This article was co-authored by Christine Michel Carter. Christine Michel Carter is a Global Marketing Expert, Best-Selling Author, and Strategy Consultant for Minority Woman Marketing, LLC. With over 13 years of experience, Christine specializes in strategic business and marketing consulting services including market analysis, organizational alignment, portfolio review, cultural accuracy, and brand and marketing review. She is also a speaker on millennial moms and black consumers. Christine holds a BS in Business Administration and Art History from Stevenson University. She is a leader in multicultural marketing strategy and has written over 100 articles views for several publications, including TIME and Forbes Women. Christine has worked with Fortune 500 clients such as Google, Walmart, and McDonald’s. She has been featured in The New York Times, BBC News, NBC, ABC, Fox, The Washington Post, Business Insider, and Today.

There are 12 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. This article has 16 testimonials from our readers, earning it our reader-approved status.

This article has been viewed 527,784 times.

Being a small business owner comes with challenges unique to the size and function of the business. The small business owner has to handle all the challenges of selling, delivering, financing, managing and growing the business with little or no staff, while trying to make it a success. The most important of all is to retain the interest of all stakeholders like customers, vendors and team to build momentum in a short span of time. Running a small business can be hugely rewarding both personally and financially.

Steps

Drafting a Usable Business Plan

-

1Put your idea into writing. It is important to take the ideas in your head and get them down on paper. Most successful businesses offer a new product or service or fill an existing niche in the market. Whatever your reasons may be for starting a small business, make sure to clearly and concisely put them in writing.[1]

- It can be helpful to go through many drafts or iterations of your business plan.

- Include as many details as you can in your business plan. Overthinking the details is never as damaging as ignoring the details.

- It can also be useful to include questions in drafts of your business plan. Identifying what you don't know is as helpful as listing things you are sure about. You do not want to present a business plan with unanswered questions to potential investors, but laying out relevant questions in your initial drafts will help you identify questions that require answering in your final business plan.

-

2Meet with your local Small Business Development Center. SBDC's provide help during all stages of the business life cycle. They can help you create a stellar business plan to approach a lender with and their counseling is always free.[2]Advertisement

-

3Identify your customer base. In your business plan, you need to identify who you think will buy your product or service. Why would these individuals need or want your product or service? The answer to these questions should help to determine all other aspects of your business’ operations.[3]

- Here, it useful to ask questions of your service or product. For example, you may want to ask questions like, does my product/service appeal to younger or older people? Is my product/service affordable for lower-income consumers or is it a high-end purchase? Does my product/service appeal to people in specific environments? You won't be selling many snow tires in Hawaii or beach towels in Alaska, so be realistic about the appeal of your product.

-

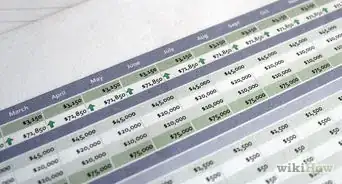

4Outline your finances. In your business plan, you need to address key questions about your business’ fiduciary situation.

- How will your product or service generate money? How much money will it generate? How much does it cost to produce your product or service? How do you intend to pay operational costs and employees? These, and others, are critical question you need to answer in planning your small business’ financial future.[4]

-

5Project growth. All successful small businesses need to grow their customer base and production capabilities over the first few years of operating. Make sure you have identified how your business can and will respond to growth potential.[5]

- Be realistic with your growth potential. Keep in mind that growing your business requires a growth in investment capital as well. Projecting too much growth in too short a time period can quickly deter potential investors.

Establishing Good Fiscal Practices

-

1Make your bank work for you. Run your small business with financial efficiency by exploring all the options that banks offer small business owners and choosing the right bank for your business' financial plan. Many financial institutions offer accounts with low fees, loans with discounted rates or free direct deposit programs for small business account holders. Banking with the institution that gives you the best deals will help you stretch every dollar.

- Use banking options against one another to secure the largest upfront capital and lowest interest rates. For example, if one bank offers you a $10,000 loan at an interest rate of 4%, you may be able to take that offer to a competing bank to see if they can provide more upfront capital or a lower interest rate.

-

2Secure a loan or other type of investment. Successful businesses need capital to get off their feet. Be sure that you have arranged and secured enough fiscal backing to cover all of your small business’ operating, production, and marketing costs until your business is in a position to generate and operate on its own profits.[6]

- Be sure to investigate the various interest rates applied to small business loans.

-

3Ensure collection methods are in place. Be sure to account for how your business will collect on bills due and outstanding debts to your company. A successful business needs constant cash flow. Being unable to accept customer payments or waiting on those who owe you money will disrupt your business.[7]

- You will need to decide if you will accept cash, credit cards, checks, or some combination of the three from your clients and customers.

- Cash transactions are easiest to deal with on a day-to-day basis, but are often difficult to track over longer periods. Also, dealing with cash makes securing your company's incoming cash flow more difficult, as it is easier for employees to steal from a cash-based businesses.

- While accepting checks helps to prevent theft from within the business, checks can bounce, leaving you to handle outstanding issues with the bank.

- Credit cards and debit cards are generally the most secure forms of payments, but accepting them requires your to take on additional fees paid to various credit card companies which, depending on the size and complexity of your business, may not be worthwhile.[8]

-

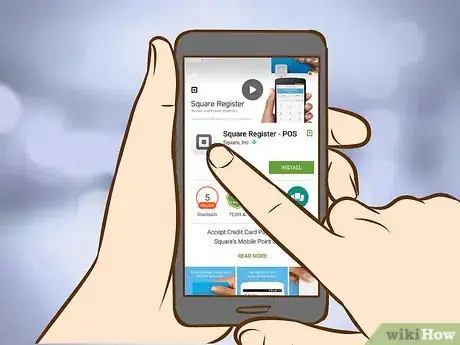

4Consider using a credit control app. These are apps that help small businesses improve their cash flow through better management of day-to-day cash collection and customer credit control tasks. This would allow you to take-on new customers or monitor existing ones, chasing invoice payment or running cash collection more safely. There are several software providers that can help you with this such as iKMC from where you can also get a free trial.[9]

-

5Manage your inventory efficiently. Inventory management can make or break a small retail business, so manage it carefully to ensure that you're maximizing every dollar spent. Invest in small inventory quantities at first and continuously monitor inventory numbers so you know what's selling and what isn't. Rotate inventory frequently to remove slow sellers and replace them with new items.[10] [11]

- Inventory management is often dictated by the "shelf-life" of the product you are selling. For example, if you are dealing with perishable items, it is critical to move the oldest products out of your inventory first to maximize the profits of your business.

-

6Consider hiring a financial professional. It may be fiscally worthwhile for you to hire a dedicated staff member who can control the financial affairs of your small business. Accountants can help you identify areas of your business that are not running efficiently from a fiscal standpoint, allowing you to maximize your profits.

- You do not necessarily need a full-time employee to handle financial responsibilities. For example, if you have a solid grasp on your inventory flow and cash flow management, you may only need a CPA when tax time comes around.

Managing Your Small Business

-

1Get your license. Remember to register and acquire your small business license in the particular industry of your business. This step is important to ensuring that you're running your business legally and according to industry regulations. Be sure to register for permits related to particular services you offer, like home repair or tax preparation, which could require registration and certification. You will not be able to hire effective employees if your business is not operating with the appropriate licenses and permits.[12]

- Not all businesses require licenses. Be sure to check with your local small business administration to see what your business requires.

-

2Certify employees. Employ individuals with certification in your business' field, like certified public accounting or electrical repair technician. Having certifications for all employees will ensure that your employees are skilled at the highest level and will increase your client's confidence in your business.[13]

-

3Stay organized. Organization of your time, employees, finances and inventory is one of the keys to successfully run a small business. Develop a spreadsheet that helps you keep track of all the important details so you don't have to keep them straight in your head, and make time -- at least once a week -- to review everything.[14]

- Organizing weekly, bi-weekly or monthly meetings between you and your staff can help ensure that everyone is on the same page and will help you avoid wasted time or overlap in the various responsibilities of your team members. Meetings can also help you analyze who is and who is not adequately performing the duties assigned to them.[15]

-

4Delegate responsibilities. You can’t do everything yourself, so delegate the various jobs and responsibilities to qualified employees. Small businesses often require employees to take on many tasks and responsibilities that may not fall firmly in their areas of expertise.

- It is often helpful to break your business' overall operations down into specific functions and delegate those functions to various employees or members of your team.

- Also, when delegating responsibilities, make sure you are assigning oversight of a specific function to a qualified individual. For example, you would not want an accountant representing you in a legal matter or a lawyer balancing your financial books. Thinking of your business functions in this way should also help you identify your needs when you are in the process of hiring employees.

-

5Be involved. Once you have decided who should be responsible for the duties in your business, you need to remain involved to make sure all of your employees are following through with the tasks that have been assigned to them. Also, you need to be responsive to the needs of your customers. Make sure you are aware of customer needs and feedback and don’t back away from engaging with your customer base, even if that duty has been assigned to an employee.

- From time to time you will need to hire or fire an employee. Make sure you are aware of all state and federal laws that deal with employment equality and anti-discrimination laws in your area as they pertain to the hiring, firing, disciplining and treatment of employees.[16]

- Leaving customer feedback strictly in the hands of your employees is a dangerous managerial tactic. Employees may benefit from presenting you with skewed information about customer satisfaction or product usefulness, which, in turn, will lead you to make bad managerial decisions for the company as a whole. As such, do not simply accept what your employees tell you about your business without seeing evidence of their claims. It is your company and you have put yourself in a position of risk, so be proactive in overseeing business results.

Growing a Customer Base

-

1Employ targeted promotional and marketing campaigns. It is important to get the word out about your company. Make sure the money you set aside for marketing is well-spent by conducting demographic research. This will help you tailor your marketing plan to be as effective as possible.[17] [18]

- It is helpful to think of promotions and marketing relative to the capacity of your business. Paying to run a commercial on a national network does you little good if your business is only designed to operate at the local level.

- Think about who is most likely to buy your product and why they would buy it. For example, if you are selling dentures, it makes little sense to include younger people in your marketing considerations.

- Take advantage of the free consumer data available from the Census Bureau and Department of Labor. After you identify your consumer profile (who’s actually buying the product), use the federal data to find even more consumers and reach the masses. Couple this data with insights from free reports provided by research firms (such as Nielsen) to determine how best to market your product/service to your consumer mass.[19]

-

2Network as much as possible. Gain the support of other local small businesses by networking with other small business owners. Join small business associations and participate in community events to raise awareness of your business. Participate in community functions so potential clients will be aware of the services you offer.[20]

-

3Know your business. Stay on top of what's new or trendy in your business so your small business can stay competitive within the industry. Subscribe to periodicals or online newsletters to stay informed about current events in your small business' industry. Staying at the cutting edge of your industry will help you draw customers away from competing businesses.[21] [22]

-

4

-

5Be accessible. Make sure potential clients and customers can get in touch with you and your business whenever they may need to. The best way to grow your reputation as a respectable business is to be responsive to your customers’ needs.[25]

- Large businesses can afford to be unresponsive and lose a handful of customers from time to time. Small businesses cannot. As a small business owner, it is up to you to make yourself and your company accessible to potential clients and your customer base. This may require you to make your personal cell phone number or email address accessible to clients as you attempt to grow your business.

-

6Deliver what you promise. Your small business will need to offer a product or service of some kind to be successful. However, if you want to grow your business by growing your customer base, you have to give people not only what they want, but what you promised them. If your product or service does not match what you advertise consistently, you will have incredible difficulty in growing your customer base.[26]

- Delivering what you promise begins with how you tailor your approach to sales. If you or your sales team is offering or promising too much, your customers will be understandably disappointed when they receive or use your product or service, leading to negative reviews and bad word-of-mouth about your business. Remember, good sales tactics should be centered around identifying and understanding your customer's needs and making them see the realized benefits that your product has, not lying to your customers and clients about the potential of your product.

Expert Q&A

-

QuestionWhat deductions can I claim on my taxes for a small business?

John Gillingham, CPA, MAJohn Gillingham is a Certified Public Accountant, the Owner of Gillingham CPA, PC, and the Founder of Accounting Play, Apps to teach Business & Accounting. John, who is based in San Francisco, California, has over 14 years of accounting experience and specializes in assisting consultants, bootstrapped startups, pre-series A ventures, and stock option compensated employees. He received his MA in Accountancy from the California State University - Sacramento in 2011.

John Gillingham, CPA, MAJohn Gillingham is a Certified Public Accountant, the Owner of Gillingham CPA, PC, and the Founder of Accounting Play, Apps to teach Business & Accounting. John, who is based in San Francisco, California, has over 14 years of accounting experience and specializes in assisting consultants, bootstrapped startups, pre-series A ventures, and stock option compensated employees. He received his MA in Accountancy from the California State University - Sacramento in 2011.

Certified Public Accountant & Founder of Accounting Play One common mistake that many small business owners make is that they don't treat their assets properly, so they're not utilizing all of the deductions they may be eligible for. For instance, they might not be deducting for their home office if they have one, or they may not be treating their health insurance properly.

One common mistake that many small business owners make is that they don't treat their assets properly, so they're not utilizing all of the deductions they may be eligible for. For instance, they might not be deducting for their home office if they have one, or they may not be treating their health insurance properly.

References

- ↑ http://smallbusiness.findlaw.com/starting-business/starting-business-overview/starting-business-overview-tips.html

- ↑ http://smallbusiness.findlaw.com/starting-business/starting-business-overview/starting-business-overview-tips.html

- ↑ http://smallbusiness.findlaw.com/starting-business/starting-business-overview/starting-business-overview-tips.html

- ↑ https://www.sba.gov/category/navigation-structure/starting-managing-business/managing-business/running-business/managing-business-finances-accountin

- ↑ http://smallbusiness.findlaw.com/starting-business/starting-business-overview/starting-business-overview-tips.html

- ↑ https://www.sba.gov/category/navigation-structure/starting-managing-business/managing-business/running-business/managing-business-finances-accountin

- ↑ https://www.sba.gov/category/navigation-structure/starting-managing-business/managing-business/running-business/managing-business-finances-accountin

- ↑ https://www.sba.gov/category/navigation-structure/starting-managing-business/managing-business/running-business/managing-business-finances-accountin

- ↑ https://www.sba.gov/category/navigation-structure/starting-managing-business/managing-business/running-business/managing-business-finances-accountin

- ↑ http://smallbusiness.findlaw.com/starting-business/starting-business-overview/starting-business-overview-tips.html

- ↑ http://www.startupnation.com/articles/899/1/AT_InventoryMgt.asp

- ↑ https://www.sba.gov/category/navigation-structure/starting-managing-business/managing-business/running-business/human-resources

- ↑ https://www.sba.gov/category/navigation-structure/starting-managing-business/managing-business/running-business/human-resources

- ↑ http://smallbusiness.findlaw.com/starting-business/starting-business-overview/starting-business-overview-tips.html

- ↑ https://www.sba.gov/category/navigation-structure/starting-managing-business/managing-business/running-business/human-resources

- ↑ https://www.sba.gov/category/navigation-structure/starting-managing-business/managing-business/running-business/human-resources

- ↑ Christine Michel Carter. Global Marketing Expert. Expert Interview. 30 September 2020.

- ↑ https://www.sba.gov/content/advertising-basics

- ↑ Christine Michel Carter. Global Marketing Expert. Expert Interview. 30 September 2020.

- ↑ http://www.businessballs.com/business-networking.htm

- ↑ http://smallbusiness.findlaw.com/starting-business/starting-business-overview/starting-business-overview-tips.html

- ↑ http://www.entrepreneur.com/article/223884

- ↑ http://www.businessballs.com/business-networking.htm

- ↑ http://smallbusiness.findlaw.com/starting-business/starting-business-overview/starting-business-overview-tips.html

- ↑ http://www.entrepreneur.com/article/223884

- ↑ http://www.entrepreneur.com/article/223884

About This Article

To run a small business, contact your local Small Business Development Center to help you develop a business plan and secure financing. Once your business is up and running, make sure you have a collection method established. Download a credit control app to help with this process. For daily operations, delegate tasks to employees and managers, if applicable. To increase revenue, do some targeted marketing campaigns. For more on getting your business registered and licensed, keep reading.