This article was co-authored by Jill Newman, CPA. Jill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.

There are 8 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. This article has 12 testimonials from our readers, earning it our reader-approved status.

This article has been viewed 721,266 times.

Amortization refers to the reduction of a debt over time by paying the same amount each period, usually monthly. With amortization, the payment amount consists of both principal repayment and interest on the debt. Principal is the loan balance that is still outstanding. As more principal is repaid, less interest is due on the principal balance. Over time, the interest portion of each monthly payment declines and the principal repayment portion increases. Amortization is most commonly encountered by the general public when dealing with either mortgage or car loans but (in accounting) it can also refer to the periodic reduction in value of any intangible asset over time.

Steps

Calculating First Month’s Interest and Principal

-

1Gather the information you need to calculate the loan’s amortization. You’ll need the principal amount and the interest rate. To calculate amortization, you also need the term of the loan and the payment amount each period. In this case, you will calculate monthly amortization.[1]

- The principal is the current loan amount. For example, say you are paying off a 30-year mortgage. If your loan has a balance outstanding of $100,000 (not counting any accrued interest), that is the principal.

- Your interest rate (6%) is the annual rate on the loan. To calculate amortization, you will convert the annual interest rate into a monthly rate.

- The term of the loan is 360 months (30 years). Since amortization is a monthly calculation in this example, the term is stated in months, not years.

- Your monthly payment is $599.55. The dollar amount of the payment stays constant. However, the portion of the payment that is principal or interest will change. You will mostly be paying off the interest when you start making payments, and then your payments will start to go to the balance.

-

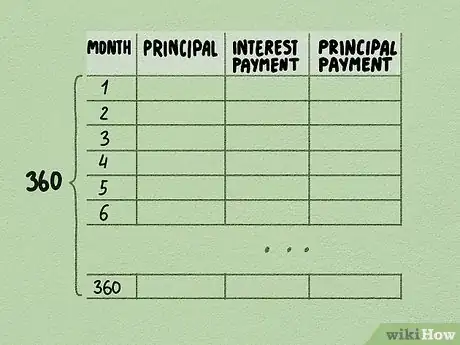

2Set up a spreadsheet. This calculation has a few moving parts and would best be accomplished in a spreadsheet where you've pre-loaded all your relevant info into column headings like: Principal, Interest Payment, Principal Payment, and Ending Principal.

- The total number of rows below those headings would be 360 to account for each monthly payment.

- A spreadsheet makes the calculations significantly quicker because, if done correctly, you only have to enter a given equation once (or twice, as when you are using the previous month's calculation to fuel all subsequent calculations).

- Once entered correctly, simply drag your equation(s) down through the remaining cells to compute amortization over the life of the loan.

- Even better is to set aside a separate set of columns and input your main loan variables (e.g. monthly payment, interest rate) as this will allow you to quickly visualize how changes will affect each other over the life of the loan.

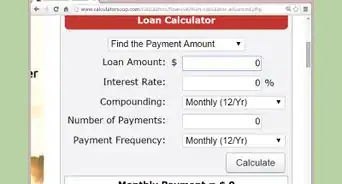

- You can also try an online amortization calculator.

Advertisement -

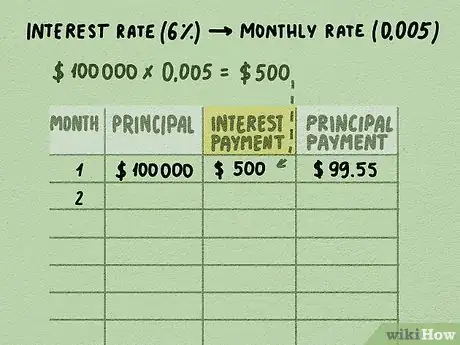

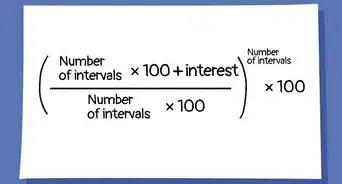

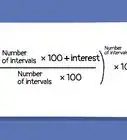

3Calculate the interest portion of the monthly payment for month one. This calculation requires several steps. You need to convert the interest rate to a monthly amount. The monthly rate is used to compute how much interest you will pay for the month.[2]

- Loans that amortize, such as your home mortgage or car loan, require a monthly payment. As a result, you need to compute the interest and principal portion of each payment on a monthly basis.

- Convert the interest rate to a monthly rate. That amount is: (6% divided by 12 = 0.005 monthly rate).

- Multiply the principal amount by the monthly interest rate: ($100,000 principal multiplied by 0.005 = $500 month’s interest).

- You can use the equation: I=P*r*t, where I=Interest, P=principal, r=rate, and t=time.

-

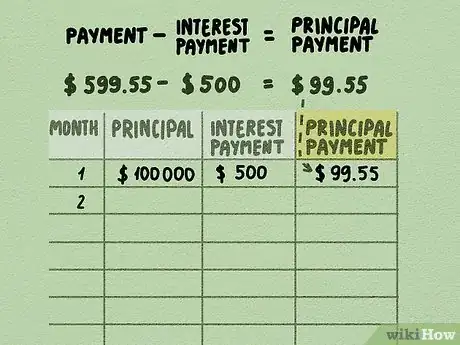

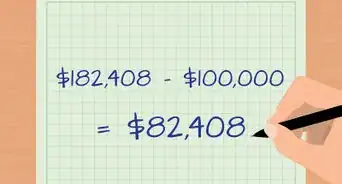

4Compute the principal portion of the payment for month one. Subtract the interest for the month from the first payment to compute the principal payment amount.

- Subtract the month’s interest from the payment amount to calculate the principal payment: ($599.55 payment - $500 interest = $99.55 principal payment).

- As more principal is repaid, the interest due on your principal balance each month will decline. A larger portion of each monthly payment will go toward principal repayment.

-

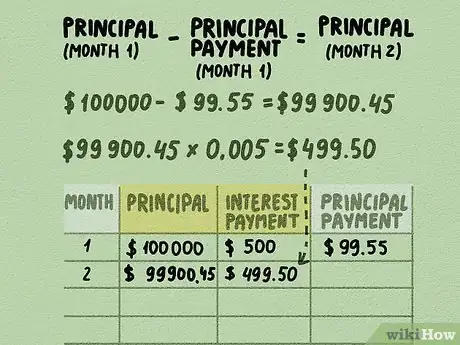

5Use the new principal amount at the end of month one to calculate amortization for month two. Each time you calculate amortization, you subtract the principal amount repaid in the prior month.[3]

- Calculate the principal amount for month two: ($100,000 principal - $99.55 principal payment = $99,900.45).

- Compute the interest for month two: ($99,900.45 principal X 0.005 = $499.50).

-

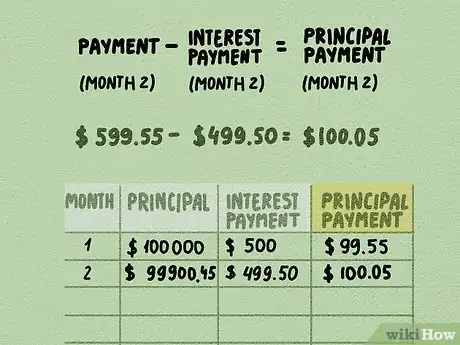

6Determine the principal repayment for month two. Just as you did in month one, your interest for the month is subtracted from the total monthly loan payment. The remaining amount is your principal repayment for the month.[4]

- Calculate the principal payment in month two: ($599.55 - $499.50 = $100.05).

- The principal repayment in month two ($100.05) is larger than month one ($99.55). Since the total principal balance declines each month, you pay less interest in the balance. In month one the interest was $500. In month two, the interest was only $499.50.

- As the required interest payment declines, the portion of the payment that goes toward principal increases.

Computing Amortization for the Entire Loan’s Term

-

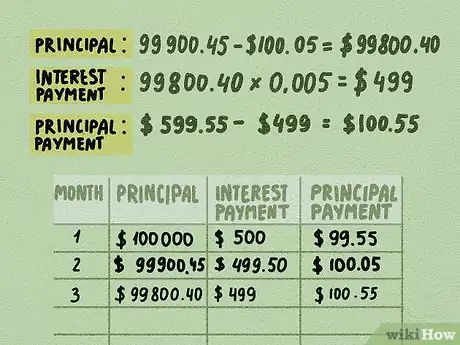

1Analyze the trend that occurs over time. You can see that the loan’s principal is reduced each month. Because the principal amount declines, the interest computed on the lower principal amount also goes down. Over time, a growing amount of each monthly payment goes toward principal.[5]

- Calculate the new principal balance for month three’s interest calculation: ($99,900.45 - $100.05 = $99,800.40).

- Compute interest for month three: ($99,800.40 X 0.005 monthly interest = $499).

- Calculate the principal payment in month three: ($599.55 monthly payment - $499 interest in month three = $100.55).

-

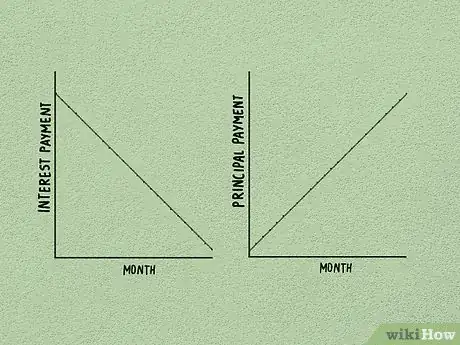

2Consider the impact of amortization at the end of the loan’s term. You’ll see that, over time, the amount of interest charged each month declines. The principal portion of each payment increases over time as your remaining balance gets smaller.[6]

- Interest payments decline to nearly zero. In the last month of the loan’s term, the interest payment is $2.98.

- By the last period of the term, the principal portion of the payment ($596.37) is close to the entire payment amount.

- The principal amount still owed is $0 at the end of the term.

-

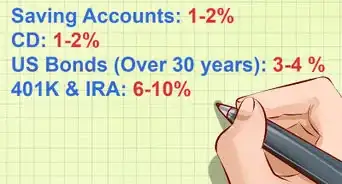

3Use the concept of amortization to make smart choices about your finances. Since your mortgage loan and many car loans use amortization, you need to understand this concept. You can use your knowledge of amortization to manage your personal debts.[7]

- Whenever possible, make extra payments to reduce the principal amount of your loan faster. The faster you’re able to reduce principal, the less total interest you will pay over the loan term.

- Consider the interest rate on the debts you have outstanding. Your extra payment will have the biggest impact on the loan with the highest interest rate. You want to reduce the principal amount for the debt with the highest interest rate.

- You can find loan amortization calculators on the Internet. Use a calculator to compute the interest you will save if you make extra payments. Say, for example, that your extra payment reduces your principal from $10,000 to $9,900.

- Use the $10,000 figure and calculate your amortization over the remaining term of the loan. Change the principal from $10,000 to $9,900 and run the calculation again. Take a look at the total interest paid over the life of the loan. You’ll see a difference, based on the extra $100 principal payment.

Tip: You can either make a spreadsheet or use an online amortization calculator to create an amortization schedule. This is a table that shows how much money you pay in principal and interest over the lifetime of the loan.[8]

Expert Q&A

-

QuestionWhat do you do if there are taxes to be paid each month. Also, what happens if a monthly payment is missed?

Jill Newman, CPAJill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.

Jill Newman, CPAJill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.

Financial Advisor If there are taxes to be paid each month, this will be added to the amount of the calculated loan payment. There will not be interest charged on the tax amount. If a monthly payment is missed, there will likely be a late fee charged which should be included in your next payment. You will need to either make a double payment the next month to keep on the loan schedule, or your loan will be extended one month past the ending date.

If there are taxes to be paid each month, this will be added to the amount of the calculated loan payment. There will not be interest charged on the tax amount. If a monthly payment is missed, there will likely be a late fee charged which should be included in your next payment. You will need to either make a double payment the next month to keep on the loan schedule, or your loan will be extended one month past the ending date. -

QuestionHow do I re-calculate amortization when I want to pay an additional amount on the principal each month?

Jill Newman, CPAJill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.

Jill Newman, CPAJill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.

Financial Advisor Using a spreadsheet is the best way for this. Just add a column called "Additional Payment" and input the extra amount you are paying that month. It will automatically calculate that for you. If you are doing this with a calculator, simply reduce the principal by the amount of your additional payment and complete the calculation. Make sure you have informed your lender that any additional payment amount is to be applied to your principal balance. Otherwise it may be applied to your next payment, and this will extend the life of your loan rather than decrease it.

Using a spreadsheet is the best way for this. Just add a column called "Additional Payment" and input the extra amount you are paying that month. It will automatically calculate that for you. If you are doing this with a calculator, simply reduce the principal by the amount of your additional payment and complete the calculation. Make sure you have informed your lender that any additional payment amount is to be applied to your principal balance. Otherwise it may be applied to your next payment, and this will extend the life of your loan rather than decrease it.

References

- ↑ http://www.myamortizationchart.com/articles/how-is-an-amortization-schedule-calculated/

- ↑ http://www.calculatorsoup.com/calculators/financial/amortization-equal-principal-payments-calculator.php

- ↑ http://www.investopedia.com/terms/a/amortization_schedule.asp

- ↑ http://themortgagereports.com/11183/bi-weekly-mortgage-payments-will-you-pay-your-mortgage-faster

- ↑ https://www.creditkarma.com/calculators/amortization

- ↑ http://www.thetruthaboutmortgage.com/amortization/

- ↑ http://www.bankrate.com/finance/mortgages/pay-extra-toward-mortgage-principal.aspx

- ↑ https://www.bankrate.com/glossary/a/amortization-table/

About This Article

To calculate amortization, start by dividing the loan's interest rate by 12 to find the monthly interest rate. Then, multiply the monthly interest rate by the principal amount to find the first month's interest. Next, subtract the first month's interest from the monthly payment to find the principal payment amount. Once you've done that, repeat the process for the second-month loan payment. Finally, subtract the principal amount paid in the first month from the principal amount paid in the second month to calculate the amortization. To learn more from our Accountant co-author, like how to apply amortization to the entire term of the loan, keep reading!