This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

There are 12 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, several readers have written to tell us that this article was helpful to them, earning it our reader-approved status.

This article has been viewed 139,490 times.

Learn more...

Leasing retail space can be a daunting task when you're just starting a business or relocating an existing one. To find retail space, you need to estimate how much you can afford and then find properties in your price range. You must also take care to understand the lease terms before negotiating them.

Steps

Finding Properties

-

1Determine how much space you need. Walk through your competitor’s stores to check their layout and estimate how much space they use. Your needs will vary depending on your business, but generally you’ll need sales floor, stock room, dressing rooms, offices, and bathrooms.[1]

- You can estimate your sales floor needs using this simple calculation: sales volume divided by sales per square foot.

- You can find average retail sales per square foot at the statista website.[2]

-

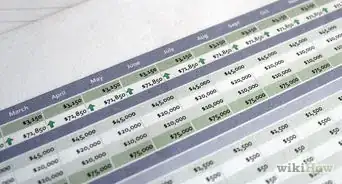

2Estimate what you can afford. If your business is already up and running, take a look at your financial performance. If you haven’t opened your business yet, you’ll have to estimate how much money is in your budget for retail space.Advertisement

-

3Search online. You want to find four or five possible spaces to rent. Look online at websites such as Loopnet.com, where you can search by location, property type, lease rate, and space size.[3]

- There are also subscription services, such as Co-Star. However, you will have to pay in order to use them. If you can’t find anything using free searches, then you might want to consider a subscription service.

-

4Look in the newspaper. Commercial landlords still advertise in the newspaper. Find the classifieds. Usually, any landlord that advertises in the newspaper also has a website you can visit. Check the website for other properties the landlord has available.

Assessing Retail Space

-

1Check the rental rate. Rent for commercial space is typically calculated by square foot or a percentage of gross sales. Rents can range from $0.90 to several dollars a square foot, or you might pay 6% of gross sales.[4] The rental rate should be listed in online or in classified ads. Contact the management office if you have questions.

-

2Check the crime rates for the area. You want your business located in a safe area, otherwise customers won’t visit. Check the crime statistics for the area at mylocalcrime.com. You can search by zip code.[5]

-

3Find where your competitors are located. Some businesses want to be located near their competitors. One advantage is that customers already will stop by the area, so you are pretty much guaranteed foot traffic (if your competitors are successful).[6]

- However, you might not want to be located too close to your competitors. It will be hard to distinguish yourself, and the public might already be loyal to established businesses.

-

4Look for complementary businesses. When people go shopping, they’ll stop at many different stores during their trip. For example, someone going to lunch might stop at a clothing store along the way. You can benefit by situating your business near other retail establishments, such as coffee shops or restaurants.[7]

- Complementary businesses should target the same demographic as your business. For example, if you have a children’s clothing store, then being located near a daycare would be ideal. However, it’s not ideal to be located near a bar.

-

5Check the proximity of public transportation. Consider whether you want to be located near public transportation, such as the bus line or a subway stop. Generally, the closer you are to public transportation, the easier it will be to get foot traffic near your store. However, you also need to consider what kind of clientele you hope to reach.

- For example, you might open a high-end boutique. In that situation, you probably don’t want to be near public transportation, since higher-income people generally will drive.

-

6Visit the retail space. Avoid relying only on pictures. Instead, stop by the retail space so that you can get a feel for it. If possible, contact the landlord and ask to walk through the space.[8]

-

7Confirm the space is zoned for your business. Zoning laws limit which businesses can operate in certain geographic zones. Once you narrow down your search, stop into the local zoning office to check whether you can operate your business in the area.

Hiring a Broker

-

1Obtain referrals. You might not be able to find any properties on your own, either online or in the newspaper. Don’t worry. You can work with a broker, who can find something suitable based on your needs. Get referrals to a tenant broker in the following ways:

- Talk to your real estate attorney. They should know local brokers.

- Ask someone who rents commercial real estate. Tell them you are looking to rent and ask for the name of their broker.[9]

- Look at the Loopnet website and click on “Find a Broker.”

-

2Ask about the broker’s fee. Commercial real estate brokers typically charge around 3% of the total lease costs. Accordingly, a five-year lease at 20,000 a year would cost around $3,000 in brokerage fees. However, you might be able to negotiate a flat fee, which could be lower.[10]

- Many landlords pay for the brokerage fee, so find that out ahead of time.[11] If the landlord pays, then using a broker is an ideal way to retail space.

-

3Consider signing an exclusive representation agreement. Brokers typically want you to work exclusively with them. Accordingly, they may ask you to sign a representation agreement, where you agree to pay their brokerage fee even if you find a property on your own. Consider whether this is your best option.[12]

- For example, you might sign this agreement if you have a lot of confidence in the broker’s ability to find you a property, or if there isn’t a lot of retail space available in your town.[13]

- Consider a non-exclusive agreement instead, in which you pay the broker a fee only if they actually find you a property.

Negotiating Your Lease

-

1Ask a leasing agent for a proposal. Once you find commercial space you want to rent, call up the leasing agent. You can find the phone number online or in the phone book. Ask for a proposal.

- If possible, ask for proposals for at least two different properties. This way, you can play the two landlords against each other.[14] You’ll be in a stronger negotiating position if you have more than one option.

-

2Have a lawyer review the lease. Before negotiating your lease, you should have a lawyer check it over. If you don’t already have a lawyer, then obtain a referral from your local or state bar association. Call them up and schedule a consultation. Tell them you have a lease and need help understanding it.

- You can save yourself a lot of time and money by pulling a lawyer into the process at the very beginning. A lawyer can also help you negotiate if you are uncomfortable doing that.

-

3Determine the length of the lease. Generally, a retail lease lasts for a minimum of three years, and some commercial leases run for 5-10 years. However, you might want a shorter lease with the right to renew. This way, you can get out of the lease if your business isn’t successful, but you can still renew if the space works for you.[15]

- Landlords typically prefer longer leases, so they might resist shortening it for you.

-

4Identify how rent is calculated. Read the proposal to find out how the landlord is calculating the rent. For example, you might be charged based on square footage or on a percentage of your gross sales.

- Also look to see how rent increases are handled. Landlords typically try to increase the rent every year. Make sure you understand how any increase is calculated. For example, the rent might rise along with the consumer price index.[16]

-

5Check who pays for expenses. Your total cost includes more than the rent. Instead, it typically includes other expenses, which the tenant is responsible for.[17] Find out who will pay for the following:[18]

- electrical

- plumbing

- heat

- air conditioning

- trash removal

- common areas

- insurance

- property taxes

-

6Obtain signage rights. If you want to put up signs, you need to check that the lease allows you to. Also check any signage restrictions and make sure you are comfortable with them. Restrictions will limit where you can put signage and how large your signs can be.

- Generally, the more important you are as a tenant, the higher your signage rights. For example, the most important tenants typically can get “building top” signage, which can be seen for blocks around.

- Less important tenants can get “eyebrow signage,” which is visible above the main entrance.

-

7Check if you can renovate the space. You might need to remodel the retail space. Landlords anticipate this and include “build-out” provisions in their leases. Check what improvements can be made and who will pay for them.[19] In a longer lease, the landlord might agree to pay for alterations to the space.[20]

-

8Get the right to sublease the space. Many landlords don’t want you to sublease the space to someone else. However, a sublease clause can protect you in case you can’t pay your rent any longer and need to vacate the premises.[21]

- If the landlord wants a longer lease, then seek out a right to sublease the property. This is a fair tradeoff.

-

9Review the exit plan clause. If you need to cancel the lease early, you can expect to pay a penalty. Try to negotiate as small a penalty as possible, e.g., two or three months of rent.[22]

-

10Check for an exclusive use clause. This clause helps keep your competitors away from your store by prohibiting your landlord from renting space to one of them.[23] As a tenant, try to get a broad exclusive use clause.

- For example, you might run a yoga studio. You’ll want to exclude other yoga studios, but you also might want to exclude all other fitness-related businesses.

Closing the Deal

-

1Draft and submit a counteroffer. After assessing the landlord’s proposal, you should draft your own counteroffer. Be aggressive in your initial counteroffer. You are unlikely to get everything that you ask for. However, you won’t get any concessions unless you ask for them.[24] Ask for a lower rental rate, shorter lease term, and a broad exclusive use clause.

- In your counteroffer, mention that you are also negotiating with another landlord. This news might spur the landlord to give you as many concessions as possible.

-

2Sign a personal guarantee. Most landlords will require you to personally guarantee the lease. This means that if your business can’t pay the lease, then the landlord can come after you personally to pay. If you’re a small business without much credit history, you can expect to sign a personal guarantee.[25]

-

3Make payment. Many commercial landlords will expect a security deposit and/or prepaid rent. You can expect up to two months’ of rent as a security deposit and one to three months of rent prepaid.[26]

Community Q&A

-

QuestionHow much does it cost to start a business?

Community AnswerIt depends on what type of business you want to start, what stage it's in, and how large you would like it to grow.

Community AnswerIt depends on what type of business you want to start, what stage it's in, and how large you would like it to grow. -

QuestionWho pays for the heat, and who replaces the heating if it becomes damaged?

Community AnswerWhen it comes to paying, it depends on the lease agreement. Generally, a landlord has to maintain the heating system. If you added a heating system yourself, then you will most likely have to pay for it--including repairs.

Community AnswerWhen it comes to paying, it depends on the lease agreement. Generally, a landlord has to maintain the heating system. If you added a heating system yourself, then you will most likely have to pay for it--including repairs.

References

- ↑ http://fitsmallbusiness.com/lease-retail-space/

- ↑ https://www.statista.com/statistics/247120/highest-sales-per-square-foot-in-us-retail-stores/

- ↑ http://www.loopnet.com/

- ↑ https://www.entrepreneur.com/article/228003

- ↑ http://fitsmallbusiness.com/lease-retail-space/

- ↑ http://fitsmallbusiness.com/lease-retail-space/

- ↑ http://fitsmallbusiness.com/lease-retail-space/

- ↑ http://quickbooks.intuit.com/r/online-store-and-retail/find-perfect-retail-space/

- ↑ http://fitsmallbusiness.com/commercial-real-estate/

- ↑ http://www.nolo.com/legal-encyclopedia/clb-signing-contract-commercial-real-estate-broker.html

- ↑ http://fitsmallbusiness.com/commercial-real-estate/

- ↑ http://fitsmallbusiness.com/commercial-real-estate/

- ↑ http://www.nolo.com/legal-encyclopedia/clb-signing-contract-commercial-real-estate-broker.html

- ↑ https://www.entrepreneur.com/article/228003

- ↑ http://fitsmallbusiness.com/commercial-real-estate/

- ↑ http://fitsmallbusiness.com/commercial-real-estate/

- ↑ http://fitsmallbusiness.com/commercial-real-estate/

- ↑ https://www.entrepreneur.com/article/228003

- ↑ http://smallbusiness.findlaw.com/business-operations/negotiating-a-lease-for-commercial-real-estate.html

- ↑ http://fitsmallbusiness.com/commercial-real-estate/

- ↑ http://fitsmallbusiness.com/commercial-real-estate/

- ↑ http://fitsmallbusiness.com/commercial-real-estate/

- ↑ http://fitsmallbusiness.com/commercial-real-estate/

- ↑ https://www.entrepreneur.com/article/228003

- ↑ http://fitsmallbusiness.com/commercial-real-estate/

- ↑ https://www.entrepreneur.com/article/228003