested modification with you. This is a mutual agreement to adjust child support conditions. If adjusting your future payments (even temporarily) will allow you to catch up enough on your arrears that you will come in under your state threshold for an offset, this will do the trick![5]

- So long as this happens early enough for you to catch up on your arrears, you should beat the clock on your state filing for the offset.

- To do this, you and your ex would fill out court forms together and submit them to the city or county court. A verbal agreement will not have any impact on your future payments.

- If you’ve been working with a pro-bono lawyer, ask them to help you with this process. They’ll file all of the paperwork for you and make sure everything is in order.

-

2File a contested modification if your ex isn’t open to changing the payment. This process will differ from state to state, but you typically fill out a form at a local court and ask to see a judge. Then, you and your ex appear before the judge and you plead your case to explain why you should be paying less in child support. If you win, you’ll buy some breathing room to catch up on your arrears.[6]

- Do not bring up your tax refund with the judge, even if that’s why you’re doing all of this. It’s just not a valid reason to adjust child support payments.

- You are unlikely to win the modification case unless you can prove:[7]

- Your income has dramatically diminished for reasons beyond your control.

- There are extraordinary circumstances that prevent you from paying.

- An excessive burden is being placed on you due to these payments.

-

3Try filing a court order to see if a judge will prevent the offset for you. Many states allow you to file petitions with the court system. You can try this, or ask the court to prohibit the offset the next time you’re in front of a judge for a child support-related issue (like a modification case). Keep in mind, you’ll need to justify the request with the judge, so work out your explanation ahead of time.[8]

- You would need to do this in the 60-day window between the day you receive the notice from the state that your refund is being offset, and the day your check would be distributed by the federal government.

- For example, if you need that refund to complete a certification that will result in you getting a job, which will help you pay your child support, the judge might let you off the hook!

- If you just say, “Your honor, I just really want my tax refund,” they’re not going to help you out.

-

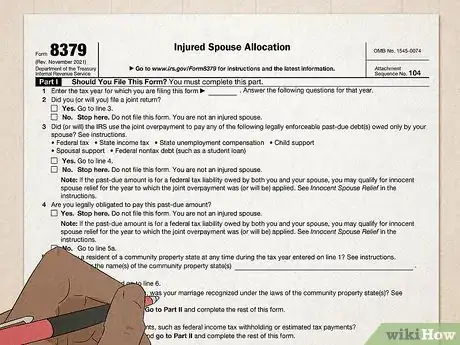

4Ask your spouse to file an injured spouse claim to save a portion of the refund. If you’re married, ask your partner to file an “injured spouse” claim on their taxes. This is a bit of a workaround to get some of your refund back. If you file your taxes jointly with your spouse, ask them to submit IRS Form 8379, and select “injured spouse” in the top right of the form.[9] If it is accepted, the federal government will prorate the interception and give you and your spouse at least a portion of your refund back.[10]

- The injured spouse claim is basically your spouse telling the federal government, “Hey, this isn’t my debt, so don’t penalize me for it.” Since a joint tax filing turns you and your spouse into one taxable entity, they’ll lay off a percentage of the refund.[11]

- Do this before you file your taxes. This way, the injured spouse claim will be processed before the federal government has the ability to respond to the state regarding an interception.

Paying Down Your Arrears

-

1Use the money you have now to get under the state’s threshold. Getting your tax refund later depends on how much you can pay now. You’re going to have to pay the arrears eventually, and paying down as much as you can now may help you beat the clock. If you can work your balance down to be lower than the threshold for your state to send a request to the BFS (Bureau of the Fiscal Services), you may be able to save your tax refund.[12]

- If you can pick up a second job, find some freelance work, or cut back on other expenses, do it. Whatever you can do to work that balance down, doing it will increase the odds that you prevent the offset.

- Even if you do save your tax refund, you may eventually have your paychecks garnished (or future benefits intercepted) if you don’t pay off your arrears.[13] Catch up on your child support as soon as you can!

-

2Reach out to a debt reduction program to get some help. Some local governments have programs to help ease this burden. Depending on where you live, there may be a state- or city-based government program that will help you reduce your debts and pay down your child support arrears. Even if they don’t pay your arrears off for you, they’ll at least help you petition the court, come up with a payment plan, or show you how to consolidate your debt to help you catch up.[14]

- If you’re in a position where your tax refund is going to be a key factor in whether you can stay in good legal standing with the state, these programs will typically offer you help.

- If your child is receiving any kind of public assistance (like food stamps, or reduced-rate housing), you should qualify for any government programs.

-

3Roll a child tax credit over to pay down your arrears. The one government check that can’t be intercepted is a child tax credit. The American Rescue Plan Act of 2021 expanded the tax credits for dependents. Under this new law, the payments you’ll receive for any dependents cannot be intercepted for child support. If you’re trying to get under the arrear threshold but your state is garnishing your wages and you’re struggling, rolling this tax credit over to pay for your arrears can buy you some breathing room.[15]

- This is an especially good idea if you live in a state where you accrue interest on child support arrears. Compounding interest can make it exceptionally hard to get out from under your debts, so paying the high-interest debts down first can make things easier in the future.[16]

-

4Take out a personal loan if you absolutely need the refund. It’s not a perfect solution, but a loan may get you under the threshold. This is not an ideal way to go about things most of the time, since you’ll be paying interest on the loan you take out. However, it is an option if you really need your tax refund for personal reasons. Contact a reputable debt consolidation company in your area and work with them to take a loan out and combine your debts to make paying them off easier.[17]

- This is a uniquely good idea if you live in Colorado or Vermont, where you pay a ton in interest (12%) for unpaid child support. If you can get a loan for 5-10% interest, and use that to pay off the child support in these states, you come out ahead in the long run.

Warnings

- If your arrears are intercepted for the offset program, your state will charge you a fee (normally around $25). If you see a discrepancy between the refund and the offset, that’s why.[18]⧼thumbs_response⧽

- Do not try to “beat the clock” with a rapid refund program. Companies like H&R Block and TurboTax will pay you out immediately with these programs, but the state will just intercept the refund anyway and you may end up in legal trouble with whatever company gave you the rapid refund.[19]⧼thumbs_response⧽

References

- ↑ https://www.acf.hhs.gov/css/faq/case-eligible-federal-tax-refund-offset-program

- ↑ https://mn.gov/dhs/people-we-serve/children-and-families/services/child-support/programs-services/federal-tax-refund-offset.jsp

- ↑ https://www.irs.gov/taxtopics/tc203

- ↑ https://www.irs.gov/taxtopics/tc203

- ↑ https://texaslawhelp.org/guide/i-need-to-change-a-custody-visitation-or-support-order-modification

- ↑ https://texaslawhelp.org/guide/i-need-to-change-a-custody-visitation-or-support-order-modification

- ↑ https://www.montcopa.org/542/Modifying-Changing-a-Support-Order

- ↑ https://mn.gov/dhs/people-we-serve/children-and-families/services/child-support/programs-services/federal-tax-refund-offset.jsp

- ↑ https://www.irs.gov/pub/irs-pdf/i8379.pdf

- ↑ https://www.texasattorneygeneral.gov/child-support/covid19/your-child-support-federal-stimulus-payments-and-tax-returns

- ↑ https://www.irs.gov/forms-pubs/about-form-8379

- ↑ https://www.texasattorneygeneral.gov/sites/default/files/files/child-support/Publications/re-entering-parents-handbook-ENG.pdf

- ↑ https://www.in.gov/dcs/child-support/faqs/non-custodial-parent-ncp-faqs/#Do_I_have_to_still_pay_child_support_if_Im_not_beg_allowed_to_have_parenting_time_with_my_child

- ↑ https://cssd.lacounty.gov/reduce-my-debt/

- ↑ https://floridarevenue.com/childsupport/compliance/Pages/economic_impact_payment_offsets.aspx

- ↑ https://www.texasattorneygeneral.gov/sites/default/files/files/child-support/Publications/re-entering-parents-handbook-ENG.pdf

- ↑ https://dadsdivorce.com/articles/child-support-debt-consolidation-possible/

- ↑ https://mn.gov/dhs/people-we-serve/children-and-families/services/child-support/programs-services/federal-tax-refund-offset.jsp

- ↑ https://mn.gov/dhs/people-we-serve/children-and-families/services/child-support/programs-services/federal-tax-refund-offset.jsp