This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

This article has been viewed 55,538 times.

If you are not prepared to file your taxes when April 15th comes around, you can apply for an extension to file. The IRS almost never makes any inquiries as to why you are asking for the extension, so almost everyone who files is granted one, so long as they don't owe back taxes for multiple years. Remember, even if your extension is granted, you will still owe any tax liability plus interest.

Steps

Filing an Individual Extension

-

1Get the proper form. For an individual extension, you'll need a copy of IRS Form 4868. You can find a copy at http://www.irs.gov/pub/irs-pdf/f4868.pdf. Remember to make sure you have the form for the proper year.

-

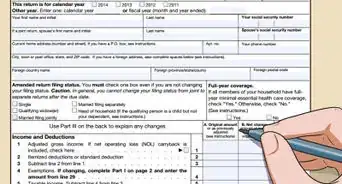

2Gather your information. You will need to know your name, address, social security number, and your spouse's social security number in order to fill out IRS Form 4868.Advertisement

-

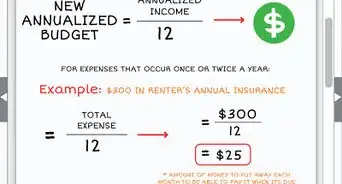

3Estimate your income. Even if you file for an extension, you will still be asked to estimate the amount you would owe if you filed on time. The starting point for this estimate will be your yearly income. While the estimate will be useful for you, it's more for the IRS' purposes than your own.[1]

- In order to estimate your income, it's best to use last year as a starting point. If you haven't changed jobs, gotten a significant raise at that job, or received a payment from investment income, your income is probably close to what it was the year before.

-

4Enter the amount of tax you have already paid. This includes any amount of tax that has already been withheld from your paycheck, any quarterly estimated tax payments you made, overpayment from the prior year, and if you are eligible, the amount of any credits or deductions, including the Earned Income Credit.

- There are many types of deductions and credits that are available to taxpayers. One of the most common is the Earned Income Credit. To see if you are eligible for specific deductions or credits, consult a tax preparer or the instructional forms for taxes, which can be found at http://www.irs.gov/instructions/. There are instructions for many different forms, but most people use a 1040 to file taxes.

-

5Estimate your tax liability. The amount of your tax liability is based on your taxable income, which is your income minus allowable deductions. There are many tax liability calculators/estimators available online, like the one at http://www.irs.ustreas.gov/pub/irs-pdf/f1040es.pdf.

-

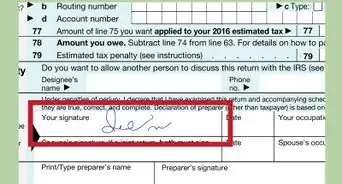

6Pay any amount of your estimated tax that you can. Since you are charged interest on your back taxes, you will want to minimize the amount of back tax you will owe. Therefore, pay whatever you can when you submit your form. This will offset any interest or penalties you will owe when you file. Make a payment here: http://www.irs.gov/Payments

-

7Submit the form. Submit your form either electronically or via certified mail (always get a return receipt so you have proof of when it was filed). The proper address can be found on Form 4868. Unless you hear from the IRS, you can assume that your request for an extension has been granted. You will usually hear from the IRS within 60 days.[2]

-

8Mark your calendar. If you file for an automatic extension, you will have until October 15 to file your taxes, assuming the original due date is April 15.

Filing a Corporate Extension

-

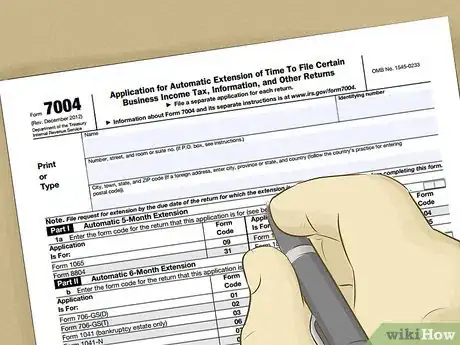

1Obtain the proper form and gather identifying information. In order to file an extension for a business, you're going to need a copy of IRS Form 7004, which you can find at http://www.irs.gov/pub/irs-pdf/f7004.pdf. Make sure to check the year. You will also need to know your basic identifying information, including name, address, and your Employer Identification Number.

-

2See if you qualify for an automatic extension under Regulation 1.6081-5. Certain types of businesses qualify for 3-month extensions without having to file under Form 7004. If they do file form 7004, then they can only get a maximum of 3 additional months past the regular due date, for a total of 6 months. Qualifying business are:[3]

- Foreign corporations that maintain a place of business in the US.

- A US corporation that transacts business and keeps its account records outside of the US or Puerto Rico.

- A US corporation whose main source of income comes from US territories and other possessions.

-

3Determine if you qualify for a 6-month extension for your business. The automatic extension period for all business types is 6 months (except for C corporations with a tax year ending June 30). However, the rules for businesses are often far more complex than those for individuals, so it is best to consult a tax attorney, accountant, or other tax professional to determine which extension to file.

- Alternatively, you can find a list of the instructions for all of the IRS' forms at http://www.irs.gov/instructions/, which all include instructions on who should file what type of return.

-

4Estimate your total income tax. Estimate your federal income tax liability for the year and report this total on Line 6 of Form 7004. Note any payments you have already made (such as quarterly payments) on Line 7, then include the projected balance due on Line 8.

-

5Pay as much as you are able toward any balance due. This will reduce your penalties and interest charges. If possible, pay the full balance. Make a payment here: http://www.irs.gov/Payments

-

6File your extension electronically or with a paper form. Mail your form and/or payment to the address printed on your instructions via certified mail, or use your own electronic filing software.

- Businesses with assets of $10,000,000 or more are required to e-file.[4]

- Assume your extension filing has been accepted by the IRS unless you hear otherwise. It is called an "automatic" extension because the IRS rarely rejects the request.

Warnings

- Remember that filing for an extension does not mean you have an extension to pay any taxes that you owe. If you do not pay on time, you may be subject to interest charges and late fees.⧼thumbs_response⧽

References

About This Article

If you need to file an extension for individual taxes, start by locating IRS Form 4868, which you can find on the IRS website. After you’ve gathered your personal information, provide an estimate of your income by using last year as a guide. Next, enter any taxes you’ve already paid, like taxes taken from your paychecks. To calculate your tax liability, find an online tax calculator and enter your taxable income to get an estimate of what you owe. Then, pay any amount of the taxes you can to reduce interest charges before submitting the form. To learn more from our CPA co-author, like how to file a corporate extension for taxes, keep reading the article!