This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 56,522 times.

Internal Revenue Service (“IRS”) Form 8949 and Schedule D are the Capital Gains and Losses section of the Form 1040. Schedule D is used to calculate and report the sale or exchange of a capital asset. To start, you will need to fill out Form 8949. This form allows you to total your gains and losses for various investments and assets obtained during the year. On your Schedule D form, you will use these values to figure out if you had a net loss/gain for the year in terms of short and long term investments.

Steps

Filling Out Form 8949

-

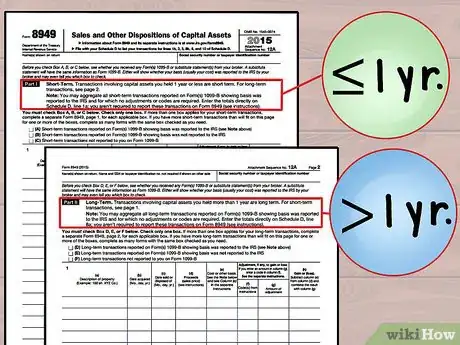

1Separate short term and long term gains and losses. This is mainly what you're tracking in Form 8949 and Schedule D. Your gains and losses are based on your capital assets. Capital assets are anything you own that can make or lose money throughout the year. They include things like your home, car, artwork, and collectables. They also includes investment assets like stocks, bonds, and some properties.[1] [2]

- The first section of Form 8949 includes your short term gains and losses. These include any assets you've bought and sold within a single twelve-month period. For example, say you bought 8 stocks in the Nestle corporation in April of 2015. You sold these stocks in October of 2015. This would be considered a short term gain or loss.

- The second section of Form 8949 covers long term gains and losses. These are assets you've held for more than one year. For example, if you've owned stocks in GM for 5 years, you would record the gains and losses made from those stocks in the second part of Form 8949.

- Go through all your capital assets. Make a list of all assets sold during the year of filing, determine the holding period by the difference between the sell and purchase dates, and separate into short and long-term categories. This will simplify the process when you begin filling out your tax forms.

-

2Gather specific details of each capital asset. These details are important to calculate whether you had a net gain or loss for a year. Before you even start filling out Form 8949, gather this information. Having it ahead of time will make the process go smoother.[3]

- You will need to know the date when each asset was purchased or acquired, as well as the price.

- If you sold an asset, you need to know the date it was sold. You should also include the price for which the asset was sold.

Advertisement -

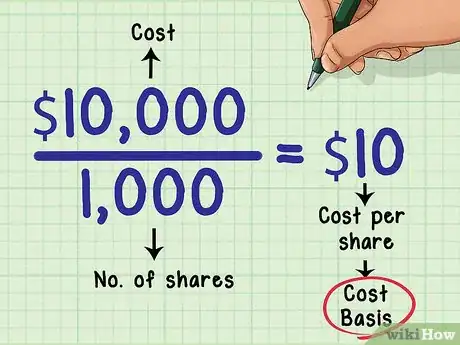

3Determine the cost basis of your assets. This is the amount you paid for the asset, as well as any other fees associated with the asset. Take your time here. While determining cost basis may seem simple, there are some calculations that go into the process, especially when stocks have increased or decreased in value.[4]

- In the event you received these shares as a gift, you would give the cost basis based on their original value. Even if you did not pay that value, it can still affect what you will be taxed on in the coming year.

- The basis for assets received as a gift is the donor's basis adjusted for amount paid in gift tax. Refer to IRS Publication 551 for more information.

- Other factors can affect the cost basis. If your shares appreciated in value, and you then sold them, you would need to figure out how much of this sale is subject to taxes. You would need to determine the new cost basis. For example, the shares rose to $15/share when you sold, giving you $15,000. The extra $5,000 may be subject to a capital gains tax.

- There will be a different cost basis and holding period for assets received by inheritance. Refer to IRS Publication 550 for more information.

- In the event you received these shares as a gift, you would give the cost basis based on their original value. Even if you did not pay that value, it can still affect what you will be taxed on in the coming year.

-

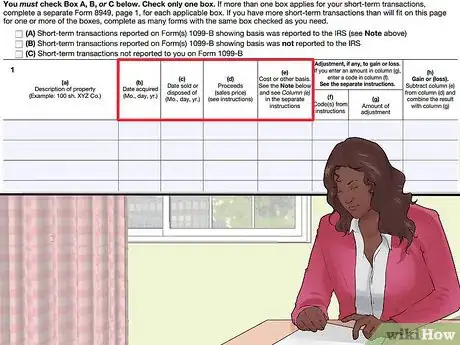

4Fill out the long and short term sections on Form 8949. You will use the information gathered here. For each asset, you will give the name of the asset, or the company associated with the stocks or bonds. You will also put in the buy and sell dates, the purchase price, the sales price, and the cost basis.[5]

- Remember, long term and short term gains and losses are different. Form 8949 includes different sections for long and short term assets. Make sure you are filling in the right sections as you complete Form 8949.

-

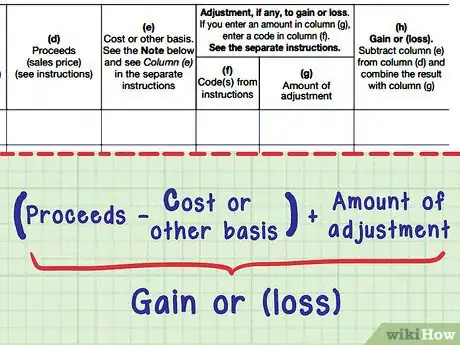

5Calculate the total gains and total losses for each asset. Eventually, this will help you determine if you had a net gain or net loss for the year. Go through each asset on both the short term and long term gains/losses sections. Figure out whether each asset resulted in a gain or a loss for the year.[6]

- If you gathered all your information ahead of time, things should be simple from here. You simply need to subtract the costs associated with the asset from the money earned from the asset.

- Work slowly and use a calculator. Check your answers several times. You want to make sure your numbers are accurate when filling out your taxes.

Completing Schedule D

-

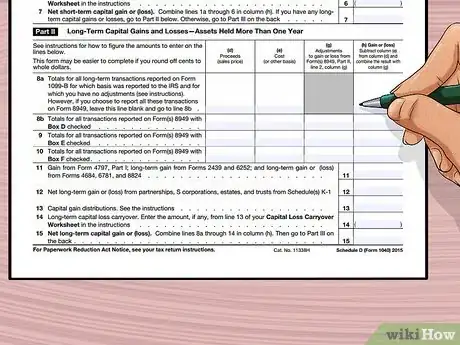

1Write your totals from Form 8949 on Schedule D. On Schedule D, you will have to fill out a section for short term and long term gains and losses. Here, you'll be transferring the total gain/loss for each asset you determined when filling out Form 8949. In both Section 1 and 2, the first lines on Schedule D regard your values from Form 8949.[7]

- As with Form 8949, make sure you're writing in the correct section. Short term gains/losses need to be in the short term section, while long term gains/losses need to be in the longterm section.

- Recalculate the totals as you go. You want to make sure all your figures match.

-

2Refer to Form 1099 B if you needed it. This is usually an overview of stock transactions for the year. The 1099-B is completed by the financial firm rather than by the filer. The 1099-B information should have already been separated by into short and long-term, documented, and totaled when filling out form 8949. It can therefore be used a reference if needed.[8]

- Form 1099 B will have transaction details that are important to gains and losses related to stock investments.

- Schedule D will ask for totals from Form 1099 B several times.

-

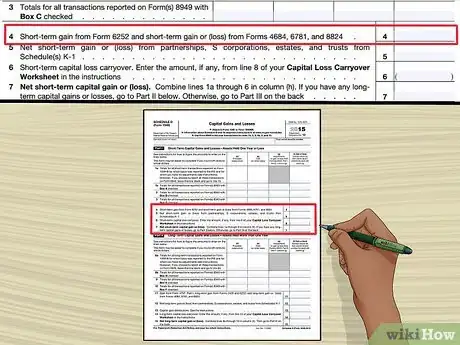

3Deal with Line 4. Line 4 wants to know how many gains or losses you've had related to specific circumstances. The following are losses/gains you would list on line 4: installment income from sales, casualty or theft, transaction with stock options, or the exchange of business or investment property. Count how many losses or gains you have had due to these circumstances and write that number in Line 4.[9]

- If you did not have any gains or losses due to these circumstances, write "0."

-

4Fill out Line 5 and Line 6, if necessary. These lines may not be relevant to your situation, but if they are you need to fill them out. These are gains/losses not recorded in Form 8949 that you need to report to the IRS.[10]

- Line 5 deals with gains and losses from any businesses you own. This includes S corporations, estates, and trusts. You'll be asked to report your total gains/losses for the year. If you do not own any businesses, there is no need to fill out part 5.

- These refer to specific types of financial entities, generally pass-through arrangements that are not filed as Schedule C Profit and Loss from a Business.

- Line 6 includes any short term capital loss carryover. These are capital losses earned during the previous year that, for whatever reason, you could not report on that year's taxes.

- Carryovers exist because only a certain amount of short term capital losses can be used to offset earned income in a given tax year. The remainder are kept as carry-overs for future years.[11]

- Line 5 deals with gains and losses from any businesses you own. This includes S corporations, estates, and trusts. You'll be asked to report your total gains/losses for the year. If you do not own any businesses, there is no need to fill out part 5.

-

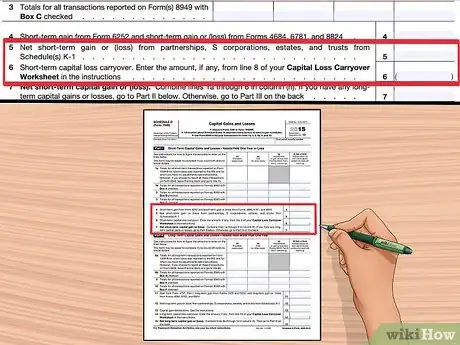

5Find the net short term gain (or loss) for the year. In Part 1, you're working with short term gains or losses. You simply have to add the values you copied from Form 8949 here, as well as any values you added to Line 5 or Line 6.[12]

- You would enter the total value you find in Line 7. This value will be either positive or negative. It represents your net gain or loss for assets owned one year or less.

- The IRS will use this information to determine how to tax your assets.

-

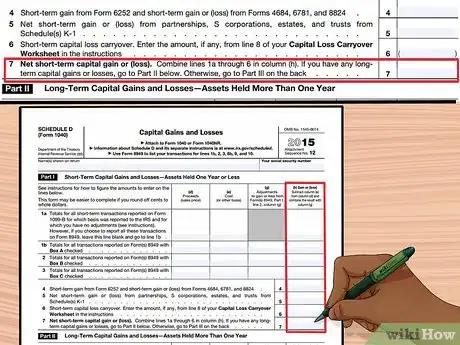

6Use the same process for Part 2. Part 2 deals with long term gains and losses. As with Part 1, you would add up the totals from Form 8949. You also have to fill out some specific lines associated with Part 2, and total all the values to find your total gain/loss for the year regarding long term investments.[13]

- In Part 2, Line 12 would include gains and losses from businesses. It's the same information you entered in Line 5, only associated with long term investments. Any capital carryover would be entered in Line 14.

- You will write your grand total in Line 15. This is your net gain/loss for the year in regards to long term investments.

-

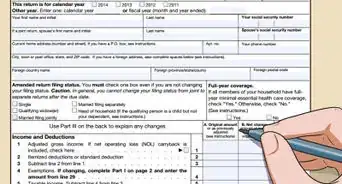

7Proceed to part 3. Part 3 of Schedule D is the summary of the document. Start by adding up your totals from lines 7 and 15. Place the sum on line 16, which represents your total gain or loss. If you experienced a loss (your sum on line 16 is less than zero), and less than $1,500 if filing as single or $3,000 if filing as married filing jointly, enter the loss on line 22. If your loss is greater than these figures, enter the figure instead ($1,500 or $3,000 instead of your loss).

- If you had no gain or loss, enter "0" on lines 16 and 21.

- If you experienced a capital gain (your line 16 total is above zero), go to line 17. If you choose yes on line 17, go on to 18.

- Report gains from the sale of depreciated property on line 19, if applicable.[14]

Avoiding Errors

-

1Learn the situations where you do not need Form 8949. In some situations, you do not need to fill out Form 8949. Before you waste your time filling out the form, see if you're supposed to skip that form this year.[15] Generally, the use of Form 8949 is based upon the number of reported transactions and is intended to minimize paperwork by organizing otherwise unorganized information.

- If you have a separate sheet of paper you made yourself, detailing your transactions, you can include that as long as it's adequately organized. This would help if you recorded things like dates of sale, purchase, and so on using scrap paper. It would save you the time of copying down information.

- If you received from 1099-B, you may not need Form 8949. Read the instructions written on form 1099-B.

-

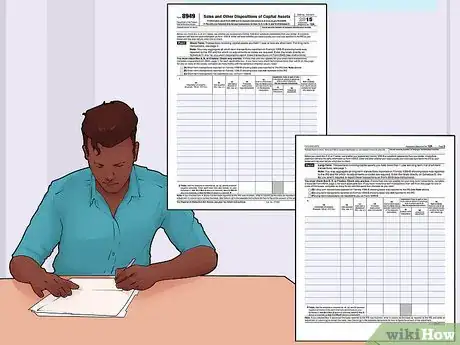

2Make sure the figures in Schedule D and Form 8949 match. You do not want to miscalculate when dealing with taxes. A small miscalculation could delay your taxes and any refunds you receive.[16]

- Recalculate your numbers many times. Look through Schedule D and Form 8949 to make sure your figures matched. A simple typo can set you back here.

-

3Consider hiring an accountant. Schedule D can be very confusing, especially if you do not typically do your own taxes. If you're struggling to complete the information, reach out to an accountant. You do not want to make a mistake on your Schedule D form.

- You can also use a tax program such as TurboTax or TaxAct to assist you in your preparation. Doing so will require more work from you, but will be cheaper than using an accountant.

-

4Take a break if you get frustrated. You're more likely to make a mistake if you're feeling stressed or frustrated. In the event you begin to feel overwhelmed, take a break. You will return to the situation recharged and revitalized.[17]

- Go for a short walk. Watch a movie. Take 15 minutes to read a book or chat with a friend online.

- If you're getting particularly frustrated, you may want to set the forms aside for the night. You can return to them in the morning with fresh eyes. They may make more sense to you after some distance.

Expert Q&A

-

QuestionWhat do you do with wash sale totals?

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Business Advisor While you would report wash sales (the sale of a stock at a loss and reestablishing the same or virtually same position within 30 days of the sale), the loss cannot be deducted. You would report the wash sale with a "W" on column f of form 8949.

While you would report wash sales (the sale of a stock at a loss and reestablishing the same or virtually same position within 30 days of the sale), the loss cannot be deducted. You would report the wash sale with a "W" on column f of form 8949.

References

- ↑ http://finance.zacks.com/fill-out-schedule-d-capital-gains-losses-4310.html

- ↑ https://turbotax.intuit.com/tax-tools/tax-tips/IRS-Tax-Forms/Guide-to-Schedule-D--Capital-Gains-and-Losses/INF19991.html

- ↑ http://www.moneycrashers.com/tax-form-8949-instructions/

- ↑ http://www.investopedia.com/ask/answers/05/costbasis.asp

- ↑ http://finance.zacks.com/fill-out-schedule-d-capital-gains-losses-4310.html

- ↑ https://www.irs.gov/pub/irs-pdf/f8949.pdf

- ↑ http://finance.zacks.com/fill-out-schedule-d-capital-gains-losses-4310.html

- ↑ http://www.investopedia.com/terms/f/form-1099-b.asp

- ↑ http://taxhow.net/articles/you-win-some-you-lose-some-and-then-you-file-schedule-d

- ↑ http://taxhow.net/articles/you-win-some-you-lose-some-and-then-you-file-schedule-d

- ↑ http://www.obliviousinvestor.com/how-do-capital-loss-carryovers-work/

- ↑ http://taxhow.net/articles/you-win-some-you-lose-some-and-then-you-file-schedule-d

- ↑ http://taxhow.net/articles/you-win-some-you-lose-some-and-then-you-file-schedule-d

- ↑ http://taxhow.net/articles/you-win-some-you-lose-some-and-then-you-file-schedule-d

- ↑ https://turbotax.intuit.com/tax-tools/tax-tips/IRS-Tax-Forms/Guide-to-Schedule-D--Capital-Gains-and-Losses/INF19991.html

- ↑ http://finance.zacks.com/fill-out-schedule-d-capital-gains-losses-4310.html

- ↑ https://open.buffer.com/science-taking-breaks-at-work/