This article was co-authored by Katherine Kirkinis, Ed.M., MA and by wikiHow staff writer, Eric McClure. Katherine Kirkinis is a Career Coach and Psychotherapist who has served as a career expert for Forbes, Medium, Best Life, and Working Mother Magazine, and as a diversity and inclusion expert for ATTN and Quartz. She specializes in working with issues of career, identity, and indecision. She has doctoral-level training in career counseling and career assessment and has worked with hundreds of clients to make career decisions through career assessments. She is pursuing a doctoral degree at The University of Albany, SUNY where her work focuses on diversity and inclusion, racism in the workplace, and racial identity. She is a published author and has been featured in academic journals as well as popular media outlets. Her research has been presented at 10+ national APA conferences since 2013.

There are 13 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 22,824 times.

Becoming the CEO (chief executive officer) of a bank is a time-consuming process that requires a lot of hard work and a little luck. Start by getting an undergraduate degree in finance, business, or accounting to learn the business. Work at a bank or accounting firm while you're in school to get some real-world experience at the same time. Then, attend graduate school to develop a managerial skillset. Start out at a bank and work hard while assuming as many responsibilities as you can. Apply for open positions to move up the corporate ladder until you're an executive. As CEO, oversee the company's overall health and make major decisions to ensure that your bank continues to grow and flourish.

Steps

Getting the Right Education and Experience

-

1Get an undergraduate degree in finance, accounting, or business. The banking industry can be pretty complicated and you'll need a strong education to stand out and work your way up the corporate ladder. Attend a prominent undergraduate program and major in finance or accounting if you want to focus on the data and finance components of your field. Major in business if you want a more generalized education that may offer more flexibility later.[1]

- Keep your GPA as high as possible while you're in college. The higher your GPA is, the more likely it is that you'll get into a top-tier graduate school.

Tip: You do not have to have an undergraduate degree in a banking-related field—people change careers all the time. However, you do need to complete an undergraduate degree. There are very few CEOs that never attended college.

-

2Work at a bank while you're in undergraduate school. While you're completing your undergraduate degree, get a part-time job at a bank. Apply to be an intern, assistant, or teller to get some experience with the industry at the ground level. Many hiring managers actively look for employees with lower-level experience since they tend to have more knowledge regarding the operations of a financial company.[2]

- If there isn't a bank near your school, look for open positions for financial clerks and accounting assistants.

Advertisement -

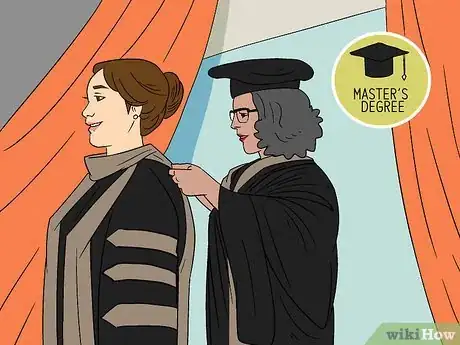

3Attend an executive master's program or business school to stand out. To make yourself look like a strong candidate for management positions, go to graduate school. Apply for a master's program that specializes in executive management if you want to learn how to oversee employees and organize a workforce. Go to business school if you want to specialize in marketing, operations, and project management.[3]

- You do not have to go to graduate school immediately after you've finished your undergraduate degree. You can always work for a few years and then apply for a graduate program later.

- The vast majority of CEOs have graduate degrees. It will be challenging to become a CEO without one.

- If you're going to graduate school, you really want to attend an acclaimed program if you can. Unknown programs won't carry nearly as much weight as a degree from Wharton, Harvard Business School, or the London School of Economics.[4]

-

4Network while you're in school to build a set of contacts. Executive managers, more so than many other occupations, tend to rely on personal contacts when it comes to hiring consultants and getting the inside scoop on new offers. While you're in school, introduce yourself to as many people as you can. Strike up conversations and ask your professors if they’d like to get coffee or lunch. Develop as many contacts as you can so that you have a strong resource once you graduate.[5]

- This is especially important while you're in graduate school. Graduate classes tend to be smaller, and the students often form tight bonds with one another that last well after they've graduated.

Moving up the Corporate Ladder

-

1Create a resume and cover letter that highlight your leadership skills. Start by writing your name, address, and contact information. List your job experience in descending chronological order and include your previous titles along with the dates that you worked there. Emphasize your managerial background and experience by using verbs like, “Managed,” “Oversaw,” and “Controlled” in your job descriptions. List your education underneath. Customize every cover letter based on the position that you're applying for to explain why you're fit for the position and make a strong candidate.[6]

- Skip the objective and summary. Most executives and managers don't include these on their resume to make space for job descriptions and accolades.

- If you have any certifications or have completed any professional development courses, list them at the bottom of the resume.

-

2Look for a managerial position at a bank and apply. While it's certainly good to have experience working on the ground floor of a company, you'll set yourself back if you shoot too low after graduate school. Look for positions at a company with a managerial component, even if it doesn't have “management” in the name. If you haven't completed your graduate degree yet, be open to starting a little lower on the ladder.[7]

- Starting positions for people with a graduate degree include director of operations, revenue manager, financial reporter, or controller.

- If you don't have a graduate degree, look for positions as a branch manager, loan officer, account manager, or accountant.

- Depending on where you live, you may need to become a Certified Public Accountant (CPA) before applying to some of these positions. This shouldn't be too hard, though; you complete a short class and take an exam to get certified.

Tip: Most CEOs work their way up the corporate ladder by getting promoted at their company. There are relatively few external hires for this position, and the handful that do get hired externally have decades of management experience.[8]

-

3Attend the interview and answer their questions to get the job. Be prepared by doing research on the company's history, goals, and culture. Identify what makes your resume interesting and come up with some talking points related to your experience and skills. Banks will ask a lot of problem solving questions and test your knowledge of financial regulations, so brush up on your country's reporting and lending laws before going to the interview.[9]

- Do not show up late to your interview. You will not receive a call back if you can't show up on time.

- Relate your past work experience to the current positions roles. For example, you might say, “I know I don’t have any experience writing financial disclosures, but I’ve filed a lot of mortgage paperwork with the federal government and I know that the processes are extremely similar.”

- Many financial positions require a written or oral skills test. If you're offered to take the test, ask what the content and format of the test will be so that you can adequately prepare for it.

-

4Establish yourself as a leader at work by taking on responsibilities. The best way to move up the corporate ladder is to prove that you're responsible, capable, and skilled in your position. Whether you're starting as an account manager at a financial investing firm or a branch manager at a brick-and-mortar bank, volunteer for every initiative and responsibility that you can. Be diligent and take off as little time as possible to show upper-management that you're executive material.[10]

- Be professional at work to stand out as a responsible employee. Iron your clothes before putting them on, style your hair, and show up on time.

- Becoming the CEO of your company is a long and difficult process. Don't get frustrated if it doesn't happen overnight. It may be years before you're promoted or make your way up the chain of command.

-

5Complete any professional development your company offers. Companies often offer management courses or workshops for employees looking to move into management positions. Volunteer or sign up for every professional development opportunity that your company offers. This will not only improve your ability to perform well in your role, but you'll gain valuable insight into what your company is looking for in an executive.[11]

- Don't volunteer for development courses that are for employees in a position lower than your role. Instead, offer to host or lead these courses to show interest without demeaning your position at the company.

-

6Apply for higher positions whenever your company has an opening. After you've settled into your role and established yourself as a leader, start looking for promotions that are available within your company. Apply for any open positions that would count as a step up for you. If you don't get the role, ask the hiring manager what they were looking for in a candidate that was missing from your resume.[12]

- Repeat this process as often as you can to continue moving up in the company. It may take 5-10 promotions to reach upper management.

- If you work for a bigger bank or financial institution, be willing to move. Many of the opportunities that become available will be for positions that aren't in your area.

-

7Ask for feedback from your superiors to improve in your role. Good feedback makes it easier to understand what you need to improve on in order to become the best employee you can. It also sends the signal to your manager that you're invested in your role at the company. Ask for feedback at least once every 6–10 months to ensure that you stay informed about how you're doing in your role.[13]

- Soliciting feedback doesn't require a massive meeting. A simple, “I’d like to discuss how I’ve been doing if you have a couple of minutes,” is a perfectly good way to solicit feedback.

- Most financial companies have annual performance reviews. If your company has annual reviews, ask for smaller pieces of feedback after larger projects or deadlines. A simple, “What do you think I could have improved on with this project?” will work just fine.

-

8Continue to work hard until you make your way to the c-suite. The c-suite is a general term for managers with a “c” in front of their title. The c-suite includes the chief financial officer, chief human resource officer, and others. Keep working hard, soliciting feedback, and taking on responsibilities until you're offered a position in the upper-tier of your company. Don't get discouraged! This step may take 10–20 years depending on your company's size and your experience.[14]

- Reaching this level alone is a major accomplishment. Most people never get the opportunity to work in this capacity.

- A large number of CEOs were promoted from the CFO position (chief financial officer). If you have an accounting or finance background, this should be the role that you're shooting for if you want the best odds of making CEO. The CFO supervises a company's financial reporting, expenses, budgets, and makes the company's major financial decisions.

-

9Wait for an opening to get an internal promotion. Once you're in the c-suite, all you have to do is wait for the current CEO to step down or be removed. This will often happen after large company-wide shakeups or major failures to achieve key goals. To get the best chance of a job offer, work particularly hard in the 1–2 months before major deadlines or initiatives so that you look like a great candidate when the CEO position does become available.[15]

- You are more likely to be hired as the CEO of your company if you've been there a while, but this takes time. If your current CEO is talented and on the younger side, they may be in the role for a while.

- If you work for a bank where the founder, or a relative of the founder, is the CEO, your odds of being promoted to CEO are extremely low.

-

10Look for CEO openings at other banks to be hired externally. If your odds aren't looking good at your current company, the good news is that you now have the necessary experience to be a CEO elsewhere. Go online or contact some old graduate school peers to find CEO openings at banks in your area. You'd be surprised how many openings there are for chief executives. Submit your resume, cover letter, and any other additional references that a position requires to apply.[16]

- With c-suite experience at a bank or financial institution, you'll also be a viable candidate for CEO positions at consulting companies, investment firms, and accounting companies.

- This is more difficult than being promoted to CEO at a company that you're familiar with, but it's faster than waiting for your current CEO to step down if they're going to be there for a while.

Working as the CEO of a Bank

-

1Produce results to keep your employees, customers, and board happy. The CEO's main job is to keep the company productive, profitable, and focused. Study key decisions carefully, apply yourself, and make measured choices to ensure that your company remains healthy and strong. Monitor your company's health by regularly requesting financial and qualitative reports to catch problems before they get out of hand.[17]

- Follow the board of directors’ instructions when they request certain initiatives or marketing decisions. If the board isn't happy, they'll end up restricting your ability to operate the way you see fit.

- The day-to-day activity of the CEO is different depending on your specific company.

-

2Delegate responsibilities to other executives and managers. CEOs rarely implement initiatives on their own. Instead, they pick the people that they want to lead and delegate work responsibly. Reach out to your management team whenever you have an idea for an investment or company-wide initiative and pass it off to another manager. Sign off on marketing materials, risk-assessment documents, and changes to company policy as your team presents them to you.[18]

Tip: Try your best to delegate evenly by alternating how often you enlist help from specific employees. If you only rely on 1-2 people for everything, they’re going to feel overworked and their peers are going to feel disrespected.

-

3Attract talent and promote your employees to keep the bank running. The CEO often oversees key hiring decisions. Hire a good hiring manager and human resources team to ensure that your company's talent pool stays sharp and innovative. Personally review and interview other c-suite executives to ensure that you're working alongside the best team possible.[19]

- Don't get trigger happy when it comes to replacing people. If you make too many changes too quickly, you'll end up disrupting your company's workflow and upsetting the lower-level employees.

-

4Review your company's financial reports before publishing them. For banks, it's extremely important that the financial reports are accurate and transparent. When filing with the federal government or releasing public reports, it is key that your paperwork is correct. Meet with your CFO, head controller, and financial executives to review any forms or files that you're releasing to the government or public.[20]

- It is illegal for banks to misrepresent information on financial reports, regardless of whether it was intentional or not.

-

5Promote a positive culture by starting rewards programs and initiatives. While CEOs have a reputation for being cutthroat and vicious, most successful executives lead by providing positive reinforcement. Start programs that award bonuses, vacation days, or other rewards for employees that go above and beyond the scope of their role. Promote positive thinking and recognize individual employees whenever you can to create a healthy work environment.[21]

References

- ↑ https://www.forbes.com/sites/stanphelps/2019/11/12/how-the-less-is-more-approach-boosts-employee-productivity-and-bottom-line-results-at-companies-like-t-mobile-apple-and-netflix/#30b1245a8074

- ↑ https://www.forbes.com/sites/christianstadler/2015/03/12/how-to-become-a-ceo-these-are-the-steps-you-should-take/#41a2714b1217

- ↑ https://nationalcareers.service.gov.uk/job-profiles/chief-executive

- ↑ https://www.forbes.com/sites/christianstadler/2015/03/12/how-to-become-a-ceo-these-are-the-steps-you-should-take/#41a2714b1217

- ↑ https://www.forbes.com/sites/christianstadler/2015/03/12/how-to-become-a-ceo-these-are-the-steps-you-should-take/#41a2714b1217

- ↑ https://www.resume-resource.com/executive-resume-examples/

- ↑ https://www.businessinsider.com/these-are-the-real-skills-you-need-to-score-a-c-suite-office-2011-2#the-chief-financial-officer-3

- ↑ https://www.gsb.stanford.edu/sites/gsb/files/publication-pdf/cgri-research-spotlight-08-internal-versus-external-ceos.pdf

- ↑ https://money.cnn.com/2017/05/23/pf/interview-hacks/index.html

- ↑ https://businesscollective.com/9-strategies-for-being-the-best-ceo-you-can-be/index.html#

- ↑ https://www.bizjournals.com/bizjournals/how-to/growth-strategies/2016/09/professional-development-matters-success-company.html

- ↑ https://nationalcareers.service.gov.uk/job-profiles/chief-executive

- ↑ https://hbr.org/2018/01/how-to-ask-for-a-promotion

- ↑ https://nationalcareers.service.gov.uk/job-profiles/chief-executive

- ↑ https://www.forbes.com/sites/christianstadler/2015/03/12/how-to-become-a-ceo-these-are-the-steps-you-should-take/#3fa654af1217

- ↑ https://hbr.org/2018/01/how-to-ask-for-a-promotion

- ↑ https://magazine.wharton.upenn.edu/digital/do-you-have-what-it-takes-to-be-a-ceo/

- ↑ https://careertrend.com/list-6318571-duties-responsibilities-ceo-bank.html

- ↑ https://magazine.wharton.upenn.edu/digital/do-you-have-what-it-takes-to-be-a-ceo/

- ↑ https://careertrend.com/list-6318571-duties-responsibilities-ceo-bank.html

- ↑ https://magazine.wharton.upenn.edu/digital/do-you-have-what-it-takes-to-be-a-ceo/