This article was co-authored by Alan Mehdiani, CPA. Alan Mehdiani is a certified public accountant and the CEO of Mehdiani Financial Management, based in the Los Angeles, California metro area. With over 15 years of experience in financial and wealth management, Alan has experience in accounting and taxation, business formation, financial planning and investments, and real estate and business sales. Alan holds a BA in Business Economics and Accounting from the University of California, Los Angeles.

There are 13 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 44,873 times.

The Internal Revenue Service (IRS) is responsible for collecting federal taxes. While some of your assets will undoubtedly be subject to various federal tax laws, you may be able to protect some of your assets from taxes. To do so, hire qualified help and take advantage of tax laws that allow you to legally avoid certain taxes. Specifically, you should take part in extensive estate planning to avoid estate taxes and gift taxes. In addition, you can avoid a portion of your annual tax liability by using and saving your money in specified ways.

Steps

Conducting Thorough Estate Planning

-

1Hire an attorney. When you pass away, your assets will be distributed according to what is called your "estate plan." Your estate plan is a series of documents and creations meant to allow your assets to be distributed according to your wishes and with as little financial burden as possible. To create an estate plan, hire a qualified trusts and estates attorney to help. Visit your state bar website and utilize their lawyer referral service if you do not already have a lawyer. In California, for example, you can call the state bar and talk with someone about your legal issues. They will assess your needs and get you in touch with qualified attorneys in your area.[1]

- Before hiring an attorney, ask to sit down for an initial consultation. Be sure you ask about their experience creating comprehensive estate plans for the purposes of reducing your tax liability. In addition, make sure you ask about fees.

-

2Understand estate taxes. Federal estate taxes can cost your estate between 45% and 55% of its total value. These taxes must usually be paid in cash within nine months of your death. Any estate with a value of $5.45 million or more will have to pay estate taxes (i.e., the exemption is $5.45 million).[2]Advertisement

-

3Use all valid tax exemptions. Anything you pass down to your spouse is exempt from estate tax. While this is a great short-term solution, you may be creating problems for your spouse when they die. By using this exemption, you are adding to your spouse's estate value, which may increase their tax liability when they pass away.

- For example, assume Bob and Sue have an estate value of $10 million and they both die when the exemption is $5 million. When Bob dies, he can pass everything to Sue and no estate taxes will be due. But when Sue dies, her estate will equal $10 million and she can only use a $5 million exemption. The other $5 million will incur estate taxes in the amount of $1.75 million.[3]

-

4Transfer your unused exemption. If you pass away and do not use all of your $5.45 million exemption, you can pass the unused portion to your spouse. This is called portability. You can use portability to give your spouse a larger exemption than they would usually have.

- For example, assume Will and Sally are married to each other. Will has $3 million in assets and Sally has $7.5 million in assets. When Will dies, he uses $3 million of his exemption to shield his assets from estate taxes. His unused exclusion amount is $2.45 million (if the exemption amount is $5.45 million). He passes that unused portion to Sally. When Sally passes away, she will have an exemption amount of $7.9 million. Because she has $7.5 million in assets, she will be able to distribute her entire estate without having to worry about estate taxes.[4]

-

5Set up a trust. If you set up certain types of irrevocable trusts, you will be able to remove a large portion of your assets from your estate and avoid estate tax. An irrevocable trust simply means that once you put the property in trust, you no longer own those assets. Even if you do not own the assets in the trust, you can still benefit from the trust during your lifetime. To create a trust, you need to place property in trust for the benefit of one or more beneficiaries. You do all of this by creating a trust document.

- One type of trust is a qualified personal residence trust (QPRT). When you set up this trust, your home will be removed from your estate but you can continue to live there for a certain period of time. Usually, the time period is somewhere between two and 20 years. Once this period is up, the home will be transferred to the trust's beneficiaries.[5] [6]

-

6Make annual tax-free gifts. The tax code allows you to make a certain amount of tax-free gifts every year. If you need to reduce the value of your estate to avoid estate taxes, consider giving annual gifts to others. In 2016 the annual exclusion amount is $14,000 per donee. This means you could give each of your children $14,000 every year without being taxed.[7]

-

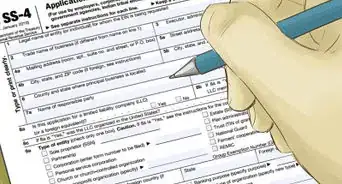

7Create a limited liability company (LLC). An LLC is a legal entity recognized in all 50 states. When you create an LLC, you are creating a business entity that has certain protections and responsibilities. In a family LLC, you (the parent) will maintain management of the LLC and your children and other family members will hold shares in the LLC's assets.

- Once you create the LLC, you can begin transferring whatever assets into the LLC that you want (e.g., cash, property, and personal possessions). You will then translate the value of those assets into LLC units of value (i.e., stock). Now you can transfer those units to whoever you want.

- The LLC units can be discounted up to 40% when they are transferred to non-managing members. This is where you can really reduce your tax liability.

- For example, if you want to gift one child non-management shares of LLC units that are valued at $1,000 each, you can apply a 40% discount to the value (bringing the value of each unit to $600). Now, instead of transferring 14 shares before having to pay a gift tax (because the gift tax applies after $14,000), you can transfer 23 shares.[8]

-

8Transfer life insurance. If you die and own one or more life insurance policies, the full amount of the proceeds will be included in your taxable estate. Because some life insurance policies can be for upwards of $500,000, they can put add a substantial amount to your taxable estate. However, if you do not own the life insurance policies, they will not be included in your estate. To transfer ownership of your life insurance policies:

- Transfer ownership to other people. Each policy will set out the ways you can transfer ownership. Look at your policy for details. When you use this method, the Internal Revenue Service (IRS) will disallow the transfer if you die within three years of making the transfer.

- Create an irrevocable life insurance trust. Once you transfer ownership of your policies to the trust, you are no longer the owner of them and they will not be included in your estate. Your trust will then distribute the proceeds to any beneficiary you name.[9]

Reducing Your Annual Tax Liability

-

1Hire a certified public accountant (CPA). Before you hire a CPA, consider what you will be using them for. Do you only need them to prepare a tax return? Do you need someone to analyze your entire financial situation? Do you need help planning for the future? Will you use them for business or personal assets? Once you answer these questions, begin your search.

- Get references from bankers, insurance agents, or other professionals.

- Find out what each candidate charges for their services.

- Verify credentials and check references.

- Finally, conduct a face-to-face interview. Ask them how long they have been in the business; how long your task will take to complete; what software they use; and how often their clients get audited.[10]

-

2Earn tax-free income. Some income you earn is not subject to income tax. Find these sources of income and utilize them. Some examples include selling a primary home and taking advantage of employer offered fringe benefits. Examples of fringe benefits include health benefits, life insurance, disability insurance, and educational assistance.[11]

-

3Maximize tax credits. Tax credits are incredibly helpful and can reduce your taxes dollar for dollar (i.e., credits will reduce the amount of taxes you must pay). If you think you qualify, talk with your CPA about taking the credit. The IRS offers the following types of tax credits:

- First time home buyer credits;

- child care credits;

- Adoption credits; and

- Education credits.[12]

-

4Carefully plan individual retirement account (IRA) rollovers. An IRA rollover happens when you withdraw money from one IRA and redeposit the funds in another IRA no later than 60 days after you receive the funds. if you do this, the transaction will not be taxed.

- However, new rules only allow you to do this once in any 12-month period. Therefore, you need to plan your rollovers carefully to avoid taxes.[13]

-

5Increase retirement contributions. Any contributions you make to retirement plans, up to a certain amount, will not be taxed. In addition, the contributions will reduce your taxable income, which will in turn reduce your tax liability.

- In 2014, the most you could contribute to a 401(k), 403(b), or 457 plan is $17,500.[14]

- Try to contribute the maximum amount possible to reduce your tax burden as much as possible.

-

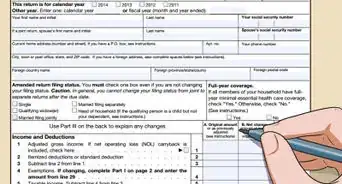

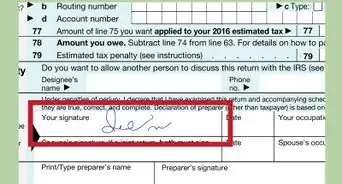

6Update your current withholding.If you are an employee, your employer likely withholds income tax from your pay. Check your current withholding to make sure it is in line with your expected earnings. You should update your withholding any time you have a major change in your life. Some of these changes may include marriage, divorce, the birth of a child, or starting a new business. When you overpay, you reduce the amount of cash flow. If you underpay, you may incur penalties and interest.

- To update your withholding, fill out IRS Form W-4 and turn it in to your employer. IRS Form W-4 can be found at https://www.irs.gov/pub/irs-pdf/fw4.pdf. The Form will ask you whether to withhold at a single or married rate; how many withholding credits you claim (each allowance reduces the amount withheld); and whether you want anything else withheld.[15] [16]

-

7Maximize deductions. When you do your taxes (or have someone do them for you), you want to make sure you take as many deductions as possible. When you do your taxes, you have the option of either taking a standard deduction or itemizing your deductions. To choose between these options:

- Calculate your itemized deductions, which will include expenses like mortgage interest, state and local income taxes or sales tax, real estate taxes, gifts to charities, casualty or theft losses, and un-reimbursed medical expenses.

- Know your standard deduction, which for a single person is $6,100.[17]

- Compare the two and make a choice. Take advantage of whatever option offers you a bigger deduction.

-

8Check your investment income. You can benefit from investment losses by selling them off. To qualify, you must have both taxable gains and losses. You can then use those losses to offset your gains. If the loss exceeds your gains, you can deduct the loss.[18]

-

9Donate to charity. When you give cash to an IRS-qualified organization (i.e., a 501(c)(3) organization), you can deduct the full amount of that gift if you itemize your deductions.[19]

Expert Q&A

-

QuestionWhat is the cheapest way to register an LLC?

Alan Mehdiani, CPAAlan Mehdiani is a certified public accountant and the CEO of Mehdiani Financial Management, based in the Los Angeles, California metro area. With over 15 years of experience in financial and wealth management, Alan has experience in accounting and taxation, business formation, financial planning and investments, and real estate and business sales. Alan holds a BA in Business Economics and Accounting from the University of California, Los Angeles.

Alan Mehdiani, CPAAlan Mehdiani is a certified public accountant and the CEO of Mehdiani Financial Management, based in the Los Angeles, California metro area. With over 15 years of experience in financial and wealth management, Alan has experience in accounting and taxation, business formation, financial planning and investments, and real estate and business sales. Alan holds a BA in Business Economics and Accounting from the University of California, Los Angeles.

Certified Public Accountant The cheapest way would be to go directly through the state. So, every state has their own agency that forms entities. For example, in California, the Californian Secretary of State needs to file articles of organization to form an LLC. You just complete the articles submitted and typically pay a small fee to the state—within a short period of time, you get that filed and have an active LLC.

The cheapest way would be to go directly through the state. So, every state has their own agency that forms entities. For example, in California, the Californian Secretary of State needs to file articles of organization to form an LLC. You just complete the articles submitted and typically pay a small fee to the state—within a short period of time, you get that filed and have an active LLC.

Warnings

- Reducing your taxes and protecting your assets is legal. Evading taxes and hiding your assets is not. If you are unsure about a specific method of ‘tax planning’, consult a CPA, tax attorney, or an IRS agent.⧼thumbs_response⧽

Expert Interview

Thanks for reading our article! If you'd like to learn more about protecting your assets from the irs, check out our in-depth interview with Alan Mehdiani, CPA.

References

- ↑ http://members.calbar.ca.gov/fal/MemberSearch/FindLegalHelp

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/estate-tax

- ↑ http://www.estateplanning.com/Understanding-Estate-Taxes/

- ↑ http://www.ustrust.com/Publish/Content/application/pdf/GWMOL/UST-WSR-Portability-of-estate-tax-exemption.pdf

- ↑ http://www.bankrate.com/finance/taxes/estate-taxes-trusts-1.aspx

- ↑ http://www.estateplanning.com/Understanding-Estate-Taxes/

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes

- ↑ http://www.investopedia.com/articles/personal-finance/071514/using-llc-estate-planning.asp

- ↑ http://www.nolo.com/legal-encyclopedia/transfer-life-insurance-decrease-estate-tax-29585-2.html

- ↑ https://www.cpaexam.com/how-to-hire-the-best-cpa-for-your-situation/

- ↑ http://tax.findlaw.com/federal-taxes/ten-ways-to-lower-your-taxes.html

- ↑ http://tax.findlaw.com/federal-taxes/ten-ways-to-lower-your-taxes.html

- ↑ http://www.forbes.com/sites/northwesternmutual/2014/11/18/still-time-tips-to-help-reduce-your-2014-tax-bill/#2bc0ed2a7f39

- ↑ http://www.forbes.com/sites/northwesternmutual/2014/11/18/still-time-tips-to-help-reduce-your-2014-tax-bill/#2bc0ed2a7f39

- ↑ https://www.irs.gov/individuals/employees/tax-withholding

- ↑ http://www.forbes.com/sites/northwesternmutual/2014/11/18/still-time-tips-to-help-reduce-your-2014-tax-bill/#2bc0ed2a7f39

- ↑ https://www.irs.gov/newsroom/itemize-or-choose-the-standard-deduction

- ↑ http://tax.findlaw.com/federal-taxes/ten-ways-to-lower-your-taxes.html

- ↑ http://www.forbes.com/sites/northwesternmutual/2014/11/18/still-time-tips-to-help-reduce-your-2014-tax-bill/#2bc0ed2a7f39