This article was co-authored by Darron Kendrick, CPA, MA and by wikiHow staff writer, Jennifer Mueller, JD. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

There are 10 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 74,312 times.

Generally, you are not required to file a tax return with the IRS if your income is below the taxable threshold. However, even if you had no income for the year, you may want to file a return if you are eligible for refundable tax credits. If you're filing a tax return with zero income, you can use the IRS's Free File system to avoid preparation fees.[1]

Steps

Reporting Zero Income

-

1Choose the correct form. There are 3 different versions of the standard tax return: the 1040, the 1040A, and the 1040EZ. If you're filing a zero income tax return, you'll probably not be using a 1040EZ, which is for individuals with no dependents claiming no credits. Most likely, you'll be filing the 1040A.[2]

- If you're using online tax preparation software, it will automatically choose the correct form for you based on the information you provide.

-

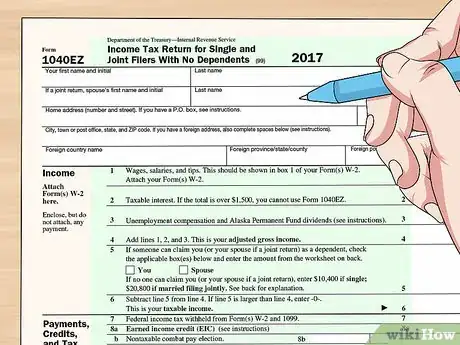

2Provide your identification information. When you start filling out your tax return, you must enter your name, address, and Social Security number. If you're married, you must also complete this information for your spouse.[3]

- You'll also enter information for your filing status (single or married) and any dependents you're claiming.

Advertisement -

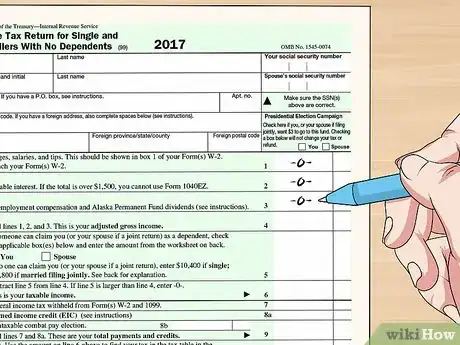

3Enter "-0-" for all income categories. The next portion of the tax return asks about your income. Since you didn't earn any income for the year, you'll enter a "-0-" in each blank. Your total income will also be "-0-."[4]

- Double-check to make sure that none of the income categories applies to you. For example, if you have money in a savings account that earns interest, you may have to report that interest as income.

-

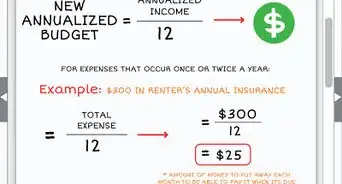

4Make any applicable adjustments to your income. Since you didn't have any income for the year, you likely don't have any adjustments either. Any adjustments would result in a negative number for your adjusted gross income (AGI). However, your AGI can't be less than zero, so you'd still enter "-0-" in the line for AGI.[5]

Claiming Refundable Credits

-

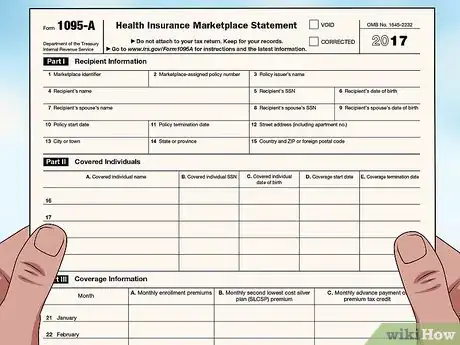

1Gather necessary documents and information. Even though you don't have any income, you may qualify for some refundable credits. If you do, you could get a refund from the IRS even though you didn't pay any taxes during the year.[6]

- If you purchased health insurance through the Marketplace, you should have gotten a Form 1095A in the mail that summarized any advance premium tax credit you received to subsidize your health insurance premiums throughout the year.

-

2Reconcile any advance premium tax credit you received. If you purchased health insurance through the Marketplace on healthcare.gov, you may have received all or part of your premium tax credit in advance to subsidize your monthly insurance premiums.[7]

- If you were eligible for a larger tax credit than you received in advance, you may get some of that back as a refund. On the other hand, you may owe the IRS money back if you had too much money advanced. Since you had no income for the year, this is unlikely to be the case.

-

3Figure your child tax credit if you have children. The child tax credit allows $1,000 for each eligible child to be subtracted directly from your tax liability. Since you have no income (and therefore no tax liability), you may be eligible for the additional child tax credit, which is refundable.[8]

- Complete the worksheet with your tax return to find out if you're eligible for this tax credit. If you're completing your taxes online using tax preparation software, you'll typically just answer a few questions.

-

4Compute your education tax credit if you went to school. Many people who report zero income were going to school full time during the year, and may have had an unpaid internship over the summer.[9]

- If you're eligible for the education tax credit, most of it merely decreases your tax liability. Since you have no tax liability, this doesn't do anything for you. However, 40 percent of the tax credit is refundable. You can get that money back even if you didn't owe anything in taxes.

Using IRS Free File

-

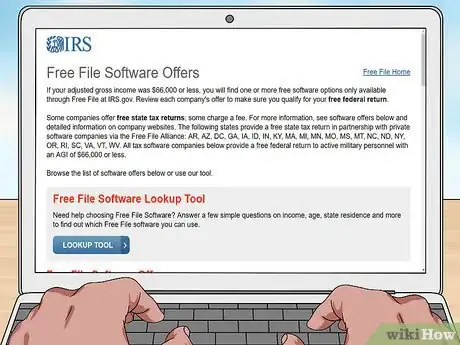

1Choose your free file software. The IRS offers free downloads of brand-name tax preparation software that you can use to file your taxes for free if your income is below $66,000. Some software will do state returns as well.[10]

- Use the IRS's free tool to look up the software available for you by going to https://apps.irs.gov/app/freeFile/jsp/wizard.jsp.

-

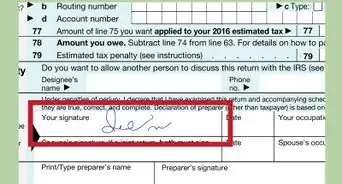

2Verify your identity to file electronically. To file your tax return electronically, use the adjusted gross income (AGI) you reported on the previous year's tax return to verify your identity. If you filed electronically last year and created a 5-digit PIN to sign your forms, you can also use that.[11]

- If you don't have a copy of last year's tax return, go to https://www.irs.gov/individuals/get-transcript and get a free online transcript. It will list your AGI.

-

3Mail paper returns to the correct address for your state. If you don't want to file your return electronically, or are unable to for whatever reason, you can still mail in paper returns to the IRS. There is a separate address for taxpayers in each state.[12]

- Find out where to mail your return by going to https://www.irs.gov/filing/where-to-file-paper-tax-returns-with-or-without-a-payment and clicking on the name of your state.

Zero Income Tax Return Glossary

Expert Q&A

-

QuestionWhat are common mistakes people make when filing their taxes?

John Gillingham, CPA, MAJohn Gillingham is a Certified Public Accountant, the Owner of Gillingham CPA, PC, and the Founder of Accounting Play, Apps to teach Business & Accounting. John, who is based in San Francisco, California, has over 14 years of accounting experience and specializes in assisting consultants, bootstrapped startups, pre-series A ventures, and stock option compensated employees. He received his MA in Accountancy from the California State University - Sacramento in 2011.

John Gillingham, CPA, MAJohn Gillingham is a Certified Public Accountant, the Owner of Gillingham CPA, PC, and the Founder of Accounting Play, Apps to teach Business & Accounting. John, who is based in San Francisco, California, has over 14 years of accounting experience and specializes in assisting consultants, bootstrapped startups, pre-series A ventures, and stock option compensated employees. He received his MA in Accountancy from the California State University - Sacramento in 2011.

Certified Public Accountant & Founder of Accounting Play

-

QuestionHow can I maximize my IRS tax deductions?

John Gillingham, CPA, MAJohn Gillingham is a Certified Public Accountant, the Owner of Gillingham CPA, PC, and the Founder of Accounting Play, Apps to teach Business & Accounting. John, who is based in San Francisco, California, has over 14 years of accounting experience and specializes in assisting consultants, bootstrapped startups, pre-series A ventures, and stock option compensated employees. He received his MA in Accountancy from the California State University - Sacramento in 2011.

John Gillingham, CPA, MAJohn Gillingham is a Certified Public Accountant, the Owner of Gillingham CPA, PC, and the Founder of Accounting Play, Apps to teach Business & Accounting. John, who is based in San Francisco, California, has over 14 years of accounting experience and specializes in assisting consultants, bootstrapped startups, pre-series A ventures, and stock option compensated employees. He received his MA in Accountancy from the California State University - Sacramento in 2011.

Certified Public Accountant & Founder of Accounting Play

References

- ↑ https://www.irs.gov/newsroom/deciding-whether-and-how-to-file-heres-what-to-remember

- ↑ https://www.irs.gov/taxtopics/tc352

- ↑ https://www.irs.gov/pub/irs-pdf/f1040.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/f1040.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/f1040.pdf

- ↑ https://www.irs.gov/e-file-providers/what-you-need-to-get-started

- ↑ https://www.irs.gov/pub/irs-pdf/i8962.pdf

- ↑ https://www.irs.gov/publications/p17#en_US_2017_publink1000174526

- ↑ https://www.irs.gov/publications/p17#en_US_2017_publink1000174558

- ↑ https://www.irs.gov/filing/free-file-do-your-federal-taxes-for-free

- ↑ https://www.irs.gov/e-file-providers/what-you-need-to-get-started

- ↑ https://www.irs.gov/filing/where-to-file-paper-tax-returns-with-or-without-a-payment

- ↑ https://www.irs.gov/affordable-care-act/individuals-and-families/the-premium-tax-credit-the-basics-0