This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 11 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 58,305 times.

The after-tax yield is the amount an investor can expect to receive from an investment after paying taxes. It is often calculated to help investors compare the profitability of taxable investments with that of tax-free investments, like municipal bonds. It is also useful information when trying to minimize the tax effect of withdrawals from funds during retirement.

Steps

Understanding the After Tax Yield

-

1Learn the definition. The after-tax yield or after-tax return is the profitability of an investment after all applicable taxes have been paid. The type of tax paid and the investor’s marginal tax rate affect the amount of the after tax yield.[1]

-

2Understand why it is important. Your financial advisor calculates the after tax yield on your investments. Knowing the after-tax yield of your investments enables you to effectively compare them to tax-free investments, such as mutual bonds.[4] Also, your financial advisor can use the information to increase the tax efficiency of your investments over the long term.[5]Advertisement

-

3Compare your taxable investments to tax-free investments. Investors can reduce their taxes by purchasing municipal bonds, the interest on which is sheltered from federal and some state and local taxes. However the yield on municipal bonds is typically lower than that of taxable investments. In order to compare the profitability of taxable and tax-free investments, it is very helpful to calculate the after tax yield on the taxable investments.[6]

-

4Increase your after tax yield over the long term. Depending on your tax bracket and how close you are to retirement, you can increase your after tax yield in the long-term with certain investment strategies. Different kinds of investments are taxed differently. Also, the same investment can be taxed differently depending on whether it is in a taxable brokerage account or a tax-deferred account such as an IRA, a 401k, a 403b or a Roth account.[7]

- Your financial advisor can assess the after tax yield of different kinds of investments in different scenarios and counsel you on how to minimize the tax impact on these investments.

Gathering the Information

-

1Identify the taxable yield. Don’t calculate the taxes based on the earnings of an investment during the calendar year. Instead, the taxes should be calculated taxable yield of the security.

- For example, suppose an investor owns a corporate bond. The bond's taxable yield is 6%.

-

2Categorize the character of the distribution. Different kinds of distributions receive different tax treatments. For some distributions, the marginal tax rate is applied. For others, other rates apply.[8]

- The investor’s top marginal tax rate is used for short-term capital gains, taxable interest and non-qualified dividends.

- Long-term capital gains and qualified dividends are usually taxed at a lower rate than regular income tax rates.

- Long-term capital gains are realized from investments that have been held for more than one year. Taxpayers in the 10 percent and 15 percent tax brackets pay 0 percent. Taxpayers in the 25 percent, 28 percent, 33 percent, and 35 percent tax brackets pay 15 percent. Taxpayers in the 39.6 percent tax bracket pay 20 percent.[9]

- Qualified dividends are taxed at the same rate as long-term capital gains.[10]

-

3Find the investor’s marginal tax rate. The terms “tax bracket” and “marginal tax rate” are used synonymously. They both refer to the percentage of someone’s income that is paid in taxes. The higher a person’s income, the more they pay in taxes.[11]

- Marginal tax rates range from as low as 10 percent to as high as 39.6 percent. The income limits for each tax bracket differ for single filers, married joint filers and head of household filers.[12]

-

4Determine if the net investment income tax should be applied. As of 2013, investors whose modified adjusted gross income is above a certain threshold are required to pay a 3.8 percent Medicare tax on interest, dividends and capital gain distributions.

- For 2015, the threshold was $250,000 for married filing joint status.[13]

Calculating the After Tax Yield

-

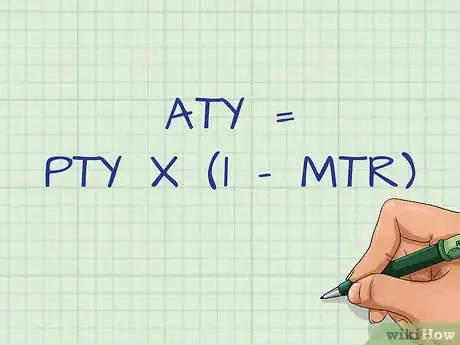

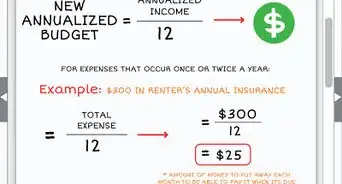

1Know the formula. After-tax yield can be calculated by simply multiplying the pre-tax yield by a multiple that incorporates the marginal tax rate on the bond. This formula is where ATY is the after-tax rate, PTY is the pre-tax rate, and MTR is the marginal tax rate.[14]

-

2Determine the correct tax rate for the calendar year distribution. For short-term capital gains, taxable interest and non-qualified dividends, apply the top marginal tax rate. For long-term capital gains and qualified dividends, apply the appropriate tax rate.

- For example, suppose investors who are married and filing jointly have a total taxable income of $100,000. Their highest marginal tax rate, according to the IRS, is 25 percent.[15] Also, the interest on their investments is subject to the 3.8 percent Medicare tax.

- The total tax rate to be applied to their short-term capital gains and taxable interest is 38.8 percent (25 + 3.8 = 28.8).

- For long term capital gains and qualified dividends, their tax rate would be 15 percent.[16]

-

3Do the calculation. Input your variables into the equation and solve. Make sure that you've used the correct marginal tax rate for appropriate year. The result is your after-tax yield.

- Remember to convert your percentages to decimals when calculating the after tax yield. Convert by dividing by 100. For example, 6% would be 6/100, or 0.06.

- For example, with the 6% corporate bond and the 28.8 percent marginal tax rate, your after-tax yield would be calculated using the following equation:

- This calculations gives an after-tax yield of 0.0427, or 4.27%.

References

- ↑ http://financial-dictionary.thefreedictionary.com/After-Tax+Return

- ↑ http://financial-dictionary.thefreedictionary.com/After-Tax+Return

- ↑ http://budgeting.thenest.com/calculate-aftertax-yield-25418.html

- ↑ http://budgeting.thenest.com/calculate-aftertax-yield-25418.html

- ↑ http://www.kiplinger.com/article/taxes/T055-C000-S004-boost-your-after-tax-investment-returns.html#

- ↑ https://www.aaii.com/journal/article/munis-vs-taxables-how-to-determine-the-taxable-equivalent-yield.touch

- ↑ http://www.kiplinger.com/article/taxes/T055-C000-S004-boost-your-after-tax-investment-returns.html#

- ↑ https://www.bogleheads.org/wiki/Qualified_dividend

- ↑ https://www.bogleheads.org/wiki/Qualified_dividend

- ↑ https://www.bogleheads.org/wiki/Qualified_dividend

- ↑ https://www.fidelity.com/taxes/tax-brackets

- ↑ http://taxfoundation.org/article/2015-tax-brackets

- ↑ https://www.irs.gov/uac/Newsroom/Net-Investment-Income-Tax-FAQs

- ↑ http://www.investopedia.com/exam-guide/cfa-level-1/fixed-income-investments/after-tax-yield-taxable-security.asp

- ↑ http://taxfoundation.org/article/2015-tax-brackets

- ↑ https://www.bogleheads.org/wiki/Qualified_dividend

-Step-10.webp)

-Step-10.webp)