This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 33,524 times.

Workers' compensation is a form of insurance that provides short- or long-term wage replacement for workers who are injured on the job. Each state administers its own workers' compensation program that covers employees who work for either the state government or private companies. The federal government, through the United States Department of Labor, administers its own workers' compensation program that covers federal employees. Workers' compensation fraud occurs when someone makes a false representation in order to obtain or deny workers' compensation benefits. If you suspect that someone has committed fraud, then you can report it to the appropriate authorities.

Steps

Recognizing Fraud

-

1Understand what workers' compensation is. Workers' compensation is an insurance program that provides workers who sustained a qualifying, work-related injury with short- or long-term wage replacement.[1] Workers' compensation insurance is intended to ensure that workers who are inured on the job receive some form of compensation to help lessen the need of individuals to file personal injury lawsuits against their employers.[2]

-

2Learn the requirements. To qualify for workers' compensation benefits, an individual worker must work for a covered employer and must meet certain threshold eligibility requirements:

- You must work for a covered employer. Generally, an "employer" is a person or organization that has employees.[3] Employers who may not be covered include Native American organizations and employers of maritime workers.

- You must sustain a covered injury. Generally, only an injury sustained in the course and scope of your employment is covered.[4] For example, you if are a delivery driver and you strain your back picking up heavy boxes as part of your job, then the injury arose out of employment. If you strained your back helping your child move into his dorm room, then you did not sustain the injury in the course and scope of your employment.

- Workers' compensation rules vary by state. In some states, workers cannot recover for “stress related” injuries, whereas in other states they can.[5]

Advertisement -

3Confirm the individual is drawing workers' compensation. Not everyone who stops working because of a claimed injury is drawing federal or state benefits. Many employers offer private short-term disability insurance. Alternatively, the person could be taking extended sick leave.

- Ask yourself how you know the person is drawing federal or state benefits. Has the individual told you so? Have you seen documentation from either the state or federal agency?

-

4Understand what constitutes fraud. Workers' compensation fraud is the act of making a false or fraudulent workers' compensation insurance claim. It may be committed by either an employee or an employer.[6]

- For instance, an employee who fakes an injury to collect benefits would be committing fraud.

- Likewise, an employer that knowingly fails to have workers' compensation insurance coverage is also committing fraud.[7]

-

5Learn the penalties for fraud. Individuals who make fraudulent workers' compensation claims may be subject to harsh penalties such as imprisonment and/or a fine. The severity of the punishment depends on the state.

- In California, making a false or fraudulent claim is a felony. You would be subject to 5 years in prison or a fine up to $50,000.[8]

- In New Jersey, failure to provide workers' compensation insurance can result in civil penalties of $1,000 for the first 20 days and can escalate to 18 months in jail for serious offenses.

Reporting the Suspected Fraud

-

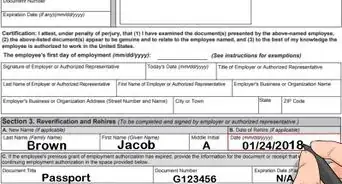

1Document the alleged fraud. You will need evidence that the person or organization has committed fraud. If your employer has misclassified employees or failed to purchase workers' compensation insurance as required by law, then you will want documents related your employer's payroll. If you are reporting fraud perpetrated by a claimant of compensations benefits, then you will need the following:

- Description of the suspicious activity (e.g., performing heavy labor or running around)

- Location where you observed the activity

- The time and date

- How the fraud was committed

- Why the person has committed fraud (if known)

- Who else has knowledge of the fraudulent activity

-

2Obey the law. As you gather evidence, be sure not to break the law. There is no reason to trespass, open someone's mail, hack into someone's computer, or snoop in order to get evidence.

- It is against federal law to open someone's mail without permission.[9] You are not permitted to open an adult child's mail simply because you are a parent.

- The legality of videotaping someone without their consent depends on state law. Generally, if the person is in public space, then you may videotape them. People have no expectation of privacy when they are walking in public, standing in their driveway, or sitting on their porch.

- Thirteen states prohibit using a camera in private places, such as someone's home. These states include Alabama, Arkansas, California, Delaware, Georgia, Hawaii, Kansas, Maine, Michigan, Minnesota, New Hampshire, South Dakota, and Utah.[10] In other states, such as New Jersey, videotaping someone in private could subject you to a civil suit for intrusion or invasion of privacy.[11]

- Rather than videotape someone and risk being sued, you could simply document in writing the day and time you noticed the activity. Once you have notified your state's Department of Insurance, you can leave it to them to investigate further.

-

3Find your state's Department of Insurance. You can report the suspected fraud to your State Department of Insurance program. Visit this website and select your state.

- The website should provide a link for how to report fraud. Look for links to “Whistleblowers” or “Report Fraud.” Kentucky's website, for example, has a link for “Report Fraud.” It provides a link to a form, as well as the number to a telephone hotline.[12]

- New Jersey's website provides a hotline (609-292-2414) and an email address (oscf@dol.state.nj.us) for providing tips on fraudulent activity related to workers' compensation. Your referral will be completely confidential.

- To report fraud committed by federal employees or by recipients of federal workers' compensation benefits, contact the federal government's Department of Labor. You can call Office of Inspector General hotline at 1-800-347-3756 or email at hotline@oig.dol.gov.

-

4Report the fraud. Gather your documentation and contact the appropriate Department of Insurance. If you are filling out a form, use blue or black ink, or fill out the form online in PDF format.

- If the Department of Insurance requests that you mail in evidence (such as employer documents or notes on someone's activity), then be sure to keep a copy of any evidence for your files.

-

5Understand whistleblower protection. If you report fraud committed by an employer, federal or state law could protect you. To see if your state has a whistleblower protection law, visit this website.

- Many state laws protect only public employees who work for the government. If you work in a private business, you may want to consult with an attorney before reporting the fraud so that you can be sure of the risks involved.

References

- ↑ https://www.law.cornell.edu/wex/workers_compensation

- ↑ https://www.law.cornell.edu/wex/workers_compensation

- ↑ S.G. Borelleo & Sons, Inc. v. Dept. of Industrial Relations (1989) 48 Cal. 3d 341, 256 Cal. Rptr. 543.

- ↑ http://www.disabilitysecrets.com/workmans-comp-question-9.html

- ↑ http://www.nolo.com/legal-encyclopedia/denied-workers-compensation-claims.html

- ↑ http://www.laworks.net/Downloads/OWC/wcfrauddef.pdf

- ↑ http://www.laworks.net/Downloads/OWC/wcfrauddef.pdf

- ↑ Cal. Lab. Code 5432

- ↑ https://www.law.cornell.edu/uscode/text/18/1702

-Status-Step-6.webp)