This article was co-authored by Marcus Raiyat and by wikiHow staff writer, Eric McClure. Marcus Raiyat is a U.K. Foreign Exchange Trader and Instructor and the Founder/CEO of Logikfx. With nearly 10 years of experience, Marcus is well versed in actively trading forex, stocks, and crypto, and specializes in CFD trading, portfolio management, and quantitative analysis. Marcus holds a BS in Mathematics from Aston University. His work at Logikfx led to their nomination as the "Best Forex Education & Training U.K. 2021" by Global Banking and Finance Review.

There are 11 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 44,481 times.

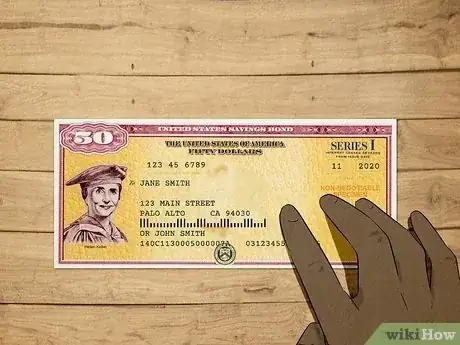

If you’ve stumbled across some old paper bonds your grandparents got you or you purchased electronic bonds and you’d like to check in on your investment, you may need some help calculating your gains. Alternatively, you may simply need some guidance figuring out how much your bond is paying out. In any case, we’ve got you covered. In this article, we’ll break down how you can check the value of government savings bonds—regardless of what kind of bond you’re holding—so that you can make the best financial decisions for you.

Things You Should Know

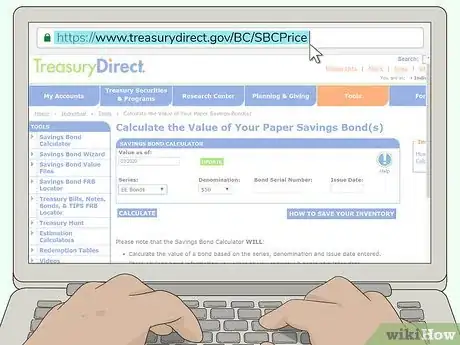

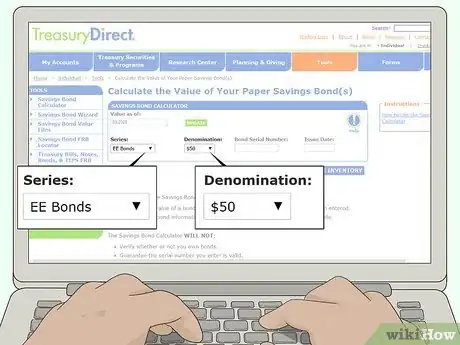

- Use the Treasury Direct bond savings calculator to determine the value of any paper bonds you have.

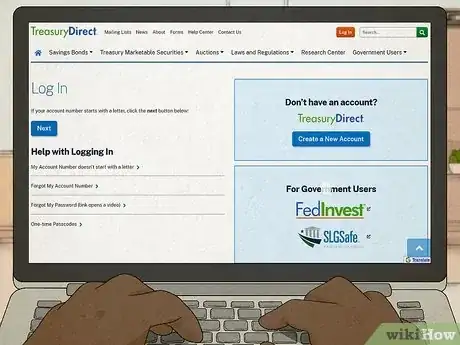

- All electronic savings bonds are hosted on Treasury Direct, the official website of the US Treasury. You can find your bonds’ values there.

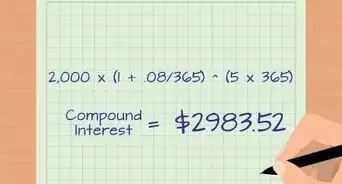

- There are two types of savings bonds today; EE bonds, which pay a fixed rate, and I bonds, which are tied to inflation.

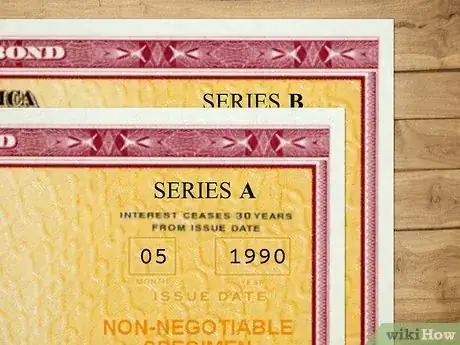

- Bonds will continue to accrue interest until they mature (30 years from issuance), so don’t sell them before their maturity date for maximum value.

Steps

Calculator and Glossary

Community Q&A

-

QuestionI got bonds when I was in the Army. I mailed them to my sister and forgot about them until 2014, so I called and she didn't have them. I bought them in 1973 or 1974. What's the easiest way to find them?

wikiHow Staff EditorThis answer was written by one of our trained team of researchers who validated it for accuracy and comprehensiveness.

wikiHow Staff EditorThis answer was written by one of our trained team of researchers who validated it for accuracy and comprehensiveness.

Staff Answer wikiHow Staff EditorStaff AnswerUnfortunately, with physical bonds you can't redeem them if you've lost them and you don't know when you bought them specifically. If you do have the month and year of purchase, you can file FS form 1048 in front of a notary at a bank and send that to the US Treasury. They'll search their records to see if they can find the bonds you bought.

wikiHow Staff EditorStaff AnswerUnfortunately, with physical bonds you can't redeem them if you've lost them and you don't know when you bought them specifically. If you do have the month and year of purchase, you can file FS form 1048 in front of a notary at a bank and send that to the US Treasury. They'll search their records to see if they can find the bonds you bought. -

QuestionWhy does my bond say not eligible for payment? It is 24 years old.

wikiHow Staff EditorThis answer was written by one of our trained team of researchers who validated it for accuracy and comprehensiveness.

wikiHow Staff EditorThis answer was written by one of our trained team of researchers who validated it for accuracy and comprehensiveness.

Staff Answer wikiHow Staff EditorStaff AnswerIs it possible you've got a corporate or municipal bond? A 24-year-old government bond is eligible for payment. Some non-government bonds must be held to maturity, though.

wikiHow Staff EditorStaff AnswerIs it possible you've got a corporate or municipal bond? A 24-year-old government bond is eligible for payment. Some non-government bonds must be held to maturity, though. -

QuestionForm to pay taxes on EE interest when collected?

wikiHow Staff EditorThis answer was written by one of our trained team of researchers who validated it for accuracy and comprehensiveness.

wikiHow Staff EditorThis answer was written by one of our trained team of researchers who validated it for accuracy and comprehensiveness.

Staff Answer wikiHow Staff EditorStaff AnswerYou shouldn't need to fill out a form. Download the 1099-INT from your Treasury Direct account. It'll have everything you need to file your taxes.

wikiHow Staff EditorStaff AnswerYou shouldn't need to fill out a form. Download the 1099-INT from your Treasury Direct account. It'll have everything you need to file your taxes.

References

- ↑ https://www.treasurydirect.gov/BC/SBCPrice

- ↑ https://www.treasurydirect.gov/images/content/Paper-bond-info.png

- ↑ https://www.treasurydirect.gov/savings-bonds/cashing-a-bond/

- ↑ https://www.forbes.com/advisor/banking/how-to-redeem-savings-bonds/

- ↑ https://www.treasurydirect.gov/savings-bonds/cashing-a-bond/

- ↑ https://www.treasurydirect.gov/savings-bonds/cashing-a-bond/

- ↑ https://www.treasurydirect.gov/auctions/how-auctions-work/where-you-hold-securities/

- ↑ https://treasurydirect.gov/forms/savpdp0039.pdf

- ↑ https://time.com/nextadvisor/banking/savings/when-to-cash-in-your-savings-bonds/

- ↑ https://time.com/nextadvisor/banking/savings/when-to-cash-in-your-savings-bonds/

- ↑ https://www.forbes.com/advisor/investing/series-ee-bonds/

- ↑ https://www.treasurydirect.gov/savings-bonds/ee-bonds/

- ↑ https://www.forbes.com/advisor/investing/what-are-i-bonds/

- ↑ https://www.treasurydirect.gov/savings-bonds/cashing-a-bond/old-bonds-from-other-series/