X

wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, volunteer authors worked to edit and improve it over time.

This article has been viewed 25,603 times.

Learn more...

Sallie Mae allows you to make payments on your student loan services using a debit card, personal check, money order, or bill-pay service through your bank. At this time, you cannot pay Sallie Mae using a credit card; however, you can apply for one or more exclusive credit cards through Sallie Mae that offer reward points and cash back on student-related purchases that can help pay off your student loans.

Steps

Method 1

Method 1 of 2:

Applying for the Sallie Mae MasterCard

-

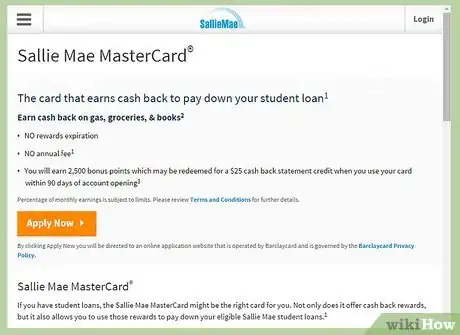

1Navigate to Sallie Mae’s website at https://www.salliemae.com/credit-cards/sallie-mae-card/.

-

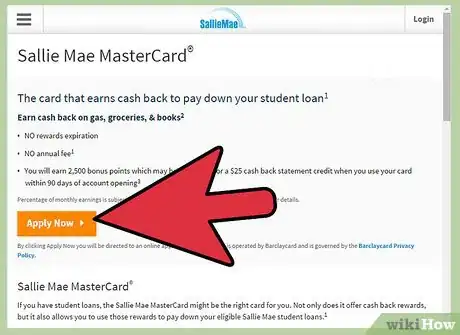

2Click on “Apply Now.” You will be redirected to an online application website operated by Barclaycard.Advertisement

-

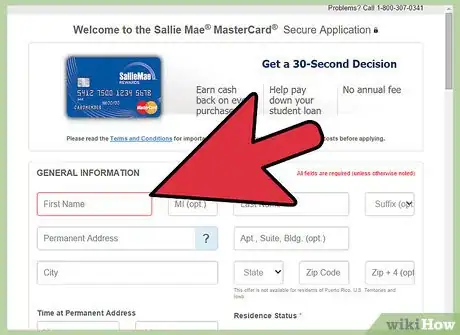

3Fill out all required fields on the form to apply for a Sallie Mae MasterCard. You will be required to provide your name, address, employment and financial information, security information, and more.[1]

-

4Click on “Apply” at the bottom of your session. The website will process your information, inform you whether you qualify for a MasterCard, and send you a card if applicable.[2]

-

5Use your Sallie Mae MasterCard when purchasing groceries, gasoline, and books. Sallie Mae offers rewards whenever you purchase groceries, gas, and books from participating merchants.[3]

- Review the terms and conditions of your Sallie Mae MasterCard agreement to locate participating merchants in your area.

-

6Continue using your Sallie Mae MasterCard until you’ve earned at least 2,500 reward points, which equates to $25. You can only redeem reward points after you’ve earned at least $25.

-

7Redeem your credit card reward points at https://www.barclaycardus.com/. You can either apply your reward points to your student loans, or request cash back to help pay off your student loans.

Advertisement

Method 2

Method 2 of 2:

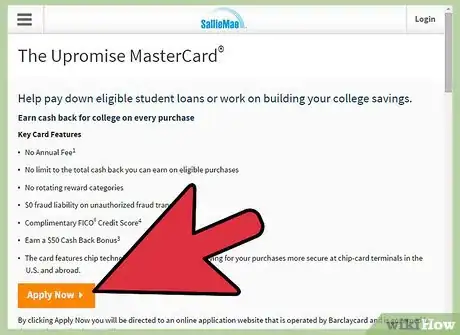

Applying for the Upromise MasterCard

-

1Navigate to Sallie Mae’s website.

-

2Click on “Apply Now.” You will be redirected to an online application website operated by Barclaycard.

-

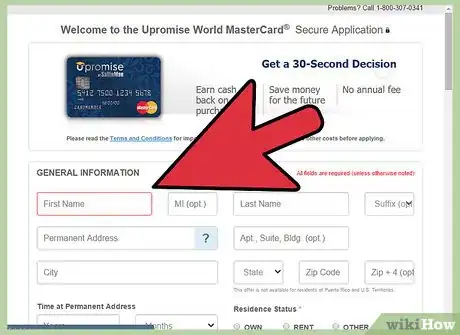

3Fill out all required fields on the form to apply for a Upromise MasterCard. You will be required to provide your name, address, employment and financial information, security information, and more.

-

4Click on “Apply” at the bottom of your session. The website will process your information, inform you whether you qualify for a Upromise MasterCard, and send you a card if applicable.

-

5Use your Upromise MasterCard for online purchases, restaurants, online travel, movie theaters, department store purchases, and all other purchases to qualify for the cash back rewards program. The Upromise credit card offers cash back on most purchases from participating merchants.

- Review the terms and conditions of your Upromise MasterCard agreement to locate participating merchants in your area.

-

6Sign up for the Sallie Mae Upromise rewards program at http://www.upromise.com/ to receive your cash back earnings. You can then apply your cash earnings to your student loans with Sallie Mae.

Advertisement

References

About This Article

Advertisement