This article was co-authored by Scott Maderer, MBA. Scott Maderer is a Certified Financial Coach and Stewardship Coach in San Antonio, Texas. He received a Master of Business Administration from Texas A&M University-Commerce in 2013 and is a Licensed Human Behavior Consultant (DISC) by Personality Insights, Inc.

There are 9 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 95% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 396,258 times.

Collections agencies specialize in collecting money for creditors after you've failed to pay back a debt for a certain amount of time. These agencies are known for making harassing phone calls and using intimidating language to collect money. While the best way to avoid a collections agency is to pay back all your debts on time, financial difficulty unfortunately makes this impossible sometimes. If you find yourself contacted by a collections agency, don't panic. You have rights and options open to you.

Steps

When the Collection Agency First Contacts You

-

1Wait before paying anything. Collections agencies will either contact you through the mail or over the phone. Either way, you should not pay any money right away. The collection agency is legally required to take several steps to prove that you owe them money before you're obligated to pay. There are even scams where con artists pose as debt collectors and intimidate you into sending them money. So don't pay anything before going through more steps to verify that you legitimately owe the agency money.[1]

-

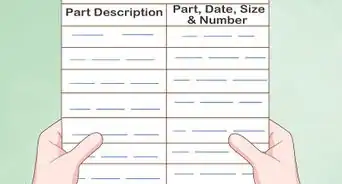

2Get the agency's information. It is important to keep track of all your contacts with the agency. If the situation eventually ends up in court, you'll have plenty of records to help your case.[2]

- If you receive a phone call, ask for the name of the collection agency, the name of the person speaking to you, and the amount they say you owe. Write all of this down with the date you were contacted and a summary of the conversation. Do this every time you speak to the agency on the phone.

- Make copies of any letters the agency sends you in the mail and keep them all together in a folder. Also keep copies of letters you send to the agency and send everything via certified mail and request to be notified when it is successfully delivered.

- Save any voice mails or phone messages the agency leaves you.

- According to federal law, collectors must disclose their identity to you.[3] If the person who's contacted you refuses to reveal the information you've requested, you may be dealing with a con artist. Inform them that they are legally required to identify themselves and if they still refuse, hang up.

Advertisement -

3Demand all information in writing. Within five days of first contacting you, the collection agency is legally required to send you a verification of the debt you owe. This letter should include the amount of money you owe and the name of the original creditor.[4]

- If the agency contacts you over the phone, refuse to talk further until you've received verification of your debt. All you should say is that you want written proof of your debt, and then you should stop talking.

- If the agency initially contacts you with a letter, write back and demand more information. Remember to send all of your correspondence via certified mail — this will ensure that the agency can't claim that they didn't receive your letters.

-

4Prepare a script. Talking with a collection agency on the phone can be very nerve-racking. If you'll have trouble remembering all of this information, write down what you'll say and keep it in front of you while you talk to the collector. There isn't much reason to deviate from this script — you won't be disclosing and personal information and all you should really do when speaking to the collector directly is request documents in writing. The less you say the better.[5]

- Your script might be something like: "I'm not going to talk with you until I receive a Debt Verification Letter proving you are legally allowed to contact me about this debt."[6] They may ask for your work address to send the letter — do not give them that information. The letter should be sent to your home address or P.O. Box if you have one.

- Remember the collector is trained in getting you to respond emotionally. If you respond with emotion, they can get you to do things you wouldn't normally do. The more information you give them, the more they have to use against you. If you mention that you are a Christian, they will quote scripture, if you mention you had an illness, they will use it to make you feel guilty.

-

5Stop communicating with the agency until you receive your bill in writing. End the phone call after you request written confirmation of your debt. The collector may make threats like he will freeze your assets if you don't pay, but he has no power to do this. In fact, a collector making such a threat has violated federal law. If the collector fails to send you this statement in writing then the claim is no longer valid.[7]

- They may also claim that if you don't pay you may go to jail, but owing a debt is not punishable by jail time.

-

6Educate yourself on the law regarding collection agencies. It would be beneficial for you to learn the laws that collection agencies must abide by while you wait for the agency's statement in the mail, . All collection agencies are regulated by the Fair Debt Collection Practices Act (FDCPA). This act bans several practices for collectors. Read this law carefully in preparation for your dealings with the collection agency. By learning the laws, you can counter threats or intimidation by saying that you know the law and the collector's actions are illegal. Among the banned practices are:

- Calling you before 8AM or after 9PM (your local time), unless you've agreed otherwise.

- Using any obscene or abusive language.

- Contacting you at work if you've requested them to stop.

- Accusing you of committing a crime.

- Threatening to take your property without first going through the court system.

- Remember that even if the agency purchased the debt from the original creditor, it is still considered a collector and not a creditor. It is therefore still bound by the rules of the FDCPA, even if collectors try to tell you otherwise.[8]

After the Agency Sends You a Statement

-

1Examine the bill the agency sends you. According to the FDCPA, this statement must include the following to be considered valid.[9]

- The amount of the money owed.

- The name of the original creditor.

- A statement that if you don't dispute the debt within thirty days, the debt is assumed valid.

- A statement that if you dispute the debt within thirty days, the agency will obtain proof of the debt and send it to you.

- A statement that upon request, the agency will provide the name and address of the original creditor, if it differs from the current creditor.

-

2Request validation of your debt. It is very important to make sure you actually owe the money the collector says you do. Though it is illegal, creditors could inflate the amount of money you owe to make a greater profit. You legally have thirty days to dispute the charge and ask for validation of the debt. Once you do so, the collector must cease pursuing you for the money until he produces proof of the original debt.[10] The agency must provide one of the following.[11]

- Proof that they either own or have been assigned the debt from the original creditor.

- A copy of a statement from the original creditor.

-

3Check the statute of limitations on your debt. When the agency provides proof that you owe the money, you still have options. Each state has different laws on how long a debt is considered effective.[12] These are mostly, but not universally, less than ten years. When a collection agency comes after you for outdated debt, it is known as zombie debt (Deal with Zombie Debt).

- Check the date of the proof the agency provided. Then match it against the statute of limitations for debt in your state.

- If the date of the original debt is older than the statute of limitations, you can no longer be sued for the debt. They can call you, they can contact you, but they can't sue you or threaten you.[13]

-

4Threaten to sue if your debt is not legitimate. If the agency has not provided adequate proof of your debt, their claim is not legitimate. Send a certified letter informing them that their actions are in violation of the FDCPA and you will pursue legal action if they keep trying to collect from you.[14]

Talking to the Debt Collector

-

1Stay calm. While it is easy to get flustered talking to a debt collector, you should always remain calm. Getting angry and yelling at the collector won't help your situation.[15]

- State your willingness to work with the collector. Say you fully intend to pay your debt as soon as the agency provides adequate proof.

-

2Avoid providing personal information. Collectors may tell you that they require this information, but this isn't true. They don't need to know your banking information, place of employment, or any information besides your phone number and address. You can ask them to read your phone number and address to you, and you will confirm if it is accurate.

- Make sure your information is not available on social media. If a debt collector finds your Facebook page and all your information is public, he may be able to find out your place of employment as well as a ton of other personal information he may try to use against you. Make sure all your social media accounts are accessible to friends only and that you don't approve any friend requests from people you don't know.

-

3Remember your rights. Become familiar with the FDCPA to spot where the collector is lying to you or trying to intimidate you. Collectors prey upon people who are unfamiliar with the law. For example, the collector may threaten to garnish your wages — that is, take a certain amount of your paycheck until the debt is paid off — if you don't pay. While this is possible, he must sue you in court first, win the lawsuit, get a judgement, and execute the judgement before garnishment is possible.[16]

- If the collector begins getting belligerent or using offensive or threatening language, inform him he is in violation of federal law and you are no longer willing to speak to him. Again, take detailed notes on everything he says and make sure you get his name and the date and time of the conversation.

- If the calls become harassing or inappropriate you should make detailed notes on the time of the call, length of the call, and exact conversation or record the call with permission.

-

4Record conversations. Since this situation could end up in court, having a complete record will be helpful.

- Some states allow you to record phone calls without the other person's knowledge. Check your local laws and see what you are legally allowed to do.

- If you are legally required to get the other person's consent to record the call, simply inform them that you will be recording the conversation for your records.

Paying Back Your Debt if it is Legitimate

-

1Get all agreements in writing. Before paying anything, have the collector send you a statement saying that the amount you are paying will cancel your debt.

-

2Negotiate with the collector. Even when the agency has confirmed that you owe money, you may still be able to get away with paying less than you owe. Chasing you down for money is a long and expensive process, and an agency may be willing to accept a smaller payout if it is immediate.[17]

- Begin by asking if the collector is willing to negotiate a deal. Be sure to say that you plan on paying immediately if you two reach a deal.

- If the collector is willing to negotiate, start by offering a small amount, like 20% of the debt. The collector will then offer a counter-amount. Keep working back and forth until the two of you reach an agreement. At this point, you must get the agreement in writing. An email or fax is generally acceptable as long as it has the amount agreed upon, the date by which you need to pay (immediately in this case), and that once paid your debt will be considered paid in full. This prevents them from taking the amount then saying it was a partial payment and chasing you for the rest.

-

3Work out a payment plan. If you cannot provide the full amount of the debt immediately, come to an agreement on how much you will send every month until the debt is repaid.

- Make sure this amount is something you absolutely will be able to pay. Missing more payments will hurt you further.

- Emphasize that you are willing to pay, but this amount is all you can afford right now. Offer to speak on the matter again in a few months to see if the monthly amount can be increased.

- As always, get this agreement in writing.

-

4Pay with a bank check or money order. Do not send the agency a personal check. This provides them with your banking information. Under no circumstances should you allow a collection agency access to your bank account. This is not necessary to pay back your debt.[18]

- If you must provide electronic transfer information, set up a new account in a separate bank and place only the amount you agreed to transfer in that account. This prevents the collector from taking out more than they've agreed.

References

- ↑ http://www.bankrate.com/finance/debt/6-tips-for-dealing-with-debt-collectors-1.aspx

- ↑ http://www.bankrate.com/finance/debt/6-tips-for-dealing-with-debt-collectors-1.aspx

- ↑ https://www.ftc.gov/enforcement/rules/rulemaking-regulatory-reform-proceedings/fair-debt-collection-practices-act-text#806

- ↑ https://www.debt.org/credit/collection-agencies/

- ↑ http://www.bankrate.com/finance/debt/6-tips-for-dealing-with-debt-collectors-1.aspx

- ↑ http://www.huffingtonpost.com/tiffany-aliche/9-ways-to-successfully_b_2999894.html

- ↑ https://www.ftc.gov/enforcement/rules/rulemaking-regulatory-reform-proceedings/fair-debt-collection-practices-act-text#805

- ↑ http://www.creditinfocenter.com/rebuild/debt-validation.shtml

- ↑ https://www.ftc.gov/enforcement/rules/rulemaking-regulatory-reform-proceedings/fair-debt-collection-practices-act-text#806

- ↑ https://www.ftc.gov/enforcement/rules/rulemaking-regulatory-reform-proceedings/fair-debt-collection-practices-act-text#806

- ↑ http://www.creditinfocenter.com/rebuild/debt-validation.shtml

- ↑ http://www.creditinfocenter.com/rebuild/statutelimitations.shtml

- ↑ http://www.creditinfocenter.com/rebuild/debt-validation.shtml

- ↑ http://www.creditinfocenter.com/rebuild/debt-validation.shtml

- ↑ http://www.bankrate.com/finance/debt/6-tips-for-dealing-with-debt-collectors-1.aspx

- ↑ https://www.debt.org/garnishment-process/

- ↑ http://www.bankrate.com/finance/debt/6-tips-for-dealing-with-debt-collectors-2.aspx

- ↑ http://www.bankrate.com/finance/debt/6-tips-for-dealing-with-debt-collectors-2.aspx

About This Article

To deal with a collection agency, avoid paying money to them immediately when they first contact you. Instead, you should ask for written verification of the debt, which the agency is legally obliged to provide within 5 days. Additionally, avoid giving them personal information, like your religious beliefs, as they'll try to use this against you. While you wait on the letter, you'll want to research the agency to confirm it's legitimate. When you receive the bill, confirm you owe the amount stated, since collection agencies may inflate your debt for profit. For tips from our Financial reviewer on how to threaten to sue an agency and how to pay back the debt if it's legitimate, read on!