This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

This article has been viewed 38,777 times.

Escrow officers are known as title closing agents or title insurance agents in some states. Although the specific title may differ, the duties are essentially the same. An escrow officer holds money involved in a real estate transaction until the sale is completed. To become an escrow officer, you must demonstrate knowledge of your state's title insurance law and the skills necessary to fulfill that role. Typically you also must apply for a license with your state.[1]

Steps

Learning Necessary Skills

-

1Talk to working escrow officers. If you're interested in becoming an escrow officer, working escrow officers can be your greatest source of information. Arrange informational interviews with several escrow officers near you.[2]

- Call title insurance companies in your area and ask if anyone would be interested in talking to you about becoming an escrow officer.

- Emphasize that you're not asking for a job, only looking for information on how to become an escrow officer.

- When you have your interview, dress presentably in professional clothing. Ask the escrow officer questions such as how they decided to become an escrow officer, what education they have, and what they enjoy about their work.

- You also may want to ask what aspects of their work they find challenging, and if there's anything they wish they'd done differently.

-

2Acquire the appropriate education. Generally, no higher education is required to become an escrow officer. However, a bachelor's degree or two-year associate's degree in a related field such as business or accounting can be an asset.[3]

- If you're already in college, speak with your academic advisor about your goals. They may be able to recommend particular courses you should take to prepare you for the real estate field.

- Typically you can get an associate's degree relatively inexpensively by going to a local community college.

- These schools are willing to work around your schedule, even if you work full-time, by offering classes in the evenings and online.

Advertisement -

3Work in a related office. Many states require you to work in the field for at least a year before you can start the licensing process. An entry-level position in a title insurance or real estate attorney's office also gives you on-the-job training in your chosen field.[4]

- Some states require you to work for a specific period of time, while others require you to have worked for a set number of hours. Keep that in mind if you've got a part-time job at a title insurance office or real estate attorney's office.

- You'll also want to make sure that the work you're doing is something that qualifies under your state's insurance law as relevant experience.

- If you're unsure, explain to your employer (or potential employer) that you want to become an escrow officer, and ask if the job you have meets the state licensing qualifications.

- There may be an affidavit or other form that must be completed by your employer to verify that you have the required work experience.

- If the form is called an affidavit, this generally means it must be signed by your employer in the presence of a notary public.

-

4Complete a classroom course. Some states require you to complete a specific state-provided licensing course before you are eligible to take the state's licensing exam. This course covers your state's insurance law and the duties of an escrow officer.[5] [6]

- Most states offer a licensing exam preparation course that you should consider taking even if it isn't required.

- An exam preparation course will help you understand the licensing requirements and the types of questions that will be asked on the exam so you can focus your studies.

- If your state requires a classroom course before you're eligible to sit for the exam, that course may not specifically be an "exam prep" course. However, it will teach you aspects of your state's title insurance law that will be on the licensing exam.

- Some states such as Florida allow you to sit for the licensing exam after having taken the classroom course, even if you don't have any relevant work experience.

-

5Take your state's licensing exam. Most states have an exam that you must take and pass with a specific minimum score before you can apply for a license to work as an escrow officer. You can find out about your state's licensing exam by contacting your state insurance board or other regulatory authority.[7]

- Once you've passed your exam, you'll receive information on what you need to do to apply for a license.

- In some states, you must get a title underwriter to sponsor your application. The requirements for this will be set forth by your state's insurance board.

- If you need a sponsor, you'll take the certificate you received after passing the licensing exam to title insurance companies in your area and ask if they are willing to sponsor your application.

- Typically you'll get a title insurance company where you've worked, or where you plan to work once licensed, to sponsor you.

- If you fail the exam, you'll get information on how to retake the exam along with your score report. In some states you must wait at least 30 days after you've failed an exam to take it again.

Getting Licensed

-

1Meet the basic eligibility requirements. Typically, you must be at least 18 years old and a legal resident of the state to become an escrow officer in that state. Some states may have additional requirements you must meet to be eligible for a license.[8]

- States typically don't require escrow officers to have any particular education apart from a high school diploma. However, you may be required to complete courses offered by the state.

- In most states you can be located anywhere in the state. There may be additional residency requirements, however, such as the requirement that you've been a state resident for at least six months.

- If you previously were licensed in another state, the requirements may be different for you. However, typically you still must take the licensing exam and complete a new application to be licensed in your new state.

-

2Complete your application. In most states, you can find an application online that you can fill out to get a license to work in that state as an escrow officer. If you can't find it online, you may have to make a trip to a local office of your state insurance board or other regulatory authority to get a paper application.[9] [10]

- The application typically requires basic background and contact information, as well as details of any work experience, education, or certifications you have that are relevant to your application.

- You must attach a copy of the certificate you received showing that you passed the licensing exam.

- You also must include any employer statements or affidavits related to your work experience.

-

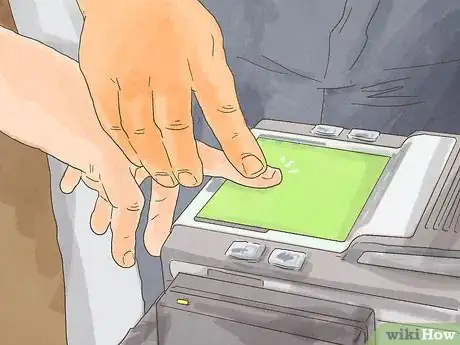

3Get fingerprinted. Some states require all title insurance license holders to be fingerprinted. Your state's insurance board will have details on whether you must be fingerprinted and what type of fingerprints are required.[11] [12]

- Fingerprints typically are necessary so the state can run a criminal background check on you. Check with your state's insurance board or other regulatory authority to make sure you're getting the fingerprints according to their procedures.

- Your fingerprints must be recent. For example, if you had them taken in anticipation of submitting your application, then didn't pass your license examination and had to retake it, you may need to get your fingerprints taken again.

- For this reason, it's a good idea not to get fingerprinted until you have passed the licensing exam, completed all other requirements, and are ready to submit your application.

- Expect to pay a fee of around $50 for your fingerprints.

-

4Submit your application packet. Once you have all application materials required by your state, send it along with your application fee to your state's insurance board or other regulatory authority. The correct address typically will be noted on your application form.[13] [14]

- You must pay a fee to apply for a license. The amount of this fee varies greatly among states, but typically is under $100.

- Make copies of every document you're sending to the state to apply for your license before you mail them, so you have them for your own records.

- Keep in mind that even if you're able to fill out and submit your application online, you still may have to mail in particular paper documents. Note any deadlines carefully.

-

5Receive your license. The state will evaluate your application. Assuming everything is complete and correct, and you meet all eligibility requirements, you should receive your license in the mail within a few weeks.[15]

- You cannot work as an escrow officer until you've received your license in the mail. Even if you've submitted your application, you still must wait until you have your license.

- Some states may allow you to check the status of your license application online. Typically you set up a profile with the state insurance division or department. Then you can log in and check your status and other information related to your license validity.

- When you receive your license, make a couple of copies of it for your records. Keep the original in a safe place so it won't be lost or damaged.

- If you're working at a title insurance company, you may be legally required to display your original license in your office.

Keeping Your License

-

1Take continuing education (CE) courses. Most states require license holders to complete a certain number of hours of continuing education each year to keep their license in good standing. Check with your state insurance board or other regulatory authority.[16]

- Keep in mind that you can't just take any classes – they must be approved by your state board for CE credit.

- Some states allow you to take correspondence or online courses. If you go this route, you typically must take and pass an end-of-course exam related to the content of the course you took.

- Tuition for CE classes can be expensive. Depending on the number of hours your state requires, you may end up spending several hundred dollars a year to maintain your license.

- Your state may offer courses for free at certain times of the year. Sign up for CE course notices so you can meet the CE hour requirements and still stay within your budget.

-

2Maintain errors and omissions (E&O) insurance. E&O insurance is a type of professional liability insurance that covers you in the event that you make a mistake in a financial transaction that results in a loss to a client. Some states require escrow officers to have at least a minimum amount of E&O insurance coverage.[17]

- Even if your state does not require E&O insurance coverage, these policies are a good idea to protect yourself and your business from liability if something happens with one of your transactions and you end up getting sued over it.

- Some states that don't require E&O insurance require you to post a bond. The amount varies depending on your license. For example, in the state of Texas you must post a $10,000 bond if you are a title agent. However, if you are an escrow officer, the required bond is only $5,000.

- Keep in mind that some states do not differentiate among these licenses. To be an escrow officer in those states, you must be licensed as a title agent.

-

3Submit financial statements. As an escrow officer, you hold other people's money during real estate closings. Some states require you to provide quarterly or yearly financial statements to the state insurance board or other regulatory authority.

- Other states require you to submit certificates of good standing regarding your escrow accounts, or to submit to quarterly or yearly audits.

- You will learn your state's specific requirements when you apply for your license, and there may be questions about this on your licensing exam.

-

4Renew your license when necessary. A license to be an escrow officer or title insurance agent does not last a lifetime. Rather, it must be renewed periodically if you want to continue to work. Most states require you to renew your license every year or every two years.[18]

- If your state has online access to your license account, you typically have the ability to renew your license online.

- Provided you've met all the maintenance requirements, renewing is as simple as paying an annual licensing fee.

- Make sure you complete your application for renewal well in advance of the expiration date. It is illegal to continue to work on an expired license, even if you've already sent in your renewal application and are waiting for the state to process it.

References

- ↑ http://www.stewart.com/content/dam/stewart/Microsites/florida/pdfs/Koogler_FAQ.pdf

- ↑ http://info.courthousedirect.com/blog/becoming-a-title-agent-in-texas-the-process

- ↑ http://info.courthousedirect.com/blog/becoming-a-title-agent-in-texas-the-process

- ↑ http://www.myfloridacfo.com/division/agents/licensure/general/docs/4-10.htm

- ↑ http://www.stewart.com/content/dam/stewart/Microsites/florida/pdfs/Koogler_FAQ.pdf

- ↑ https://www.plta.org/page/Howtobecome

- ↑ http://www.stewart.com/content/dam/stewart/Microsites/florida/pdfs/Koogler_FAQ.pdf

- ↑ http://www.stewart.com/content/dam/stewart/Microsites/florida/pdfs/Koogler_FAQ.pdf

- ↑ http://www.stewart.com/content/dam/stewart/Microsites/florida/pdfs/Koogler_FAQ.pdf

- ↑ http://www.myfloridacfo.com/division/agents/licensure/general/docs/4-10.htm

- ↑ http://www.myfloridacfo.com/division/agents/licensure/general/docs/4-10.htm

- ↑ https://www.myfloridacfo.com/division/agents/licensing/agents-and-adjusters/fingerprinting-information

- ↑ http://www.myfloridacfo.com/division/agents/licensure/general/docs/4-10.htm

- ↑ http://info.courthousedirect.com/blog/becoming-a-title-agent-in-texas-the-process

- ↑ http://www.myfloridacfo.com/division/agents/licensure/general/docs/4-10.htm

- ↑ http://www.stewart.com/content/dam/stewart/Microsites/florida/pdfs/Koogler_FAQ.pdf

- ↑ http://info.courthousedirect.com/blog/becoming-a-title-agent-in-texas-the-process

- ↑ http://info.courthousedirect.com/blog/becoming-a-title-agent-in-texas-the-process