This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 653,780 times.

Most people receive W-4 forms from their employers when they begin working. Payroll departments use the information employees provide on their W-4 forms to determine how much money should be withheld from their paychecks for federal taxes. If you've just entered the workforce, filling out a W-4 form for the first time can be confusing.[1]

Steps

Personal Allowance Worksheet

-

1Read the basic instructions provided by the IRS at the top of the form. A personal allowance reduces your taxable income. The more allowances you claim on your W-4, the less money will be withheld from your paycheck for taxes. In contrast, if you claim fewer allowances, more money will be withheld from your paycheck for taxes.[2]

-

2Determine if someone is claiming you as a dependent. Generally, parents claim their children as dependents, but you can claim other relatives if you provide over half of their support and they meet the other IRS requirements to qualify as a dependent.[3]

- If no one is claiming you as a dependent, you can enter a "1" in the blank provided for line A on the form.

Advertisement -

3Select your tax filing status. On line B, enter "1" if you will file your taxes as married filing jointly. On line C, enter "1" if you will file taxes as head of household. On line D, enter "1" if you will file as single or married filing separately and only have one job; you’re married filing jointly, have only one job, and your spouse doesn’t work; or your wages from a second job or your spouse’s job (or the total of both) are $1,500 or less.

-

4Add allowances for children that qualify for the child tax credit. If your total income will be less than $71,201 ($103,351 if married filing jointly), enter “4” for each eligible child. If your total income will be between $71,201 and $179,050 ($103,351 to $345,850 if married filing jointly), enter “2” for each eligible child.

- If your total income will be between $179,051 and $200,000 ($345,851 to $400,000 if married filing jointly), enter “1” for each eligible child. If your total income will be higher than $200,000 ($400,000 if married filing jointly), enter “0”.

-

5Add allowances for other dependents that qualify for credit for other dependents. If your total income will be less than $71,201 ($103,351 if married filing jointly), enter “1” for each eligible dependent.

- If your total income will be between $71,201 and $179,050 ($103,351 to $345,850 if married filing jointly), enter “1” for every 2 dependents (for example, enter “0” for 1 dependent, “1” if you have 2-3 dependents, and “2” if you have 4 dependents).

- If your total income will be higher than $179,050 ($345,850 if married filing jointly), enter “0”.

-

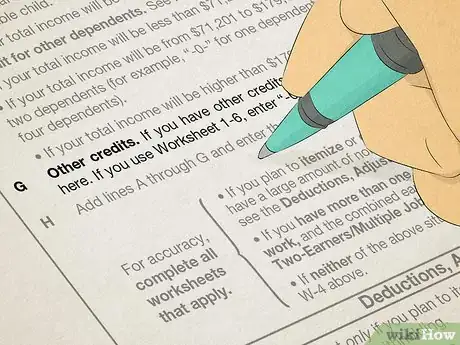

6Add allowances for other credits. If you have other credits, see Worksheet 1-6 of Pub. 505 and enter the amount from that worksheet. If you use Worksheet 1-6, enter “-0-” on lines E and F.

-

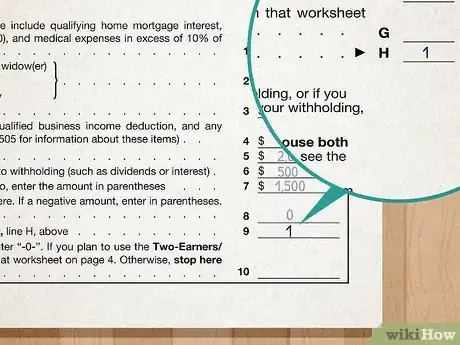

7Add up the number of allowances you have claimed on the worksheet and enter it in line H. You will put this number on line 5 of your W-4 form.[4]

- For example, if you are married with 2 children who qualify for the tax credit, your spouse does not work, and your income is $100,000 you would claim a total of 11 allowances: 1 on Lines A, B, and C and 8 on LIne E.

-

8Read the statement under line H to determine whether you need to complete the other worksheets. If you plan to itemize your deductions, you'll need to complete the Deductions and Adjustments Worksheet. If you have more than one job, or if you're married and both you and your spouse work, you'll need to fill out the Two-Earners/Multiple Jobs Worksheet.[5]

- If neither of those descriptions applies to you, you can enter the amount from line H directly into line 5 on your withholding allowance certificate.[6]

Employee's Withholding Allowance Certificate

-

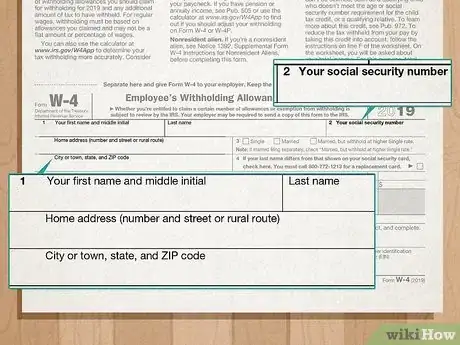

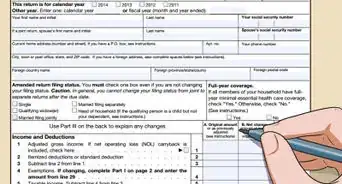

1Fill out the personal information that is required. In the boxes numbered 1 and 2, you will enter your first and last name, address, and Social Security number.[7]

-

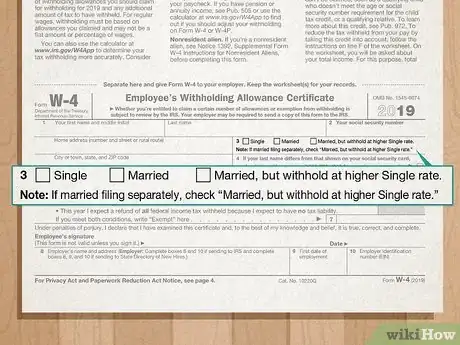

2Identify whether you are single or married. In box 3, you must check the appropriate square to indicate whether you are single, married, or married but want taxes withheld from your paycheck at the higher single rate.[8]

- You are considered single if you are unmarried, divorced, or legally separated according to state law. You also are considered single if you are married but your spouse is a nonresident of the United States.

- You are considered married if you are married according to state law. If your relationship status on the last day of the year is "married," then for the purposes of federal taxes you are married for the entire year.[9]

- You can choose to withhold taxes at a single rate, which is higher, if you are married but would prefer to have more money kept from your paycheck.[10]

-

3Record your total personal allowances. Take the number you entered in line H of your Personal Allowance Worksheet, or the result from the other worksheets you needed to use on the second page, and write it in box 5.[11]

-

4

-

5Read the exemption claim. If you had no tax liability last year, and expect a full refund this year, you can write "exempt" in box 7.[14]

-

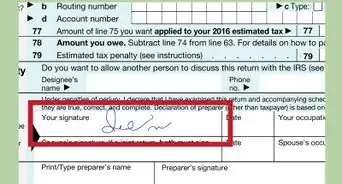

6Sign and date your W-4 form. You've finished filling out the form, but it isn't valid until you sign and date it, declaring under penalty of perjury that all the information you provided is true and complete.[15]

- When you've completed and signed your form, return it to your employer. Check your pay stubs to ensure the proper amount of money is being withheld each pay period.

-

7Review your W-4 form on an annual basis. You may want to add allowances if you received a large refund and would like to keep more money in your paycheck. In contrast, you may want to decrease your number of allowances if you had to pay the IRS last year.

- If any event happens that changes your withholding status, such as a birth or a divorce, you must file a new W-4 with your employer within 10 days of the event's occurrence.[16]

Deductions and Adjustments Worksheet

-

1Figure out if you need to use the deductions and adjustments worksheet. You should use this worksheet only if you plan on itemizing your deductions such as mortgage interest, or taking certain credits or adjustments.[17]

- This worksheet also takes into account other non-wage income you might have, such as dividends and interest.

-

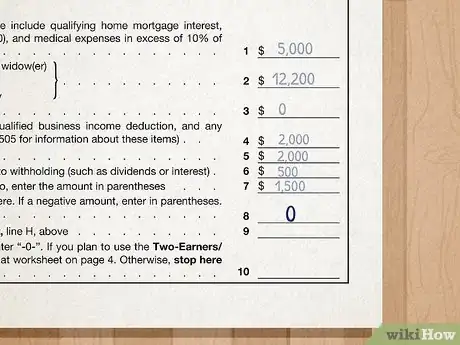

2Determine your estimated itemized deductions for the year. Deductions reduce your tax liability. You can take the standard deduction or itemize your deductions. Typically people choose to itemize their deductions when their total itemized deductions are greater than the standard deduction.[18]

- For example, suppose you are single when you file your taxes in 2019. Your standard deduction would be $12,200. When you add up your itemized deductions, the total is $5,000. In that situation, you probably would choose to take the standard deduction.[19]

- Enter the dollar amount of your estimated itemized deductions in the blank on line 1.[20]

-

3Enter the appropriate standard deduction in the blank on line 2. The worksheet provides the standard deduction amounts based on your filing status. For example, if you are single in 2019, you would enter $12,200 on line 2.

-

4Subtract the standard deduction from your estimated itemized deductions. If the result of that calculation is zero or a negative number, write "0" in the blank on line 3. To continue the previous example, subtracting $12,200 from $5,000 would produce a negative number, so you'd enter "0" on line 3.[21]

-

5Calculate an estimate of any adjustments to income. Adjustments, also called "above-the-line deductions," are amounts such as traditional IRA contributions or student loan interest that you claim directly on your 1040. Enter the amount of any adjustments on line 4.[22]

- To continue the example, suppose you paid $2,000 in student loan interest that you planned to claim on your taxes. You would enter $2,000 on line 4.

-

6Add lines 3 and 4 and write that number on line 5. This is the total amount of deductions, credits, and adjustments you estimate you will claim in the year you fill out the W-4. If you are claiming tax credits, you will have to complete an additional worksheet to convert those credits to withholding allowances.[23]

- The total in the example for line 5 would be $2,000.

-

7Write your estimated non-wage income in the blank on line 6. Non-wage income includes money you receive without working for it, such as interest or alimony.[24]

- If you received $500 in interest income, for example, you'd enter $500 on line 6.

-

8Subtract the amount on line 6 from the amount on line 5 and enter the result on line 7. If the result is zero or a negative number, enter "0."[25] To continue the example, you would subtract $500 from $2,000. The result is not zero or a negative number, so you would enter the result of $1,500 on line 7.

-

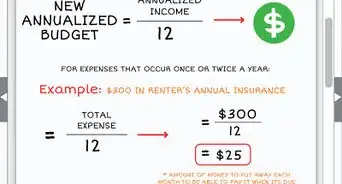

9Divide the amount on line 7 by $4,200 and write the result on line 8, dropping any fraction. In the example, you would divide $1,500 by $4,200 and the result would be 0.357. You would drop the decimals and enter "0" on line 8.[26]

-

10Enter the number from line H on your Personal Allowances Worksheet on line 9. Since in the example you are single with no dependents, you have "1" on line H as well.

-

11Add the numbers on lines 8 and 9 and write the total on line 10. If you're planning on completing the Two-Earners/Multiple Jobs Worksheet, enter the total on the first line of that worksheet. If you don't need that worksheet, enter this number on line 5 of your Withholding Allowance Certificate.[27] To finish up the example, you would enter "1" on your Withholding Allowance Certificate.

Two-Earners/Multiple Jobs Worksheet

-

1Decide if you need to use this worksheet. The Two-Earners/Multiple Jobs Worksheet is designed to make sure that single people with more than one job, or married couples who both work, have the correct amount of taxes withheld from their paychecks.[28]

- You should only use this worksheet if the instructions under line H on your Personal Allowance Worksheet directed you to do so.[29]

-

2Use the table provided to find the number that applies to the lowest paying job and enter that number on line 2. However, if the highest paying job pays $75,000 or less and the combined wages for you and your spouse are $107,000 or less, don’t enter more than “3.”

-

3Compare the number you just entered on line 2 with the number you entered on line 1 from your Deductions and Adjustments Worksheet. If the number on line 1 is greater than or equal to the number on line 2, subtract line 2 from line 1. Enter that number on line 3 and on line 5 of your Withholding Allowance Certificate, and you are done with this worksheet.[30]

- If the number on line 1 is less than the number on line 2, enter "0" on line 5 of your Withholding Allowance Certificate. You should then complete the rest of the worksheet to figure out what additional amount to have withheld from your paycheck. This will help you avoid having to pay the IRS when you file your taxes.[31]

-

4Figure out how much additional money should be withheld from your paycheck. If you entered "0" on line 5, the worksheet includes some additional calculations so you won't be facing a big tax bill in April.[32]

- Line 4 instructs you to enter the number from line 2 of the same worksheet. This was the number that corresponded to the lowest paying job. Assume, for example, that number was "3."

- On line 5 you'll need to enter the number from line 1 on the same worksheet, which was the final number you arrived at on line 10 of your Deductions and Adjustments Worksheet. To continue the example, assume that number was "1."

- Now subtract line 5 from line 4 and enter the result in line 6. In the example, the result would be "2."

- Using table 2 provided on the worksheet, find the amount that corresponds to the highest paying job. Assume you are married filing jointly, and your highest paying job pays $50,000 a year. According to the table, you should enter $500 on line 7.

- Now multiply line 7 by line 6 and enter the result on line 8. This is the total amount of additional withholding needed. In the example, that number would be $1,000.

- All you need to do now is divide that number by the number of pay periods remaining in the year. This depends on how often you're paid and what time of year you start. If you started the job for which you're filling out a W-4 in February and will be paid monthly, you would divide $1,000 by 10 because there are 10 pay periods left in the year. The result of that calculation, $100, is the additional amount of money that needs to be withheld from your paychecks. This is the amount you'd enter on your Withholding Allowance Certificate.[33]

Expert Q&A

-

QuestionDo I file single if my husband is deceased?

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Financial Advisor & Certified Public Accountant If your spouse died during the tax year, you can still file as married filing jointly for that year. For the two years following the year of death, you may be able to file as qualifying widow if you meet the following requirements: you qualified to file as married filing jointly with your spouse when they died, you didn't remarry before the close of the tax year, you have a child, stepchild, or adopted child you are claiming as a dependent, and you pay more than half of the cost of maintaining your home.

If your spouse died during the tax year, you can still file as married filing jointly for that year. For the two years following the year of death, you may be able to file as qualifying widow if you meet the following requirements: you qualified to file as married filing jointly with your spouse when they died, you didn't remarry before the close of the tax year, you have a child, stepchild, or adopted child you are claiming as a dependent, and you pay more than half of the cost of maintaining your home. -

QuestionWhen submitting my W-4 to the IRS, what address or fax number do I use?

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Cassandra Lenfert, CPA, CFP®Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

Financial Advisor & Certified Public Accountant Form W-4 is submitted to your employer which they maintain in their records. A copy does not need to be submitted to the IRS.

Form W-4 is submitted to your employer which they maintain in their records. A copy does not need to be submitted to the IRS.

References

- ↑ http://www.kiplinger.com/article/taxes/T056-C011-S001-how-to-fill-out-a-w-4-form.html

- ↑ http://www.kiplinger.com/article/taxes/T056-C011-S001-how-to-fill-out-a-w-4-form.html

- ↑ https://turbotax.intuit.com/tax-tools/tax-tips/Family/Rules-for-Claiming-a-Dependent-on-Your-Tax-Return/INF12139.html

- ↑ http://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ http://www.irs.gov/Individuals/Employees/Tax-Withholding

- ↑ http://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ http://www.irs.gov/Individuals/Employees/Tax-Withholding

- ↑ http://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ http://www.irs.gov/Individuals/Employees/Tax-Withholding

- ↑ http://www.bankrate.com/finance/taxes/working-through-the-w-4-worksheet.aspx

- ↑ http://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ http://www.irs.gov/uac/Newsroom/Itemizing-vs-Standard-Deduction-Six-Tips-to-Help-You-Choose

- ↑ http://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ http://www.bankrate.com/finance/taxes/working-through-the-w-4-worksheet.aspx

- ↑ http://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/p505.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/p505.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/p505.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/p505.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/fw4.pdf

About This Article

To fill out a W-4 for your job, first fill in the personal information in boxes 1 and 2, like your name, address, and Social Security number. Then, in box 2, check the appropriate box to indicate whether you are married or single. Once you’ve filled this out, record your personal allowances in line H. You can find more information about personal allowances, like if you have children, on the W-4 worksheet. After the personal allowances line, write a dollar amount in line 6 if you want any additional money withheld from your paycheck. This is optional. Finally, sign and date the W-4 form so it’s valid. To learn how to complete the deductions and adjustments worksheet for your W-4, scroll down!