This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

There are 8 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 54,388 times.

You can easily prepare your income taxes online using an income tax service. Filing online saves time and money. Prepare, print, and e-file your federal and state income taxes online to get a fast tax refund.

Steps

Preparing to File

-

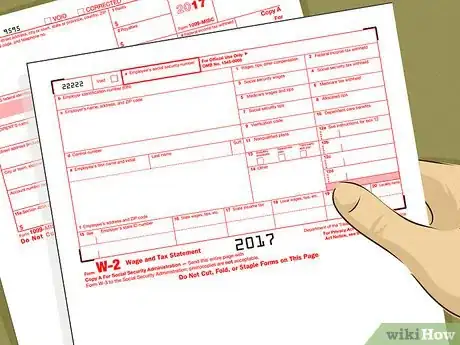

1Gather your financial documents. You should receive a W-2 form if you are employed and your employer withholds taxes from your paycheck.

- You may also receive a 1099 form. These information notices are sent for a variety of reasons, such as if you were paid for services provided as an independent contractor, you received interest or dividends, you received government payments (such as unemployment compensation), or you received withdrawals from a retirement account.

- You should receive your financial forms by early February at the latest. If you haven’t received them, follow up with your employer or those who hired you as a freelancer.

-

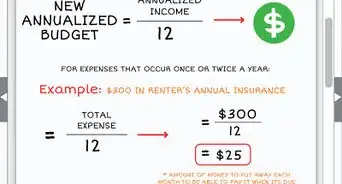

2List your deductions. You can take the standard deduction or itemize for deductible expenses. For the 2019 tax year, the standard deduction will be $12,200 for those filing as single or married filing separately or $24,400 for married filing jointly. The standard deduction is required unless you have more than the allowed standard deduction amount in itemized deductions.

- Allowable deductions may include home mortgage interest, state and local income taxes or sales tax (but not both), charitable contributions, unreimbursed medical expenses, and real estate and personal property taxes.[1]

Advertisement -

3Calculate your adjusted gross income (AGI). Since many free sites require that you have an income below a certain amount, you should roughly calculate your AGI before logging online. Simply subtract your standard or itemized deductions from your total income. This will give you a rough estimate of your AGI.

-

4Hire an accountant if you need help. If you can tell from simply estimating your AGI that preparing your taxes overwhelms you, an alternative is to hire an accountant in your area. They will calculate your taxes for you, lifting a weight off your shoulders.

- Accountants can also file your taxes online, thus getting you a refund faster.

- The Voluntary Income Tax Assistance (VITA) program provides free tax preparation for those with incomes below $55,000. The program is also available to those over 60, people with disabilities, and those with limited English.[2]

- You can find a VITA program near you by calling 1-800-906-9887 or by using the online VITA Locator tool (https://www.irs.gov/individuals/free-tax-return-preparation-for-you-by-volunteers).

Choosing an Online Filing System

-

1Visit websites that allow you to file for free. You can visit the IRS website to learn about issues related to taxes and prepare and file your taxes easily (http://www.irs.gov/). If your AGI is $66,000 or less, then you are eligible for this program.[3]

- An alternative free filing system for those with an AGI below $66,000 is https://www.myfreetaxes.com/.

- A website that provides free tax filing, regardless of your AGI, is https://www.creditkarma.com/.

-

2Choose a low-fee filing service. If you do not qualify for free filing, then visit the more popular online filing systems that charge a fee. There are many websites that offer online tax filing, which differ according to price.

- eSmart tax (https://www.esmarttax.com/) offers tax filing packages depending on complexity. They offer tiers of service from free filings for simple 1040s up to $69.95 for more complicated returns (such as business filings).

- TurboTax (https://turbotax.intuit.com/) is the largest internet tax filing service and incredibly reliable. It offers easy-to-follow instructions as well as information importing, allowing you to import your tax information directly to their site. The most basic package allows for free filings of the 1040. The Premier service costs $79.99. The TurboTax service offers live review with a CPA (Certified Public Accountant) or EA (Enrolled Agent)

- H&R Block (https://www.hrblock.com/) is the second largest internet tax filing system after TurboTax and is equally helpful. They offer a basic package for free.

-

3Determine the package you need. If you are a wage-earner whose employer withholds taxes, then you should look at Basic packages.

- Those who freelance and receive 1099 forms should pursue the Deluxe, or other mid-tier, packages.

- Filers with real estate investments and capital gains or losses should use the Premier, or higher-tier, packages.

-

4Remember to also file state taxes. Most online filing systems will also file your state taxes, but a separate fee may apply.

- If you use a basic edition of TurboTax, you can file your state taxes for free.

- With the H&R Block free package, a state filing will cost an additional $29.99.

Filing Your Taxes

-

1Prepare in advance so you can meet the April 15th deadline. Waiting until the last minute can cause you to rush and make errors. Give yourself sufficient time to gather your tax information. Personal tax returns are due by April 15th of each year, though you do have an opportunity to file a 6-month extension.

- There are many advantages to filing early. You not only can access your refund quicker, but you give yourself more time to correct errors.[4]

- Also, filing early may prevent identity theft. Identity thieves file false tax returns using stolen information. They also try to file early, to beat the real taxpayer to the IRS. Filing early yourself can prevent this.[5]

-

2Enter your information online. Each online tax filing program will give step-by-step directions explaining how to file your taxes online. For example, Turbo Tax will guide you through most of the steps required by some of the forms. It will also check for errors and provide you with an opportunity to fix them.

- Double check all numbers and information to verify the accuracy, as even a small discrepancy could trigger an audit.

- Many online tax filing services offer live chat for help. If you hit a snag, look into that option to receive help with completing your forms.

-

3File your taxes. In addition to filing electronically, online filing services often give you the option to print your tax form and physically mail it in.

- Some sites offer a 24-hour return, i.e., they send you the results of your tax return within 1 day of completing your forms, although there is usually an additional fee for this.

- Be aware that nearing the end of tax-filing season, long lines at the post office can make mailing taxes time-consuming.

-

4Troubleshoot any problems. If you file with the IRS, you should receive an explanation of why the tax return was rejected.[6] Check for some of the more common errors:

- You may have misspelled a name or entered your Social Security Number (SSN) wrong.

- You may have tried to claim as a dependent someone whose SSN appears on another taxpayer’s filing as a dependent.[7]

- If you are filing on the IRS website, contact them at 800-829-1040 with questions. Other tax preparation services should provide the number to a help-line.

-

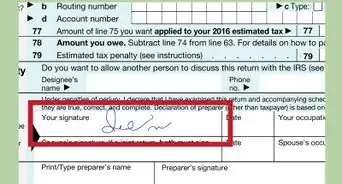

5Pay your taxes if applicable. If you owe money, there are several options to pay. You can pay with an electronic funds transfer or with a credit or debit card.[8] Payment with a credit or debit card carries a small convenience fee.[9]

- You can also pay directly from your checking or savings account.[10] You must have a valid Social Security Number or Taxpayer Identification Number to use this method of payment.

- E-filers can also send in a check or money order. Make the check payable to the “United States Treasury” and include on the face of the check your name, address, and daytime phone number. Include a Form 1040-V payment voucher.

Is It Safe To Pay Your Taxes Online?

References

- ↑ https://www.irs.gov/newsroom/itemize-or-choose-the-standard-deduction

- ↑ https://www.irs.gov/individuals/free-tax-return-preparation-for-you-by-volunteers

- ↑ http://gizmodo.com/5990179/the-cheapest-and-easiest-way-to-file-your-taxes-online

- ↑ http://www.entrepreneur.com/article/242733

- ↑ http://www.entrepreneur.com/article/242733

- ↑ https://www.irs.gov/faqs/electronic-filing-e-file/age-name-or-ssn-rejects-errors-correction-procedures

- ↑ https://www.irs.gov/faqs/electronic-filing-e-file/age-name-or-ssn-rejects-errors-correction-procedures

- ↑ http://www.irs.gov/uac/Electronic-Payment-Options-Home-Page

- ↑ http://www.irs.gov/uac/Pay-Taxes-by-Credit-or-Debit-Card

About This Article

To file your taxes online, gather the financial documents you need, like your W-2 forms. Next, choose a free or low-cost online filing service like TurboTax or use the program the IRS offers through their website. Then, open the program and follow the step-by-step prompts provided to enter your information. Finally, double check your information for accuracy and file your completed taxes electronically by following the prompts provided. To learn more about deductions, read on!