This article was co-authored by Jerry Becerra. Jerry Becerra is the President of Barbary Insurance Brokerage in San Francisco, California. Becerra is a licensed Property and Casualty Insurance Agent, with over 30 years of experience in the insurance industry. He has taught courses on business insurance for the San Francisco Renaissance Entrepreneurship Center and has served as the President and Chief Financial Officer of the Golden Gate Business Association.

There are 17 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 86% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 149,182 times.

Insurance brokers research policies offered by several insurers, ensuring that their clients get the coverage they need for the best price. Brokers can work on behalf of individuals, companies or organizations, and are usually specialists in a particular type of policy. Most work on commission, and the median salary is $48,210.[1] (More specific information on salaries in California is available here.) If you want to learn how to become an insurance broker in California, follow these steps.

Steps

Planning for a Career as an Insurance Broker

-

1Identify opportunities. Getting your insurance license takes time, hard work, and money, so you will want to make sure that your efforts will pay off. Make sure that there are lots of good opportunities in your area. You may even consider applying to insurance companies that offer financial support to pursue your insurance license. If you are not working for an insurance company, it will be very difficult to obtain the additional training and resources that you will need to work as an insurance broker.

- As an added bonus, having a job with an insurance company will help take the guesswork out of the type of insurance license you should pursue. You can simply ask your employer what type of license you will need.

-

2Consider your skill set before pursuing a license as a California insurance broker. Most licensed brokers recommend that aspiring brokers have certain skills and industry knowledge before embarking on a career in the industry:

- Interpersonal skills: Brokers must be patient and considerate with clients, many of whom are overwhelmed by the process of selecting insurance coverage. Brokers also must project confidence when negotiating policies with insurance companies. [2]

- Strong Personality: Successful agents will appear excited, eager and positive at all times when working with clients. Agents must also be able to handle rejection. You will hear “No” on a daily basis. Successful agents see each “No” as another step on the way to “Yes.”[3]

- Business education: Although only a high-school diploma is required, college-level instruction in business classes can be very useful to new brokers and may lead to higher pay.[4] Successful brokers must understand the tax and legal aspects of the products they sell and how those products fit into a client’s overall financial situation. Classes in tax law, accounting, business administration and investment planning can provide a solid foundation for a new broker.[5]

Advertisement -

3Decide what kind of insurance you want to specialize in. All aspiring brokers must take required coursework and a licensing exam in the area of specialization they choose. Specialties in California include:

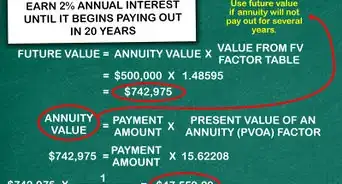

- Life insurance brokers sell products providing coverage on human lives, including life insurance (protects against the risk of early death), annuities (guaranteed income that protects against outliving one’s financial resources), and funeral and burial insurance, which provides for the cost of funeral and burial expenses.[6]

- Accident and health insurance brokers sell mostly health insurance, which pays the medical expenses incurred by the policyholder as a result of accidental injury or illness; and disability insurance, which covers lost income.[7]

- Property insurance brokers provide coverage for the loss or damage of property of any kind, including insurance for business property, crop insurance, livestock insurance, earthquake insurance, equipment breakdown insurance, flood insurance, homeowners or dwelling insurance, and inland marine insurance (covers movable property like jewelry or unusual risks).[8]

- Casualty insurance brokers, often called liability insurance brokers, provide coverage against legal liability, including that for death, injury, disability, or damage to real or personal property. The most common form is automobile insurance, but there are many other lines.[9]

- Personal lines brokers provide insurance specifically for individuals, as opposed to companies, and can includes the following policy types: automobile insurance, residential property insurance, including earthquake and flood insurance, personal watercraft insurance and umbrella or excess liability insurance.[10]

- Limited-lines auto brokers sell, solicit or negotiate automobile insurance for private use, liability coverage, physical damage coverage and collision coverage.[11]

- Bail agents issue bail bonds on the behalf of insurers. A bail bond is an insurance product that guarantees the appearance of a defendant in court.[12]

-

4Speak with an insurance broker. There is no better way to get a feel for the type of specialty that suits you than to talk with a practicing insurance broker. He or she can give you details on the nature of the work, pay, hours and more.

Getting your License

-

1Complete the required prelicensing education for your specialty.

- The California Department of Insurance requires all aspiring insurance brokers to receive 20 hours of classroom instruction in the type of insurance they want to specialize in. #*Applicants can also take 40-hour courses that combine property and casualty insurance or life and accident and health insurance.

- New brokers and brokers licensed in another state also need to complete a one-time, 12-hour course in ethics and the California Insurance Code.[13]

- You can find courses near you through the California Department of Insurance Provider Course Look Up Tool.

- You can find more information on online courses here.

-

2Study for the licensing exam. The content of your exam will depend on the insurance specialty that you chose. Use the materials provided in your pre-licensing course to study for the exam. Questions on the exam include fictional scenarios, questions about specific policies and questions about California laws regarding insurance.

-

3Submit your fingerprints. This can be done prior to or at your licensing exam. Obtaining your fingerprint impressions before the test minimizes the risk that there will be a delay in issuing your license.[14]

- To have your fingerprints taken before the exam, schedule an appointment with the California Department of Insurance’s contracted vendor, Accurate Biometrics, or another vendor. Take a completed Live Scan Request, form LIC 442-39A to your fingerprint appointment.

- If you have your fingerprints taken on the day of your licensing exam at a California Department of Insurance exam site, the processing fee will be $58.30, payable by money order, cashier’s check, personal check or credit card. Cash is not accepted.[15]

- If you have your fingerprints taken on the day of your licensing exam at a PSI test center, the processing fee will be $68.95. You should make your money order, cashier’s check or company check payable to PSI. Visa and MasterCard are also accepted. PSI does not accept personal checks or cash.[16]

-

4Take the insurance licensing exam for the type of insurance you plan on selling. The computer-based tests range from 1.5 to 2.5 hours and cover 60 to 150 questions.[17]

- The Candidate Information Bulletin provides information on how to prepare for the exam, examination site procedures, sample exam questions, test-taking strategies and driving directions to test centers.

- You will need to bring one of the following types of identification to the test center:[18]

- Current valid California or out-of-state driver’s license.

- California Identification Card.

- Passport or Passport Card.

- Military identification.

- Your name must match that on your identification.

- The examination fee is $50 if scheduled at a California Department of Insurance examination site or $83 at a PSI examination site.[19]

- California Department of Insurance examination sites are located only in Los Angeles, Sacramento and San Francisco. Examination times and examination site addresses can be found here.

- You can schedule your exam at a PSI site here.

- To cancel or reschedule your examination without forfeiting your fee, you must do so at least 48 hours in advance. If you fail to appear for your exam and wish to reschedule it, a rescheduling fee will be charged.[20]

-

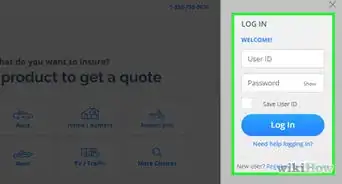

5Apply for a license online using the Fast Licensing Application Service (FLASH). You will need to provide information for both a background check and a credit check. If, after its investigation, the CDI learns that you withheld or distorted information, your application may be denied.[21]

- If you have been convicted of felony crimes of dishonesty or breach of trust or any violation of Title 18 U.S.C. § 1033, you must submit a 1033 Application for Written Consent to obtain the consent of the Commissioner prior to licensing.

- To apply for a license, you will need the 12 digit number located in the upper left corner of your passed examination letter.

- The licensing fee is $170 for all specialties except Bail Agent, for which the fee is $566.

-

6Print or download your insurance license. You can access your license on the California Department of Insurance site.

- BE AWARE: Although you are now licensed, you will need to submit additional forms before you can act as an insurance agent.

Working as an Insurance Broker

-

1Submit additional documents demonstrating financial security before transacting, soliciting or negotiating the sale of insurance. Your license will not allow you to act as an insurance broker until you have submitted these documents. Different specialties have different requirements.

-

2Submit one of the following if you are specializing in property, personal or casualty insurance. These fields allow you to either start your own practice or join an existing insurance company or agency.[22]

- A $10,000 Bond of Insurance Broker, form LIC 417-5. These bonds can be obtained from surety bond issuing companies.

- An Action Notice of Appointment submitted by a sponsoring insurance company admitted to California. This means you will be representing an insurer. The Action Notice must be submitted electronically. To do so, contact the National Insurance Producer Registry (NIPR) and its authorized business partners for a list of approved partners.

- A Business Entity Endorsement that will add you to a sponsoring insurance agency’s roster as an insurance agent. The endorsement must be submitted through the California Department of Insurance’s online service.

- An Action Notice of Solicitor, form LIC 417-31, which authorizes the licensee to act as an employee of an insurance agent or broker, aiding them in transacting insurance business.

-

3Submit one of the following if you are specializing in life, accident and health, or auto insurance. In these specialties, you must have an appointment with an insurance company or the sponsorship of an agency to begin working.

- An Action Notice of Appointment submitted by a sponsoring insurance company admitted to California. This means you will be representing an insurer. The Action Notice must be submitted electronically. To do so contact the National Insurance Producer Registry (NIPR) and its authorized business partners for a list of approved partners.

- A Business Entity Endorsement that will add you to a sponsoring insurance agency’s roster as an insurance agent. The endorsement must be submitted through the California Department of Insurance’s online service.

-

4Submit all of the following documents to begin working as a Bail Agent:

- A Bond of Bail Agent, form LIC 437-9, in the sum of $1,000, executed by a California admitted surety, and signed by the principal.

- A Bail Agent Action Notice, form LIC 437-9, executed by a surety insurer and appointing you as its agent to transact undertakings of bail.

- If you will act as the employee of an existing bail agent, you must also submit an Action Notice Statement of Employing Bail Agent or Permittee, form LIC 438.

-

5Consider working at a brokerage firm. If you are going to specialize in life, accident and health, or auto insurance, you will need an appointment from an insurance company or a job with an agency before you begin selling insurance.

- In any specialization, working at an established insurance agency will allow you to learn the ins and outs of the profession and build a client list. Most new brokers take internships or shadow experienced brokers for six to nine months before working independently.

-

6Search online job search sites find a job. Job search sites like Indeed.com and CareerBuilder.com can help you find job openings. Search for jobs that you are qualified to do, like insurance broker positions in your specialty area. You can apply for these jobs online as well.

-

7Apply directly to local insurance brokers in your area. If you know of some insurance firms in your area, you can apply directly to them. Go to the firm with a copy of your resume. Wear professional attire, like a suit, when you go to apply for a job. Be pleasant and polite.

-

8Complete continuing-education classes to maintain your license. Brokers in California must complete a certain number of hours of continuing education per two-year license-renewal cycle:

- 12 hours (bail).

- 20 hours (automobile).

- 24 hours (accident and health, casualty, life or property).

- Certain long-term care and annuities specialists must complete a separate eight-hour course.

References

- ↑ http://study.com/articles/Insurance_Broker_Educational_Requirements_to_be_a_Licensed_Insurance_Professional.html

- ↑ http://www.investopedia.com/financial-edge/1212/8-qualities-that-make-a-good-insurance-agent.aspx

- ↑ http://www.investopedia.com/financial-edge/1212/8-qualities-that-make-a-good-insurance-agent.aspx

- ↑ http://study.com/articles/Insurance_Broker_Educational_Requirements_to_be_a_Licensed_Insurance_Professional.html

- ↑ http://www.investopedia.com/financial-edge/1212/8-qualities-that-make-a-good-insurance-agent.aspx

- ↑ http://www.insurance.ca.gov/0200-industry/0050-renew-license/0200-requirements/life-only/index.cfm

- ↑ http://www.insurance.ca.gov/0200-industry/0050-renew-license/0200-requirements/accident-health/index.cfm

- ↑ http://www.insurance.ca.gov/0200-industry/0050-renew-license/0200-requirements/property/index.cfm

- ↑ http://www.insurance.ca.gov/0200-industry/0050-renew-license/0200-requirements/casualty/index.cfm

- ↑ http://www.insurance.ca.gov/0200-industry/0050-renew-license/0200-requirements/personal-lines/index.cfm

- ↑ http://www.insurance.ca.gov/0200-industry/0050-renew-license/0200-requirements/limited-lines-auto/index.cfm

- ↑ http://www.insurance.ca.gov/0200-industry/0050-renew-license/0200-requirements/bail-agent.cfm

- ↑ http://www.insurance.ca.gov/0200-industry/0040-seek-producer-forms/0100-broker-agents/upload/LIC4468PreLicProgReq.pdf

- ↑ http://www.insurance.ca.gov/0200-industry/0200-prod-licensing/0100-applicant-info/0300-ca-fingerprint/index.cfm Submit your fingerprints

- ↑ http://www.insurance.ca.gov/0200-industry/0200-prod-licensing/0100-applicant-info/0300-ca-fingerprint/index.cfm

- ↑ http://www.insurance.ca.gov/0200-industry/0200-prod-licensing/0100-applicant-info/0300-ca-fingerprint/index.cfm

- ↑ http://www.insurance.ca.gov/0200-industry/0010-producer-online-services/0200-exam-info/ExamTimesandQuestion.cfm

- ↑ http://www.insurance.ca.gov/0200-industry/0010-producer-online-services/0200-exam-info/admittance.cfm

- ↑ http://www.insurance.ca.gov/0200-industry/0050-renew-license/0200-requirements/accident-health/app-proc-ind-res.cfm

- ↑ http://www.insurance.ca.gov/0200-industry/0010-producer-online-services/0200-exam-info/rescheduling.cfm

- ↑ http://www.insurance.ca.gov/0200-industry/0050-renew-license/0200-requirements/accident-health/app-proc-ind-res.cfm

- ↑ http://www.insurance.ca.gov/0200-industry/0050-renew-license/0200-requirements/property/forms.cfm