This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 13,176 times.

Learn more...

Credit cards are a convenient way to make purchases and build your credit history, but you have to be careful. Managing credit cards can be really tricky, and if you don’t keep a close eye on your purchases, you could easily go over your budget without realizing it. The best way to avoid this is by tracking your spending. Once you see where your money is going, it’s a lot easier to make changes if you have to. Even better, tracking your spending isn’t hard! You don’t have to be a budgeting genius, and all it takes is a bit of extra time reviewing your finances.

Steps

Monitoring Your Purchases

-

1Check all of your account statements as soon as they arrive. Whether you get paper statements in the mail or electronic statements in your email, it’s easy to ignore your credit card updates. Get into the habit of checking each purchase on your statement when it comes. This is important to understand what you're spending money on and get a full picture of your financial situation.[1]

- Whether you get paper or electronic statements, they normally come once a month. If you have multiple credit cards, be sure to check the statements for each one.

- If you get paper statements, make sure you shred them when you’re done to avoid identity theft.

- Checking your statements closely is also an important way to catch any fraudulent purchases.

-

2Pick a day each week to review your accounts if you use online banking. If you use online banking, then checking your account more often is easy. Set a regular day, like Saturday each week, to log in to your account and see what you bought during the previous week. This way, you can keep track of your spending without waiting for your statements to come.[2]

- Some budgeting and money management apps give you a full readout of all your accounts. This makes checking up on your finances even easier.

- If you often forget to do this, schedule the time and set a reminder on your phone or computer. Make it a regular thing so you get into the habit of checking your finances.

Advertisement -

3Keep your receipts if you want to verify all of your purchases. This is an old-fashioned way of tracking all of your credit card purchases, but it can still be a good trick. Save the receipts from all your credit card purchases and check them against your monthly statements.[3] This way, you can catch any fraudulent charges and avoid losing money.

- You can get rid of your receipts as soon as you check them against your monthly statement and have verified all your purchases.

- If there are any suspicious charges and you can’t verify them, report it to your bank right away. As long as you report fraud early enough, you can avoid paying for the purchases.

-

4Put all of your purchases on your credit card so you can keep track. Because you get statements every month and can check your purchases online, it’s actually a lot easier to track your credit card spending than your cash spending. If you really want to keep track of all your spending, then it makes sense to use your card more often. This way, you’ll have a record of every purchase and can get a clear picture of your finances.[4]

- This is also helpful if you have a rewards or cashback card. By putting all your purchases on your card, you’ll build points that you can cash in later on.

- Use autopay to pay all of your bills with your credit card. In addition to being easier to track, this will help ensure your bills always get paid on time.

- If you already carry a lot of credit card debt or have trouble staying within your budget, then using your card more often might not be the best idea. In this case, use cash more often to keep your purchases under control.[5]

Using Tracking Tools

-

1Enroll in online banking so you can view your accounts at any time. The advantage of using credit cards is that you can check your purchases at any time with an online account. If you aren’t enrolled in online banking for your credit card accounts, do that as soon as possible. Then you can conveniently log in and check your purchases without waiting for your monthly statement to come.[6]

- Most banks also have smartphone apps you can download. With an app, you can check your account on the go at any time.

- Keep your password and login information for your online baking accounts secret. If anyone accesses your accounts, they could take your money.

-

2Sign up for credit card transaction alerts. Most credit card companies offer text or email alerts when you make a purchase. This is a good way to stay on top of your purchases and get a reminder when you spend any money with your card.[7]

- You can personalize these alerts if you want to. For example, you can set it to alert you only for charges over $100 if you want to cut down on large purchases.

- Purchase alerts are also a good way to catch any fraudulent purchases quickly.

-

3Download a spending tracker app to itemize your purchases. Luckily, there are tons of apps around now that make tracking your purchases a lot easier. These apps link to your credit cards and track your purchases as they happen. This gives you a handy readout of all your spending, especially if you have more than 1 credit card.[8]

- Some popular budgeting apps are Mint, Personal Capital, You Need a Budget, and Pocket Guard. Some of these are free and some have a small fee for premium features.

- More advanced apps can link with your other accounts and give you a readout of your income, cashflow, and investments, in addition to your spending. These are great tools for tracking your complete financial health.

-

4Use a rewards app to keep track of your credit card rewards. If you have a cashback credit card or rewards program, then it can be tough to keep track of it all. You don't want to miss out on those points! Luckily, there are some apps that can track and add up all your rewards, even across multiple cards. If you have trouble remembering all your rewards, try one of these apps.[9]

- The most popular rewards app is AwardWallet. This tracks all of your cashback points, rewards, and frequent flyer miles so you'll always know where you stand.

- Not all credit cards participate in AwardWallet, so confirm that yours does before using it.

Managing Your Budget

-

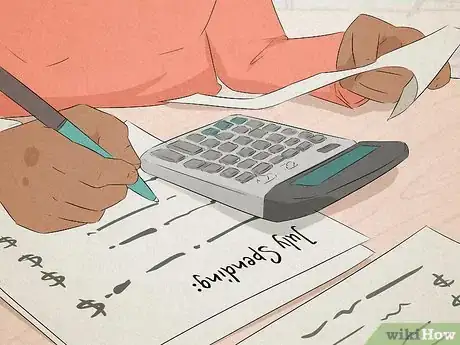

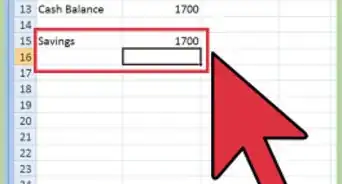

1Pull up a summary of all of your spending for the previous month. Either using your monthly statement or a budgeting app, open up your previous month’s expenses. This way, you can break down your spending and get a good idea of where your money is going.[10]

- Use a month where your spending was pretty average. If you made an unusually large purchase the previous month or spent less than normal, then it’s not a good month for comparison. Choose a different month that's more normal.

-

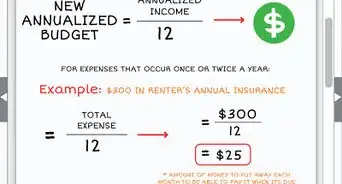

2Break your expenses into categories. Your money could be going to all kinds of different things, some of which are important and some might be unnecessary. Go through your previous month’s spending and group all of your purchases into categories. Categories could include rent or mortgage, food, clothes, gas, transportation, entertainment, restaurants, and anything else that you spend money on.[11]

- If you have a particular hobby, it might make sense to give it its own category. For instance, gaming is technically entertainment, but if you spend a lot on it, then a specific gaming category gives you a clear idea of what it’s costing you.

- Your statement or spending apps might break down your purchases for you already. Mint and Personal Capital, for example, automatically break down your spending into categories. Using one of these apps makes breaking down your budget much easier.

- Remember to double check the way your apps categorize your spending. Some categories might be incorrect, and you can re-classify them into the right one to manage your budget.

-

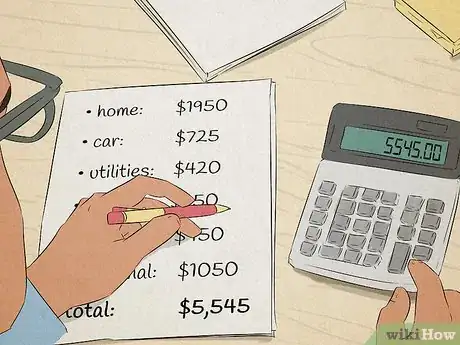

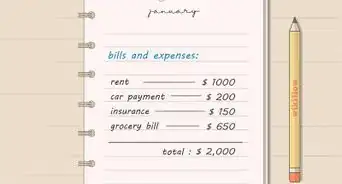

3Add up all of your necessary expenses for the month. Any budget can be divided between necessary and unnecessary expenses. Necessary expenses are things that you need to function each month, like rent or mortgage, food, utilities, taxes, insurance, and car payments. Circle these expenses or write them down in a separate column, then add them up to see what you have to spend every month. Everything that’s left over is a discretionary expense, meaning you don’t need it to live.[12]

- On the other hand, discretionary or unnecessary expenses are entertainment, trips to the bar or coffee shop, clothing purchases above what you need, designer items, and everything else that you can live without.

- If you aren’t sure how to categorize an expense, really ask yourself if you can live without it. If you can skip it without major hardship, then it’s not a necessary purchase.

-

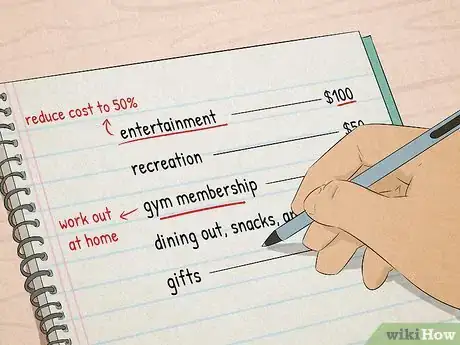

4Identify spending categories that you can cut back on. Once you find out which expenses are necessary and unnecessary, then look at areas in your budget where you’re spending a lot of money. You might be spending a lot on unnecessary purchases. Make a commitment to cut back on some of this spending if you're going over your budget.[13]

- If you see that your daily coffee trips are starting to add up, for instance, you could make coffee at home instead. However, avoid setting rules that are too strict, like only eating out once a month. That could cause you to end up overcompensating and spending more.

- Some of your necessary expenses could be scaled back too. For instance, if you tend to spend a lot of money on clothes, you might actually save by using a subscription box service.

- You might also find that your budget is in pretty good shape after you break everything down. In this case, congratulations!

-

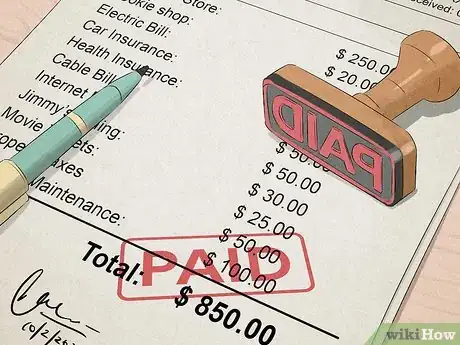

5Pay off your card in full each month if you can. This is the best way to stay out of credit card debt. Pay your balance in full at the end of each billing cycle by transferring the money straight from your bank account. This way, you won't have to pay any interest and won't build debt.[14]

- If you manage your budget and only buy things you can afford, then paying your card off shouldn't be a problem most of the time.

- This isn't always possible. You might have to make an unusually large purchase and pay it off over time, and this is okay. Just make sure you pay what you can consistently to get rid of that debt quickly.

-

6Try to pay more than the minimum each month if you can't pay the full balance. It's completely normal if you have some debt and can't pay it off in full at the end of the month. The best way to get rid of your debt gradually is by paying more than the minimum on your balance each month. If you only make minimum payments, the interest will grow. Do your best to pay as much as you can above the minimum. This will get rid of your debt faster.[15]

- For example, if you have a $2,000 balance and your minimum payment is only $25, it'll take a long time to pay that debt off. In the meantime, the interest payments will keep growing. Try to pay more like $100 each month if you can so the debt decreases over time.

- If you have multiple credit cards, it's best to focus on paying the ones with the highest interest rates first. This way, you'll gradually pay down your debt without getting deeper in the hole with interest.

-

7Avoid late fees by submitting your payments on time. It's easy to lose track of time, but don't get sloppy with your scheduling. If you pay bills late, you'll be hit with extra fees and your credit score could drop. Don't give up money like this! Mark down when all your bills are due and pay them on time.[16]

- Some banks let you set up automatic transfers on the day that a bill is due. You could set this up for your credit card account so you don't miss any payments.

- You could also set reminders on your phone to go off when your bills are due. This is a simple way to stay organized.

-

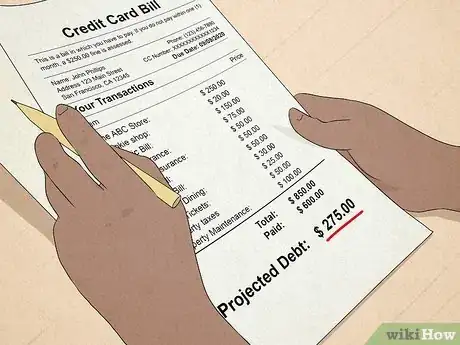

8Look at the projected debt on your statement to see what you'll pay. If you don’t pay off your credit card in full every month, then you’ll be charged interest on the unpaid balance, meaning you’ll end up paying more than you actually spent. In many countries, credit card companies are required to show you want you’ll have to pay if you only make minimum payments on the balance. Look on your statement for this box showing what you’ll owe if you don’t pay off the card in full to get a full picture of what your purchases will cost you.[17]

- For example, you may have made a $500 purchase. However, if your card had a 15% interest rate and you only make minimum payments, you could end up paying closer to $600 by the time the card is paid off.

- Paying attention to the interest is very important for avoiding credit card debt. Interest rates are commonly 15-20%, so you’ll end up in a lot of debt if you make big purchases without paying them off.

-

9Ask your bank to lower your credit limit if you can't stay in your budget. Using credit cards can be tempting, especially if you’re not used to keeping your budget under control. In this case, a credit limit that’s way higher than your usual expenses isn’t helpful. You might be very tempted to spend too much and go over budget. In this case, contact your bank and ask them to lower your limit so there’s less temptation for you.[18]

- For example, if your card has a $10,000 limit, but you only need $2,000 per month for your normal expenses, then ask to have your limit lowered to $4,000. This covers your expenses and leaves some extra room for unexpected purchases, but there’s a lot of risk of going very far over budget.

- This is only recommended as a last resort if you have a lot of trouble staying within your budget. Lowering your credit limit will also lower your credit score, since you'll be using a larger percentage of your available credit each month. Try other budgeting advice before taking this step to maintain your credit score.

- You could always ask to have your limit raised again if you get better at budgeting in the future.

Expert Q&A

Did you know you can get expert answers for this article?

Unlock expert answers by supporting wikiHow

-

QuestionHow can I cut back on high spending even if I'm a high earner?

Priya MalaniPriya Malani is a Financial Advisor and the Founding Partner of Stash Wealth, a financial planning and investment management firm for HENRYs™ (High Earners, Not Rich Yet). She has over 15 years of wealth management and financial advising experience. Priya's work with Stash Wealth has been featured in Fortune, Wall Street Journal, and CNBC as well as entertainment and lifestyle brands such as the NYPost, Bustle, SiriusXM, and Refinery29. She earned a BA in Economics from Agnes Scott College in 2004.

Priya MalaniPriya Malani is a Financial Advisor and the Founding Partner of Stash Wealth, a financial planning and investment management firm for HENRYs™ (High Earners, Not Rich Yet). She has over 15 years of wealth management and financial advising experience. Priya's work with Stash Wealth has been featured in Fortune, Wall Street Journal, and CNBC as well as entertainment and lifestyle brands such as the NYPost, Bustle, SiriusXM, and Refinery29. She earned a BA in Economics from Agnes Scott College in 2004.

Financial Advisor & Founding Partner, Stash Wealth It's very common for high earners to buy more house than their monthly income can comfortably support, so try not to buy on the higher range of what you're pre-qualified for. Food and alcohol is another money trap—however, don't deprive yourself by creating strict rules, because inevitably, you'll overcompensate and spend even more in the end.

It's very common for high earners to buy more house than their monthly income can comfortably support, so try not to buy on the higher range of what you're pre-qualified for. Food and alcohol is another money trap—however, don't deprive yourself by creating strict rules, because inevitably, you'll overcompensate and spend even more in the end.

Warnings

- Although you don’t have to pay off your credit card right away, don’t use it to buy things you can’t afford. This can leave you with a lot of debt that takes a long time to get rid of.⧼thumbs_response⧽

References

- ↑ https://www.nerdwallet.com/article/finance/tracking-monthly-expenses

- ↑ https://www.moneyadviceservice.org.uk/en/articles/managing-your-credit-card-account

- ↑ https://www.centralkansas.k-state.edu/home-family/money-management/Tracking_Your_Spending.pdf

- ↑ https://www.thesimpledollar.com/credit-cards/how-to-create-a-budget-with-a-credit-card/

- ↑ https://www.investopedia.com/articles/personal-finance/092214/credit-card-or-cash.asp

- ↑ https://www.forbes.com/sites/moneybuilder/2011/06/10/5-easy-ways-to-track-credit-card-spending/#5b7cb72b468c

- ↑ https://www.forbes.com/sites/moneybuilder/2011/06/10/5-easy-ways-to-track-credit-card-spending/#5b7cb72b468c

- ↑ https://www.nerdwallet.com/article/finance/tracking-monthly-expenses

- ↑ https://creditcards.usnews.com/articles/credit-card-management-apps-to-stay-on-top-of-payments

- ↑ https://www.nerdwallet.com/article/finance/tracking-monthly-expenses

- ↑ https://www.forbes.com/sites/moneybuilder/2011/06/10/5-easy-ways-to-track-credit-card-spending/#5b7cb72b468c

- ↑ https://files.consumerfinance.gov/f/documents/cfpb_your-money-your-goals_spending_tracker_2018-11_ADA.pdf

- ↑ https://www.nerdwallet.com/article/finance/tracking-monthly-expenses

- ↑ https://www.moneyadviceservice.org.uk/en/articles/managing-your-credit-card-account

- ↑ https://www.nerdwallet.com/article/finance/credit-card-debt

- ↑ https://www.moneyadviceservice.org.uk/en/articles/managing-your-credit-card-account

- ↑ https://www.forbes.com/sites/moneybuilder/2011/06/10/5-easy-ways-to-track-credit-card-spending/#5b7cb72b468c

- ↑ https://www.thesimpledollar.com/credit-cards/how-to-create-a-budget-with-a-credit-card/