This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 92,655 times.

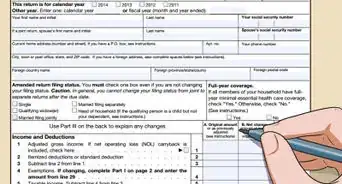

If you own property that you rent out to tenants or vacation property that you rent to others when you are not using it, you may have taxable rental income. Rental income is subject to ordinary income tax.[1] You typically use Schedule E, Supplemental Income and Loss to calculate your taxable income on any property you own and rent out.[2]

Steps

Determining Gross Rental Income

-

1Determine whether you want to be a cash basis or accrual method taxpayer. The cash basis is the more common method. With a cash basis method, you report rental income that you actually receive during the tax year.

- With an accrual method, you report rental income based on when you earn it.[3]

-

2Add up all sources of income from your rental properties. This includes rent, advance rent and the following:

- Fees paid to cancel a lease;

- Utilities and other expenses paid by the tenant;

- Services or property you received for rent instead of cash; and

- Security deposit amounts that you decide to keep, usually at the termination of the lease.[4] This does not include security deposits you receive and intend to return to the tenant at the termination of the lease. If you receive a security deposit of first and last months' rent, those amounts should be included in your gross income if they are intended to cover rent for those months.[5]

Advertisement -

3Enter that total on Line 3 of your Schedule E, after "Rents received."You can list rental income for as many as 3 properties on a single Schedule E. The schedule provides three columns for each of the 3 properties. Make sure the physical addresses you list under 1a match up with the rents.[6]

- For example, suppose you own houses for rent on 123 Main Street and 345 Mulberry Street. You list the Main Street house next to "A" and the Mulberry Street house next to "B." When you fill in your income, make sure you put the rent you receive for the Main Street house in column A and the Mulberry Street house rent in column B.

- For the purposes of the example, assume you received $100,000 in rent for the house on Main Street, and $80,000 in rent for the house on Mulberry Street.

- If you have more than 3 rental properties you must use an additional form.

Totaling up Expenses

-

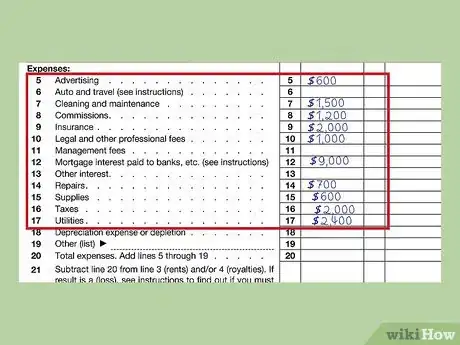

1Gather and categorize expenses you've incurred on each rental property. You are able to deduct expenses for maintaining, conserving, and managing your rental properties. The expenses on Schedule E are broken up into specific categories such as advertising, management fees, repairs, supplies, taxes, and utilities.[7]

- Add up your expenses for each category, then put that amount in the correct box. As with income, make sure you're matching up the correct expenses in the column for the correct property, if you have more than one property listed on the schedule.[8]

-

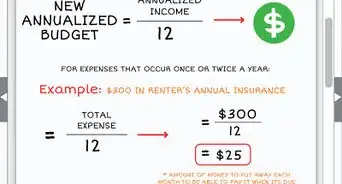

2Calculate any depreciation expenses. While repairs such as painting or replacing a roof can be deducted all at once, improvements such as adding a swimming pool or installing new insulation generally must be depreciated over several years rather than deducted in the year you paid for them. Note that depreciation expenses reduce the cost basis of your rental property and increase any gains you receive when you eventually sell the property.[9]

- Generally, you need to take your cost or other tax basis for the property, allocate that cost to the different types of property included in your rental, and then use the rates, methods and useful lives specified by the IRS for those types of property to find your annual depreciation.

- You can allocate a portion of the cost of the property to land (if you rent out a house, not an apartment). Look at the local property tax assessment and see how the value of the property is allocated between the building and improvements versus land. You do not get a depreciation deduction for land.

- For instance, if the property tax assessor has allocated 20% of the property's value to land, you would allocate $40,000 to land (20% x $200,000), which is not depreciated. Then, you can allocate $160,000 ($200,000 - $40,000) to the building, which would be depreciated over 27.5 years (which is the typical length for residential real estate).

- Property such as fences or furniture typically is depreciated using the declining balance method. The IRS indicates you should depreciate furniture using 200% declining balance. To find your yearly depreciation, refer to the declining balance tables published by the IRS.[10]

-

3Add all your expenses in each category, including depreciation, and enter the total on Line 20 of your Schedule E. For example, suppose you have expenses totaling $50,000 for your Main Street house. You would enter that amount on Line 20 in column A. If you had $80,000 in expenses for your Mulberry Street house, that amount would go on Line 20 in column B.[11]

Finding Taxable Income

-

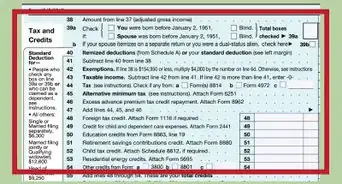

1Subtract your total expenses on Line 20 from your total income on Line 3, and enter the result on Line 21. Generally, this amount will be your taxable income from your rental property. If the amount is negative, you have a loss on your rental property. You will have to consult other forms to determine if your losses are deductible.[12]

-

2Enter any positive amount from Line 21 on Line 24. If you have losses, they should not be included on this line. For example, since you received $100,000 in rent for your Main Street house, but only incurred $50,000 in expenses, your income on the Main Street house is $50,000. Since your income and expenses for the Mulberry Street house are exactly the same, you have no rental income for that property.

-

3Enter any losses on Line 25. This includes any deductible rental real estate losses you entered on line 22 after calculating passive activity losses using Form 8582. Passive activity losses are complicated, but generally, you can deduct as much as $25,000 a year in losses on rental properties if you have an adjusted gross income of less than $100,000.[13]

-

4Add Lines 24 and 25 and enter the result on Line 26. This amount is your total taxable rental income, and should be included on your 1040.[14]

- To finish the example, your total taxable rental income for your two houses on Main Street and Mulberry Street would be $50,000.

Warnings

- Any payments you receive after a tenant exercises an option to buy are treated as proceeds from a sale rather than rental income.⧼thumbs_response⧽

- If you personally use a vacation home for more than 14 days in a year, or more than 10 percent of the days you rent it out to others at a fair market price – whichever is greater – it is not classified as a rental property for tax purposes.[17]⧼thumbs_response⧽

References

- ↑ http://www.realestate.com/advice/tax-and-investment-property/

- ↑ http://www.irs.gov/taxtopics/tc414.html

- ↑ http://www.irs.gov/taxtopics/tc414.html

- ↑ http://www.irs.gov/taxtopics/tc414.html

- ↑ https://turbotax.intuit.com/tax-tools/tax-tips/Rental-Property/Real-Estate-Tax-and-Rental-Property/INF12039.html

- ↑ http://www.irs.gov/pub/irs-pdf/f1040se.pdf

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/tips-on-rental-real-estate-income-deductions-and-recordkeeping

- ↑ http://www.irs.gov/pub/irs-pdf/f1040se.pdf

- ↑ https://turbotax.intuit.com/tax-tools/tax-tips/Rental-Property/Real-Estate-Tax-and-Rental-Property/INF12039.html

- ↑ https://turbotax.intuit.com/tax-tools/tax-tips/Rental-Property/Real-Estate-Tax-and-Rental-Property/INF12039.html

- ↑ http://www.irs.gov/pub/irs-pdf/f1040se.pdf

- ↑ http://www.irs.gov/pub/irs-pdf/f1040se.pdf

- ↑ http://www.realestate.com/advice/tax-and-investment-property/

- ↑ http://www.irs.gov/pub/irs-pdf/f1040se.pdf

- ↑ http://www.irs.gov/taxtopics/tc414.html

- ↑ https://rsmus.com/what-we-do/services/tax/lead-tax/are-you-a-materially-participating-real-estate-professional.html

- ↑ http://www.irs.gov/taxtopics/tc415.html

About This Article

Calculating your taxable income on your rental properties is relatively easy if you have your records at hand. You'll need records of your income from all the properties you rent out and all expenses you paid for, including insurance, advertising, and maintenance of your properties. You'll usually need to enter this information on your schedule E form. To work out your total taxable income, you'll need to work out your total income and your total expenses, then subtract your expenses from your income. For more tips from our Financial co-author, including how to work out declining balances for depreciating property, read on.