This article was co-authored by Dmitriy Fomichenko and by wikiHow staff writer, Jennifer Mueller, JD. Dmitriy Fomichenko is the president of Sense Financial Services LLC, a boutique financial firm specializing in self-directed retirement accounts with checkbook control based in Orange County, California. With over 19 years of financial planning and advising experience, Dmitry assists and educates thousands of individuals on how to use self-directed IRA and Solo 401k to invest in alternative assets. He is the author of the book "IRA Makeover" and is a licensed California real estate broker.

There are 8 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 93% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 900,737 times.

Financial advisors provide advice relating to investment strategies, mutual funds, bonds, and stocks. You may work at a bank or brokerage firm, or at an insurance company. To become a financial advisor, you generally need at least a four-year degree and some experience in the financial services industry. Most financial advisors also have a professional certification.[1]

Steps

Acquiring Necessary Skills and Education

-

1Get a bachelor's degree in a finance-related discipline. Most financial advisors have at least a four-year degree in a discipline such as finance or accounting. Choose an area that interests you and that you want to pursue as a career.

- Take introductory courses in retirement and estate planning, income tax, investment strategies, and risk management. Then take advanced courses in the areas that interest you the most.

- Your specific major typically doesn't matter as much, but degrees in financing, accounting, economics, mathematics, or computer science can look good on a financial advisor's resumé.

-

2Look for certification preparatory programs. If you plan on gaining a professional certification, for example as a Certified Financial Planner (CFP), a program specifically designed to prepare you for the certification examination process can help you a lot.

- In some countries, such as Canada, a CFP is required if you want to work as a financial advisor in any capacity, although some other financial certifications or licenses are accepted as equivalent.

Advertisement -

3Look for an internship while still in school. Many financial advisors start their careers as unpaid interns before they complete their coursework. Provided you have the means to do so, an internship can give you connections and experience in the financial services industry.[2]

- Your school typically will have information on available internships through the department office or career services office, along with other resources to help you secure a position.

- Some internships may be eligible for class credit towards your degree.

-

4Take some psychology courses. As a financial advisor, you'll spend a lot of time counseling people. Some understanding of the way people think and behave can help you counsel your clients as well as predict the market.[3]

-

5Go further with a master's degree or doctorate. Having a graduate degree will make you a more valuable financial advisor. You'll be able to command a higher salary and, if you eventually start your own firm, you can charge your clients more for your services.[4]

- Graduate degrees or professional degrees also open up other opportunities for you. For example, if you get a law degree, you could provide clients with legal and financial advice.

- If you have a master's degree or Ph.D. in finance, business, or economics, you may be able to skip any licensing and certification exams.

Gaining Work Experience

-

1Find an entry-level position in the financial services industry. Even before you get your degree, an entry-level position can help you gain an understanding of the work involved. It also gives you the opportunity to talk to financial advisors.

- For example, you could get a job as a teller at a bank, or as an entry-level clerk at a brokerage firm.

- Insurance agencies also help prepare you for a career as a financial advisor, particularly if you want to work in the retirement planning sector.

- It's okay if you don't get your dream job right away! Just take advantage of whatever opportunities are around you, and focus on improving your knowledge and skills.[5]

-

2Sign on with a training program. Larger investment firms typically start new financial advisors in a formal training program where you work side-by-side with a senior financial advisor or additional education leading up to your licensing or certification exams.[6]

- These programs typically last a year or longer, and give you the skills and knowledge you need to pass certification exams and become a successful financial advisor.

- Larger, more established firms tend to have highly competitive training programs. To be accepted, you need top grades and impeccable references. In addition, look for other opportunities that can set you apart from other applicants, such as research projects or competitions.

-

3Try starting out with a smaller company. While training programs with large investment companies are highly competitive, smaller companies typically offer more hands-on learning opportunities and one-on-one time with a senior advisor.[7]

- Small independent investment firms also typically have access to a greater variety of investment products than some of the larger firms. This gives you broader experience, which will give you more flexibility in your career.

- Particularly with smaller companies, research the background and reputation of the company itself and the people who work there. You don't want to get caught up in unethical or fraudulent activity, especially when you're just starting out.

-

4Work toward starting your own firm. You may be satisfied working for an established firm, or you may decide you want to strike out on your own. Starting your own firm will give you more flexibility and control over your business.[8]

- While training, focus on how to make the work process streamlined and more efficient. Learn the policies of the firm where you're working, but think about how you can adapt those policies to work better.

Getting Licensed and Certified

-

1Decide what type of work you enjoy. Financial advisors work in several different areas. There are a number of different professional certifications or licenses financial advisors may have. Once you know the path you want to follow, you'll know which certifications or licenses you need or want.[9]

- Licenses and certifications can get expensive if you get more than one, and multiple licenses or certifications may not improve your value as a financial advisor. Choose what you want to do wisely.

- For example, if you most enjoy complex global transactions and international investment opportunities, you might want to get licensed as a Chartered Financial Analyst (CFA).

- If you plan to work for an insurance company, you typically must be licensed as an insurance agent.

-

2Become a Certified Financial Planner (CFP) if you want to be a personal financial planner. The CFP is one of the more flexible certifications available for financial advisors. In some countries, you can't work with the public as a financial advisor without this certification.

- This designation doesn't allow you to actually buy and sell investment products – it is solely a professional credential. You may need additional licenses, depending on the type of work you want to do as an advisor.

- To get a CFP, you must have a four-year degree, three years of work experience, and take a two-day, 10-hour exam. You can take preparatory classes for the exam through a university, or take a self-study course on your own.

-

3Get licensed as a Chartered Financial Analyst (CFA) if you want a career in global investments. The CFA primarily prepares you to handle large global investment portfolios or to be a financial research analyst.

- To be eligible for a CFA, you must have at least a bachelor's degree and four years experience as a financial advisor. The CFA is offered by the CFA Institute, which offers a self-study program split into three phases, with a six-hour exam at the end of each phase. To get the charter, you must become a regular member of the CFA Institute.

- The CFA is a globally recognized career distinction that will help you stand out in the competitive financial advisor market. It also gives you a shot at a job with major investment firms, such as Merrill Lynch and JPMorgan Chase.

-

4Become a Registered Investment Advisor (RIA) to get paid for investment advice. Other financial advisors may be paid a salary by their employer, or they may receive commissions from the sell of investment products. However, if you have an RIA, clients will pay you directly for you investment advice.[10]

- You don't need an RIA if you're simply being paid for general investment advice. But if you're giving clients specific investment advice on buying or selling a specific commodity, you must be registered as an investment advisor.

- This designation may require other licenses or registrations depending on the laws in your country and the size of the portfolios you handle.

-

5Register with the securities commission. Depending on the amount of investments you manage, securities registration may be required. You'll have to pay a fee to register, and may be required to take exams or otherwise demonstrate your competence as an investment advisor.[11]

- You typically must register with the securities commission if you buy and sell investments and commodities directly on behalf of your clients. Generally this requirement kicks in if you manage portfolios totaling over $100 million in investments.

- In addition to national commissions, you also may be required to register with state or local regulators.

-

6Get any necessary insurance licenses. If you're working with an insurance company, you typically have to be a licensed insurance agent. The license typically requires you to take an exam that tests your knowledge of insurance law.[12]

- Insurance licenses typically are the easiest of any license a financial advisor may need. All you have to do is pay a fee and take a two- or three-hour exam.

-

7Follow up with continuing education. Many licenses and certifications have a continuing education requirement that you must meet to maintain your license or certification in good standing. You also typically must pay a renewal fee every year.

- For example, even though an insurance license is one of the easiest licenses for a financial advisor to get, they typically require fairly extensive continuing education to maintain.

- Continuing education also keeps you up-to-date on various market and investment trends that could directly impact your clients and the success of their investments.

- Don't think of continuing education as something you have to do to keep your license, but as something you want to do to be the best possible financial advisor.

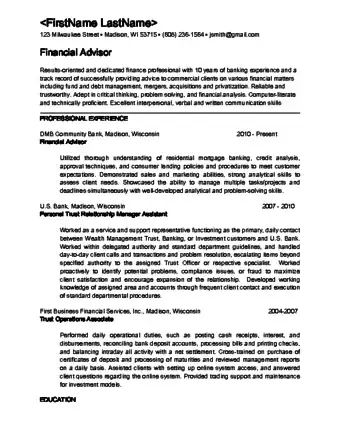

Sample Resume

Expert Q&A

-

QuestionWhat should I study to become a financial advisor?

Benjamin PackardBenjamin Packard is a Financial Advisor and Founder of Lula Financial based in Oakland, California. Benjamin does financial planning for people who hate financial planning. He helps his clients plan for retirement, pay down their debt and buy a house. He earned a BA in Legal Studies from the University of California, Santa Cruz in 2005 and a Master of Business Administration (MBA) from the California State University Northridge College of Business in 2010.

Benjamin PackardBenjamin Packard is a Financial Advisor and Founder of Lula Financial based in Oakland, California. Benjamin does financial planning for people who hate financial planning. He helps his clients plan for retirement, pay down their debt and buy a house. He earned a BA in Legal Studies from the University of California, Santa Cruz in 2005 and a Master of Business Administration (MBA) from the California State University Northridge College of Business in 2010.

Financial Advisor Psychology courses also help you develop your interpersonal and communication skills, which will be invaluable to you when you start working with clients.

Psychology courses also help you develop your interpersonal and communication skills, which will be invaluable to you when you start working with clients.

References

- ↑ https://www.bls.gov/ooh/business-and-financial/personal-financial-advisors.htm#tab-1

- ↑ https://www.kaplanfinancial.com/resources/getting-started/how-to-become-a-financial-advisor/

- ↑ https://www.forbes.com/2010/09/21/financial-advisor-jobs-employment-leadership-careers-career-change-10-advice.html

- ↑ https://www.kaplanfinancial.com/resources/getting-started/how-to-become-a-financial-advisor/

- ↑ Derick Vogel. Credit Advisor & Owner, Credit Absolute. Expert Interview. 26 March 2020.

- ↑ https://www.bls.gov/ooh/business-and-financial/personal-financial-advisors.htm#tab-4

- ↑ http://www.investopedia.com/articles/financialcareers/08/big-or-small-firm.asp

- ↑ https://www.brazen.com/blog/archive/career-growth/how-to-become-a-financial-advisor-6-tips-for-mastering-this-career/

- ↑ https://www.kaplanfinancial.com/resources/getting-started/how-to-become-a-financial-advisor/

- ↑ https://www.kitces.com/blog/are-the-licensing-and-other-requirements-to-become-a-financial-advisor-too-easy/

- ↑ https://www.bls.gov/ooh/business-and-financial/personal-financial-advisors.htm#tab-4

- ↑ https://www.kitces.com/blog/are-the-licensing-and-other-requirements-to-become-a-financial-advisor-too-easy/

About This Article

It can take a lot of work to become a financial advisor, but if you’re interested in the stock market or economics, it can be a rewarding career. Start by earning a bachelor’s degree in a related subject, like finance, economics, or accounting. If you can, try to find an internship at a brokerage firm or a bank while you’re still in school. After graduation, it’s a good idea to pursue a professional certification, such as becoming a Certified Financial Planner, as this will give you a competitive edge when finding clients. For advice on starting your own firm, keep reading!