This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 313,120 times.

If you've ever had financial troubles, there's a chance you could be on the ChexSystems list. ChexSystems actively holds credit data on over 300 million consumers in the US and provides that data to approximately 80% of the banks across the country.[1] Credit scores can range from 100 (the lowest possible credit score) to 899 (the highest), and that credit rating is calculated using the data ChexSystems holds on a given consumer. A low credit score can affect a person's ability to open a checking or savings account for years after a low score has been assigned.[2] Learning how to find out if you're on the ChexSystems list, and what options you have if you are, can help you make sound financial plans for the future.

Steps

Discovering Whether You're on the ChexSystems List

-

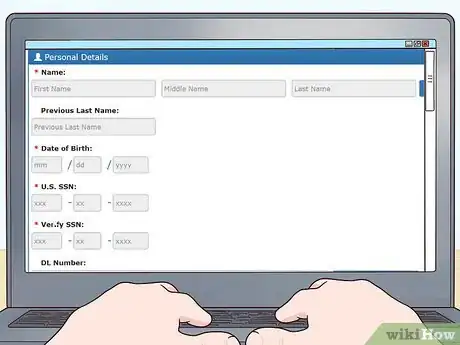

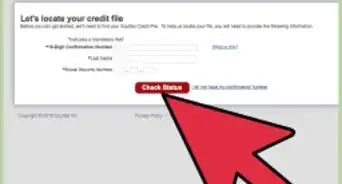

1Request a ChexSystems report online. Consumers who are worried about a potentially poor ChexSystems rating can request a report from the company. The report will detail a consumer's instances of unpaid fees, bounced checks, and instances of suspected fraud, as well as a list of credit inquiries, check orders, and credit freezes.[3]

- Consumers can request a report from the company by going to the ChexSystems website and filling out the necessary identifying information, including the consumer's full name, address, and social security number, and submitting that information through the website.

- ChexSystems will respond to requests for a consumer report within five business days.

- Only the consumer himself or herself may request a consumer report.

- Not everyone is on the ChexSystems list. If you request a copy of your report and you are not on the ChexSystems list, you will receive a blank report.

-

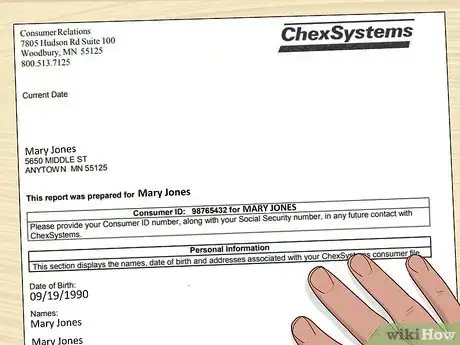

2Request a ChexSystems report by mail. Consumers can order a ChexSystems report via mail by printing and filling out the downloadable form. Consumers should then mail the completed form to Chex Systems.

- Address the envelope to "Chex Systems, Inc., Attn: Consumer Relations".

- The address for ChexSystems is 7805 Hudson Road, Suite 100, Woodbury, MN 55125

- ChexSystems will mail out a consumer report within five business days from the time the initial request is received.

Advertisement -

3Order a ChexSystems report by phone. Consumers can request a ChexSystems report over the phone by calling 1-800-428-9623. Callers will then verify personal information through ChexSystem's voice messaging system.

-

4Order a ChexSystems report by fax. In addition to phone, standard mail, and online requests, ChexSystems also offers a fax option.

- Consumers will have to fill out the same offline request form required for standard mail requests, available on the ChexSystems website.

- Consumers should then fax the completed request form to (602) 659-2197.

-

5Check your report carefully. There are a number of reasons why certain items contained in your report may be inaccurate. You will need to address these issues immediately if you suspect that your report is incorrect.

- Victims of fraud or identity theft may have an inaccurate report due to spending activities of the fraudulent party.[4]

- Occasionally banks make mistakes when compiling credit information. It's possible a consumer's bank has not yet updated the status of a previously delinquent account, or reported the wrong date of an account delinquency.[5]

Recovering Your Credit After a ChexSystems Listing

-

1Dispute an error in your report. Consumers who wish to dispute an error in a ChexSystems report may initiate that dispute with either ChexSystems or the bank that provided ChexSystems with that information. Because consumers may initiate disputes with both ChexSystems and the bank, it may expedite the dispute process by filing a dispute with both institutions.[6]

- Highlight or circle the account listing that you believe is inaccurate or incorrect. Then make a photocopy of your report, keeping the original for your own records.[7]

-

2Write a request for validation letter. This can be addressed to the bank, to ChexSystems, or to both institutions. The letter should state in as professional a manner as possible what the discrepancies are, itemizing all of the suspected errors in your report. Request validation of your information and the removal or correction of the disputed items in your report.[8]

- Send your request for validation letter with a photocopy of your report (having highlighted the inaccuracy you wish to dispute) to the bank and/or to ChexSystems.[9]

- If you are sending a request for validation to ChexSystems, you will also need to fill out a Consumer Request for Reinvestigation form, available online.

-

3Send all materials via certified mail. Every form, letter, or complaint you send to either your bank or to ChexSystems should be sent by certified mail with a request for a return receipt. This will provide you with documentation that the requests were received by the appropriate party or parties on a given date, should either fail to respond in a timely manner.[10]

- ChexSystems and your bank must respond to your request within 30 days (21 days in the state of Maine). If either institution fails to respond to your request in the required time frame, the item(s) under dispute must be removed from your record. This is mandated by law.[11] Once the allotted time has passed, you may proceed to sending a Demand for Removal letter. A sample letter can be found online.

-

4Send a Procedural Request letter. If the disputed item was confirmed by either the bank or ChexSystems as an error but has not been deleted from your record, you may then send a Procedural Request letter to either institution, requesting detailed information as to why the information has not been removed and asking for the name and contact information of each source of disputed information. Each institution then has 15 days to complete the re-investigation and supply you with the requested information, or they could face investigation by the Federal Trade Commission and other legal action.[12] A sample Procedural Request letter can be found online at http://wallethub.com/edu/chexsystems-removal/12781/#procedural-request.

-

5File a formal complaint. If either institution continues to ignore your requests for removal of the false/disputed information, you may then file a formal complaint with a regulator, such as the Office of the Comptroller of Currency (OCC), the National Credit Union Administration (NCUA), the Consumer Financial Protection Bureau (CFPB), your State Attorney General's Office, your State Banking Commission, or the Federal Trade Commission (FTC). You may also file a lawsuit in small claims court against the appropriate institution.[13]

-

6Add a consumer statement to your file. If you were unsuccessful in getting a disputed item removed from your file, you can request to add your own statement to your file. This will allow any financial institutions you attempt to do business with to see in their report on your credit that you disputed an item and that the institution(s) responsible failed to resolve the issue.[14]

- Print and fill out the Request for Consumer Statement form from the ChexSystems website.

- Send the completed form to ChexSystems Consumer Relations at 7805 Hudson Rd., Ste. 100, Woodbury, MN 55125.[15]

- Consumer statements must be fewer than 100 words, with the exception of Maine residents, who are permitted up to 200 words. All consumer statements must be free from profanity or explicit language.

- Consumer statements may not include the names of other persons or businesses and must refer specifically to the information contained in that consumer's file.

-

7Pay back any money that you owe. If you closed out a checking account without first paying off any overdraft fees levied by the bank, you may have to pay that amount in its entirety back to the financial institution you previously conducted business with in order to remedy your financial situation.[16]

- Obtain proof of payment from the bank or financial institution once you've paid off your debt.[17]

- Request a written agreement from your bank to either delete your information from the ChexSystems database, or to update your account to reflect that the balance was paid in full.[18]

- ChexSystems isn’t obligated to remove the report if it was originally accurate. However, the financial institution is required to update the report to reflect a “paid in full” or “settled in full” status.

-

8Open a second chance/fresh start checking account. Many national and regional financial institutions offer special checking accounts to consumers who cannot open a standard bank account. These accounts are variously called second chance accounts or fresh start accounts. They are typically accompanied by monthly fees, and the financial institutions offering these accounts may require eligible consumers to undertake financial management classes in order to maintain an account.[19]

- Some financial institutions will convert a second chance account into a standard checking account after a consistent period (such as 12 months) of financial responsibility.[20]

- Every state in the US except New Hampshire, Rhode Island, and Vermont has a financial institution that offers some type of second chance checking account.[21]

- Consumers in US states that do not offer second chance checking accounts may wish to try to open an account through one of the nationwide financial institutions that offer these accounts, such as Green Dot Bank and Wells Fargo.[22]

Understanding How ChexSystems Works

-

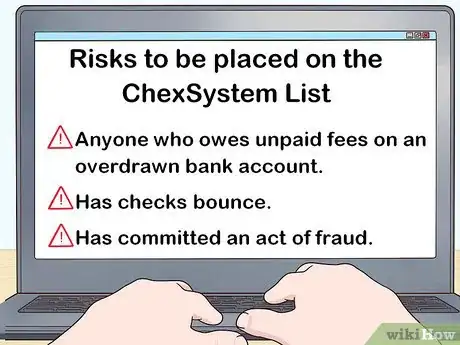

1Learn who is at risk. Anyone who owes unpaid fees on an overdrawn bank account, has had checks bounce, or has committed an act of fraud could be placed on the ChexSystems list.[23]

-

2Know how ChexSystems affects consumers. A negative ChexSystems score stays with the consumer for five years, unless the score is contested by the consumer and proven to be inaccurate. Though there are ways to open a checking account in spite of a poor credit score, many consumers cannot afford the substantial fees that come with a poor score checking account, and may end up being unable to open an account at all.[24]

-

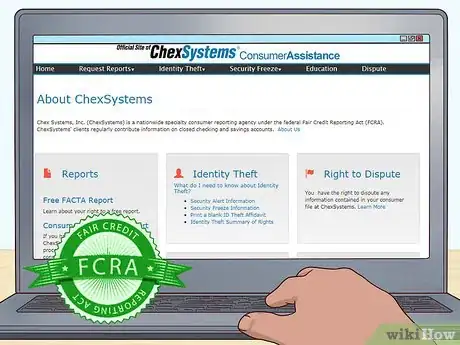

3Understand the role of ChexSystems. Many consumers mistakenly believe that ChexSystems denied them from opening a bank account, when in fact it is the financial institution that a given consumer tried to do business with that accepts or declines their account. ChexSystems merely provides financial institutions with a consumer's credit score and financial history.

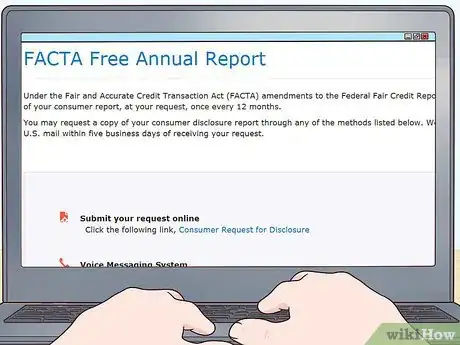

- ChexSystems is governed by the Fair Credit Reporting Act, meaning federal guidelines are followed to ensure that any information in a consumer's file is accurate, and that the consumer's privacy is protected. However, mistakes do happen from time to time, which underscores the importance of discovering your ChexSystems file and taking the appropriate actions.[25]

- Under federal guidelines, consumers are entitled to one free copy of the ChexSystems consumer report every 12 months.

- Be aware that the company primarily deals lists negative information. If you request a ChexSystems report and the file they send you is blank, that is generally a good thing.[26]

Warnings

- Having negative information on a ChexSystems report can prevent you from being able to open a bank account. And remember, your information stays on the report for five years.⧼thumbs_response⧽

- When submitting a “consumer statement” to be added to your report, be careful not to include confidential personal data (like medical information). If you do include it, that information won’t be removed or hidden. Therefore, it will be visible to anyone making a legitimate request for a copy of your report.⧼thumbs_response⧽

References

- ↑ http://money.cnn.com/2012/08/16/pf/bank-account-history/

- ↑ http://money.cnn.com/2012/08/16/pf/bank-account-history/

- ↑ http://www.nerdwallet.com/blog/banking/blacklisted-chexsystems-heres/

- ↑ http://wallethub.com/edu/chexsystems-removal/12781/

- ↑ http://wallethub.com/edu/chexsystems-removal/12781/

- ↑ http://wallethub.com/edu/chexsystems-removal/12781/

- ↑ http://wallethub.com/edu/chexsystems-removal/12781/

- ↑ http://wallethub.com/edu/chexsystems-removal/12781/

- ↑ http://wallethub.com/edu/chexsystems-removal/12781/

- ↑ http://wallethub.com/edu/chexsystems-removal/12781/

- ↑ http://wallethub.com/edu/chexsystems-removal/12781/

- ↑ http://wallethub.com/edu/chexsystems-removal/12781/

- ↑ http://wallethub.com/edu/chexsystems-removal/12781/

- ↑ http://wallethub.com/edu/chexsystems-removal/12781/

- ↑ http://wallethub.com/edu/chexsystems-removal/12781/

- ↑ http://wallethub.com/edu/chexsystems-removal/12781/

- ↑ http://wallethub.com/edu/chexsystems-removal/12781/

- ↑ http://wallethub.com/edu/chexsystems-removal/12781/

- ↑ http://www.nerdwallet.com/blog/checking/second-chance-checking/

- ↑ https://www.libertysavingsbank.com/fresh-start-checking.aspx

- ↑ http://www.nerdwallet.com/blog/checking/second-chance-checking/

- ↑ http://www.nerdwallet.com/blog/checking/second-chance-checking/

- ↑ http://money.cnn.com/2012/08/16/pf/bank-account-history/

- ↑ http://money.cnn.com/2012/08/16/pf/bank-account-history/

- ↑ http://www.nerdwallet.com/blog/banking/blacklisted-chexsystems-heres/

- ↑ http://www.nerdwallet.com/blog/banking/blacklisted-chexsystems-heres/

- ↑ http://www.moneybluebook.com/flagged-by-chexsystems.html/

- ↑ http://www.moneybluebook.com/flagged-by-chexsystems.html/

- ↑ http://wallethub.com/edu/chexsystems-removal/12781/

About This Article

The ChexSystems list includes over 300 million people in the U.S. and their credit data. Anyone who owes unpaid fees on an overdrawn bank account, has had checks bounce, or has committed an act of fraud can be placed on the list. To see if you’re on the ChexSystems list, request a report on their website. If you’d prefer to request a report via mail or phone, you can do this too. Once you receive your report, make sure all of the information is accurate, since banks can make mistakes, especially if you’ve been a victim of fraud or identity theft. If you notice a mistake, file a dispute with either ChexSystems or the bank that provided the information. For more tips from our Legal co-author, including how to improve a poor credit report, read on.