This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 35,133 times.

Filling out a credit application is relatively simple. Most applications ask for the same information with the goal of determining whether you are financially stable and responsible. Always read the terms and conditions before applying and shop around for the best offer.

Steps

Completing the Application

-

1Review the credit agreement before completing or signing the application. The credit agreement is usually found in the last section of the application. It outlines the terms and conditions to the consumer as required by the Federal Law Consumer Disclosure Act and explains the binding agreement between you and the issuer.

- Pay attention to the APR (annual percentage rate) and the late charge penalties (i.e. the amount you pay if you make a late payment).

- If you are unsure about any of the terms or have any questions, contact the card issuer before you start filling out the application.

-

2Provide your personal information. The application will ask you for your personal information. The issuer is looking to see if you have a stable residence, and if you are who you say you are. Information that you will typically provide includes:[1]

- Name - Last, first, middle, surname, maiden name.

- Address including city, state, and zip code

- Phone numbers - Primary and secondary numbers.

- The length of time you have lived at your current residence

- Previous address and the length of time you lived there.

- Email address - Sometimes optional, but most financial institutions are going paperless and will insist.

- Your Social Security number is mandatory to secure credit. The number will be used for identification purposes and to obtain credit history.

Advertisement -

3Give your employment history. If you are currently unemployed, your application will probably not be approved. A solid employment history demonstrates that you are responsible and have the ability to make payments. The longer you have been at the same job, the better. The application will ask for the:[2]

- Name of your employer

- Your position

- Length of employment - Start date and end date.

- The type of business - Education, financial, food service, etc.

- Address and phone number of business

- You may have to provide information for your last few employers

-

4Provide your financial information. Your financial information is one of the most important parts of your application. The issuer wants to know if you are financially stable and the percentage of your income that you spend on housing. It looks more favorable if you have a higher income, own a home instead of rent, and have multiple bank accounts. Typical information includes:[3]

- Annual income - Household.

- Bank information - Checking, savings, money market or IRA.

- Residence - Do you rent or own?

- Monthly rent or mortgage payments.

-

5Submit the form and authorization to a financial institution. Review the application and correct any errors or omissions. Sign and date your application, stating the information you gave is correct. Send it in online or mail in the application.[4]

-

6Wait for an answer. The three outcomes for your application are accepted, referred, or declined. If everything checks out, your application will be accepted and you will receive your credit card within 2 weeks. If your application is referred, the issuer needs more information before a decision can be made and will likely contact you.[5] If your application has been declined, read the rejection letter to determine the reason. Common reasons for rejection are:[6]

- You made a mistake on your application.

- There is a problem with your work history or financial information. If you have changed jobs recently or are unemployed, your application may be denied. Consider reapplying when your income increases, or you have been employed for 6 months.

- There is a problem with your credit report. If you have credit problems such as low credit score, late payments, error on your credit report, or multiple inquiries into your credit, you may be denied.

Avoiding Common Mistakes

-

1Limit the number of credit applications. Every time your credit is reviewed by a bank, lender, credit card company, or employer, it is considered an inquiry on your credit report. Too many credit applications can lower your credit score. Applying for too many credit cards, for example, can hurt your chances of your application getting accepted.[7]

- Apply for one credit card at a time. Do not fill out 2 or 3 applications as a back up just in case your first application is denied.[8]

- Shop around for credit cards only when you need to and without filling out multiple applications.

- Do not shop for a credit card if you are also applying for a car loan or mortgage.

-

2Check your credit score before you apply. Knowing your credit card score can help you apply for a realistic card and limit the number of applications you fill out. A FICO credit score ranges from 300-850.[9] If you have a 320 score, you should not apply for a platinum, top tier card. Instead you would apply for a card that caters to people who are trying to rebuild or build credit.[10]

- If you have a high credit score (usually 720+), you can apply to any card that you want.

- If you have a low credit score, try applying for secured credit cards.

-

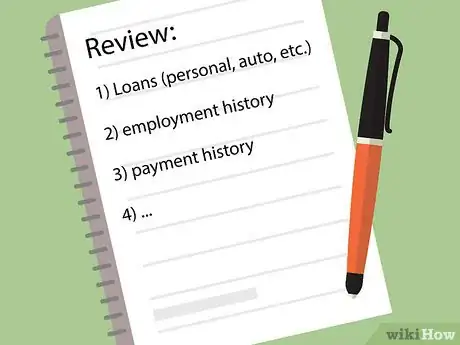

3Make sure your finances are in order. Review your credit card debt and loans (e.g. personal, school, auto, etc.) before you apply. Also think about your work history and payment history. If you identify an area that needs improvement, work on that before you apply.[11]

- Avoid taking any cash advances or going over your credit limit when you seeking to apply.

- Establish a history of timely payments for all of your debt.

Choosing the Right Card

-

1Determine your needs. There are 3 major types of credit cards. They are cards that help you build or repair your credit, cards that save money on interest, and cards that offer you rewards. The best card for you depends on your current needs.[12]

- If you are trying to build your credit, you do not need to apply for a card that offers cashback or travel rewards. Apply for a secured card or a student credit card (if it applies to you).

- To save money on interest, look for a low interest, 0% APR, or a balance transfer card.

- If you plan to pay off your balance in full every month, you may want a rewards card. These cards have a higher APR rate, but have many benefits.

-

2Shop around for a card. Once you have determined the type of card you need, shop around to find the best deal. Start looking at your current bank or credit union. You may be able to get a better deal because you are an existing customer. Take your search online after that. Check each credit card for the following things:[13]

- APR

- APR for balance transfers

- Penalty APR (How much? How long does it last? What initiates it?)

- Fees (e.g. annual fee, cash advance fee, late-payment fee, and balance transfer fee)

-

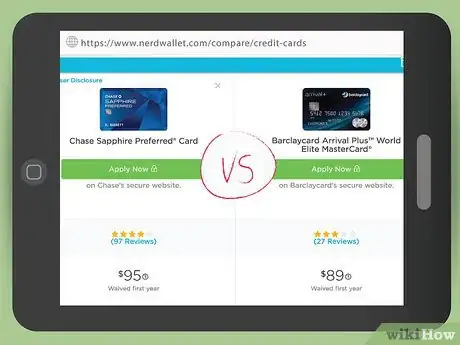

3Compare your final choices. You may find two or three cards that meet your needs. Examine each card for differences. Nerdwallet has a tool that lets you do side-by-side comparisons of different cards.[14] Things that you should look depend on the type of card you have:[15]

- For low-interest cards look for late fees, the change in the APR after initial period, and the length of the APR period.

- For secured and credit cards look for credit limit increases for making timely payments.

- If you are using a balance rewards card look for an expiration date to use your rewards.

References

- ↑ http://www.indexcreditcards.com/finance/creditcardapplication

- ↑ http://www.indexcreditcards.com/finance/creditcardapplication

- ↑ http://www.indexcreditcards.com/finance/creditcardapplication

- ↑ http://www.indexcreditcards.com/finance/creditcardapplication

- ↑ http://www.tescobank.com/creditcards/elh/application-outcomes.html

- ↑ http://www.creditcards.com/credit-card-news/how-not-to-get-rejected-for-new-credit-card-1267.php

- ↑ http://www.bankrate.com/finance/credit-cards/avoid-credit-card-application-risks.aspx

- ↑ https://www.nerdwallet.com/blog/credit-cards/apply-for-a-credit-card/

- ↑ https://www.nerdwallet.com/blog/finance/credit-score-ranges-and-how-to-improve/

- ↑ https://www.nerdwallet.com/blog/credit-cards/apply-for-a-credit-card/

- ↑ https://www.nerdwallet.com/blog/credit-cards/apply-for-a-credit-card/

- ↑ https://www.nerdwallet.com/blog/credit-cards/how-to-pick-the-best-credit-card-for-you-4-easy-steps/

- ↑ http://www.consumerfinance.gov/about-us/blog/how-do-i-shop-for-a-credit-card/

- ↑ https://www.nerdwallet.com/credit-cards/?trk=nw_gn_2.0

- ↑ https://www.nerdwallet.com/blog/credit-cards/how-to-pick-the-best-credit-card-for-you-4-easy-steps/