This article was co-authored by Carla Toebe. Carla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

There are 8 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 203,527 times.

Businesses applying for a loan from a lending institution may be asked to prepare a loan request letter. This letter should include documentation of a strong management team, substantial experience in the industry and a complete understanding of the current marketplace. The letter should not only introduce your business to the lending institution, but it should also clearly state how much money you need, how you will repay the loan and the security you would pledge to back up the loan.[1]

Steps

Writing an Executive Summary

-

1Provide corporate data. State the name of your business. List your business address and phone numbers. Provide the date your business was established. Briefly explain your business structure. For example, if your business is a corporation, state this and give the date of incorporation.[2]

-

2Describe your business location. In addition to indicating where your company is, describe the property. For example, a property owner requesting a loan for improvements would provide the size of the property, the number of units and the acreage. A brief description of the neighborhood would also be relevant, as location can determine market value. Photos and maps may also be included.[3]Advertisement

-

3Provide a market analysis. Describe your target market. Identify the critical needs of your target customers. Define the size of your target market and indicate its potential for growth. Project how much market share you expect to gain. Describe your competitive advantage in the market.[4]

-

4Explain how the loan will help your business succeed. Whether your company is a start-up or an established business, you might need financial help. Explain how the loan will help you expand your business. For example, businesses use loans to maintain current operations, purchase equipment or expand to a new location. Loans can also help companies increase their working capital. This helps them maintain operating cash flow and cover unexpected expenses during economic downturns.[5]

-

5Write the executive summary last. Even though it belongs at the beginning of the proposal document, the executive summary is written last. This is because it provides a summary of all of the relevant information in the loan proposal. Develop this summary as you gather your documentation for your loan. Writing the executive summary last reflects a thorough understanding of the purpose of the loan proposal. Writing it at the end of the process also makes it more persuasive.[6] Limit the length of the Executive Summary to less than a page.

Describing Your Business

-

1Write a business profile. Explain the nature of your business. For example, if you are a flooring company, describe the products you sell. Identify your typical customers. The typical customer of a flooring company might be retailers of carpet, linoleum, tile and hardwood. Describe the primary focus of your business, such as service and delivery of flooring products to retail businesses for resale.[7]

- Include a narrative discussion of the development of your products or services since the inception of your business. Detail the volume of business each product generates. Describe significant changes in your products or services.[8]

- Briefly state your tentative goals for the next 5 years.[9]

- Describe your work force, including the size and their critical skills.[10]

- Briefly describe your supplies and name your major suppliers.[11]

-

2Describe your management team. List the company owners and describe the legal structure of your business. Provide profiles of senior management summarizing their key experience, qualifications and credentials. Briefly explain the organizational structure. If there is a board of directors, list their qualifications. Name their positions on the board and how they contribute to the company's success.[12]

-

3Provide your marketing plan. Explain how you create customers. Outline your strategy for growth. State how you communicate with customers. Describe your sales activities. Explain your competitive advantage. For example, you may offer customers added value with lower prices or additional benefits and services.[13]

-

4Describe your production plan. Explain your manufacturing process. Quantify the total amount of output your manufacturing department generates in a given period. Describe how you allocate resources, such as employees and materials. Explain how you meet promised delivery dates and avoid overloading or underloading your production facility. Assure your lender that you have the operational capacity to meet your production goals.

-

5Describe your human resources management. Explain how you recruit qualified employees. Describe your training process. Specify how you orient new hires. Note any continuing education and advanced training you provide. Mention your employee retention statistics. State how you retain qualified employees who project your business further.[14]

Writing the Loan Request

-

1State the amount of money you need. Be realistic about the amount of money you are requesting. Explain how you determined the amount. Include relevant quotes. For example, if you are purchasing equipment, include quotes for equipment and supplies. If you are expanding, provide quotes for building costs. Explain how you will use the loan and why you need it.[15]

-

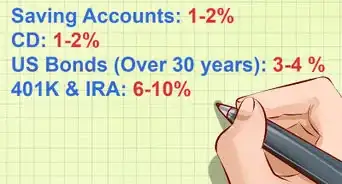

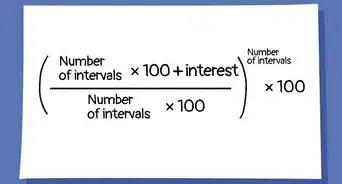

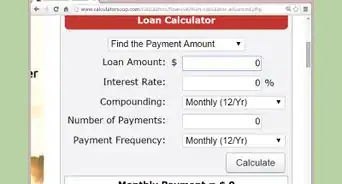

2Discuss loan repayment. Describe the terms you hope to receive. Include the interest rate and term you expect to receive. Provide sales and cash flow projections to demonstrate that you can make the payments. Realize that interest rates and terms will be negotiated by the lender. They will base their loan terms on their risk assessment of your business.[16]

-

3Describe collateral you are willing to pledge. Most loan programs require collateral. Collateral secures the loan because it can be sold in the event that the business cannot repay the loan. Most lenders require at least 2 forms of loan repayment. The first is cash flow generated from the business. The second would be collateral that is pledged to secure the loan.[17]

Including Other Documentation

-

1Include personal financial statements. Any owner with a 20% share or more in the business should provide personal financial statements. Recent statements are required. The statements must be under 90 days old. Tax returns may also be required. Some lenders ask for tax returns for up to the past 3 tax years.

-

2Provide business financial statements. Provide 3 years' worth of financial statements. Also provide current statements for the past 90 days. If you are just starting out, provide projected financial statements. Include a balance sheet that lists your assets, liabilities and equity. Provide an income statement, or profit and loss statement, which includes all income and expenses in a given period of time. Prepare a reconciliation of net worth, which is an accounting of financial changes that have increased or decreased the net worth of the business.[18]

-

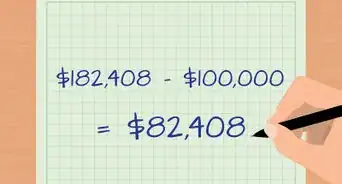

3Give a statement of equity. Explain how much equity you and the other owners have in the business. Lenders will want to see that you have put some of your own money into the business. The amount depends on the type of loan requested, how it will be used and the terms. You can build equity in your business through retained earnings or from an injection of cash. Usually, lenders want to see that any business debt totals less than 4 times the amount of equity.[19]

-

4Provide financial projections. Lenders generally want to see how you expect your company to perform over the next 5 years. Generate projected monthly and quarterly financial statements for the first year. Provide quarterly and annual statements for the following years. Include forecasted income statements, balance sheets, cash flow statements and capital expenditure budgets. Prepare to discuss how you will change operations if you do not generate the projected cash.[20]

- Make sure to include the assumptions behind the projections and state clearly that your estimated results are projections, which means they aren't guaranteed, and may not be reached.

-

5Include supporting documents that show your loan request is based on facts. Provide market studies or other documentation that supports your forecasts. Produce documents that support your financial data. For example, include copies of leases, subcontractor estimates and letters of credit. Include copies of customer testimonials. Provide copies of media reports about your company.[21]

Expert Q&A

-

QuestionHow can I find a sample of a letter to set up an interview with bank manager to acquire information on how to get a small business loan?

Carla ToebeCarla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

Carla ToebeCarla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

Real Estate Broker The Small Business Administration has Score Mentors that can work with you to get the appropriate letter written and delivered to the right bank. They will likely be familiar with which banks service small businesses in a positive way. See allbusiness.com/how-to-prepare-a-loan-proposal-11725601-1.html for the detailed information about writing a letter but also tips from the Small Business Administration by following the link at the end of the article.

The Small Business Administration has Score Mentors that can work with you to get the appropriate letter written and delivered to the right bank. They will likely be familiar with which banks service small businesses in a positive way. See allbusiness.com/how-to-prepare-a-loan-proposal-11725601-1.html for the detailed information about writing a letter but also tips from the Small Business Administration by following the link at the end of the article.

References

- ↑ http://www.allbusiness.com/how-to-prepare-a-loan-proposal-11725601-1.html

- ↑ https://www.sba.gov/offices/district/nd/fargo/resources/how-prepare-loan-proposal

- ↑ http://bisonfinancial.com/loans/sample-executive-summary/

- ↑ https://www.bdc.ca/EN/articles-tools/money-finance/get-financing/Pages/how-write-proposal-business-loan.aspx?caId=tabs-1

- ↑ http://www.thedailymba.com/2011/02/14/the-advantages-of-a-business-loan/

- ↑ http://www.captureplanning.com/articles/92131.cfm

- ↑ https://www.sba.gov/offices/district/nd/fargo/resources/how-prepare-loan-proposal

- ↑ http://www.brs-seattle.com/loan%20proposal.pdf

- ↑ http://www.brs-seattle.com/loan%20proposal.pdf

- ↑ http://www.brs-seattle.com/loan%20proposal.pdf

- ↑ http://www.brs-seattle.com/loan%20proposal.pdf

- ↑ https://www.sba.gov/offices/district/nd/fargo/resources/how-prepare-loan-proposal

- ↑ https://www.bdc.ca/EN/articles-tools/money-finance/get-financing/Pages/how-write-proposal-business-loan.aspx?caId=tabs-1

- ↑ https://www.bdc.ca/EN/articles-tools/money-finance/get-financing/Pages/how-write-proposal-business-loan.aspx?caId=tabs-1

- ↑ https://www.sba.gov/offices/district/nd/fargo/resources/how-prepare-loan-proposal

- ↑ https://www.sba.gov/offices/district/nd/fargo/resources/how-prepare-loan-proposal

- ↑ https://www.sba.gov/offices/district/nd/fargo/resources/how-prepare-loan-proposal

- ↑ https://www.sba.gov/offices/district/nd/fargo/resources/how-prepare-loan-proposal

- ↑ https://www.sba.gov/offices/district/nd/fargo/resources/how-prepare-loan-proposal

- ↑ https://www.sba.gov/content/financial-projections

- ↑ https://www.bdc.ca/EN/articles-tools/money-finance/get-financing/Pages/how-write-proposal-business-loan.aspx?caId=tabs-1