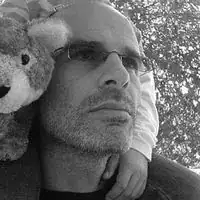

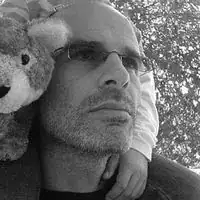

This article was co-authored by Gene Linetsky, MS. Gene Linetsky is a startup founder and software engineer in the San Francisco Bay Area. He has worked in the computer science industry for over 30 years, with experience spanning staffing and management of engineering teams, game design and development, communication protocols, sales automation, and more. He has also been involved in incorporating computer science curriculum into high schools, developing educational software, and was a co-author on a computer science textbook. He is currently the Director of Engineering at Poynt, a technology company building smart Point-of-Sale terminals for businesses.

There are 14 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 99% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 48,972 times.

Managing a business requires you to pay attention to many details simultaneously. Most importantly, you need to handle your staff, whether you have only a few employees or many. You need to keep your staff motivated, well-informed, and satisfied in their jobs. At the same time, you need to handle your business’s financial needs. This includes payroll, invoicing, purchasing, and handling taxes. Finally, you should always be thinking of ways to improve and increase the size of your business.

Steps

Managing Employees

-

1Determine your necessary staff size. Whether you are starting a business from the ground up or are managing an existing business, you need to examine your staffing needs. You need to think about the tasks that get done and decide how much one person can do. This analysis may show you that you need more people than you have, or it may tell you that you need to reassign staff that you already have. Focus on the tasks rather than individual people and personalities.[1]

- For example, suppose you are managing a store that employs sales clerks. You could analyze your sales records and find when your busy periods occur. Then hire an additional clerk for the busiest times of the day.

- If you observe an employee who seems to have too much free time, you should consider increasing that employee's duties. If you don't have additional work for that employee, you may need to cut back the hours or eliminate the position completely.

-

2Hire new staff as needed. Develop written job descriptions for each role in your business. The job description should include an outline of the tasks to be performed, the expected working hours, the person supervising the role, and a general statement of goals for the position. Advertise, interview, and hire staff members who will best serve each position.[2]

- For more help on hiring, you may want to read this helpful article.

- As part of your hiring process, if you are starting a new business, you must attend to certain federal and state regulations. You need to get a federal employer identification number (FEIN), register with your state’s labor office, and obtain worker’s compensation insurance.

Advertisement -

3Take care of payroll. Having employees requires you to pay your employees, on time and correctly. You need a reliable payroll system that accounts for employee hours and pay rates. You must withhold the proper amounts for federal, state and local taxes, and deposit those as required with the taxing authorities. Establish a consistent system for payment, whether weekly or bi-weekly.[3]

- For help with federal tax requirements, the IRS has put out two publications, the Employer’s Tax Guide, Publication 15, and the Employer’s Supplemental Tax Guide, Publication 15a.[4] You can find both publications at the IRS publications page, at www.irs.gov/forms-pubs.

-

4Develop and use an employee handbook. An employee handbook is a written collection of all the rules and expectations for your staff. It should also set out what the staff can expect from the company. It will explain the employees’ rights as well as the legal obligations for both employees and the employer. You should include the following topics in a well-designed employee handbook:[5]

- Anti-discrimination policies.

- Compensation and payroll schedules.

- Work schedules.

- Expected standards of conduct.

- Safety and security.

- Acceptable computer/technology use policy.

- Media relations.

- Leave policies and other employee benefits.

-

5Maintain open two-way communication. A good manager will communicate regularly with staff. You need to know what they are observing in the business, how they feel about their jobs, and whether any problems are brewing. It also helps for the staff to hear from you and know, in advance, if any changes are coming or anything else that will affect their work. Regular communication can resolve many problems before they even start. Depending on the size of the business and your position as a manager, you may communicate through any or all of the following:[6]

- Regularly scheduled staff meetings.

- Written newsletter or other bulletins.

- Regular informal email communications.

- A company bulletin board (either a real physical bulletin board or an online virtual site).

- A shared calendar of events.

Dealing With Finances

-

1Establish an accounting system. If you are not trained in accounting, you may need to hire a bookkeeper or at least consult with a trained accountant. You need to choose an accounting system for operating your business. Different systems exist, with a variety of strengths and weaknesses, depending on your kind of business:[7]

- Cash method. This is generally better for small businesses. You will count your cash as an asset when you actually receive it. Similarly, you measure your expenses when you actually pay them.

- Accrual method. Larger business tend to prefer this method, which works more on an invoicing system. You count the asset when a sale is made, whether or not you actually receive payment at that time. You will measure expenses when you receive the item, not at the time of actual payment.

-

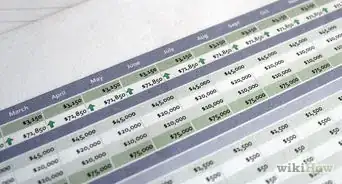

2Keep good financial records. Whether you use software programs, electronic cash registers, or keep old-fashioned records on hand-written receipts, you need a system for recording sales and expenses. Whatever system you select, you must use it consistently and correctly. Mistakes in record-keeping can lead to serious problems for any business.[8] Some currently popular accounting software programs include:[9]

- QuickBooks or QuickBooks Online

- PeachTree Accounting

- Sage Live

- NetSuite

- Zoho Books

-

3Reconcile your accounts regularly. At least once a month, you should compare your bank accounts with your accounting statements. If you are not comfortable with reconciling accounts, you may need to consult with a bookkeeper or accountant. Your actual balances should match the balances reported in your accounting statements. You may need to make slight variations for any invoices that have been issued but not yet paid.[10]

- If your accounts do not reconcile, you need to examine your accounting system more closely and discover the error. If you do this monthly, you can often catch mistakes while they are small and can be corrected. If not, your business can face big problems.

Expanding and Improving Your Business

-

1Generate some growth ideas. Any business manager may want to do more business, but you need some ideas. Work with your staff to develop areas for growth. Try to identify what you can do to expand the business. Some specific considerations might include:[11]

- Reach out to a new customer base.

- Expand your hours of service.

- Increase manufacturing and sales.

- Change your advertising schemes.

- Hire more staff.

-

2Create a marketing plan. Before just launching into a new area for your business, you need to plan. A good marketing plan defines your objectives, details your finances, describes staffing needs and helps you plan for the changes you anticipate. If you write a strong marketing plan and then follow it, your growth is more likely to succeed.[12]

- For help with specifically writing a marketing plan, check out Create a Marketing Plan.

-

3Plan a budget. Expansion costs money, and as the manager you will need to know where it comes from. As part of your marketing plan, you should develop a budget. You should determine if you can finance growth from the company’s own revenues or if you need to borrow. If you decide to borrow, you need a plan for repayment over time, to keep the business profitable.[13]

-

4Implement your changes. Putting your plan into action can be the most exciting part of managing a business. Follow your marketing plan and make the changes that you laid out. If you need to increase staff, advertise and interview. If you are increasing manufacturing capacity, this is the time to purchase and install the new equipment. Whatever you set out to do, follow your plan and guide the process through.

-

5Monitor your plan. As you implement the changes to your company, keep reviewing your marketing plan to stay on track. If your marketing plan contained a good budget, then you should stick to it. Follow the design that you set out. Even after your changes have been implemented, return to the marketing plan periodically to check your growth. Is your company moving in the direction you wanted? At least once a year, you and any other members of your management team should review the marketing plan and consider any changes you might need.[14]

Dealing With Conflicts

-

1Manage staff problems. This can often mean resolving conflicts. Ideally, your employee handbook should address any problem situation, and open communication should identify problems early. Even so, sometimes, things may rise to a level that requires you to intervene. You should try to be as impartial as possible and use your best judgment to resolve the situation.

- If an employee raises a complaint or concern, you should listen carefully to the problem. If another employee is involved, you should then give that person an opportunity to speak to you. Refer to the employee handbook, if that can help address the situation.

- You may not be able to satisfy everyone involved. At least be fair and reach a conclusion that is best for the company as a whole.

-

2Deal with customer disputes. If your business has regular customers, you are likely to run into complaints at some point. Handle these as respectfully as possible. Let the customer know that you respect their business and you are sorry for the problem (even if you don't believe you are at fault). If the customer is someone with an open contract with you, then refer to the terms of the contract to see if that will provide a solution. In the end, you should balance whether possibly losing the customer's business is worth the cost of addressing the complaint.

- For example, suppose your business supplies personalized stationery to other offices, and a customer refuses to pay for a shipment because the quality is poor. If you disagree, you should balance the price of that one invoice against the costs of suing for collection and losing that customer's future business. It may be better for your business to lose the value of one shipment but keep a longstanding satisfied customer.

-

3Handle emergencies. You should plan for any possible emergencies that could occur. This includes anything from a staff illness or injury to a fire in your store or some natural disaster. Develop a written emergency plan to account for any kind of occurrence. Your plan should address every staff member's role, how to guide customers who may be in your facility, and how to work with emergency care staff when they arrive. Make sure that your facility is adequately stocked with the following emergency equipment, and that all staff know how to use it:

- Fire extinguishers.

- Smoke alarms and detectors.

- First aid kits.

- Automated external defibrillators (AEDs).

Using Outside Resources for Help

-

1Use resources from the SBA. In the United States, the Small Business Administration (SBA) is a federal agency that exists to help small businesses. The SBA website is full of resource materials about starting and managing businesses. The SBA can assist with legal and financial matters and can help in obtaining financing as well.

- Access the SBA website at www.sba.gov.

- You can call the general SBA Answer Desk at 800-827-5722.

- Every state has one or more local district offices. You can find a listing of these district offices at https://www.sba.gov/tools/local-assistance/districtoffices.

-

2Use the IRS online resources. A big part of managing a business is handling the finances and taxes. The IRS publishes a wide range of useful materials and has staff people available to answer questions.[15]

- Find IRS publications at www.irs.gov/forms-pubs.

- Find links to local IRS offices at https://www.irs.gov/help/contact-your-local-irs-office.

-

3Join your local or national Chamber of Commerce. The Chamber of Commerce is an organization of business owners and managers. It is designed to help businesses succeed and support their communities. The U.S. Chamber of Commerce advocates on a national level for legislation that supports business activities.[16] On a more local level, your Chamber of Commerce provides a networking resource. You can meet other business leaders in your community, learn about sponsorship opportunities, and even get discounts on material and supplies for your company.[17]

- You can find out about joining the U.S. Chamber of Commerce at www.uschamber.com.

- You can locate your local Chamber of Commerce by searching online for the name of your community and the phrase “Chamber of Commerce.”

-

4Work with the Better Business Bureau. The Better Business Bureau (BBB) is a name for many independently run local agencies. Collectively across North America they form the Council of Better Business Bureaus (CBBB). Their objective is to build strong relationships between businesses and consumers. You can find your local BBB by searching at www.bbb.org.

- Becoming an accredited member of the BBB increases consumer trust in your business and often leads to increased income.[18]

-

5Network with other business leaders. Get out of your office and get to know other business leaders in your community. Speaking with other business managers can help you generate ideas for your own business. You can also build up goodwill with both consumers and suppliers. By meeting community leaders you can spread the name of your business and generate informal publicity. Such meetings often can lead to an increase of referrals for your business.[19]

- You may find a group of like-minded managers and create a weekly or monthly networking group.

Expert Q&A

-

QuestionWhat's the key to successful leadership?

Gene Linetsky, MSGene Linetsky is a startup founder and software engineer in the San Francisco Bay Area. He has worked in the computer science industry for over 30 years, with experience spanning staffing and management of engineering teams, game design and development, communication protocols, sales automation, and more. He has also been involved in incorporating computer science curriculum into high schools, developing educational software, and was a co-author on a computer science textbook. He is currently the Director of Engineering at Poynt, a technology company building smart Point-of-Sale terminals for businesses.

Gene Linetsky, MSGene Linetsky is a startup founder and software engineer in the San Francisco Bay Area. He has worked in the computer science industry for over 30 years, with experience spanning staffing and management of engineering teams, game design and development, communication protocols, sales automation, and more. He has also been involved in incorporating computer science curriculum into high schools, developing educational software, and was a co-author on a computer science textbook. He is currently the Director of Engineering at Poynt, a technology company building smart Point-of-Sale terminals for businesses.

Startup Founder & Engineering Director Confidence is key! If you don't trust your own ability to allocate tasks and tell people what to do, your employees won't either, and then you'll fail as a manager. You have to motivate every single team member, and you have to set clear goals for the whole team.

Confidence is key! If you don't trust your own ability to allocate tasks and tell people what to do, your employees won't either, and then you'll fail as a manager. You have to motivate every single team member, and you have to set clear goals for the whole team. -

QuestionHow can I research and advertise for my business without having to pay?

Community AnswerThis article contains some ideas about networking in your community, which can generate free publicity. You can research advertising ideas online or with the Small Business Administration.

Community AnswerThis article contains some ideas about networking in your community, which can generate free publicity. You can research advertising ideas online or with the Small Business Administration.

References

- ↑ http://www.mynewcompany.com/employees.htm

- ↑ http://www.mynewcompany.com/employees.htm

- ↑ http://www.mynewcompany.com/employees.htm

- ↑ https://www.irs.gov/businesses/small-businesses-self-employed/understanding-employment-taxes

- ↑ https://www.sba.gov/starting-business/hire-retain-employees/employee-handbooks

- ↑ http://primepay.com/blog/10-tips-effective-employee-communication

- ↑ http://www.mynewcompany.com/accounting.htm

- ↑ http://www.mynewcompany.com/accounting.htm

- ↑ http://www.capterra.com/accounting-software/

- ↑ http://www.mynewcompany.com/accounting.htm

- ↑ https://www.sba.gov/managing-business/growing-your-business/forecasting-growth

- ↑ https://www.sba.gov/managing-business/growing-your-business/developing-marketing-plan

- ↑ https://www.sba.gov/managing-business/growing-your-business/financing-growth

- ↑ https://www.sba.gov/managing-business/growing-your-business/developing-marketing-plan

- ↑ https://www.irs.gov/

- ↑ https://www.uschamber.com/about-us/about-the-us-chamber

- ↑ http://www.raleighchamber.org/member-benefits.html

- ↑ http://whybbb.org/why.php

- ↑ https://www.shopify.com/guides/make-your-first-ecommerce-sale/local-business-network

About This Article

To manage a business, develop an employee handbook so your employees know what to expect from each other. Additionally, implement an effective payroll system so that workers are paid on time and the right amount of taxes are withheld. You should also keep good financial records by using an accounting software, like QuickBooks. If you need additional help, try using free online resources from the SBA and IRS websites. For tips on how to grow your business, read on!