This article was co-authored by Ara Oghoorian, CPA. Ara Oghoorian is a Certified Financial Accountant (CFA), Certified Financial Planner (CFP), a Certified Public Accountant (CPA), and the Founder of ACap Advisors & Accountants, a boutique wealth management and full-service accounting firm based in Los Angeles, California. With over 26 years of experience in the financial industry, Ara founded ACap Asset Management in 2009. He has previously worked with the Federal Reserve Bank of San Francisco, the U.S. Department of the Treasury, and the Ministry of Finance and Economy in the Republic of Armenia. Ara has a BS in Accounting and Finance from San Francisco State University, is a Commissioned Bank Examiner through the Federal Reserve Board of Governors, holds the Chartered Financial Analyst designation, is a Certified Financial Planner™ practitioner, has a Certified Public Accountant license, is an Enrolled Agent, and holds the Series 65 license.

There are 9 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 91% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 209,127 times.

The economy always has and always will have its ups and downs. It's easy to coast through the good times, but how do you come out of the tough times unscathed? By preparing adequately, cutting costs, and making sure you still have some income coming in, you can emerge out of a recession just as strong as you were before it.

Steps

Preparing For a Recession

-

1Create an emergency fund. If you don't already have you an adequate emergency fund set aside, specify a goal for how much money you want to add to it every month. Your fund should be kept in a savings account with your bank.[1]

- While normally it's recommended that a two-income couple keep three months' worth of expenses in an emergency fund, during a downturn the recommended amount is six months' worth instead.[2] This is especially important if you're in an industry that gets hit hard by a recession (e.g., construction, financial services, food) and if you're a one-income family.

- Dual-income families may be safe with three or four months' worth of savings.

- If you're self-employed, you should set aside up to a year's worth of expenses.

-

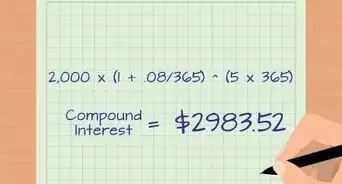

2Pay off debt.[3] You should always work to be debt free, but when a recession is coming it's even more important to do so. Focus first on paying off your debt with the highest interest rate, which is usually your credit card debt. From here, pay off debts with lower interests rates as you can, working to lower your debt as much as possible. Reducing your debts will lower your monthly expenses and give you a better chance of surviving a recession if you lose your job or need to cut down on spending.

- Money saved from not having to pay debt repayments can then be saved for your emergency fund or otherwise saved. Saved money can be invested in securities when their prices drop during a recession.[4]

Advertisement -

3Create additional income streams. In a recession, there's always the chance that you might lose your job. Your primary focuses should be to keep your current job and be ready to enter the market again for a new one if you lose it (keep an updated resume, investigate job opportunities, etc.). However, you can also increase your financial security by creating separate income streams. These can be a second job, an online business, or any form of passive income.

- Even if you can only make an additional $500 or $1,000 per month, this extra income can help you get through tough time if your primary source of income dries up.

-

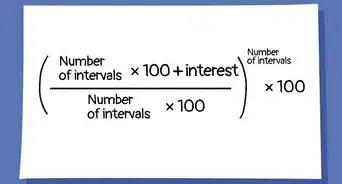

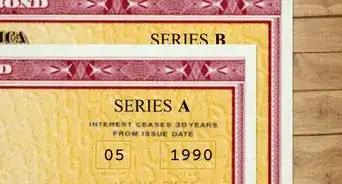

4Diversify your investments. During a recession, stock prices will usually fall dramatically, which means your investment accounts could be hit hard. While many companies, and their stock prices, will recover out of the recession, some will enter default and cause you to lose money. You can reduce the risk of this happening by spreading out your investments. Think about buying bonds, investing in securities from other countries, or investing in precious metals. These investments, particularly the last two, may move independently of the market and can protect your assets in a recession.

- You can also look outside the market to invest in real estate, like land or apartments, that will usually appreciate in value over time, sometimes even through recessions.[5]

Surviving a Recession

-

1Talk it over. Sit down with every member of your household and go over your finances. How you resolve and differences in your approach to money will have a profound effect on your relationship's chances of succeeding.

- Now is the perfect time to set an example for your children, and show them how a family can pull together during tough times and everyone can chip in.[6]

-

2Reduce expenses. There are many ways to cut expenses during a recession. In many cases, you can maintain your same quality of life while focusing on living lean and cutting out extravagant and unnecessary expenses.

- Cut discretionary spending. Buy nothing if you don't need it to live. Resist sales pitches. Don't even think about using that new credit card offer in the mail, even if it does have a low APR and no payments for two years, you should evaluate it carefully.

- Transportation: Carpool as much as you can. Consider commuting by bicycle or even living without a car. But if that's not practical, look for ways to save money on gas.

- Housing: Get a roommate or consider relocating to an area with a lower cost of living. Maybe you can move in with family members until the economic downturn blows over. Keeping the peace in a multigenerational household isn't always easy, but it has its own rewards.

- Food: Stop going out to eat; instead, try to cook at home from scratch more often. Consider the benefits of the slow food movement. If you don't have enough time to cook, try doing it just once a month. Find good deals at a local farmers' market.[7]

-

3Keep the money flowing in. If you have a job, be an amazing employee. Now is not the time to slack. Show up early, stay late, and volunteer for projects. Pick up the slack for other workers; it's what will happen when people get laid off, anyway, so now is the time to prove yourself. Look for ways to save your employer money, especially if you see your employer doing little things to that effect, like encouraging employees to turn off their computers. Try to quantify your efforts in terms of how you've raised profits and cut costs. Start networking so that in case you still get laid off, you have a safety net of contacts who might be able to help.

- If you don't have a job, find other ways to make money fast. Focus on cutting your expenses, as described in the previous step, and consider volunteering; if you've got the spare time, there are organizations that will need your help, and you could build good karma in your community.

-

4Keep saving. If you can, fit saving into your budget, even during a recession. You should make every effort to continue contributing to retirement accounts and college funds, if you have them. If you don't have the money to contribute, consider cutting out other expenses to make it work. When you come out of the recession, you'll be glad you kept up with saving and your accounts will reflect the interest you've earned during that time.

- Take a portion of your paycheck and move it to a savings account right after you get paid.[8]

- In addition, putting money into the stock market during a recession can be a wise move. If you buy stock in reputable companies when prices are low, you stand to gain a lot of money when they come back up out the recession.

-

5Enjoy life. In order to avoid recession depression, don't let fear control you. An intense feeling of paranoia can make you an inflexible employee and also strain your relationships. Be thankful for what you have, and make sure to have fun. Instead of not taking a family vacation, for example, take a Staycation or exchange your home for free accommodation instead. Invite your family to think of creative ways to save money without skimping on happiness. Accept difficult times as a challenge for your fortitude and adaptability.

Getting Your Business Through a Recession

-

1Develop a risk management plan. If you haven't already done so, create a plan for what to do in the event of a recession. This risk management plan should include a set of actions you plan to take in the event that you lose business or customers due to an economic downturn. After all, it will be easier to think of what to do before a recession that in the heat of the moment as your employees are panicking and unsure of what to do. Make sure to create concrete steps to follow and then transmit the plan to other managers or partners so that they can follow it as well.[9]

-

2Reduce expenses. Your first course of action when hit by a recession should be to cut expenses where you can. This will help your business stay in operation while you work out a more permanent solution or until the economy recovers. Look around to reduce overhead costs like utilities, administration, and wasted materials. You can also reduce your inventory levels so that your assets aren't so tied up in product that may go unsold for months. If those don't work, consider:

- Cutting your advertising spending. Pull out of traditional advertising like television and radio and instead focus on improving your social media presence. Doing so is free, even though it might take more of your time.

- Downsizing. Your other option to downsize. This can mean either reducing employees or moving to a cheaper location. Your remaining employees may have to work harder, but your business will at least be able to survive.[10]

-

3Cross-train your employees. If you do end up letting some employees go, you will need others to step into their roles. This is why it is important to cross-train your employees for various roles within the business. This is best if done before it is needed.[11]

-

4Focus on customers. You should focus all of your efforts on retaining regular customers and maintaining your relationships with them. Make sure that they know that their business is appreciated. In addition, keep your quality just as high as before, even it you've had to make other cuts around the business.

- A recession is also a good opportunity to evaluate your customers. You may have those customers who are not profitable to work with. A recession is the perfect time to sever these relationships and seek new ones.[12]

-

5Don't cut your prices. Many businesses turn to deals and sales when the recession is hurting them. However, doing so will only make it harder for customers to justify paying your regular prices when the recession is over. In addition, these lower prices can cut into much needed profits. The only exception is that you may want to offer one-time payment extensions or discounts to customers that are also having a hard time. Just be clear to them that you are only extending this service once.[13]

Expert Q&A

Did you know you can get expert answers for this article?

Unlock expert answers by supporting wikiHow

-

QuestionWhat should you not do in a recession?

Benjamin PackardBenjamin Packard is a Financial Advisor and Founder of Lula Financial based in Oakland, California. Benjamin does financial planning for people who hate financial planning. He helps his clients plan for retirement, pay down their debt and buy a house. He earned a BA in Legal Studies from the University of California, Santa Cruz in 2005 and a Master of Business Administration (MBA) from the California State University Northridge College of Business in 2010.

Benjamin PackardBenjamin Packard is a Financial Advisor and Founder of Lula Financial based in Oakland, California. Benjamin does financial planning for people who hate financial planning. He helps his clients plan for retirement, pay down their debt and buy a house. He earned a BA in Legal Studies from the University of California, Santa Cruz in 2005 and a Master of Business Administration (MBA) from the California State University Northridge College of Business in 2010.

Financial Advisor

-

QuestionWhat's the best thing to do to prepare for a recession?

Benjamin PackardBenjamin Packard is a Financial Advisor and Founder of Lula Financial based in Oakland, California. Benjamin does financial planning for people who hate financial planning. He helps his clients plan for retirement, pay down their debt and buy a house. He earned a BA in Legal Studies from the University of California, Santa Cruz in 2005 and a Master of Business Administration (MBA) from the California State University Northridge College of Business in 2010.

Benjamin PackardBenjamin Packard is a Financial Advisor and Founder of Lula Financial based in Oakland, California. Benjamin does financial planning for people who hate financial planning. He helps his clients plan for retirement, pay down their debt and buy a house. He earned a BA in Legal Studies from the University of California, Santa Cruz in 2005 and a Master of Business Administration (MBA) from the California State University Northridge College of Business in 2010.

Financial Advisor

-

QuestionWhat should you do with your investments during a recession?

Benjamin PackardBenjamin Packard is a Financial Advisor and Founder of Lula Financial based in Oakland, California. Benjamin does financial planning for people who hate financial planning. He helps his clients plan for retirement, pay down their debt and buy a house. He earned a BA in Legal Studies from the University of California, Santa Cruz in 2005 and a Master of Business Administration (MBA) from the California State University Northridge College of Business in 2010.

Benjamin PackardBenjamin Packard is a Financial Advisor and Founder of Lula Financial based in Oakland, California. Benjamin does financial planning for people who hate financial planning. He helps his clients plan for retirement, pay down their debt and buy a house. He earned a BA in Legal Studies from the University of California, Santa Cruz in 2005 and a Master of Business Administration (MBA) from the California State University Northridge College of Business in 2010.

Financial Advisor Though you may want to be proactive and be tempted to sell, do not sell. If you have money in the stock market, and the stock market takes a tumble, try your best not to do anything. This is hard, as it goes against human instinct and your desire for control. One of the best things you can do to enforce that strategy is to ignore the financial news

Though you may want to be proactive and be tempted to sell, do not sell. If you have money in the stock market, and the stock market takes a tumble, try your best not to do anything. This is hard, as it goes against human instinct and your desire for control. One of the best things you can do to enforce that strategy is to ignore the financial news

References

- ↑ Ara Oghoorian, CPA. Certified Financial Planner & Accountant. Expert Interview. 11 March 2020.

- ↑ Ara Oghoorian, CPA. Certified Financial Planner & Accountant. Expert Interview. 11 March 2020.

- ↑ Benjamin Packard. Financial Advisor. Expert Interview. 11 March 2020.

- ↑ http://www.askmen.com/money/investing_200/208_investing.html

- ↑ http://www.mymoneycoach.ca/blog/money-saving-tips-how-to-survive-recession.html

- ↑ http://money.cnn.com/2008/07/08/pf/saving/toptips/index.htm?section=money_pf_saving

- ↑ https://www.legalzoom.com/articles/top-ways-to-survive-a-recession

- ↑ Ara Oghoorian, CPA. Certified Financial Planner & Accountant. Expert Interview. 11 March 2020.

- ↑ http://www.business.vic.gov.au/disputes-disasters-and-succession-planning/how-to-manage-risk-in-your-business/prepare-a-risk-management-plan

About This Article

The key to surviving a recession is reducing your expenses, working hard, and staying calm. During a recession, you should avoid buying things you don’t need. Cut down on luxuries like holidays, technology, and eating out, and avoid buying things on credit. It’s okay to treat yourself on occasions, but try to save as much money as you can, in case you need it for an emergency. At work, try to put in extra effort, which will give you the best chance of keeping your job. However, be prepared to find a new job at any time. Start networking so you’ll find out about new job opportunities, and keep your resume up to date. For more tips, including how to get your business through a recession, read on!