This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

There are 10 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 40,545 times.

Learn more...

Experts estimate that nonprofits lose almost $77 billion a year to fraud. Nonprofit fraud harms not only those who give to charity but the nonprofit itself. In order to report nonprofit fraud, you should gather evidence of the fraud, such as financial records or confidential emails. Then you should contact the police and other organizations.

Steps

Reporting the Fraud to the Government

-

1Identify the fraud. Any nonprofit that defrauds people has committed a crime. Although fraud can take many shapes, there are two fraudulent schemes nonprofits often commit:

- Deceptive fundraising. The nonprofit might make misrepresentations about charitable giving, such as the fair market value of donated assets or whether the nonprofit complies with donor-imposed restrictions on a gift.

- Fraudulent financial reporting. The nonprofit might misclassify donations in order to mislead donors or charity watchdogs; misclassify expenses for fundraising and administration; or issue fraudulent statements of compliance.

-

2Gather evidence of the fraud. The police would benefit from receiving as much evidence as possible that supports your accusation of fraud. Be sure to gather the evidence legally. For example, don't break into someone's computer or office. Also, don't secretly tape a conversation since this is illegal in many states.[1] Instead, get copies of evidence available to you:

- Financial records. If the nonprofit has committed financial fraud, then you will want copies of the records which show the fraud.

- Advertisements. The nonprofit might misrepresent its activities or purpose to the public. You should get samples of any misleading flyer or advertisement.

- Letters or other communications. If the nonprofit lies to a donor, then you should get a copy of the misleading communication, provided you can legally access the letter or email.

Advertisement -

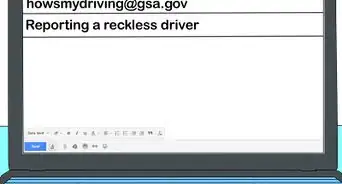

3Notify the police of the fraud. You should report this crime to the police so that they can investigate. Stop into the police station or call. If the police want to see your evidence, then share copies of all documents with them.

-

4Contact the nonprofit if fraud is committed by an employee. The nonprofit should also know if an individual within the organization is committing fraud. In this way, the nonprofit officers or board can investigate and fire the employee if necessary.

- Check if there is a hotline you can call anonymously. Some nonprofits have created hotlines where whistleblowers can file an anonymous report of fraud.[4]

- If not, then find an appropriate person in management to report the fraud to. Make sure the person does not work under the person you suspect of fraud.

Reporting a Charity to the Better Business Bureau

-

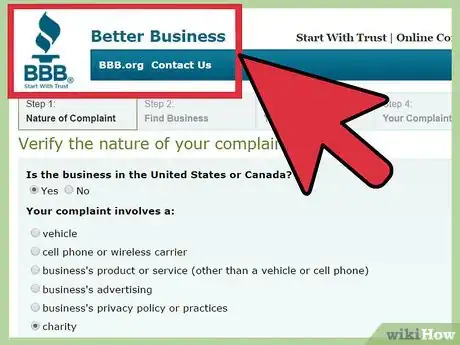

1Visit the BBB website. If you aren't sure that the nonprofit has committed a crime—but you suspect that it is running a scam charity—then you might want to report the charity to the Better Business Bureau (BBB). You can go to the Online Complaint System page.[5] On that page, you can select “charity.”

- You will then be asked whether the charity is one that solicits nationally. The reporting process differs depending on whether the charity is national or local.

-

2Provide information about the national charity. If you are reporting a national charity, then you will be asked for the following information:

- your name and contact information, unless you want to remain anonymous

- charity name and contact information

- details about your complaint

-

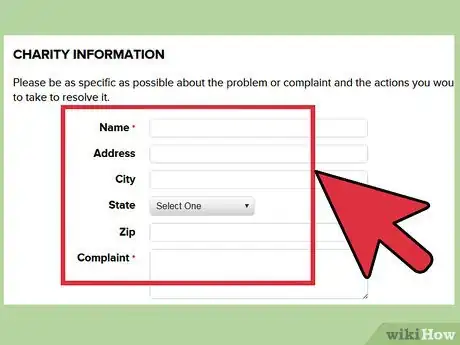

3Provide information about a local charity. You will have to provide more information to report a charity that doesn't solicit nationally. Instead, you will need to search for the charity's name by entering its address, URL, phone number, or email address.[6]

- If the charity hasn't been listed on BBB yet, then enter its name and other information.

-

4Complete a complaint for a local charity. Depending on where you live, the BBB website might direct you to a local branch of the BBB. At the local website, you can fill out a complaint. You will have to provide similar information as you would provide for a national complaint:[7]

- your name and contact information

- a description of your complaint with the charity

Suing to Recover Money

-

1Meet with a lawyer. Fraud is not only a crime, it is also a civil wrong which you can sue for. When someone defrauds you, you can sue to get back the money taken. You may also be able to get additional damages. Only a qualified attorney can advise you about your options.

- To find a lawyer, you should contact your local or state bar association, which should run a referral program.

- As a nonprofit, you may be able to get free legal assistance. For example, an individual lawyer or a law firm may volunteer their services pro bono. You may also get a legal aid organization to provide free legal services. To find a legal aid organization near you, you can visit the Legal Services Corporation's website.[8]

-

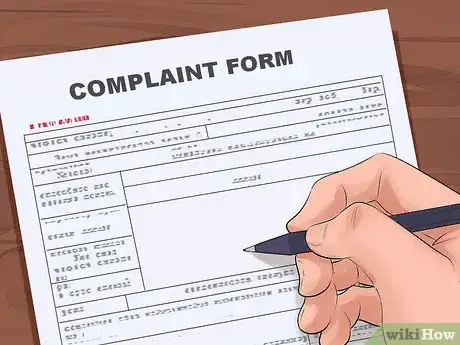

2File a complaint. You will start the lawsuit by filing a complaint in court. This legal document identifies you as the “plaintiff” bringing the lawsuit and the person who committed fraud as the “defendant.” The complaint also describes the fraud and makes a request for compensation.[9]

- Your lawyer can draft the complaint for you and file it with the court.

-

3Serve notice of the lawsuit on the defendant. You can give the defendant notice by serving a copy of the complaint and a “summons,” which is a legal document you can get from the court clerk.

- Generally, you can serve the complaint by hiring a private process server to make hand delivery. You may also have someone 18 or older who is not part of the lawsuit make hand delivery.

- Ask whoever makes service fills out a “proof of service” (also called “affidavit of service”) form. You must file this form with the clerk to show that proper service was made on the defendant.

-

4Attend trial. At a fraud trial, you must prove fraud using documents and witness testimony. As the person bringing the lawsuit, you will present your evidence first. The defendant will also be able to testify and present evidence as well.

- Your lawyer should handle the trial for you. Although you won't have to do anything (other than possibly testify), you should stay engaged throughout the lawsuit and the trial.

-

5Collect your judgment. If you win at trial, then you face the challenge of trying to get back the money you were defrauded of. Roughly half of all nonprofits are unable to recover the money they lost.[10] Accordingly, you may have to be creative.

- For example, you could garnish the defendant's wages. However, if the person is unable to get future employment, then you won't be able to garnish anything. Also, if the person switches jobs, you have to file a new garnishment action each time.

- Another option is to put liens on the defendant's property and foreclose on it. You can then get some of the proceeds and apply them toward the money judgment the court awarded you.

- For more information, see Collect a Court Ordered Judgment.

References

- ↑ http://www.dmlp.org/legal-guide/recording-phone-calls-and-conversations

- ↑ http://www.charitiesnys.com/complaints_new.jsp

- ↑ http://www.charitiesnys.com/pdfs/char030.pdf

- ↑ http://www.fraudhl.com/about

- ↑ https://www.bbb.org/consumer-complaints/file-a-complaint/nature-of-complaint/

- ↑ https://www.bbb.org/consumer-complaints/file-a-complaint/find-business/

- ↑ http://odrcomplaint.bbb.org/odrweb/public/NewComplaintForm.aspx?Qualified=y&BBBID=69&BusinessID=88265107

- ↑ http://www.lsc.gov/

- ↑ http://legal-dictionary.thefreedictionary.com/Civil+Complaint