This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 53,264 times.

Individuals around the world take out different kinds of loans for many different purposes. Each loan is a unique contract between the lender and the borrower. Evaluating loans must take place on a case-by-case basis. However, there are certain conventions that have become somewhat universal in terms of lending. One of these is the process that many borrowers use to pay off loans early by putting extra money toward the principal of the loan. For those who are looking at how to pay extra for the principal of a loan, these are some of the most common steps recommended by lending experts and those who have experience in working with lenders on existing loan products.

Steps

Changing Your Payment Agreement

-

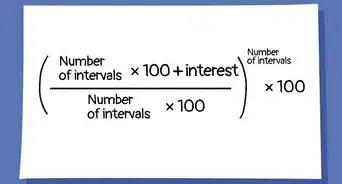

1Switch to bi-weekly payments. Talk to your lender about possibly switching to bi-weekly payments rather than making full payments every month. Bi-weekly payments take advantage of the fact there are 12 months in the year but 52 weeks. If you pay half the amount every two weeks, by the end of the year you'll have made 13 full payments rather than 12.[1]

- Talk to your bank or lender about setting up a bi-weekly payment plan. Some companies are willing to set up a plan of this type for free while others might charge a fee.[2]

- Sometimes, outside companies offer to set up bi-weekly payments for you. However, this is unnecessary. You should not have to pay additional fees for something you can do yourself.[3]

-

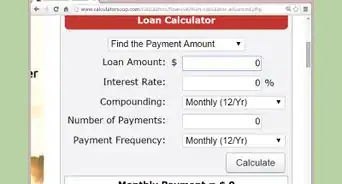

2Go for a shorter term mortgage. If you have a mortgage payment, you can save money by shortening your mortgage. You can shorten a 20 year payment plan to a 15 year one. While payments will be higher, you can work with your lender to find manageable payments and interest rates. However, if you're worried about affordability you don't have to refinance your mortgage. You can find a refinance calculator online and see what your rates would be with a shorter term plan. Then, take initiative on your own to pay more each month. If you're unable to make the higher mortgage payment one month, you won't be in any trouble with the bank.[4]Advertisement

-

3Agree to make one extra payment each year. You can also talk to your lender about making one extra payment each year. If you plan ahead around the month when the extra payment is due, this is manageable. In some loan agreements, you may get a bonus or a sizable tax refund for making an extra payment.[5]

Paying More Each Month

-

1Increase your monthly checks by one twelfth. If you're unsure you want to renegotiate the terms of your payment plan, you can simply work on increasing your monthly payments each month. Each month when you write your checks for the loan, increase the amount you're paying by one twelfth. While it might not seem like a lot, you are slowly chipping away at the principal of the loan.[6]

-

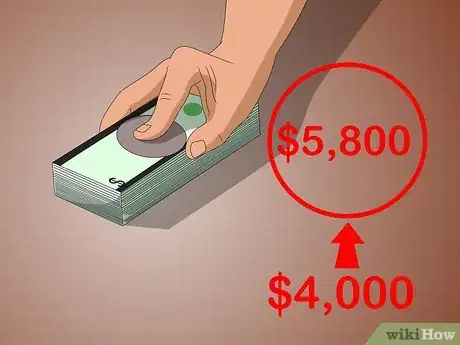

2Pay a bit more each month. Many people are nervous about committing to a payment plan with strict, set amounts. One way simple way to pay extra towards the principal of a loan is to simply pay more each month when you can. If you have extra money one month, put it towards your loan. If you're low on funds the next month, just pay the regular amount.[7]

-

3Understand pros and cons of simply paying more. Some people enjoy the flexibility of simply paying more, but it comes with certain drawbacks. Understand the pros and cons when considering a flexible payment plan.

- You have to take initiative on your own if you're simply paying more. When you agree to a new payment system, you're essentially to pay more. However, going at it alone means you have to take personal responsibility. If you're not great at financing and budgeting on your own, you might want to reconsider simply paying more.

- The main plus side on a flexible payment plan is that you're under no obligation to make higher payments if you can't afford to do so. If you're financial situation is somewhat unstable, this might be a good idea.

- Keep in mind that, for most payment plans, paying extra one month does not mean you will not owe your regular payment the next month.[8]

Avoiding Pitfalls

-

1Make sure to communicate with the lender. If you want to send extra money to a lender, it's not necessary to let the lender know ahead of time. However, communication is important to any smooth borrower/lender relationship. You want to assure extra funds are applied to the principal of your loan. Your borrower may assume the extra money is for your next payment. It's not a bad idea to let a lender know ahead of time if you're planning on putting extra money in one month to go towards the principal of a loan.[9]

-

2Keep track of when payments are due. Paying extra never means you don't owe your regular monthly payments. Keep a calendar to track when payments are due. Make sure you don't miss any payments, as this can affect your interest rates and credit.

-

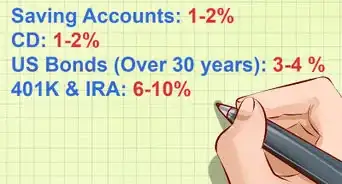

3Budget for extra payments. If you've switched your payment plan, you'll need to form a whole new budget. Many borrowers get overzealous and sign up for a payment plan they cannot keep manage. If you've switched to bi-weekly payments or another payment plan to requires extra money, spend some time budgeting for the extra money. Write down your income and how much you need to put towards the loan each month. Calculate other necessary expenses, like rent and bills. From there, figure out how much money you can reasonably spend on things like food, entertainment, and so on while paying off your loan.

Expert Q&A

-

QuestionExtra money towards the principal, how would I write it out on the check?

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

VP, CAPITALPlus Mortgage Simply write "apply excess towards principal" on the memo of the check.

Simply write "apply excess towards principal" on the memo of the check. -

QuestionCan I ask the lender what the principal amount is, and does this extra money come off the loan balance?

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

VP, CAPITALPlus Mortgage Yes you can ask, but it should also say on your statement each month. If you are paying more than the minimum payment, just be sure to write "apply excess to principal" on the check to make sure that money pays down your balance.

Yes you can ask, but it should also say on your statement each month. If you are paying more than the minimum payment, just be sure to write "apply excess to principal" on the check to make sure that money pays down your balance.

References

- ↑ http://www.bankrate.com/finance/mortgages/4-ways-to-pay-off-your-mortgage-earlier-4.aspx

- ↑ http://www.bankrate.com/finance/mortgages/4-ways-to-pay-off-your-mortgage-earlier-4.aspx

- ↑ http://www.bankrate.com/finance/mortgages/4-ways-to-pay-off-your-mortgage-earlier-4.aspx

- ↑ http://www.bankrate.com/finance/mortgages/4-ways-to-pay-off-your-mortgage-earlier-3.aspx

- ↑ http://www.interest.com/refinance/news/3-free-ways-to-pay-your-mortgage-faster/

- ↑ http://www.interest.com/refinance/news/3-free-ways-to-pay-your-mortgage-faster/

- ↑ http://www.bankrate.com/finance/mortgages/4-ways-to-pay-off-your-mortgage-earlier-2.aspx

- ↑ http://www.interest.com/refinance/news/3-free-ways-to-pay-your-mortgage-faster/

- ↑ http://www.bankrate.com/finance/mortgages/pay-off-mortgage-quickly.aspx