This article was co-authored by John Gillingham, CPA, MA and by wikiHow staff writer, Jennifer Mueller, JD. John Gillingham is a Certified Public Accountant, the Owner of Gillingham CPA, PC, and the Founder of Accounting Play, Apps to teach Business & Accounting. John, who is based in San Francisco, California, has over 14 years of accounting experience and specializes in assisting consultants, bootstrapped startups, pre-series A ventures, and stock option compensated employees. He received his MA in Accountancy from the California State University - Sacramento in 2011.

There are 19 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 11,937 times.

The US tax system requires you, as a taxpayer, to figure out how much money you owe in taxes and then pay that amount—and you want to make sure you pay as little as possible. Tax avoidance is perfectly fine, while tax evasion is illegal and can land you in prison. But what's the difference? Generally, you can do anything and everything within the bounds of the law to lower your tax bill. Not reporting all of your income or trying to hide your income is a huge red flag. So is taking deductions for expenses or losses that you can't back up with evidence. If your tax situation is complex or you're worried that what you're doing looks like evasion, talk to a tax attorney or accountant.[1]

Steps

Reporting All Income

-

1Keep a log of any cash payments you receive. Working "under the table" can be helpful because you get paid in cash immediately—but it doesn't mean you don't owe taxes on the money you make. Start a log with the date, amount, and name of the person who paid you that you can use to record all of these payments.[2]

- This includes money someone gives you for one-time assistance, such as if a friend pays you to help them move or a neighbor pays you to mow their lawn.

- If you work regularly as a babysitter, mowing lawns, or helping people around the house, these cash payments are all taxable income.

-

2Record all of your tips if you work in the service industry. Tips are the life-blood of many in the service industry, but even cash tips are subject to tax. While it might be common for many people to simply pocket that money, doing so is tax evasion.[3]

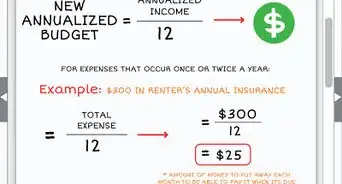

- Credit card tips are included with your regular income, which means your employer withholds taxes. However, if your employer doesn't require you to report cash tips to them, that could mean you end up owing.[4] Get ahead of the game by putting aside $3 for every $10 you make in tips. That way, you won't face an unpleasant surprise in April.

Advertisement -

3Record income from side-gigs. Whether you sell cosmetics, ride-share, or deliver food, all of your income from side-gigs is taxable—regardless of whether the company submits a 1099 form reporting it. Keep track of every dollar, even if you only keep the side-gig temporarily.[5]

- If you have a side-gig like this, you're considered self-employed—even if you work a full-time job. This means you can deduct any expenses you incurred for your side gig and reduce the amount of tax liability you have on that income. However, you still have to report all of the income.

- If you have multiple streams of income going, make sure you keep them separate, because they'll need to be reported separately. For example, if you drive for Uber and also deliver food for GrubHub, you would need to keep those incomes separate. Similarly, if you drive for both Uber and Lyft, you still need to keep those incomes separate.

-

4Calculate the fair market value of benefits you receive as compensation. Anything you receive other than money in exchange for your services is considered taxable income. This includes barter, in which you exchange a service for a service from someone else.[6]

- For example, if you mow your dentist's yard in exchange for free dental work, the fair market value of that dental work would be considered taxable income.

- If your employer offers employees a free gym membership as a fringe benefit or perk, the fair market value of that gym membership is also typically considered income. However, there are exceptions to this. Talk to a tax attorney or accountant.

-

5Include settlement amounts in your income for the year. If you won a lawsuit or received a settlement, the amount you won is likely part of your gross income. There is an exception if your settlement or award is related to a physical injury you sustained.[7]

- This also applies to debt settlements. Generally, if you settle a debt with a credit card company or collections agency, you can expect to pay taxes on the difference between the amount you paid and the total amount you originally owed. If you've recently settled a debt, it's a good idea to talk to an accountant or tax attorney about this.[8]

-

6Leave out inheritances unless you sell inherited property. Generally, inherited money is not considered income, so you wouldn't have to either report it or pay taxes on it. However, if you inherit property and later sell it, you might owe taxes on any money you made as a result of the sale.[9]

- To figure this out, you need to know the fair market value of the property on the date the person you inherited it from died. The executor of that person's estate has this information because they needed it to total the value of the estate. That's the value of the property that you inherited (called your "basis" for tax purposes).

- If you sell the property for more than your basis, that amount is taxable income. For example, if you inherit real estate valued at $250,000, then sell it for $500,000, you would have $250,000 in taxable income.

Taking Allowable Deductions

-

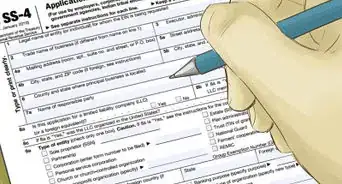

1Claim deductions only if you have receipts. While you don't have to submit receipts with your tax return, the IRS expects you to have them if your return is audited. Even if you specifically remember a deductible expense, you can't claim it without proof of it. Some expenses may require more than one document to prove that you had the expense and it's deductible for the reason you claim.[10]

- For example, if the receipt doesn't specifically list your purchases, you might need to keep an invoice or order form that does include the specific items.

- If you claim a deduction that you don't have receipts for, the best-case scenario if you're audited is that the IRS will disallow the deduction and require you to pay more in taxes. Too many of those, though, and it starts to look like you were evading taxes.

-

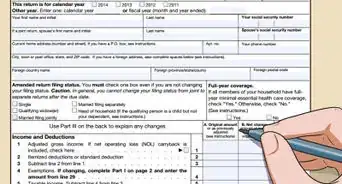

2Complete the IRS worksheets for credits and deductions every year. The IRS offers many credits and deductions that allow anyone to reduce their tax bill. But just because you took the credit last year doesn't mean you're still qualified to take it this year. Do the work every year to make sure you still qualify—even if your situation hasn't changed, the tax law might have.[11]

- If you do your taxes using tax preparation software, the program will ask you questions to determine whether you qualify for various credits or deductions. This can help you ensure that you meet the requirements.

-

3Itemize your deductions only in extraordinary circumstances. As of 2020, the standard deduction provides more benefit to most Americans than itemizing. If you choose to itemize your deductions, your tax return might attract closer scrutiny. To avoid accusations of tax evasion, only itemize if any of the following are true (and you can back your deductions up with thorough documentation):[12]

- You had significant uninsured medical and dental expenses, such as an extended hospital stay

- You paid interest or taxes on your home that exceed the amount of your standard deduction

- You had substantial uninsured losses as the result of a federally declared disaster (usually a severe weather event)

- You made extraordinary charitable contributions, such as donating real estate

-

4Use your home office only for business purposes. If you're a freelancer who works from home, your home office deduction is likely your largest single deduction. It can also be the easiest thing to fudge if you want to lower your tax bill—but doing so likely constitutes tax evasion. To qualify for a home office deduction, use the entire area you claim exclusively for business purposes.[13]

- For example, suppose you have your office set up in the guest bedroom of your house. You use the room exclusively for business purposes, except for twice a year when your sister comes to visit and stays in that room. You would need to subtract those 2 periods since the room isn't being used exclusively for business purposes during that time.

- Even if you only have the space to set up a small corner for your home office, it's still crucial if you want to take advantage of this deduction. Working from your dining room table is only deductible if your dining room table is only ever used for that purpose, and never for family dining, game night, or arts and crafts.

-

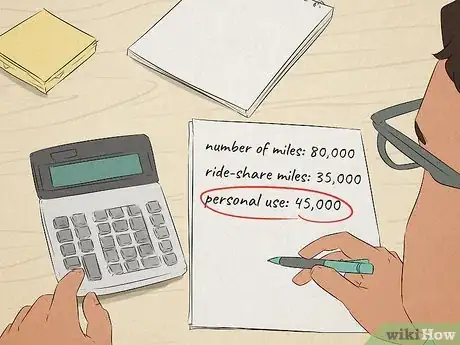

5Allocate business and personal use realistically. You get deductions for a lot of things you use in your business that you wouldn't get a deduction for otherwise. If you have a side-gig, it can be tempting to inflate the percentage of time you use things for business to get a bigger deduction and lower your tax bill. Unfortunately, this is tax evasion.[14]

- If you work for a ride-share company and want to deduct costs associated with your car, keep mileage logs for your ride-share gig. Compare the miles you drove ride-share to your total mileage for the year. That percentage is the percentage of vehicle costs you can deduct.

- For example, if you drove a total of 80,000 miles over the year, and 35,000 of those miles were ride-share, you could safely deduct up to 44% of your vehicle costs.

- If you use the same resources for different side-gigs, you also need to allocate between those. For example, if you drive for both Uber and Lyft, you would need to calculate the number of miles you drove for Uber and the number of miles you drove for Lyft.

-

6Value non-cash donations fairly and honestly. If you make a cash contribution to a charity, you can claim a deduction on your taxes. The same goes for "in-kind" donations, such as if you donate clothing or canned goods. However, the value of those items is usually less than what you paid for them retail. Typically, you can ask the charity for a receipt and they'll assign a tax-deductible value to your goods for you.[15]

- For example, if you donate a bag of clothes, it's typically valued by weight—not by the value of specific items of clothing, even if they all happen to be high-end designer pieces.

- If your non-cash donation is legitimately worth more than $500, there's an additional form for you to fill out and submit with your tax return. If it's worth more than $5,000, you have to back up your valuation with a qualified appraisal.

- A large amount of charitable donations, especially if you don't typically claim significant deductions for charitable contributions, can be a huge red flag to IRS auditors.[16]

Maintaining Complete Records

-

1Create a single location for maintaining your files. Invest in a filing cabinet or box where you can keep your tax records. Then, you'll need file folders or envelopes to separate the records for each year. If your tax return is relatively simple, you might not need much more than this.[17]

- For example, if you don't have any self-employment income and don't claim any deductions, you may not have anything in your file but your W-2 and your tax return. These can be easily kept in a single manila envelope.

- If you claim numerous deductions in different categories, you'll typically need a more elaborate filing system to keep everything organized.

- If you're keeping digital files, organize them in much the same way you would if you have a paper filing cabinet. Create one folder for tax records, then add a folder within it for each year. Use folders within each year's folder to further organize your files.

-

2Label receipts and documents clearly. Right after you buy something, you likely know exactly what the receipt is for. But will you still remember a year from now, or even 3 years from now? Make notes on your receipts and documents so you'll always know exactly what they are.[18]

- Thermal receipts can fade with time, so make a photocopy of it as soon as possible after the purchase. Staple the original receipt to the photocopy.

-

3Organize your documents into categories. If you're claiming a lot of deductions, keeping your receipts and documents organized will make your life (or your accountant's life) easier come tax time. Create file folders for all of the following categories in which you anticipate having deductible expenses:[19]

- Personal expenses

- Medical and dental expenses

- Utility bills

- Mortgage payments and home improvements (if you own your home)

- Bank statements

- Investment statements

- Pay stubs and other income records

- Business expenses (by category)

-

4Keep digital and paper records. Even if you still keep paper records, scan all of your documents so you have a digital copy. Digital copies don't degrade the way paper records do, and you'll always have a backup on hand if that receipt fades or that invoice goes missing.[20]

- If you're paper-free, make a copy of your tax documentation on a thumb drive and store it in a different location, so if anything happens, you've still got the records you need.

-

5Save your records for at least 7 years. While it's true that you can get away with tossing some records after 3 or 4 years, you want to be on the safe side. Keep at least digital copies of all your tax records for at least 7 years from the date of the tax return they apply to.[21]

- If the records are related to real estate or physical property, keep them for as long as you own the property.

- If you are self-employed, you may have more administrative and tax burden than employees.[22]

- You can use accounting software such as Quickbooks to maintain records.[23]

- Set up a separate business bank account so someone else can help you out with the accounting.[24]

Expert Q&A

-

QuestionHow do you pay taxes as a self-employed individual?

John Gillingham, CPA, MAJohn Gillingham is a Certified Public Accountant, the Owner of Gillingham CPA, PC, and the Founder of Accounting Play, Apps to teach Business & Accounting. John, who is based in San Francisco, California, has over 14 years of accounting experience and specializes in assisting consultants, bootstrapped startups, pre-series A ventures, and stock option compensated employees. He received his MA in Accountancy from the California State University - Sacramento in 2011.

John Gillingham, CPA, MAJohn Gillingham is a Certified Public Accountant, the Owner of Gillingham CPA, PC, and the Founder of Accounting Play, Apps to teach Business & Accounting. John, who is based in San Francisco, California, has over 14 years of accounting experience and specializes in assisting consultants, bootstrapped startups, pre-series A ventures, and stock option compensated employees. He received his MA in Accountancy from the California State University - Sacramento in 2011.

Certified Public Accountant & Founder of Accounting Play If you are self-employed, you may have more administrative and tax burdens than employees. As an employee, your company takes a lot of the compliance burden. Self-employed individuals have to pay the whole FICA tax of 15% - 15.3%, while an employee pays only half the amount. The employer pays around 7.62% - 7.8% for them. Automatically 7% – 8% is taken out of their cheque. But a self-employed person has to take care of all the administrative work as well.

If you are self-employed, you may have more administrative and tax burdens than employees. As an employee, your company takes a lot of the compliance burden. Self-employed individuals have to pay the whole FICA tax of 15% - 15.3%, while an employee pays only half the amount. The employer pays around 7.62% - 7.8% for them. Automatically 7% – 8% is taken out of their cheque. But a self-employed person has to take care of all the administrative work as well. -

QuestionWhat can you do to make the tax season less stressful?

John Gillingham, CPA, MAJohn Gillingham is a Certified Public Accountant, the Owner of Gillingham CPA, PC, and the Founder of Accounting Play, Apps to teach Business & Accounting. John, who is based in San Francisco, California, has over 14 years of accounting experience and specializes in assisting consultants, bootstrapped startups, pre-series A ventures, and stock option compensated employees. He received his MA in Accountancy from the California State University - Sacramento in 2011.

John Gillingham, CPA, MAJohn Gillingham is a Certified Public Accountant, the Owner of Gillingham CPA, PC, and the Founder of Accounting Play, Apps to teach Business & Accounting. John, who is based in San Francisco, California, has over 14 years of accounting experience and specializes in assisting consultants, bootstrapped startups, pre-series A ventures, and stock option compensated employees. He received his MA in Accountancy from the California State University - Sacramento in 2011.

Certified Public Accountant & Founder of Accounting Play Organize all the tax documents and get everything scanned in individual PDFs with descriptive titles. Ask a professional or do the accounting yourself. If you cannot afford to get a professional within your budget at this time of the year, file an extension. It will give you time to complete the work until October 15 instead of April 15.

Organize all the tax documents and get everything scanned in individual PDFs with descriptive titles. Ask a professional or do the accounting yourself. If you cannot afford to get a professional within your budget at this time of the year, file an extension. It will give you time to complete the work until October 15 instead of April 15. -

QuestionCan I deduct part of my house payment for my home office?

Alex KwanAlex Kwan is a Certified Public Accountant (CPA) and the CEO of Flex Tax and Consulting Group in the San Francisco Bay Area. He has also served as a Vice President for one of the top five Private Equity Firms. With over a decade of experience practicing public accounting, he specializes in client-centered accounting and consulting, R&D tax services, and the small business sector.

Alex KwanAlex Kwan is a Certified Public Accountant (CPA) and the CEO of Flex Tax and Consulting Group in the San Francisco Bay Area. He has also served as a Vice President for one of the top five Private Equity Firms. With over a decade of experience practicing public accounting, he specializes in client-centered accounting and consulting, R&D tax services, and the small business sector.

Certified Public Accountant If you get a W2 from your job, even if you work from home, you can not claim the home office expense. However, if you're a contractor or a proprietorship, you can claim an office space, as long as it's clearly set aside as an office and you don't use it for anything else. You can't claim your dining room because you occasionally use it as a home office, for instance.

If you get a W2 from your job, even if you work from home, you can not claim the home office expense. However, if you're a contractor or a proprietorship, you can claim an office space, as long as it's clearly set aside as an office and you don't use it for anything else. You can't claim your dining room because you occasionally use it as a home office, for instance.

Warnings

- This article discusses how to avoid tax evasion in the US. If you live in another country, consult a local tax attorney or an accountant.⧼thumbs_response⧽

References

- ↑ https://apps.irs.gov/app/understandingTaxes/whys/thm01/les03/media/ws_ans_thm01_les03.pdf

- ↑ https://apps.irs.gov/app/understandingTaxes/whys/thm01/les03/media/ws_ans_thm01_les03.pdf

- ↑ https://apps.irs.gov/app/understandingTaxes/whys/thm01/les03/media/ws_ans_thm01_les03.pdf

- ↑ https://nomadcapitalist.com/2020/01/29/how-to-avoid-paying-taxes/

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/manage-taxes-for-your-gig-work

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/what-is-taxable-and-nontaxable-income

- ↑ https://www.cpajournal.com/2018/11/20/tax-consequences-of-settlement-and-litigation-award-payments-determining-the-correct-treatment/

- ↑ https://www.consumer.ftc.gov/articles/0145-settling-credit-card-debt

- ↑ https://www.irs.gov/faqs/interest-dividends-other-types-of-income/gifts-inheritances/gifts-inheritances

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/what-kind-of-records-should-i-keep

- ↑ https://www.irs.gov/credits-deductions-for-individuals

- ↑ https://www.irs.gov/taxtopics/tc501

- ↑ https://www.irs.gov/publications/p587

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/deducting-business-expenses

- ↑ https://www.irs.gov/taxtopics/tc506

- ↑ https://www.accountingtoday.com/list/12-red-flags-that-can-trigger-an-irs-audit

- ↑ https://www.moneycrashers.com/home-filing-system/

- ↑ https://consumerist.com/2010/02/11/how-to-protect-your-receipts/

- ↑ https://www.moneycrashers.com/home-filing-system/

- ↑ https://njaes.rutgers.edu/sshw/message/message.php?p=Finance&m=300

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/how-long-should-i-keep-records

- ↑ John Gillingham, CPA, MA. Certified Public Accountant & Founder of Accounting Play. Expert Interview. 3 March 2020.

- ↑ John Gillingham, CPA, MA. Certified Public Accountant & Founder of Accounting Play. Expert Interview. 3 March 2020.

- ↑ John Gillingham, CPA, MA. Certified Public Accountant & Founder of Accounting Play. Expert Interview. 3 March 2020.

- ↑ https://www.accountingtoday.com/list/12-red-flags-that-can-trigger-an-irs-audit