This article was co-authored by Brian Stormont, CFP®. Brian Stormont is a Partner and Certified Financial Planner (CFP®) with Insight Wealth Strategies. With over ten years of experience, Brian specializes in retirement planning, investment planning, estate planning, and income taxes. He holds a BS in Finance and Marketing from the University of Denver. Brian also holds his Certified Fund Specialist (CFS), Series 7, Series 66, and Certified Financial Planner (CFP®) licenses.

There are 15 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 100% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 202,122 times.

Debt feels like a lead weight that hangs around your neck, and with student loans, car payments, and medical bills, it all adds up into a pretty heavy one. Learning to confront your loans head-on and form a strategy for paying them down can help you start managing them. Get out from under your loans and get back in the world, then learn to stay debt free.

Things You Should Know

- Prioritize paying off loans with the highest percentage of interest.

- If your debts have similar interest rates, pay off the debts with the lowest balance first.

- Create a strict budget for yourself, cut costs wherever you can, and set aside money to save from every paycheck.

Steps

Forming a Plan

-

1Assess your problems. If you are in debt, you can't afford to be an ostrich. Don't bury your head in the sand and give up. Immediately, right now, you've got to figure out how much money you owe so you can form a plan for getting out of the hole and getting on with your life.[1] [2] Get realistic and crunch some numbers.

- Generally credit card debt, car payments, mortgage, and student loans make up the majority of outstanding debt that most people struggle with. Add up these debts and any other types of debt that you've incurred. Get a number on the table and face it.

-

2Prioritize your highest interest debts.[3] Once you've got the raw data, it's important to look a little closer. Which loans have the highest percentage of interest?[4]

- Part of the reason debt is so hard to get out of is that it gets bigger over time. If you don't pay it down quickly, you end up paying a lot more in the long run, making it very difficult to get out from underneath.[5]

Advertisement -

3Come up with a plan for paying down your debts. Review your finances thoroughly, crunch the numbers, and see which method of making payments will be the most effective for your situation.[6]

- Work on paying down the debt with the highest interest first, while making minimal payments on everything else.[7] This is sometimes called "laddering" your debt, and helps the borrower feel more actively in control of the debt.

- If the interest rates are similar for your debts, pay off the one with the lowest balance first. This is sometimes called "reverse laddering," which allows you see your progress faster, and will make you feel good after each smaller debt is paid off.

-

4Talk to a financial advisor about consolidating your debt. You don't have to go about this alone. Loan paperwork is notoriously complex; it's frustrating to try to go through it solo, but find a financial advisor that you can trust and talk about consolidating the loans into a more manageable single payment each month, to make it easier to pay down your debt.[8]

- It may also be possible to get the interest rate lowered on certain loans, or to establish a deferral for a short period of time.[9] [10] In some situations, you may be able to defer the payment for a certain length of time, during which you won't accrue interest. During this time, you can aggressively pay down the loan while it's not getting any bigger, a serious advantage.

Paying Down Debts

-

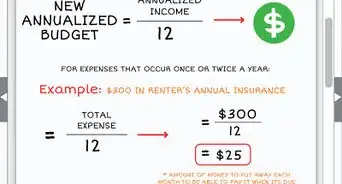

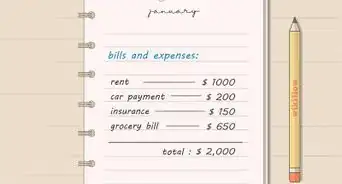

1Create a strict budget. Doing the math necessary to live within your means isn't as complicated as it might seem. Here goes: Add up what you make every month, then add up your necessary expenses every month. Your necessary expenses include food, rent or mortgage payments, bills, and substantial payments on the most essential loans.[11]

- Balance the amount of money that goes into each category of your necessary expenses to try to get as much as possible of your income into the loan payment category, so you can pay down your loans more quickly. Stick to this budget month in and month out.

- If the outgoing funds are more than the incoming funds, you've got some work to do. Obviously, you've got to either cut some expenses or make more money. In some situations you can do both. Consider getting a second job, taking extra hours and extra responsibilities at work, and cutting costs wherever you can find them.

-

2Cut costs wherever you can.[12] Learning to cut your necessary costs down as much as possible and stretch every dollar will help you devote more money toward paying down your loans and getting out from under debt as quickly as possible.

- Cook dollar-saving meals. Stop going out to eat and start buying cheap bulk ingredients and learning to cook big meals that'll help feed your family on the cheap. Fast food restaurants trick people into thinking it's cheap, but a pot of vegetables, rice, and beans goes much farther much more healthfully than a cheeseburger.

- Cut inessential entertainment expenses. Are cable and Netflix subscriptions really necessary when you live in a town with a public library? Do you really need to hit that restaurant, club, or music venue? Find ways to have fun for cheap.

-

3Pay up on your debts whenever you're flush. Made a little extra on your paycheck this week? You could blow it all on a night out, or you could put it toward your loans. Got a bonus for the winter holiday? You could buy a bunch of gifts or you could put it toward your loans. If you want to be debt free, you have to be strict with yourself. No excess expenditures until you're completely debt free and can pay for things without going back into debt. Commit to getting there and work hard until you're there.

-

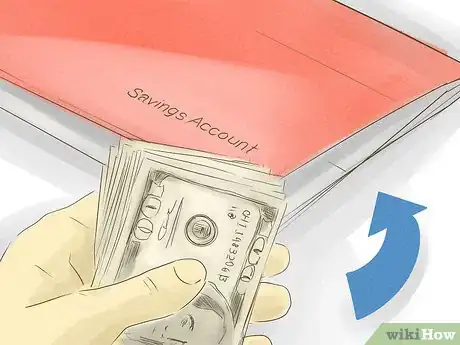

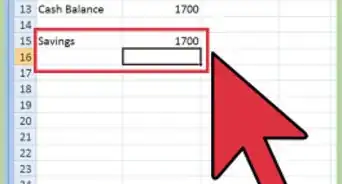

4Save anything you don't spend. If you've budgeted appropriately and have some money left over at the end of the month, save it.[13] It's important to have money saved up for incidentals, emergencies, and other expenditures which can sink you right back down into debt.[14] Having an emergency fund is absolutely essential to avoiding debt and staying debt free.[15] [16]

- Come up with a savings goal. Even if it's just a few hundred dollars, going about the steps necessary to save money instead of spending it and watching your savings account grow can be a hugely satisfying experience for some people. Make saving more addictive than spending.

-

5If you're entitled to a tax refund, spend it wisely. For many people, tax season is something to dread. For some, it's actually an opportunity to get back a little money in the form of a tax refund. Those eligible for benefits like the Earned Income Tax Credit (EITC),[17] moreover, could get a refund for as much as $6,000 if they support a family of three or more children.[18] Imagine how much debt you could pay off with your tax refund. Don't expect a huge windfall during tax season, but don't be unprepared to use it wisely if it does come.

Staying Debt Free

-

1Commit to a change in behavior. If you want to be debt free, you need to freeze all of your inessential spending and avoid buying things that you can't afford.[19] [20] If you can't pay for something in cash, today, you don't need it. Commit to the process and the journey of remaining free of debt and enjoy the freedom that it brings.

- Being debt free doesn't mean living like a miser. If you want to spend a little on vacation, or splurge a little every now and then, feel free to go for it. Just make sure that these kind of fun expenses come from monthly income that's in excess, not being charged on accounts that are already swollen beyond capacity.

-

2Keep saving. Every paycheck, put aside some money for bills, food, and other needed necessities of living, and some money aside to save.[21] Also put aside a little money for non-necessities. It's important to be able to buy things you want without going into debt. Keep saving money, and paying off bills so that you can pay off your debt.

-

3Be happy living within your means. For many people, debt happens because we think we deserve a certain quality of life. Why don't we deserve the expensive cars, the fine jewelry, and the fancy vacations that other people can afford? This kind of thinking is how people get sunk into heavy debts they struggle their whole life to pay off. Learn to be happy living within your means, and take pleasure in every dollar you save, in every day that you spend out from under the boot of someone else's money. Be free.[22]

-

4Stay healthy. Medical debts quickly sink financially secure people into financial trouble. You need to eat well, exercise, and maintain proper dental health to avoid costly and unexpected expenses that come as the result of health scares. A single trip to the hospital can bankrupt people who aren't prepare for it. Don't be one of them.

- If you're uninsured, make sure you get some kind of affordable health insurance as quickly as possible. Talk to your employer about insurance options, or research national options in the marketplace. It's very important to have health insurance for when you need a little help.

-

5Build credit. When you've got your debts paid down, the fun can start. Building credit and working your way into a good credit score will have those credit cards and expenses working to your advantage. When you can afford to buy something outright, pay for it with credit and then pay it off immediately to help build back the credit that might have suffered under the weight of your loans. Take steps to make your credit work for you.[23]

Expert Q&A

Did you know you can get expert answers for this article?

Unlock expert answers by supporting wikiHow

-

QuestionWhy is hard to be debt-free?

Benjamin PackardBenjamin Packard is a Financial Advisor and Founder of Lula Financial based in Oakland, California. Benjamin does financial planning for people who hate financial planning. He helps his clients plan for retirement, pay down their debt and buy a house. He earned a BA in Legal Studies from the University of California, Santa Cruz in 2005 and a Master of Business Administration (MBA) from the California State University Northridge College of Business in 2010.

Benjamin PackardBenjamin Packard is a Financial Advisor and Founder of Lula Financial based in Oakland, California. Benjamin does financial planning for people who hate financial planning. He helps his clients plan for retirement, pay down their debt and buy a house. He earned a BA in Legal Studies from the University of California, Santa Cruz in 2005 and a Master of Business Administration (MBA) from the California State University Northridge College of Business in 2010.

Financial Advisor

-

QuestionIs consolidation the same as settlement?

Brian Stormont, CFP®Brian Stormont is a Partner and Certified Financial Planner (CFP®) with Insight Wealth Strategies. With over ten years of experience, Brian specializes in retirement planning, investment planning, estate planning, and income taxes. He holds a BS in Finance and Marketing from the University of Denver. Brian also holds his Certified Fund Specialist (CFS), Series 7, Series 66, and Certified Financial Planner (CFP®) licenses.

Brian Stormont, CFP®Brian Stormont is a Partner and Certified Financial Planner (CFP®) with Insight Wealth Strategies. With over ten years of experience, Brian specializes in retirement planning, investment planning, estate planning, and income taxes. He holds a BS in Finance and Marketing from the University of Denver. Brian also holds his Certified Fund Specialist (CFS), Series 7, Series 66, and Certified Financial Planner (CFP®) licenses.

Certified Financial Planner Nope! Debt consolidation involves bringing all of your debt to one location and trying to reduce your overall costs with intent to eventually pay everything off. Debt settlement is basically just telling your creditors that your payments need to be reduced or you won't be able to pay anything at all.

Nope! Debt consolidation involves bringing all of your debt to one location and trying to reduce your overall costs with intent to eventually pay everything off. Debt settlement is basically just telling your creditors that your payments need to be reduced or you won't be able to pay anything at all. -

QuestionHow can I pay off debt if I have no money?

Benjamin PackardBenjamin Packard is a Financial Advisor and Founder of Lula Financial based in Oakland, California. Benjamin does financial planning for people who hate financial planning. He helps his clients plan for retirement, pay down their debt and buy a house. He earned a BA in Legal Studies from the University of California, Santa Cruz in 2005 and a Master of Business Administration (MBA) from the California State University Northridge College of Business in 2010.

Benjamin PackardBenjamin Packard is a Financial Advisor and Founder of Lula Financial based in Oakland, California. Benjamin does financial planning for people who hate financial planning. He helps his clients plan for retirement, pay down their debt and buy a house. He earned a BA in Legal Studies from the University of California, Santa Cruz in 2005 and a Master of Business Administration (MBA) from the California State University Northridge College of Business in 2010.

Financial Advisor When it comes to debt, focus on little bits of progress. If your goal was to run a marathon, you wouldn't expect to run your first marathon in a week. For example, continue ordering out, but skip the glass of wine and appetizer. You can also look into refinancing. There are lots of great ways to refinance credit cards and student loan debt, for example. If you can lower an interest rate by just a single percentage point, it can have a big impact.

When it comes to debt, focus on little bits of progress. If your goal was to run a marathon, you wouldn't expect to run your first marathon in a week. For example, continue ordering out, but skip the glass of wine and appetizer. You can also look into refinancing. There are lots of great ways to refinance credit cards and student loan debt, for example. If you can lower an interest rate by just a single percentage point, it can have a big impact.

Warnings

- Avoid materialist traps. No one cares what you own, and if they do, they're insecure. If you want to have nice things, make sure they're for convenience and you can pay cash for them.⧼thumbs_response⧽

References

- ↑ https://www.creditkarma.com/advice/i/how-to-pay-off-debt-5-steps/

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.

- ↑ https://cashmoneylife.com/how-to-prioritize-debt-payments/

- ↑ https://www.creditkarma.com/advice/i/how-to-pay-off-debt-5-steps/

- ↑ Benjamin Packard. Financial Advisor. Expert Interview. 11 March 2020.

- ↑ https://www.forbes.com/sites/robertberger/2017/07/20/debt-snowball-versus-debt-avalanche-what-the-academic-research-shows/#63690eca1454

- ↑ http://money.com/money/collection-post/2791960/which-debts-should-i-pay-off-first/

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.

- ↑ Benjamin Packard. Financial Advisor. Expert Interview. 11 March 2020.

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.

- ↑ https://www.nerdwallet.com/blog/finance/how-to-build-a-budget/

- ↑ Benjamin Packard. Financial Advisor. Expert Interview. 11 March 2020.

- ↑ https://www.moneysavingexpert.com/family/stop-spending-budgeting-tool/

- ↑ Benjamin Packard. Financial Advisor. Expert Interview. 11 March 2020.

- ↑ https://www.investopedia.com/financial-edge/0812/why-an-emergency-fund-is-important.aspx

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.

- ↑ https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit

- ↑ http://www.irs.gov/Individuals/EITC-Income-Limits,-Maximum-Credit--Amounts-and-Tax-Law-Updates

- ↑ https://www.daveramsey.com/blog/7-characteristics-of-debt-free-people

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.

- ↑ https://bettermoneyhabits.bankofamerica.com/en/saving-budgeting/ways-to-save-money

- ↑ https://www.becomingminimalist.com/live-within-means/

- ↑ https://www.nerdwallet.com/blog/finance/how-to-build-credit/