This article was co-authored by Alan Mehdiani, CPA. Alan Mehdiani is a certified public accountant and the CEO of Mehdiani Financial Management, based in the Los Angeles, California metro area. With over 15 years of experience in financial and wealth management, Alan has experience in accounting and taxation, business formation, financial planning and investments, and real estate and business sales. Alan holds a BA in Business Economics and Accounting from the University of California, Los Angeles.

This article has been viewed 67,176 times.

The state of California is one of a number of states in the United States that has special taxing districts within its borders. People who sell items within the state's borders are required to collect, report, and pay these district taxes, if they apply, in addition to the state sales tax on purchases made from them. The following steps tell how to calculate California sales tax.

Steps

Determining Your Responsibility to Pay Sales Tax

-

1Know the difference between California sales tax and use tax. Sales and use taxes differ according to what purchases they are applied to and whose responsibility it is to pay the tax to the appropriate taxing jurisdiction.

- Sales tax generally applies to purchases made within the state's borders, including merchandise such as motor vehicles. Payment of sales tax to the state is the responsibility of the business authorized to collect it.

- Use tax applies to items purchased outside the state of California, such as by mail order or online, where purchasers don't pay sales tax. It also applies to the purchase of motor vehicles, mobile homes, watercraft, and aircraft from sellers without a California seller's permit and when business owners withdraw taxable merchandise from their inventories for their personal use. Payment of use tax is usually the purchaser's responsibility.

-

2Determine if you have nexus. A company has "nexus" if it is considered to be "engaged in business" in the state of California. That is, it has nexus if it maintains a sales office or warehouse, employs a sales representative whose office is within the state's borders, or receives rental receipts from equipment located inside the state. These businesses are required to collect, report, and pay California sales or use tax.

- An out-of-state retailer may also have nexus if they work through California affiliates, vendors, or advertisers. Additionally, companies that make sales through internet sales or mail catalogs may have nexus.

- Companies not considered to be "engaged in business" are not required to collect, report, and pay California sales or use tax, but many register with the state's Board of Equalization anyway to relieve their customers of the responsibility of paying the use tax.

Advertisement -

3Find out if your products or services are taxable. As a general rule, California sales tax is charged on the sale of tangible property. This means products that can be physical touched, weighed, seen, felt, or measured. This covers all physical products. However, some intangible items are also taxed, like cover charges and corkage fees at restaurants.

- Some tangible items are exempt from California sales or use tax, such as groceries and prescription medicines.

- Many intangible services, like writing or plumbing services, are not taxable. However, if the service product a salable product, that product may be taxed.[1]

- A complete list of exempt items is available in the state Board of Equalization's Publication 61, Sales and Use Taxes, Exemptions and Exclusions.

-

4Determine if your customers must pay sales tax. If you make sales to non-profits or resellers, you may not need to charge sales tax on these sales. To qualify, the charity or non-profit must provide you with a valid resale certificate.[2]

Figuring Out Your District Tax Rate

-

1Understand district tax rates. California has one of the most complicated sales tax systems in the country. Whereas most states charged origin-based or destination-based (using the origin or destination of the sale)sales tax at a standard rate, California combines the two methods in a hybrid origin-destination system. In addition, California tax rates are a determined using the flat state tax rate of 7.5 percent and then adding one or multiple "district" rates. These district rates add a small additional amount on top of the standard 7.5 percent rate.

- As a seller, you may be able to choose whether you collect taxes using origin-based or destination-based calculations.

- If the site of a purchase falls in more than one taxing district, the rates of all districts are applied.[3]

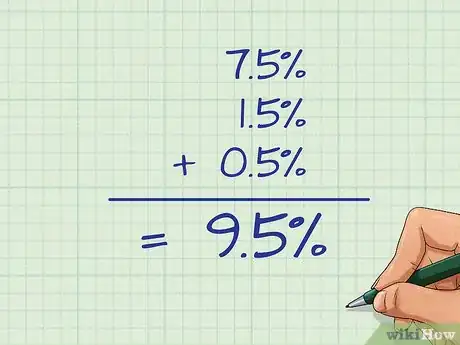

- For example, a sale might be charged tax at a rate of 9.5 percent, which is calculated from the 7.5 percent state rate plus 1.5 percent country rate and a 0.5 percent district rate.

-

2Collect origin-based sales tax. Your first option as a seller is to collect origin-based sales tax. If you are selling to a district in California in which you do not have nexus, you will only have to pay the statewide sales tax rate (7.5 percent). If you sell within your district, you will have to pay the total sales tax amount (state plus country plus district).

- This may leave your customers in other districts liable for their own district sales taxes.[4]

-

3Decide to collect destination-based sales tax. Your other option is charge the total sales tax (state plus country and district) for each district that you sell to. That is, you would charge the sales tax rate relevant to the destination district. Many large retailers choose this option because it does not leave their customers liable for sales taxes.[5]

-

4Determine the district tax rate for the applicable district(s). District tax rates range from 0.1 to 1 percent and are added to the state sales tax rate as a surtax. Again, there may be more than one district tax applied to the sales tax in a given area. In all, tax rates in California range from 7.5 percent to over 10 percent, depending on the area.[6]

- The California Board of Equalization's Publication 71: California City and County Sales and Use Tax Rates lists the rates and effective dates for California district taxes, as well as the combined rates.

- You can also search for the correct rate at https://maps.gis.ca.gov/boe/TaxRates/

- Additional resources on California sales and use taxes and district taxes include the Board of Equalization's Publication 44: Tax Tips for District Taxes and Publication 105: District Taxes and Delivered Sales.

Calculate the Amount of Sales Tax

-

1Know the basic California sales tax rate. The starting point for calculating sales tax is the statewide rate of 7.5 percent. This rate is standard across California and is the lowest sales tax rate a seller or consumer can pay.

-

2Figure out the total tax rate. Add in any district rates that apply to your sale based on the tax calculation system you are using (origin or destination) and the destination of the sale. Sum these with the state-wide tax amount for a total sales tax rate.

- For example, imagine that a retailer in San Jose ships a product to a customer in El Monte (a city within Los Angeles County). If they are using the destination-based system, they would charge the state tax rate, 7.5 percent, plus a country rate for 1.5 percent for Los Angeles County, plus an additional 0.5 percent for the city of El Monte for a total of 9.5 percent.

- Alternately, if they were using the origin-based system, they would simply use the state-wide rate of 7.5 percent.

-

3Multiply the total tax rate by the amount of the purchase. This determines the amount of tax owed.

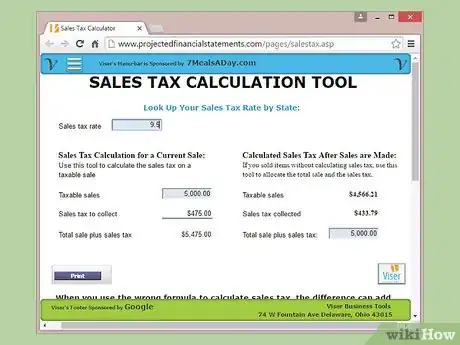

- You can use an online tax calculator to assist in calculating California sales tax. One such calculator is Pitney Bowes' Geotax calculator. Another calculator is available at http://www.projectedfinancialstatements.com/pages/salestax.asp. It allows calculating sales tax rates for California and nine other states that have special tax jurisdictions within their borders.

Community Q&A

-

QuestionIf I buy an item on sale, do I tax the regular price or the sale price?

Community AnswerThe sale price. You can only tax the money paid for the item.

Community AnswerThe sale price. You can only tax the money paid for the item. -

QuestionIs there sales tax in restaurants?

Community AnswerYes, there is sales tax in restaurants in California. Tax is primarily charged on food and beverage sales, however tax is also charged on things like corkage fees and mandatory tips. If in doubt, assume that tax will be charged on any restaurant sales.

Community AnswerYes, there is sales tax in restaurants in California. Tax is primarily charged on food and beverage sales, however tax is also charged on things like corkage fees and mandatory tips. If in doubt, assume that tax will be charged on any restaurant sales. -

QuestionIf I'm charged an incorrect sales tax due to the store having an incorrect address on file, am I due a refund when I show them my correct address and thereby prove that the sales tax rate is less then what they charged?

Community AnswerNo. Sales tax is a tax within the tax district where the item is purchased; it's not based on where you yourself reside. The exception may be depending on specific jurisdictions, and the item is dispatched by the seller to a different state (assuming USA). If in Euroland, VAT is added at the point of sale, and can only be altered if it is sent by the seller to the other country, whence it will attract the VAT of that country.

Community AnswerNo. Sales tax is a tax within the tax district where the item is purchased; it's not based on where you yourself reside. The exception may be depending on specific jurisdictions, and the item is dispatched by the seller to a different state (assuming USA). If in Euroland, VAT is added at the point of sale, and can only be altered if it is sent by the seller to the other country, whence it will attract the VAT of that country.

References

- ↑ http://www.taxjar.com/states/california-sales-tax-online/#is-what-youre-selling-even-taxable

- ↑ http://www.taxjar.com/states/california-sales-tax-online/#is-what-youre-selling-even-taxable

- ↑ http://blog.taxjar.com/sales-tax-for-california/

- ↑ http://blog.taxjar.com/sales-tax-for-california/

- ↑ http://blog.taxjar.com/sales-tax-for-california/

- ↑ http://blog.taxjar.com/sales-tax-for-california/