wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 17 people, some anonymous, worked to edit and improve it over time.

There are 8 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. This article received 29 testimonials and 97% of readers who voted found it helpful, earning it our reader-approved status.

This article has been viewed 465,982 times.

Learn more...

If you want to make a difference in the world in a big way, and you have the money to do it, you might consider starting a private foundation. Private foundations are a special type of nonprofit organization that gives money away for charitable purposes. They can have tax benefits, but also require that you follow all the relevant laws and regulations. Read on to learn more.

Steps

-

1Understand what a private foundation is. A private foundation is a nongovernmental, nonprofit corporation organized "exclusively for charitable, educational, religious, scientific and literary purposes" under Section 501(c)(3) of the IRS Code.[1] It is organized by a family, individual or corporation to make donations (grants) to other nonprofit organizations. Here are some key characteristics of a private foundation.

- Funding - Unlike many nonprofits whose work is supported by donations from the public, a private foundation is funded by an investment of cash, securities and other assets from the founder.

- Activities - Nonprofits provide various types of services for charitable or educational purposes. A private foundation's principal activity is making grants to nonprofits to support their activities.

- Tax Status - Like other nonprofits, private foundations are exempt from income tax. They are, however, subject to a one or two percent excise tax on income generated by investments.[2]

-

2Clarify why you want to set up a foundation. There are many reasons people choose to set up a private foundation. Before you make this step, you should think seriously about your reasons, and what you want to accomplish. They might include:

- Tax advantages - They can be significant. As an individual, you can donate up to 30% of your annual income to a private foundation and receive a tax deduction.

- Controlling your philanthropic activities - Unlike other planned giving vehicles, a private foundation allows you - the founder - to tightly control what types of charities receive support, as well as the management of the assets funding that support.

- Supporting a pet cause - If you have a cause that is dear to your heart, you might want to set up your foundation to fund charities that are working in that area.

- Creating a legacy - You might choose to name your foundation after yourself, to carry on and associate your family name with good works. You could also consider naming the foundation after someone you want to honor.

- Involving your family - A private foundation can be a way to get your family members involved in philanthropic activities. You can name them to the board, or hire them as staff.

Advertisement -

3Identify your areas of interest. An important aspect of starting a foundation is deciding what types of charitable work you want to support. Sometimes founders know right away what they want to support, but others need to give it some thought. While some foundations are very general about their funding, most foundations have specific topics, causes or geographic regions they prefer to focus on.

- You can get as specific as you like, depending on your interests.

- Before you decide on your causes, it's a good idea to do research to learn about the needs in that area and the organizations that are involved in that work.

-

4Incorporate. A private foundation must be incorporated in the state where it will conduct its business.[3] You can hire an attorney to do this for you, or you can do it yourself. Specific requirements will vary from state to state. Check with your Secretary of State's business office to learn the exact procedure you should follow for the state in which you live. In general, you will need to do the following:

- Verify that your proposed foundation name is not registered to another corporation. This can often be done with an online search.

- Draw up Articles of Incorporation, which is the legal document that governs the management of your corporation. If you are handling the process yourself, look for templates online for incorporating a nonprofit entity in your state.[4]

- Identify your board members. Most states require that new corporations have at least three members serving on the board of directors. You will name them in the Articles of Incorporation.[5]

- Pay the required filing fees.

-

5Draw up a set of by-laws (optional). By-laws are an organization's internal operating rules. They establish the rules for selecting board members, board terms, and specify the organization's fiscal year.[6]

- Some states require nonprofits to have by-laws and some do not; check with your state's Secretary of State to be sure.

- Even if you are not required to, it's a good idea to have by-laws as a reference document, as you will occasionally need to provide documentation about the items covered in them.

-

6Draw up a conflict of interest policy. The policy will handle instances where the personal interest of a board member or office are at odds with the best interest of the organization. A common example of a conflict of interest is when a board member's firm is hired to perform services for the organization. These types of transactions are not illegal, and can be perfectly acceptable if the decision was vetted in an objective way and truly benefits the organization. You can find templates of conflict of interest policies online.[7] A policy typically:

- Prohibits or limits transactions where conflict is an issue

- Requires board members to disclose potential conflicts

- Requires board members to recuse themselves from making decisions in which they have a personal interest

- Establishes guidelines for requiring competitive bid processes for transactions over a certain dollar amount, to ensure that organizations are getting fair value.

-

7Establish funding guidelines. Your funding guidelines will spell out the interest areas you identified earlier, the process by which you distribute funds, and how or whether organizations can request grants from you. Here are some things to include:

- Selection of grantees - You can decide to give grants only to organizations that you identify yourself, or to accept grant proposals from charities who want funding. If you choose the latter, you can decide whether you want to allow only proposals that you solicit, or whether any eligible organization can apply.

- Application process - If you opt to receive applications for funding, you'll need to decide what your process will be. What information do you want to know about the proposed project or organization? It can be as simple as a form or a letter mailed to your foundation, or a very detailed proposal, according to your preference. Whatever you decide, your guidelines should carefully and specifically spell out what you want from applicants.

- Grant ranges - You will need to determine how large your grants will be. This will be determined in large part by the size of your endowment and how your investments are performing.

- Calendar - If you intend to accept proposals, you will need to decide how often you want to review them. You can set any schedule you like, from a rolling basis to once a year.

-

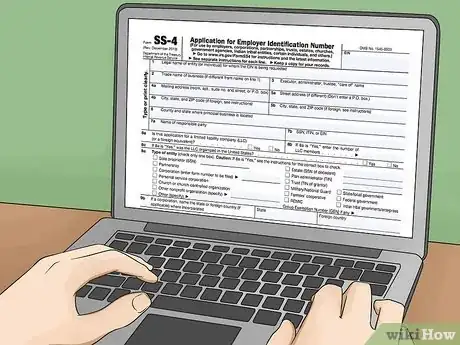

8Apply for an Employer Identification Number (EIN). An EIN is like a social security number for a business. It will be used by government agencies to identify your foundation. Even if you don't intend to hire any employees, it's a good idea to have an EIN for your foundation.[8] There is no fee to get an EIN. To apply for an EIN:

- Download and complete IRS Form SS-4, Application for Employer Identification Number. Your EIN will be mailed to you after your paperwork is processed.

- Call the IRS Business & Specialty Tax Line at (800) 829-4933. A representative will take your information over the phone and issue your EIN at the end of the call.

- Complete the Internet EIN application. At the end of the process, you will receive your EIN.

-

9Apply to the IRS. In order to receive your tax exempt status, you will need to file the correct paperwork with the IRS. The main form you need is Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code. This form asks questions about how your corporation is organized, what your primary activities will be, the composition of your board of directors, your foundation's financial information, and other details. Be prepared to include:

- A copy of your grant making guidelines

- Copies of your organization's organizing documents (articles of incorporation, bylaws, etc.).

- The correct filing fees. Check the IRS website to verify the current required fees.

-

10Be prepared to answer follow up questions. It is very common for the IRS to have questions about your application for tax exempt status. Do not be discouraged if this happens. Be prepared to answer any questions thoroughly.

Community Q&A

-

QuestionHow can I create a fund for young children who have recently lost their mother?

Community AnswerYou need to be able to get out there and let people know about your fund. Create a website or something to get people's attention. Add the story of why you are creating this fund. (For websites, there are plenty of free websites that you can use to create your own websites like "Wix"-check it out. Really great.) Then find people who would be willing to add to the cause. This can usually help in a chain reaction of others helping out as well.

Community AnswerYou need to be able to get out there and let people know about your fund. Create a website or something to get people's attention. Add the story of why you are creating this fund. (For websites, there are plenty of free websites that you can use to create your own websites like "Wix"-check it out. Really great.) Then find people who would be willing to add to the cause. This can usually help in a chain reaction of others helping out as well. -

QuestionWhat major things should I focus on before starting the foundation?

Community AnswerBefore starting a foundation, you'll need to define your mission and secure funding and a team of people who will help you reach your goals.

Community AnswerBefore starting a foundation, you'll need to define your mission and secure funding and a team of people who will help you reach your goals. -

QuestionAre raffles authorized in a private foundation?

Community AnswerIt depends on who you are planning to sell to. If it is family and friends, then it is authorized. If strangers, then it is not such a good idea.

Community AnswerIt depends on who you are planning to sell to. If it is family and friends, then it is authorized. If strangers, then it is not such a good idea.

Warnings

- Special rules apply if you are planning to provide grants to organizations outside the U.S. Make sure you thoroughly understand them, or you put yourself at risk of losing your nonprofit status.⧼thumbs_response⧽

- You are responsible for following all of the laws and regulations that govern private foundations, so keep up to date with them.⧼thumbs_response⧽

- Filing Form 1023 is not required before beginning your foundation's activities; however, if you want your tax exemption to be effective as of the date of your incorporation, you must file within 27 months of incorporation. Otherwise, your exemption will only be effective as of the postmark date of your application.[9]⧼thumbs_response⧽

References

- ↑ https://www.irs.gov/charities-non-profits/charitable-organizations/exemption-requirements-section-501c3-organizations

- ↑ https://nonprofithub.org/board-of-directors/board-diversity-recruit-talent-not-tokens/

- ↑ https://www.501c3.org/frequently-asked-questions/do-we-need-to-incorporate/

- ↑ https://nonprofitally.com/start-a-nonprofit/articles-of-incorporation/

- ↑ https://nonprofithub.org/board-of-directors/board-diversity-recruit-talent-not-tokens/

- ↑ https://grantspace.org/resources/knowledge-base/nonprofit-bylaws/

- ↑ https://www.boardeffect.com/blog/conflict-of-interest-template-nonprofit-boards/

- ↑ https://www.irs.gov/charities-non-profits/employer-identification-number

- ↑ https://www.irs.gov/pub/irs-pdf/i1023ez.pdf

About This Article

To start a private foundation, choose the type of charitable work you want to support and create a unique name for your foundation. Next, draw up Articles of Incorporation documents, submit them to your Secretary of State's business office, and pay the required filing fee. Then, draw up a conflict of interest policy, establish funding guidelines, and apply for an Employer Identification Number (EIN). Don't forget to file paperwork with the IRS to receive your tax exempt status! For tips on establishing funding guidelines, read on!

(3)-Nonprofit-Organization-Step-19-Version-2.webp)

(3)-Status-of-a-Nonprofit-Step-13-Version-2.webp)

(3)-Nonprofit-Organization-Step-19-Version-2.webp)