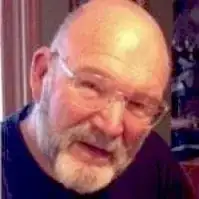

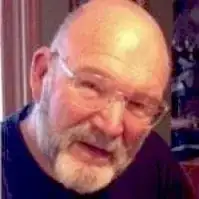

This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 13 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 88% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 186,969 times.

Whether it be for an emergency, some needed home repairs, or that can’t-miss investment opportunity, just about everyone needs a quick infusion of cash now and then. But if you don’t have the money readily available, maybe it’s time to consider a loan. With all the financial resources that seem to be floating around out there today, you might tend to overlook one that’s probably sitting in a desk drawer or a safe deposit box—your whole life insurance policy.

Steps

Determining Whether Your Policy Qualifies As a Loan Source

-

1Check to see which kind of life insurance policy you have. Not all life insurance policies allow you to borrow against them, so you need to find out the type of policy you own. The most common types of life insurance policies are:

- Permanent life policies. These policies have a savings element along with the mortality coverage, and that is why you can borrow from them. This category can be broken down into:

- Whole Life Insurance. You pay the same amount of premium for a specific period to receive the death benefit.

- Universal Life Insurance (also known as "adjustable life insurance"). You can reduce or increase your death benefit, and also pay your premiums at any time and in any amount (subject to certain limits) after you’ve made your first premium payment.

- Variable Life Insurance. Most of your premium is invested in one or more separate investment accounts, such as stocks, bonds and mutual funds. The interest that your accounts earn increases your policy's cash value.

- Variable Universal Life Insurance. Gives policyholders the option to invest, as well as easily change the insurance coverage amount.

- Term Life Insurance. Pays the face amount of the policy at death, and only provides protection for a set term period (normally 30 years maximum). Does not build cash value.

- Permanent life policies. These policies have a savings element along with the mortality coverage, and that is why you can borrow from them. This category can be broken down into:

-

2Find out if your particular policy permits you to take a loan. Take a look at your policy to check if there’s a loan provision. You can also contact your agent for this information. For the most part, you can borrow against a permanent life insurance policy, since it has a cash surrender value.[1] As for term life policies, these are not loan sources since they don’t have a cash value that can be borrowed.[2]

- Only the owner of the permanent life insurance policy can borrow from it, not the insured or beneficiaries, unless they are also the owner.

Advertisement -

3Verify that your policy has enough cash value available for the loan. Check on your insurance company’s website or with your agent to find out the cash value of your policy. You can typically borrow up to the cash value you've accumulated in the account, but guidelines may differ from one company to the next.[3] Note that cash value grows slowly at first, so you may have to own the policy for a while (sometimes as long as ten years) before you can borrow against it.[4]

Deciding Whether to Take the Loan

-

1Weigh the benefits of a life insurance loan versus a conventional loan. There are several reasons a loan against your insurance policy may prove to be a better deal than a standard bank loan. Some of these are:

- There’s no approval process, credit check, or income verification, since technically you’re borrowing against your own asset.

- Insurance policy loans usually have much lower interest rates than bank loans.

- You’re not limited as to how you can use the money. A bank might restrict how you can apply the loan proceeds, but an insurance policy loan has no such limitations.

- There’s no required monthly loan payment, and there’s no payback date. The balance of the loan will be deducted from the death benefit that goes to your beneficiaries.[5]

-

2Take into account the downside to borrowing against your life insurance. Few things in life are risk-free. And taking a loan against your insurance policy is no exception. For example:

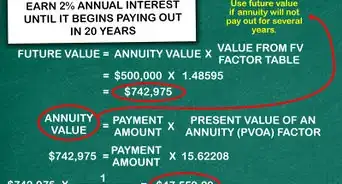

- If you don't pay the interest on your loan, the insurance company will add that unpaid interest to your loan amount. This interest is subject to compounding. What that basically means is that in addition to paying interest on the actual loan amount, you’re paying interest on all the accumulated interest as well.

- Dividends generated by the insurance policy will likely decrease as long as the loan is outstanding. Insurance dividends are basically a periodic return of your premiums. The dividend is based on the amount of your money available to be invested by the insurer. Taking the loan means that less of your money is available for investment, thus—lower dividends.[6]

- In many cases, the cash value in your insurance policy is protected from creditors. However, once you withdraw money, the amount you take out is no longer sheltered.

- If the increasing amount of unpaid interest causes your loan balance to exceed your policy’s cash value, the insurance policy could lapse.[7]

- To keep the policy from lapsing if your loan balance becomes greater than your policy’s cash value, you’d have to pay back the entire loan. You can’t pay it back in increments.[8]

-

3Consider the tax consequences. The proceeds of the insurance policy loan are usually not taxable to you, as long as the loan amount is equal to or less than the total premiums you’ve paid. However, if the policy lapses, the IRS then considers your loan balance plus interest as taxable income for which you’re liable. This only occurs when the loan proceeds exceed the cash surrender value and it only applies to the difference.[9] [10]

Requesting the Loan

-

1Contact the insurance company to obtain the necessary forms. Your insurer can forward you the appropriate form for taking out the loan. You may also be able to download the form from the company’s website. Depending on your insurance company, you might be permitted to arrange for the loan by phone. For example, one insurer instructs its clients to call if the loan is for $25,000 or less.

-

2Make sure you properly identify the owner of the policy. The information needed to properly complete the loan application depends on whether the owner is an individual, a business, or a trust. If it’s a trust (see definition here), you’ll need to know the date the trust was executed (signed). You’ll also have to provide the owner’s contact information, as well as a social security number (for an individual) or a tax ID (for a business or trust).[11]

- You will need to be a trustee and have legal authority within the trust in order to make the transaction.

-

3Determine the payout method. The loan application will most likely ask how you want the proceeds distributed. Obviously this will depend on your purpose for taking out the loan. Usually you’ll have the choice of:

-

4Keep track of the loan. Since you don’t have to make monthly loan payments, or pay back the loan within a certain time, it could be very easy to simply forget about it. That would be a mistake. Remember, your life insurance policy and the loan are financial investments. Here are some guidelines you might want to follow:

- Monitor the loan balance regularly, in comparison to the cash value of the policy. You don’t want the loan to exceed the policy’s cash value, which could result in the policy lapsing.

- Devise a disciplined loan repayment plan and make regular scheduled payments. Don’t forget that any amount of the loan remaining when you die means that much less money for your beneficiaries.

- Pay the interest on the loan every year to prevent the loan from increasing.[14]

Expert Q&A

-

QuestionAfter the insurance company receives the application form for a loan how long will the insurer take to approve the loan amount?

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Business Advisor Since insurance policies are regulated on a state-by-state basis, there is no specific time that must elapse before receiving funds on a cash value loan. In most cases, funding requires between 5 to 15 days from application date depending upon the location of the insurance company and its internal processes.

Since insurance policies are regulated on a state-by-state basis, there is no specific time that must elapse before receiving funds on a cash value loan. In most cases, funding requires between 5 to 15 days from application date depending upon the location of the insurance company and its internal processes. -

QuestionWhy does my life insurance policy let me borrow so little?

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Business Advisor The amount borrowed from a life insurance policy depends upon the terms of insurance contract and its cash value at the time of the loan request. Cash value grows over time and accumulating premium payments. In this case, you may have requested a loan based upon the face value of the policy rather than the accumulating cash value. Contact your insurer to understand your options.

The amount borrowed from a life insurance policy depends upon the terms of insurance contract and its cash value at the time of the loan request. Cash value grows over time and accumulating premium payments. In this case, you may have requested a loan based upon the face value of the policy rather than the accumulating cash value. Contact your insurer to understand your options.

Warnings

- Even if you instruct your insurer to pay your loan interest with dividends generated by your insurance policy, if the dividends don’t cover the full interest due, the unpaid interest will accrue and be added to the loan balance.[19]⧼thumbs_response⧽

References

- ↑ http://www.investopedia.com/ask/answers/205.asp

- ↑ http://thelawdictionary.org/article/can-you-borrow-against-a-term-life-insurance-policy/

- ↑ http://www.bankrate.com/finance/insurance/are-life-insurance-loans-a-bad-idea-2.aspx

- ↑ http://www.investopedia.com/articles/personal-finance/121914/understanding-life-insurance-loans.asp

- ↑ http://www.bankrate.com/finance/insurance/are-life-insurance-loans-a-bad-idea-2.aspx

- ↑ http://www.bankrate.com/finance/insurance/are-life-insurance-loans-a-bad-idea-2.aspx

- ↑ http://www.investopedia.com/ask/answers/111314/how-can-i-borrow-money-my-life-insurance-policy.asp

- ↑ http://www.bankrate.com/finance/insurance/are-life-insurance-loans-a-bad-idea-2.aspx

- ↑ http://www.investopedia.com/ask/answers/111314/what-are-pros-and-cons-life-insurance-policy-loans.asp

- ↑ http://www.360financialliteracy.org/Topics/Insurance/Life-Insurance/Life-Insurance-Policy-Loans-Tax-and-Other-Implications

- ↑ https://eforms.metlife.com/wcm8/PDFFiles/31170.pdf

- ↑ http://www.investopedia.com/ask/answers/111314/what-are-pros-and-cons-life-insurance-policy-loans.asp

- ↑ http://www.investopedia.com/articles/personal-finance/121914/understanding-life-insurance-loans.asp

- ↑ http://www.protective.com/learning-center/life-insurance/life-insurance-policy-loans/

- ↑ http://www.investopedia.com/articles/personal-finance/121914/understanding-life-insurance-loans.asp

- ↑ http://www.360financialliteracy.org/Topics/Insurance/Life-Insurance/Life-Insurance-Policy-Loans-Tax-and-Other-Implications

- ↑ http://www.bankrate.com/finance/insurance/are-life-insurance-loans-a-bad-idea-2.aspx

- ↑ http://www.investopedia.com/articles/pf/08/life-insurance-cash-in.asp

- ↑ http://www.bankrate.com/finance/insurance/are-life-insurance-loans-a-bad-idea-2.aspx