This article was co-authored by Darron Kendrick, CPA, MA. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

There are 15 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 44,985 times.

Requesting a tax transcript is a simple and free process. The IRS even has an online portal, which you can use to request either a PDF on your computer or a paper copy in the mail. You can also call the IRS to get a transcript mailed to you. If you need the transcript for a business, you will need to mail the form instead. Keep in mind that a tax transcript is not the same thing as a copy of your tax return. If you need a copy instead of a transcript, file Form 4506 instead.[1]

Steps

Getting an Online Transcript

-

1Create an account at IRS.gov. If you already have an account, log in. If you don't, go to the IRS website, and click "Get my Tax Record." Then click "Get Transcript Online." To make a new account you will need to provide:[2]

- Your full name

- Date of birth

- Social Security Number (SSN) or Individual Tax Identification Number (ITIN)

- Tax filing status (single, married, etc.)

- Mailing address used on the last tax return

- Mobile phone number that accepts texts

-

2Verify your new account using the code texted to you. As soon as you create a new account, a page will appear asking for a verification code. This code should be texted to you almost immediately. Type this code into the box.[3]

- If you do not have a mobile phone that accepts texts, you cannot request an online transcript.

Advertisement -

3Provide a number from 1 financial account to prove your identity. The form will ask you for the account number from a credit card, mortgage, home equity loan, or car loan. You only need to provide an account number from one of these.[4]

-

4Choose why you need the transcript. There are many different types of tax transcripts. To help you find the one that you need, the online portal will ask you why you are requesting a transcript. Choose an option from the drop down box, such as "Student Aid," "Mortgage Application," or "Income Verification."

-

5Choose the tax year that you want the transcript for. The portal will tell you which years are available. Click on the year that you want. Most transcripts will only allow you to see the current tax year and the previous 3 years. In some cases, you may be able get transcripts for up to 10 years before the current tax year.[5]

-

6Download the PDF file. Once you have filled out all of the information, you will receive a PDF. Download it and save it to your computer so that you have it. Print out the transcript to keep a physical copy.

Receiving the Transcript by Mail

-

1Visit the IRS website. Go to https://www.irs.gov/, and click "Get my Tax Record." Select "Get Transcript by Mail." This is a simple online form. You do not need to create an account to get your transcript by mail.[6]

-

2Fill the form out with your personal information. The form asks for your Social Security Number (SSN) or Individual Tax ID Number (ITIN). You must also provide your date of birth, mailing address, and zip code. [7]

- The mailing address must be the one that the IRS has on file for you. In most cases, this will be the address on your last tax return. If your address has changed since your last return, fill out and submit Form 8822-Change of Address before proceeding.[8]

-

3Choose which type of transcript you would like. You will see a dropdown box with 2 options for transcripts. Choose which option you need. In most cases, you should select a tax return transcript. This can be used to verify your income, apply for student aid, or get a mortgage.[9]

- A tax return transcript shows your adjusted gross income as well as most forms and schedules from your tax return.

- A tax account transcript tells you basic information about your return, such as return type, filing status, taxable income and payment types.

-

4Wait 5 to 10 days for the transcript to arrive. A paper transcript will arrive in an envelope. Keep in mind that this will not be a copy of your tax return. If you would like a copy, file Form 4506 instead.[10]

Requesting a Transcript by Phone

-

1Call 1-800-908-9946. This number will connect you to an automatic system to request your transcript. Follow the prompts as they are spoken to you.[11]

- Make sure that your address is up to date with the IRS before you begin. If you have moved since filing your last tax return, you will need to submit Form 8822 before you can proceed.

-

2Follow the prompts to provide your SSN and street address. These details will verify your identify. First, you may need to dial in your SSN. Then you may be asked for the numbers in your street address.[12]

- For example, if your street address is 123 Main Street, dial in “123.”

-

3Choose option 2 on the menu. You will hear a menu with options. Press option 2 to get tax return transcripts.[13]

-

4Enter the tax year that you want. When prompted by the operator, dial the year using the keypad. For example, if you want a transcript from 2016, dial in “2016.”[14]

-

5Wait 5 to 10 days for the transcript to arrive by mail. The transcript will be sent to the address that the IRS has on file for you.[15]

Requesting a Transcript for a Business

-

1Fill out and print form 4506-T. You can fill out the form using a PDF reader. Type in the employer identification number (EIN), the address, and the name on the original return. Check which type of transcript you would like. Print the form out when you are done.[16]

- You can find the form at https://www.irs.gov/pub/irs-pdf/f4506t.pdf.

-

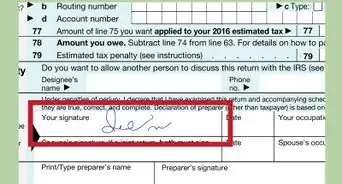

2Ask an approved representative to sign the form. If you are requesting the transcripts of a business, estate, or corporation, you will need the form signed by either a representative of the board, an officer with legal control of the company, or a shareholder with more than 1% ownership.[17]

- The signatory must check the box that states “Signatory attests that he/she has read the attestation clause and upon so reading declares that he/she has the authority to sign the Form 4506-T.”

- Have them sign at the bottom of the first page where it states “Sign Here.” Under the signature, write the title of the person within the company.

-

3Mail the form to the correct address on page 2. Where you send the form depends on which transcript you are requesting and where you live. The second page of the form has a list of addresses. Find the address which applies to you, and file the form there. It will take up to 30 days to receive your transcript.[18]

Expert Q&A

-

QuestionWhat is a tax account transcript?

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Financial Advisor A transcript is a document from the IRS that contains your contact information, personal information, a record of your income (wages or business income), any balance due, and penalties and interest if applicable.

A transcript is a document from the IRS that contains your contact information, personal information, a record of your income (wages or business income), any balance due, and penalties and interest if applicable. -

QuestionHow do I contact the IRS customer service?

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Financial Advisor The IRS website (www.irs.gov) has all the contact information related to income tax matters. If you do not have online access, you may call 800-829-1040.

The IRS website (www.irs.gov) has all the contact information related to income tax matters. If you do not have online access, you may call 800-829-1040. -

QuestionHow do I get my tax transcript?

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Financial Advisor To get your tax transcript, visit the IRS web site at www.irs.gov/individuals/get-transcript.

To get your tax transcript, visit the IRS web site at www.irs.gov/individuals/get-transcript.

Warnings

- If you have a credit freeze on your account from Equifax, you must lift the freeze before getting a tax transcript.⧼thumbs_response⧽

References

- ↑ https://www.irs.gov/forms-pubs/about-form-4506

- ↑ https://www.irs.gov/newsroom/how-to-register-for-get-transcript-online-using-new-authentication-process

- ↑ https://www.irs.gov/newsroom/how-to-register-for-get-transcript-online-using-new-authentication-process

- ↑ https://www.irs.gov/individuals/get-transcript

- ↑ https://www.irs.gov/individuals/tax-return-transcript-types-and-ways-to-order-them

- ↑ https://www.irs.gov/individuals/tax-return-transcript-types-and-ways-to-order-them

- ↑ https://www.irs.gov/individuals/get-transcript

- ↑ https://www.irs.gov/individuals/get-transcript-faqs

- ↑ http://www.hesaa.org/Documents/Requesting_IRS_Tax_Return.pdf

- ↑ https://www.irs.gov/individuals/get-transcript

- ↑ https://www.irs.gov/individuals/tax-return-transcript-types-and-ways-to-order-them

- ↑ https://studentservices.southtexascollege.edu/finaid/IRS_Tax_Return_Transcript_Request.html

- ↑ https://studentservices.southtexascollege.edu/finaid/IRS_Tax_Return_Transcript_Request.html

- ↑ https://www.nyu.edu/content/dam/nyu/financialAid/documents/verif-taxtranscript.pdf

- ↑ https://www.irs.gov/individuals/get-transcript-faqs

- ↑ https://www.irs.gov/newsroom/how-to-get-a-transcript-or-copy-of-a-prior-year-tax-return

- ↑ https://www.irs.gov/pub/irs-pdf/f4506t.pdf

- ↑ https://www.irs.gov/newsroom/how-to-get-a-transcript-or-copy-of-a-prior-year-tax-return

- ↑ https://www.irs.gov/newsroom/irs2goapp

About This Article

To get an IRS transcript, start by creating an account at IRS.gov. Then, click on "Get my Tax Record," followed by "Get Transcript Online." From there, you can enter your personal information and download a PDF of your IRS transcript. Alternatively, you can click on "Get Transcript by Mail" to have your transcript sent to you within 5-10 days. For more tips from our Accounting co-author, like how to request an IRS transcript over the phone, scroll down!