This article was co-authored by Jill Newman, CPA. Jill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.

This article has been viewed 261,684 times.

A bill for payment, also called an invoice, is a document given to someone who makes a purchase, detailing the service performed and requesting payment.[1] For example, if you are a landscaper and added shrubs or plants to a client's front lawn, you would give your client a bill for your service in order to receive payment.

Steps

Choosing a Format

-

1Create a professional invoice. If you write bills for payment often, you may want to create an invoice template you can modify each time you send a new one to a client. This is especially useful for contractors or other people who perform ongoing services. You can create an invoice template using your favorite word processing software or by searching for a template online.[2]

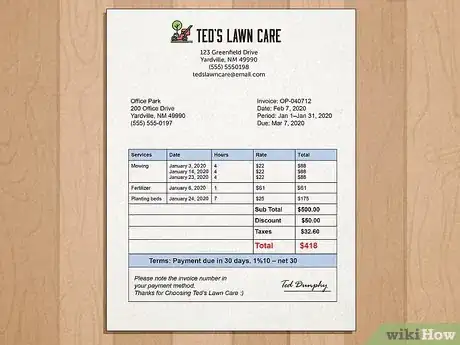

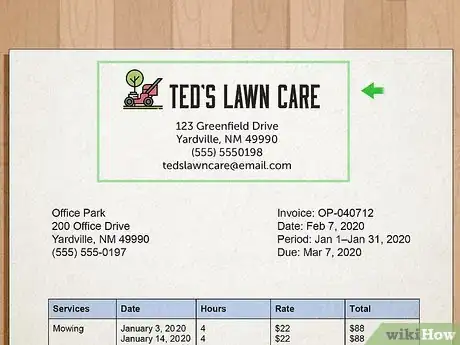

- An invoice includes a header with your name (or your business name), your address and phone number, and your company logo, in addition to a detailed account of services rendered, payment owed, and payment instructions.

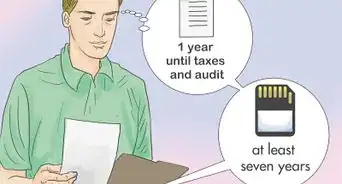

- Invoices are usually created electronically, numbered, and saved to a computer. This way you always have a copy of the invoice and don't have to worry about losing a piece of paper. Be sure, however, that you also back up your files using a file storage service, such as Google Drive or Dropbox. That way, if the hard drive on your computer crashes, you still have backup copies of your invoices.

- Choose a numbering system that makes it easy for you to organize your records. One option is to use the current date, so "INV123116" is the invoice you prepared on December 31, 2016. If you prepare more than invoice on the same day, you can add the vendor's initials.

-

2Pick up an invoice book. Invoice books are available at office supply stores. They contain forms with spaces for services rendered and payment information. Each time you need to write a bill for payment, you fill in the blanks.

- Invoice books are useful for people writing bills for items they have sold. For example, if you sell homemade cakes, it might be easier to write out a bill for payment instead of creating an invoice on the computer each time you make a sale.

- Choose an invoice book with a layer of ditto paper underneath each blank bill so that you and the customer both get a copy.

- You're still going to want safe storage, though. Be sure to keep your copy of the invoices in a fire-proof box.

Advertisement -

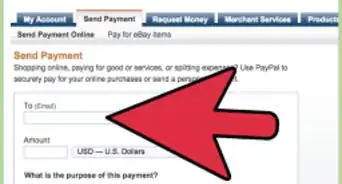

3Use an online payment system. PayPal or Square both allow you to send invoices.[3] There is a fee for this service (2.9% + 30¢ per invoice as of January 2017), but the ease of paying electronically may lead to more reliable payments.

- From within your PayPal account, select the "Send & Request" menu option at the top. Then, select "Create and Manage Invoices." Finally, click on the "Create" button to create a new invoice.

- You'll need to know the email address of your client for the "Bill To:" section of the invoice. PayPal or Square will send the invoice to the account with that email address.

-

4Get a dedicated invoice app. Invoice apps such as Invoice2go let you send and track invoices from your phone, and set up automatic payment reminders. Customers can pay you online using a debit or credit card.

-

5Create an invoice with your accounting software. If you use accounting software to manage your business, it may include an invoice system. QuickBooks, for example, has a user-friendly "Invoice" button on the dashboard that walks you through the process. Your clients won't have an instant payment option, but you can easily track the status of your invoices alongside the rest of your business records.

Including Basic Information

-

1Include your company's information. Whether you make an invoice on the computer or use an invoice book, write the name of your company at the top. Include the following information about your company just below the company name:

- The complete address

- The phone number

- The email or any other pertinent contact information

-

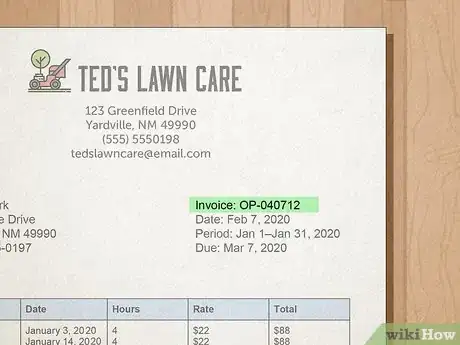

2Provide the date. It's always important to you and your clients to know the date of the invoice. That's because payment is usually due within a certain number of days of the date on the invoice.

-

3Number the invoice, if necessary. You'll number the invoice sequentially according to how many transactions you've had with the client. For example, if you've sold cakes to the same client on three different occasions, the invoice for the third sale should be #3.

- If you're using invoice slips that you purchased at an office supply store, the invoices will already be numbered.

- If you're using accounting software or PayPal, the invoice will also be automatically numbered.

-

4Write the client's information. Include the customer or client's name or company name. If you performed services for the client as a contractor, you should also include the company address and phone number.

Writing the Specifics

-

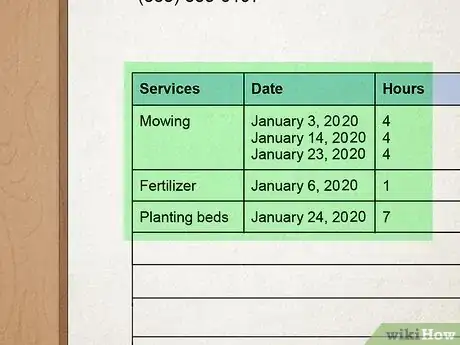

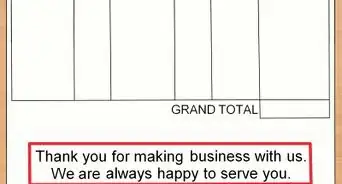

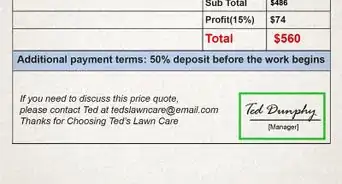

1Write a description of services rendered. Include all the work, services or products you provided the client. If you provided more than one service, created an itemized list. Include the following information about each item on the list:

- The service rendered or product sold. For example, "1 Large Sheet Cake with Floral Accents."

- The date the service was performed.

- The cost of the service.

- After each item has been listed, calculate the total and include the final amount owed.

-

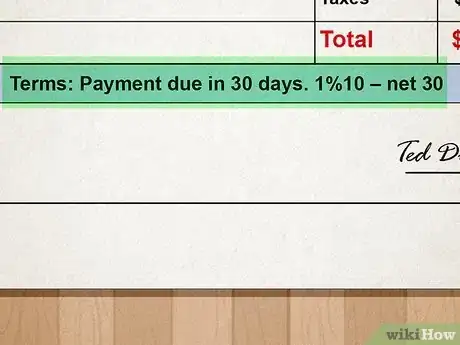

2Specify payment terms. If you expect the bill to be paid by a certain date, include that information. Detail what type of payment you are willing to receive, be it cash, check, or credit card.

- Calculate any taxes that will be added to the cost. Look up the sales tax in your region so you can accurately calculate the amount owed.

-

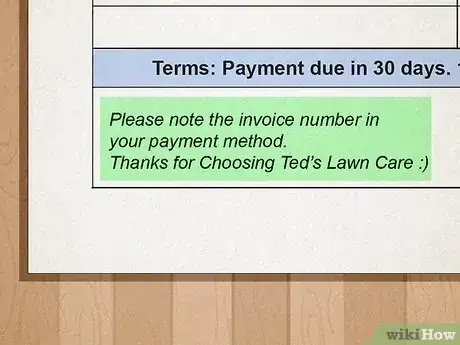

3Provide additional information. At the bottom of the bill, write a description of your return policy. You can also take the opportunity to thank the client for his or her business and list other products or services you offer.

- Include other terms of payment; for example, inform the customer that X amount of interest will be charged after 30 days of nonpayment.

Expert Q&A

Did you know you can get expert answers for this article?

Unlock expert answers by supporting wikiHow

-

QuestionHow do you write up an invoice for repairing a hole in a wall?

Jill Newman, CPAJill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.

Jill Newman, CPAJill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.

Financial Advisor This type of handyman repair is usually invoiced as time and materials. List the cost of the materials you purchased to make the repair, plus a slight markup. Also calculate your time spent getting to the job site, doing the repair, and cleaning up afterwards. Write this down and multiply by the hourly rate you and the customer agreed to. Add together the materials cost and labor cost to get the invoice total.

This type of handyman repair is usually invoiced as time and materials. List the cost of the materials you purchased to make the repair, plus a slight markup. Also calculate your time spent getting to the job site, doing the repair, and cleaning up afterwards. Write this down and multiply by the hourly rate you and the customer agreed to. Add together the materials cost and labor cost to get the invoice total. -

QuestionHow long after the work can you take to bill the customer?

Jill Newman, CPAJill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.

Jill Newman, CPAJill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.

Financial Advisor Strictly speaking you can take as long as you like, but it is in your best interest to bill immediately. If the job is fresh in your and your customer's mind, it will be easier to settle any disputes, and you will be more likely to receive prompt payment. Billing and collecting in a timely manner is also important for the financial health of your business.

Strictly speaking you can take as long as you like, but it is in your best interest to bill immediately. If the job is fresh in your and your customer's mind, it will be easier to settle any disputes, and you will be more likely to receive prompt payment. Billing and collecting in a timely manner is also important for the financial health of your business.

References

About This Article

A bill for payment, or an invoice, should detail the services performed and request payment for them. When writing up your invoice, include a header with your name or your business’ name, your address, and your phone number. Also, include your company’s logo and a numbering system that makes it easy for you to organize your records. Another option is to pick up an invoice book at an office supply store and fill in the blanks. Whichever type of form you use, make sure to note the date and the client’s information, like their name and address. Include all of the work, services, or products you provided for the client and the cost of each service. Calculate the total due and include any information on the expected payment date. For more information from our Accountant co-author, including how to write a description of your return policy, keep reading!