This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant (CPA) and a Certified Financial Planner (CFP) in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006.

This article has been viewed 275,768 times.

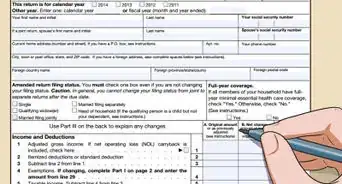

Prior to the 2017 Tax Cuts and Jobs Act, employees with unreimbursed mileage expenses could claim these expenses as part of their itemized deduction. The federal government allows a certain amount of money per mile to be deducted for the designated areas of business, medical, moving, and charitable travel.

Steps

What Mileage Counts?

-

1Learn the different rate for each type of mileage. Visit the Internal Revenue Service (IRS) website at www.irs.gov to learn about the types of mileage deductions and the rate per mile. The rate typically changes yearly, and if you're calculating for last year, it's important to double-check with the official IRS website against the figures described here below.[1] The standard mileage rates for 2018 are as follows:

- 54.5 cents per mile for business-related mileage

- 18 cents per mile traveled for medical reasons or moving purposes

- 14 cents per mile traveled when donating to or working for charitable organizations

-

2Calculate your business mileage. Mileage deducted for business purposes includes travel to clients or customers, going to a business meeting away from a regular workplace, going to a temporary workplace if you have a regular place of work or traveling among several offices within a region.Advertisement

-

3Calculate your medical deductions. Mileage deducted for medical purposes can be taken for traveling to and from a place of medical care. Tolls and other associated travel fees should be listed separately.

- Note that you will only receive a federal tax benefit for medical deductions if you itemize your deductions and your total medical expenses, including medical mileage, are greater than the medical deduction threshold for that year.

-

4Calculate your donation-related mileage. Mileage deducted for charitable purposes includes travel to and from donation locations as well as during volunteer work for an organization.

- You will only receive a federal tax benefit for charitable mileage if you itemize your deductions.

Keeping Track of Mileage

-

1Keep a small notebook in your car to record mileage. Keep it in your car at all times so that mileage can be recorded as it is incurred. It's important to differentiate the different types of mileage that you're recording, as well as the miles traveled. Alternatively, you can use a mileage app such as MileageIQ to track your mileage.

- The easiest way to do this is to write down the starting mileage at the original destination, the ending mileage at the travel destination, and the addresses of the locations you were traveling to and from, as well as the purpose of the trip business, charity, medical, or move.

- Clearly date each entry in your log book for quick access.

-

2Record applicable mileage only. In general, no other type of mileage is deductible than that for the categories described in the previous section. Your trips from home to the store cannot be deducted, even if you did it during the work day, unless it was done for business purposes.

- Some businesses will offer mileage allowances, and other types of agreements if you're given a company car. Talk to your HR representative or the financial advisor at your office for more specific information.

-

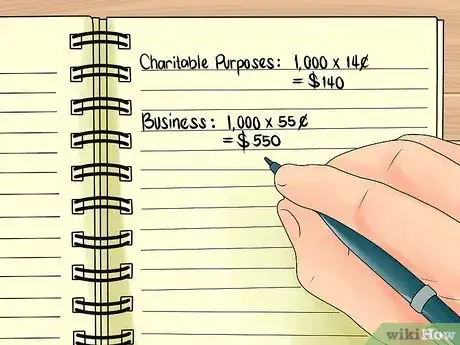

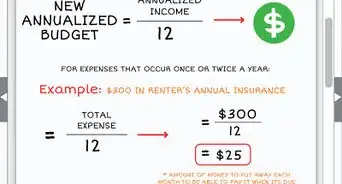

3Calculate your total at the end of the year. Multiply the total number of miles traveled throughout the year by the mileage rate for each category. For instance, you may deduct 14 cents per mile when working for charitable organizations and 54.5 cents per mile traveled for business.

- If you drove 1,000 miles (1,600 km) for charity and 1,000 miles (1,600 km) for business, then you would multiply 1,000 miles (1,600 km) by 14 cents and 1,000 miles (1,600 km) by 54.5 cents.

-

4Keep your records. The IRS suggests that you keep your records for a period of 3 to 7 years. This is the typical window of audits, so you want to keep your records at least that long, to be on the safe side.

- If you live in a state that imposes an income tax, refer to that state's statute of limitations to determine how long you need to keep your records for.

References

About This Article

To calculate mileage for taxes, start by adding up the number of miles you drove throughout the year for each category that’s deductible, like for business or moving. Then go online to the IRS website to get this year’s rates per mile for each category. Next, multiply the number of miles you drove in each category by that category’s rate per mile to get the deductible amount for that category. For more on how to calculate mileage for taxes, including how to keep a driving log throughout the year, scroll down!

-Step-9-Version-2.webp)

-Step-9-Version-2.webp)