This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

There are 11 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 42,398 times.

If you don’t pay a debt, then the creditor might report to the national credit reporting agencies (CRAs) that the account is in collections. If an account has wrongly been reported as in collections, then you can dispute that information with the CRAs. You can also correct any inaccuracies in an otherwise valid collection notation. You have a legal right to an accurate credit report.

Steps

Preparing to Dispute the Collection Account

-

1Identify the account in collections. Before disputing the collection account, you should try to identify what account is in collections. Was it a credit card? A utility bill? A medical bill? Furthermore, you need the following information to help you decide how to respond:

- Is the collection notation accurate? Or is the account inaccurately listed as in collections? If you were never behind on payments, then your account should not be listed as in collections. In this situation, you have a strong case to get the collection notation removed.

- Does the collection agency own the debt? If the account is really in collections, then you should try to figure out if the creditor has hired a collection agency to help it collect from you. Ask whoever calls you, or write the collection agency to ask. If the original creditor still owns the debt, then you might have few options.

- You cannot have accurate information removed from a credit report.[1] Consequently, if your account really is in collections, then you might want to work out a payment plan with the creditor. Or, if the collection account is more than four years old, you might not want to do anything. The older an account, the less it impacts your credits core.

- Has the debt been sold to a collection agency? Often, the collection agency pays pennies on the dollar for the right to the debt. Therefore, your $10,000 credit card debt might have been bought for a few hundred dollars. If your original creditor has sold the debt, then you might want to try and get the collection removed from your report. Because the debt is worth so little to the collection agency, they might not contest your attempt to remove it.

- How old is the collection account? Collection accounts should automatically fall off your credit report after seven and a half years.[2]

-

2Limit your conversations with collection agents. Bad debts eventually become unenforceable once enough time has passed.[3] However, it’s possible to “re-age” the account if you agree to start making payments.[4] Once a bad debt has been re-aged, the collection agency can sue you to collect payment and the collection will stay on your credit report.

- To illustrate: say you defaulted on a credit card in 2004. The account should no longer be on your credit report and the statute of limitations on the debt should have expired. However, if you agree to make a partial payment on the debt in 2015, then the collection account becomes “live” again. The clock starts over.

- Accordingly, you should be careful about what you say to collection agents who call you. You cannot make payment or even agree to make payment.[5] Either can re-age an old debt.

- If you don’t know what to say on the phone, hang up on the collector.

Advertisement -

3Seek an attorney’s assistance, if necessary. If you have questions about how to respond to debt collection, you should contact an experienced attorney who represents consumers. You can find a lawyer by visiting the National Association of Consumer Advocates. You can use the “Find an Attorney” feature at their website.

- Take any correspondence with the creditor/collection agency and a copy of your credit report to the attorney.

- If you cannot afford a lawyer, then see if there are any legal aid organizations in your area. Legal aid organizations provide free or low-cost legal services to those with low incomes. To find a legal aid organization near you, visit the Legal Services Corporation’s website at www.lsc.gov. You can search by zip code.

-

4Get a copy of your credit report. Before disputing a collection account, you should see how many collection accounts have been reported on your credit report. You are entitled to one free credit report from each of the three main credit reporting agencies (CRAs) every year.[6] You can request your free reports in one of three ways:[7]

- Telephone: call 1-877-322-8228 and request your free reports. They will be mailed to you.

- Internet: visit annualcreditreport.com and request the reports.

- Mail: send a written request to Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281.

-

5Check the reports for collection accounts. When you receive your reports, go through each of them and look for collection accounts. You should highlight all of them. Common errors with collection accounts include:

- The account is not really in collection.

- The collection account is listed as “installment,” “revolving,” or “120 days late.” These are terms used for non-collection accounts and should not appear with any collection account.

- The account balance is wrong.

- The day of the first delinquency is wrong. This date matters because the collection account should fall off your credit report after seven and half years from the date of the first delinquency.

- Both the original account and the collection account appear as “in collections” on your credit report. Your credit score will suffer more if both accounts are listed as in collections. Instead, the original account should be listed as “charged off” or “transferred to a collection agency.”[8]

-

6Decide if you really want to dispute the collection. If the collection account is five or six years old, you might just want to wait for it to fall off in a year or two. The older the account, the less it counts toward your credit score. However, should you try to correct the account balance on a collection account, then the collection notation can be “re-aged” and to the account will be factored in your credit score again.

-

7Gather supporting evidence. Try to find evidence that your credit report is inaccurate. If you have never been late on payments, then get copies of cancelled checks to show when payment was made. Similarly, if you are disputing the date on which you became delinquent, then you should find letters from the creditor reporting that you have missed payment.

Disputing the Collection Account

-

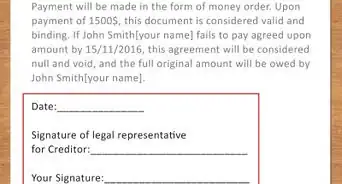

1Write a letter. Consumer advocates recommend that you dispute errors on your credit report using letters instead of an online reporting system.[9] CRAs may push you to report online, but you should always write a letter as well. In your letter, explain the facts and why you believe the collection account is inaccurate. Also include a specific request to delete the account.

- You can type up your own letter or use a sample letter provided by the Federal Trade Commission at http://www.consumer.ftc.gov/articles/0485-sample-letter-disputing-errors-your-credit-report-information-providers. You should adjust the letter to reflect your situation.

- Be as detailed as necessary to adequately explain why the collection notation is inaccurate. If you need to use extra sheets of paper, then do so.

- Once you complete the letter, make sure to keep several copies for your records.

-

2Mail the letter. Use certified mail, return receipt requested. The receipt will serve as proof that the CRA received your letter. Mail a copy of the letter to whichever CRA’s credit report shows the erroneous collection account:

-

3Dispute collection accounts online. In addition to sending a letter, you may also want to dispute the collection account by using each CRAs online dispute mechanism. You should lodge a dispute with each agency that you sent a letter to. Keep a record of the day and time when each online dispute is made.

- Equifax’s online dispute system is available on its website. Click on the “Credit Report Assistance” tab at the top of the page. Then select “Dispute info on credit report” from the drop-down menu.

- You can reach Experian’s online dispute system by visiting its website and going to the “Consumer Assistance” heading. Then select “Disputes.”[13]

- TransUnion’s online dispute system is available at its website. Click on the “Credit Reports, Disputes, Alerts & Freezes” tab at the top of the page.[14]

-

4Wait for the results of the investigation. Once you notify a credit reporting agency of an error on your report, the CRA has 30-45 days to investigate.[15] As part of its investigation, the CRA will forward your information to the creditor that lists the account as in collections.

- The creditor must then perform its own investigation of the dispute. Once it has completed its investigation, it will report the results to the CRA. If the creditor decides that you are right about the collection account, then it must notify all three CRAs.[16]

- The CRA will also send you written results of its investigation.

References

- ↑ http://www.creditcards.com/credit-card-news/five-mistakes-people-make-when-disputing-credit_report_errors-1270.php

- ↑ https://www.credit.com/credit-reports/removing-collection-accounts-from-your-credit-reports/

- ↑ http://www.bankrate.com/finance/credit-cards/state-statutes-of-limitations-for-old-debts-1.aspx

- ↑ http://www.creditcards.com/credit-card-news/collectors-re_age-debt-1282.php

- ↑ http://www.creditcards.com/credit-card-news/collectors-re_age-debt-1282.php

- ↑ https://www.credit.com/credit-reports/removing-collection-accounts-from-your-credit-reports/

- ↑ http://www.consumer.ftc.gov/articles/0151-disputing-errors-credit-reports

- ↑ https://www.experian.com/ask-experian/20060125-why-an-original-account-and-collection-account-both-appear-on-your-credit-report-for-the-same-debt.html

- ↑ http://www.creditcards.com/credit-card-news/five-mistakes-people-make-when-disputing-credit_report_errors-1270.php

- ↑ http://www.equifax.com/cs/Satellite?pagename=contact_us

- ↑ http://www.experian.com/disputes/how-to-dispute.html

- ↑ https://www.transunion.com/personal-credit/customer-support/faqs/credit-disputes.page

- ↑ http://www.experian.com/disputes/main.html

- ↑ https://www.transunion.com/

- ↑ http://www.consumer.ftc.gov/articles/0151-disputing-errors-credit-reports

- ↑ http://www.consumer.ftc.gov/articles/0151-disputing-errors-credit-reports