This article was co-authored by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

There are 11 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 23,445 times.

You may already be taking precautions against identity theft, but did you realize that identity thieves might also try to take your home? The scam here is to take your identity information and use it to transfer ownership of your home by filing a new deed. Purchase title insurance whenever you buy a new property to protect you from mistakes that might've happened while someone else owned the home.[1] You can also take some simple steps, like monitoring your property deed, to prevent scams as a homeowner. While there are "title-monitoring" companies who will help protect against property title theft for a fee, you can actually do it yourself for free without a lot of effort.[2]

Steps

Getting Title Insurance

-

1Shop around for policies at different title insurance companies. In most states, title insurance companies compete with one another, so you're likely to find a better rate if you shop around. After your offer on a property has been accepted, ask your real estate agent or attorney who they would recommend, then branch out from there.[3]

- Real estate agents are required to provide you the names of 3 title insurance companies. These will typically be companies they've worked with before, but they might not be the best for you.[4]

- In some states, such as Texas, the premium rate is set by the state insurance department. If rates are set, there's no need to shop around — just use whoever your real estate agent or attorney recommends.[5]

-

2Wait for the completion of the title search. Before a title insurance company will sell you title insurance, they'll conduct a title search to ensure that the title to the property you want to buy is clear. If there are any issues or discrepancies, these typically have to be cleaned up before the company will sell you insurance.[6]

- The most common example of a problem (also called a "defect" in the title) would be if someone else had a lien on the property, such as a mortgage lien or a tax lien for unpaid taxes. It would be the seller's responsibility to clear those issues before you could purchase the property.

- Sometimes a title search will also uncover a discrepancy with the way the boundaries of the property are described from one deed to the next. In these situations, you would typically talk to the owners of the neighboring properties to resolve the issue.

Advertisement -

3Read your policy provisions carefully so you know what it covers. Before you buy your title insurance, make sure you understand exactly what you're buying and how long your coverage will last. There are 2 basic types of title insurance:[7]

- A loan policy or lender's policy lasts for the life of your mortgage and protects your mortgage holder's interest in the property.

- An owner's policy protects you against losses that might arise from deed or title problems that occurred before you bought the property. An owner's policy does not protect you against deed fraud or other issues that come up after you've bought the property.

-

4Pay your title insurance premium. Typically, your title insurance premium will be included in your closing costs for the property. Title insurance doesn't work like other insurance you might be familiar with, in that you don't pay a premium every month for coverage. Instead, you make one lump-sum payment when the insurance is issued and it protects you for the life of the policy.[8]

- Premium rates are based on what you pay for the property. For example, in Texas, you would pay a total premium of $875 for a $100,000 policy, as of 2020.[9]

- Mortgage lenders typically require you to buy a lender's policy. You can buy both a lender's policy and an owner's policy. If you buy both, you might get a discount on the lender's policy. For example, in Texas, where title insurance premiums are regulated, you can get the lender's policy for only $100 if you also buy the owner's policy.[10]

-

5Keep your title insurance policy in a safe place. Your title insurance policy is one of those documents that you should keep forever, or at least as long as you own the property. Keep it in a safe or a fireproof box so you'll always have it.[11]

- If you have an owner title insurance policy, keep it even after you sell your home because it's still in effect and still protects you.

-

6Buy an endorsement if your home increases in value. Since your premium was based on the price you paid for the property, it only covers that amount. If your property increases in value over time (as it hopefully will), you can buy an endorsement to cover the difference. The price of the endorsement depends on how much your property has increased in value.[12]

- If you only bought a lender's policy when you bought the property, you can also upgrade to an owner's policy at any time. However, if you buy later, you'll typically pay the full price for the owner's policy — meaning you'll probably save some money if you buy them both when you initially purchase the property.

Preventing Deed Fraud

-

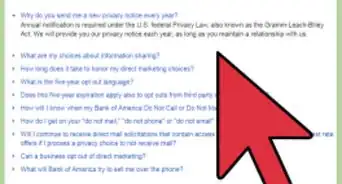

1Protect sensitive information by keeping it private and secure. Deed fraud or title theft is a form of identity theft, so by protecting your identity information, you also help protect your property title. Things you should do to protect your identity include:[13]

- Only carry essential identification with you

- Keep personal and identifying information at home in a lockbox

- Shred documents that contain sensitive information

- Opt out of direct mail credit offers

- Don't sign the back of your credit or debit cards

- Avoid giving out credit card numbers or identifying information over the phone

- Verify emails you get from creditors or other agencies

-

2Monitor your credit report for signs of identity theft. There are many different credit monitoring services you can choose from to monitor your credit report. Sign up for notifications so you'll get an alert when there's a change. Then, you can immediately review the change and spot any attempted identity theft more quickly.[14]

- Some of these services are free, while others charge an annual or monthly subscription fee. Compare the different services and what they offer. A subscription service might be better for you, but make sure anything offered above and beyond what you would get from a free service is something you'd actually use and get benefit from.

-

3Set reminders for dates when you're supposed to get property bills. Normally, you don't have to worry about not receiving your property tax bill. If it happens that you don't, your bill might have been diverted to another address. This can be one of the first clear signs of attempted deed fraud.[15]

- Make sure you know when you're supposed to get your property tax bill — if you're not sure, find out! Make a note on your calendar or set a reminder on your smartphone so you'll know when to expect it.

-

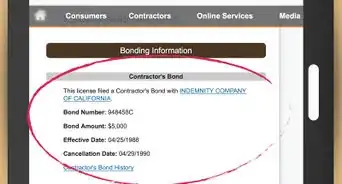

4Check for new property records at the recorder's office every few months. Call or stop by your city or county recorder's office and ask if any new documents have been recorded for your address. There's usually no charge to look this information up, although you might have to pay a small fee if you request a copy of a document.[16]

- Some offices have this system digitized so that you can also check property records online. The website for your city or county recorder's office will have more information about this.

-

5Keep your address up to date with your state property tax office. If you own property that you don't live at, update your address when you move so the bills come to you, not to the other location. Identity thieves often target second or vacation homes precisely because the owner is less likely to pay attention.[17]

- If you're renting out a property, be alert for rent payments from tenants as well. Identity thieves might send a letter to your tenants, posing as you, and tell them to mail their payments to another address.

-

6Find out if your city or state has free deed fraud protection. Many cities and states offer deed monitoring services so you don't have to remember to check with the recorder's office on your own. Check your city's website or call the recorder's office to find out. If the program is free, go ahead and sign up for it to enjoy a little more peace of mind.[18]

- For example, if you own property in Philadelphia, you can sign up for their "Deed Fraud Guard" for free through the city's website. The service notifies you by email when a document is recorded with your name on it.[19] New York City has a similar service called the "Recorded Document Notification Program."[20]

Reporting Deed Fraud

-

1Request a certified copy of your deed from the recorder's office. Contact the recorder's office in the city or county where the property is located and request a certified copy of the deed (if you don't already have one in your records). You'll need this when you report the fraud to prove that you're the rightful owner of the property.[21]

- The recorder's office will likely charge a fee for the copy and a separate fee to have the copy certified. When you call the recorder's office, ask for the total charge and what methods of payment are accepted.

- It might take a few days for your copy to be ready. The person you speak to at the recorder's office will let you know when you can come to pick up your copy. You can also get it mailed to you, although you'll probably also have to pay for shipping.

-

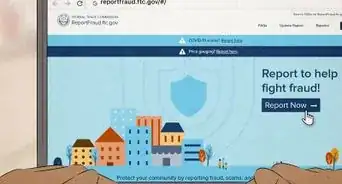

2Notify the recorder's office of the suspected fraud. While you're getting a certified copy of your deed, go ahead and tell the recorder that you suspect deed fraud. If you've gotten notification of a recent document recorded on your property, you might point them to that document.[22]

- While recorder's offices don't typically have any law enforcement capabilities, they can make a note in the property record that you reported deed fraud, which might prevent the identity thief from doing anything with the property, such as taking out a mortgage on it.

-

3File a police report with the local police. Once you have your deed, take it and any other evidence you have to the nearest police precinct and tell the desk officer that you want to file a deed fraud report. They'll assign an officer to take your report and evidence.[23]

- Get the name and direct contact information of the officer who takes your report in case you get more information that you want to add.

- It might take a few days for the written report to be ready. The officer will let you know when you can come and pick it up.

- While the local police might not necessarily launch an investigation, the official report is a valuable record for you. Keep it along with your deed, title insurance policy, and other documents related to your property.

-

4Contact your state attorney general's office to report the fraud. Your state attorney general handles identity theft and fraud. Look up contact information and file a report, including your police report and all related documents. They'll conduct an investigation and attempt to identify the perpetrators.[24]

- Usually, you can file a report with the state attorney general's office over the phone. However, you may also need to go to the office in person to speak with a staff attorney. Provide them with copies of any documents you have, including your police report and your deed.

- State attorneys general alert other homeowners to deed theft and other housing-related scams that might be happening in their area, so by informing the state attorney general's office, you're also helping protect others.[25]

Warnings

- This article primarily covers how to protect a property title in the US. If you live in another country, the procedures and resources available to you might be different. Consult an attorney or real estate agent.⧼thumbs_response⧽

- While you can always sign up for a deed protection program, these services are typically a waste of money because they don't do anything you can't do yourself for free.[27]⧼thumbs_response⧽

References

- ↑ https://www.tdi.texas.gov/title/titlefaqs.html

- ↑ https://www.kiplinger.com/article/real-estate/t048-c050-s002-how-to-protect-your-home-from-deed-theft.html

- ↑ https://www.consumerfinance.gov/owning-a-home/close/shop-title-insurance/

- ↑ https://www.colorado.gov/pacific/dora/news/consumer-advisory-title-insurance-what-it-and-why-do-you-need-it

- ↑ https://www.tdi.texas.gov/title/titlefaqs.html

- ↑ https://www.colorado.gov/pacific/dora/news/consumer-advisory-title-insurance-what-it-and-why-do-you-need-it

- ↑ https://www.tdi.texas.gov/title/titlefaqs.html

- ↑ https://www.colorado.gov/pacific/dora/news/consumer-advisory-title-insurance-what-it-and-why-do-you-need-it

- ↑ https://www.tdi.texas.gov/title/titlefaqs.html

- ↑ https://www.tdi.texas.gov/title/titlefaqs.html

- ↑ https://www.colorado.gov/pacific/dora/news/consumer-advisory-title-insurance-what-it-and-why-do-you-need-it

- ↑ https://www.tdi.texas.gov/title/titlefaqs.html

- ↑ https://www.comfortlife.ca/blog/how-to-protect-your-home-from-mortgage-and-real-estate-title-fraud-6397/

- ↑ https://www.consumer.ftc.gov/articles/0235-identity-theft-protection-services

- ↑ https://www.kiplinger.com/article/real-estate/t048-c050-s002-how-to-protect-your-home-from-deed-theft.html

- ↑ https://www1.nyc.gov/site/finance/taxes/deed-fraud.page

- ↑ https://www.kiplinger.com/article/real-estate/t048-c050-s002-how-to-protect-your-home-from-deed-theft.html

- ↑ https://www.phila.gov/services/property-lots-housing/get-help-with-deed-or-mortgage-fraud/sign-up-for-deed-fraud-protection/

- ↑ https://www.phila.gov/services/property-lots-housing/get-help-with-deed-or-mortgage-fraud/sign-up-for-deed-fraud-protection/

- ↑ https://www1.nyc.gov/site/finance/taxes/deed-fraud.page

- ↑ https://miami-dadeclerk.com/property_deed_fraud.asp

- ↑ https://www.phila.gov/services/property-lots-housing/get-help-with-deed-or-mortgage-fraud/report-suspected-deed-or-mortgage-fraud/

- ↑ https://miami-dadeclerk.com/property_deed_fraud.asp

- ↑ https://www.phila.gov/services/property-lots-housing/get-help-with-deed-or-mortgage-fraud/report-suspected-deed-or-mortgage-fraud/

- ↑ https://ag.ny.gov/press-release/2020/attorney-general-james-launches-protect-our-homes-initiative-combat-deed-theft

- ↑ https://www.tdi.texas.gov/title/titlefaqs.html

- ↑ https://www.kiplinger.com/article/real-estate/t048-c050-s002-how-to-protect-your-home-from-deed-theft.html