This article was co-authored by Gina D'Amore. Gina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

There are 8 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 137,550 times.

If you’re lucky, your business will grow without much effort. However, most business owners need a plan. A well-drafted growth plan will identify potential growth opportunities and the amount of money you will need to fund the expansion. Your plan should have multiple parts, including a marketing strategy and different financial documents. If you need help, you should visit a business development center.

Steps

Analyzing Growth Opportunities

-

1Identify growth opportunities. Unlike a regular business plan, a growth plan focuses specifically on growth opportunities. There are many ways to grow your business, including the following:[1]

- Add new products or services. For example, you might run a nail salon. You could expand your offerings by turning the business into a day spa, complete with massage.

- Sell more products. You might have a boutique that sells vintage clothing. You can try to increase new sales by changing your marketing.

- Open in a new location. If you have a brick-and-mortar business, you can expand by opening another store in a new area.

- Target a different or additional market. There might be a larger market that remains untapped. For example, if you offer massage services to women, you might want to add men as a target market. Alternately, you might be targeting middle-class consumers. Instead, you could gear your business toward high-income people.

- Go global. Get a website so that you can sell to many different countries. Plan on creating a website and selling into markets you’ll never visit in person.

- Review your business's budget—there's almost always room to save money.

-

2Review your staffing needs. When a business grows, it often needs additional staff. You should review your staffing needs before you start to write the plan. Assess your current employees and their skills. You need to understand whether your current staff can help you achieve your growth plans or whether you need to hire other staff.[2]

- Ask your current staff for help analyzing staffing needs. Ask them what other skills they have. Someone might be able to fill a new position created when you expand.

- If you need to hire staff, visit websites like PayScale or Glassdoor and check how much those employees normally make.

Advertisement -

3Confirm whether you can afford to expand. Unfortunately, it takes money to make more money. For example, if you want to open a new location, you’ll need to rent retail space (or buy it). Even if you want to expand using a website, you’ll need to hire someone to create the site and possibly maintain it. Also, your shipping costs will increase.

- Go through your budget and check what you can afford. Check how much excess cash your business has, if any, and whether you have a line of credit or business credit card you can use.

-

4Find sample growth plans.[3] Look online or ask other businesses. If you approach a current business owner, it’s probably best to contact someone in a different industry. A competitor probably doesn’t want to share the secrets of their success.

- Study the layout and overall design of the plan. You want a growth plan that looks professional. Copy what impresses you.

-

5Get help from a business counselor. In the U.S., each state has a Small Business Development Center that can help you write your growth plan.[4] You can find your nearest SBDC at this website: https://www.sba.gov/tools/local-assistance/sbdc. Search by state.

Drafting Your Growth Plan

-

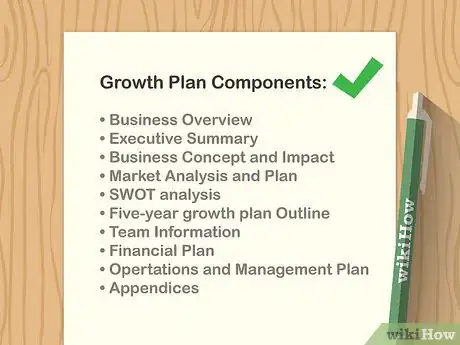

1Write your executive summary. In the first section, you should summarize your growth plan. This summary shouldn’t be too long: one to three pages is sufficient. You may want to write it last, though it will go first.

-

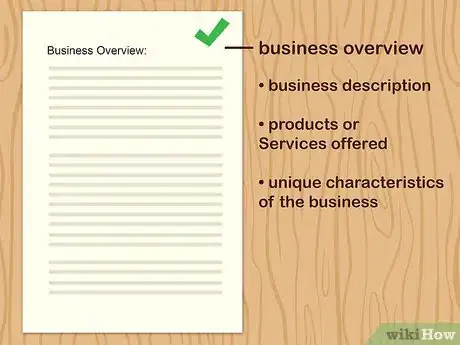

2Describe the current business. In the second section, describe your current business. Remember to include the following as part of your description:

- Description of your business. For example, “Jackson Data Processing is a two-person partnership that provides data entry and coding to medical offices.”

- Products or Services you offer. For example, “We collate, enter, and analyze client data before submitting it to appropriate government agencies and private insurers. We provide a one-time service, as well as regular billing and coding.”

- Unique characteristics of the business, if any.

-

3Provide a SWOT analysis. SWOT stands for Strengths, Weaknesses, Opportunities, and Threats. Your third section should be your SWOT analysis. The purpose of this analysis is to address how you can take advantage of opportunities using your strengths, and how you can protect against threats by improving on weaknesses or further developing your strengths. Provide information about the following:

- Strengths. Identify what your business does well. Think broadly and include tangible as well as intangible strengths. You should identify strengths in all areas of the business, such as marketing, finance, service, etc. For example, tangible strengths might include a great location or established customer base.

- Weaknesses. Identify what your business doesn’t do well. These should be things within your control. For example, a bad economy is not a business weakness since you don’t control it. Think of weaknesses such as limited resources, inferior technology, inexperienced staff, and poor location.[5]

- Opportunities. These are external to your business. Generally, opportunities are situations you can exploit to your own advantage. For example, your industry may be booming. In that case, you may try to sell more units or sell additional products in order to grow your business. Alternately, an aging population might present an opportunity for you to target this market. Opportunities can be long-term or short-term.

- Threats. A threat is something beyond your control that could undermine your business. For example, competition is always a threat. However, other threats include increasing government regulations, technological innovations, or negative press attention. A declining customer base could also be a threat. If so, you might pursue growth opportunities by moving to a new location or targeting different consumer markets.

-

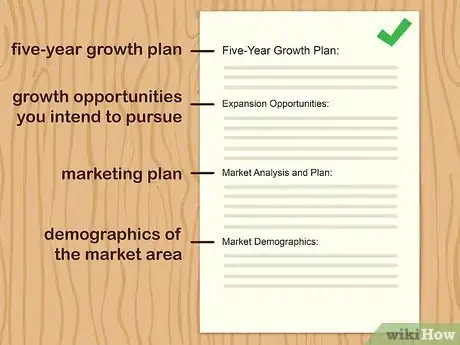

4Outline your five-year growth plan. Based on your SWOT analysis, you will devise a growth plan. Ideally, you should leverage existing strengths while pursuing growth opportunities. If you might be impeded by a weakness, then your five-year plan should explain how you will address that weakness. A growth plan should contain the following information:

- Expansion opportunities. Identify the growth opportunities you intend to pursue and why they are the right choices based on your SWOT analysis. For example, interest rates may be low, and you intend to borrow to open a new store in a growing area.

- Marketing plan. You should identify your target market and your means of reaching them, by way of paid advertising or other methods. Discuss the costs of your marketing plan, and what kinds of free marketing you can use, such as using social media or increasing word-of-mouth by encouraging customers to leave a review online.

- Demographics of the market area. For example, what is the typical age, gender, education, and income of your targeted market and what are the demographics of the area where you will be expanding.

- Make sure that your plan answers questions like "What growth are you trying to do?" "What is your reasoning behind this growth?" and "What statistics do you have that other people want this growth?"

-

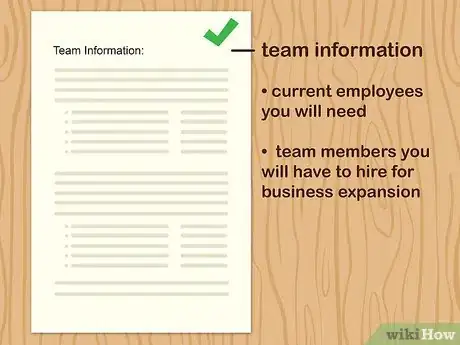

5Include information on your team. Based on your analysis, you should list the employees you will need when you expand your business. Also identify the team members you will have to hire in the coming year to successfully expand.[6]

-

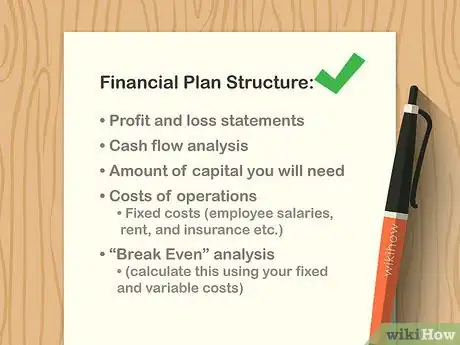

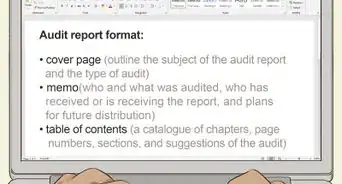

6Write your financial plan. Your financial plan will take stock of your current business and identify the money you will need to fund your growth plan. Include the following information:

- Your current financial situation. Include profit and loss statements, cash flow analysis, etc.

- The amount of capital you will need.

- Your costs of operations. Explain your fixed costs, such as employee salaries, rent, and insurance.

- A “break even” analysis. This is the point when you start making a profit. You will need to calculate this point using your fixed and variable costs.

-

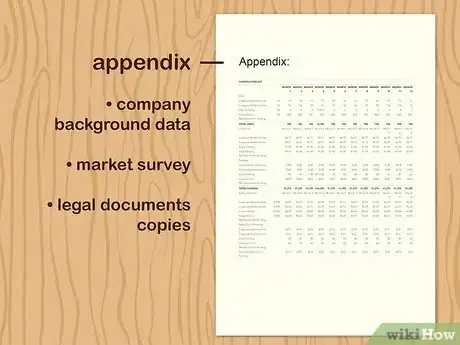

7Create an appendix. You can create an appendix for documents you want the reader to see. Some documents, like profit and loss statements, need to go in the body of the plan because they are so important. However, other helpful information can go in the appendix.

- For example, you might include background data for your company or a copy of a market survey used to develop your growth plan.

- You can also include copies of legal documents, such as your Articles of Incorporation.

Securing Financing

-

1Pull your credit report. If you need a loan to finance your expansion, you’ll have to go to a bank, which will get a copy of your credit report. Accordingly, you should check your report for errors. You are entitled to one free credit report annually from each of the three major credit reporting agencies. Get your copy in one of the following way:[7]

- Call 1-877-322-8228. You can request reports from all three agencies at once. Your copy should be mailed to you.

- Visit annualcreditreport.com. You will need to provide your name, address, date of birth, and Social Security number for identity verification.

- Complete the Annual Credit Report Request Form, available here: https://www.consumer.ftc.gov/articles/pdf-0093-annual-report-request-form.pdf. Mail it to the address on the form.

-

2Dispute errors in your credit report. There are many common errors that can lower your overall credit score. It is important to correct them right away. Common errors in reports include the following:[8]

- Someone else’s account being listed on your report. You might have a similar name or Social Security Number.

- Accounts opened as a result of identity theft.

- Accounts reported inaccurately. For example, an account might be reported as late or delinquent when you haven’t missed a payment.

- An account that appears more than once.

- Information that should have fallen off the report but which still appears. For example, unpaid debts should fall off after seven years.

- A mistake made in the balance owed or in your credit limit.

-

3Identify the types of loans available. A small business has many different options for getting a loan. You should understand all of them before you go ahead and apply. Consider the following types of small business loans:[9]

- SBA loans. The Small Business Administration guarantees loans for some small businesses. You get the loan from a regular bank, but the SBA will pay the bank if you default. SBA loans have favorable terms, though they require a lot of paperwork. SBA offers many types of loans, depending on your needs. You can get a loan to purchase equipment or buildings, expand your business, or to provide for working capital.

- Conventional bank loans. These may be easier to get than SBA loans and generally have low interest rates. However, the repayment period is typically shorter than with an SBA loan.

- Alternative lenders. If you don’t have great credit, you might seek out online lenders, such as Fundation and Kabbage. You will probably have to pay much higher interest rates.

-

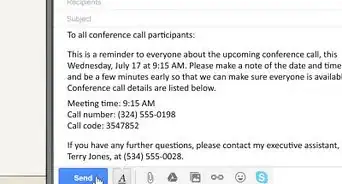

4Gather required financial documents. To apply for an SBA loan, you will need to submit a considerable number of supporting documents. You should gather them ahead of time. For example, you will need to submit the following:[10]

- Business plan or growth plan

- Personal credit report

- Resumes for all members of management

- Personal and business income tax returns

- Personal financial statements

- Personal and business bank statements

- Legal documents, such as copies of your contracts, business licenses, leases, and articles of incorporation

Expert Interview

Thanks for reading our article! If you'd like to learn more about investments, check out our in-depth interview with Gina D'Amore.

References

- ↑ https://www.business.com/articles/writing-a-business-growth-plan/

- ↑ https://www.business.com/articles/writing-a-business-growth-plan/

- ↑ https://www.business.com/articles/writing-a-business-growth-plan/

- ↑ https://www.business.com/articles/writing-a-business-growth-plan/

- ↑ http://articles.bplans.co.uk/marketing-a-business/how-to-perform-swot-analysis/300

- ↑ http://www.forbes.com/sites/davelavinsky/2013/10/18/strategic-plan-template-what-to-include/2/#4a955c63b55e

- ↑ https://www.consumer.ftc.gov/articles/0155-free-credit-reports

- ↑ https://www.consumerfinance.gov/askcfpb/1261/what-are-errors-show-credit-reports-out-having-creditors-report-your-accounts-credit-bureaus.html

- ↑ http://www.businessnewsdaily.com/7695-small-business-loan-guide.html

About This Article

A well-drafted growth plan will help you identify growth opportunities and budget for the expansion. To write your growth plan, start by identifying areas of potential growth, such as adding new products or services, expanding into new territories or markets, and increasing your marketing to sell more existing products. Once you’ve decided on a direction for your growth, take a look at your goal and figure out what your business is already doing well and where it needs to improve. Use this to write a 5-year growth plan, detailing the steps you’ll take to put the plan in motion. Then, write a financial plan, including your current financial situation, the amount of capital you need to raise, and how you’ll secure it. If you need to hire extra staff for your expansion, include this in the plan and how much it’ll cost. For more tips, including how to get a business loan to support your growth plan, read on!