This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

There are 10 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 41,352 times.

Learn more...

If you don't have a bank account, you can find workarounds to pay your bills. Many places don't want you to pay in cash, particularly by mail, so you need to find other solutions. The main options you have are check cashiers, money orders, and prepaid debit cards.

Steps

Using a Check Casher

-

1Find a check casher. A check cashier is a store whose main purpose is to cash checks for people. Of course, most of them charge a small (and sometimes not-so-small) fee to cash the check so they can stay in business. If possible, call a few in your area first to figure out which one has the lowest fee.[1]

- These businesses are most often found in low-income areas, as people in those areas are less likely to have bank accounts.

-

2Cash your check. Often, you will need to cash your check before you can move ahead with paying bills, though with some prepaid debit cards, you can add your check directly to your account. However, if you want to use something like a money order, you'll need to have cash on hand first.[2]Advertisement

-

3Pay bills through the check casher. Though in some cases, you may want to use a money order or a prepaid credit card, check cashiers will also sometimes pay bills for you, again for a fee. You just need your account information for bills like your electric or water, including how much you need to pay. The check cashier will cash your check and then pay the bill from some of the money.[3]

Using Money Orders to Pay Bills

-

1Find a location to get a money order. Many places offer money orders, including banks, post offices, places like Western Union, gas stations, grocery stores, and big box stores. You should be able to find a location near to you that offers money orders.[4]

-

2Have your information ready. A money order is similar to a check, in that you must address it to someone. In this case, you need to make it out to the company whose bill you're paying. You also need the payment amount, as the money order is made out in that amount.[5]

-

3Pay for the money order and fee. The plus side of money orders is that you can use cash, a debit card, or a credit card to pay for the money order. Also, because it's prepaid, it will never bounce like a check can. A money order is basically a check that you prepay for. You tell the person how much goes on it, and then you pay for it. You'll also pay a small fee per money order, usually a dollar or two.[6]

- You'll need a separate money order for each bill you pay.

- Keep the receipt. That's the only proof you have that you created a money order.[7]

-

4Sign the money order. Like a check, the money order needs to be signed by you before you send it, and you sign it on the front. You can also add in a memo about what the payment is for. For example, if you need to add an account number for the bill, it can go in the memo line.[8]

-

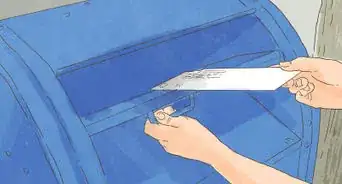

5Mail the money order. Once you have the money order, you can mail it. A money order is safer to mail than cash because it is tied to the recipient, meaning it can't be used by other people, just like a check. However, you should still use a secure envelope to mail it, the kind that has a design inside to obscure what's being mailed.[9]

- Don't forget to add anything that needs to go with it, such as the return receipt for the payment.

-

6Wait for the recipient to cash it. Once you mail it off, all you need to do is wait for the recipient to cash it. They will need to take it to the bank and provide proof that they are who they say they are before they cash it and apply it to your account.[10]

Using an Alternative Debit Card

-

1Pick one that's right for you. AccountNow and PayPal debit card both offer ways to have a debit card without having a checking account. Both work somewhat like a bank account in that you add money to the account. PayPal debit is free (with the exception of some cash withdrawals),[11] while AccountNow is $8 a month.[12]

-

2Add money to the account. Before you can pay bills, you need to add money to the account. That's because these accounts are basically prepaid accounts, and so you need something to draw on before you can use it to pay bills, which is one of the bonuses of these accounts. You don't have to jump through hoops to get these accounts, just sign up. Both accept everyone.[13]

- With AccountNow, you can set up direct deposit for your paycheck or deposit cash at one of the many locations across the country.[14]

- With PayPal, one easy way to add money is to buy PayPal cash. Basically, you buy a PayPal card at a place like CVS, Family Dollar, 7-Eleven, or Dollar Tree. It's just like buying a gift card. Once you have it, you use the number on it to add the money to your account.

-

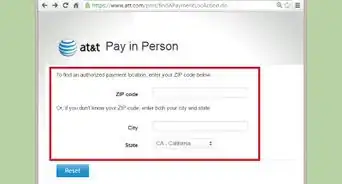

3Use the debit card to pay bills. Once you have cash in the account, you can use your debit card to pay for your bills. Online, most bills can be paid with a debit card, but you can also go in person to pay the bill if you prefer. With PayPal, you'll need to apply for the debit card separately from your account, but it's not difficult to get one.[15]

- With AccountNow, you can even use it pay bills by sending money, rather than entering your debit card on the bill's website or in person. The company will send out checks.

Community Q&A

-

QuestionCan a company garnish a PayPal account?

Community AnswerNo, your PayPal account is safe.

Community AnswerNo, your PayPal account is safe. -

QuestionWhat's the difference between a credit card and a debit card?

DonaganTop AnswererA credit card allows you to purchase something without paying for it until later. A debit card immediately pays for a purchase with money in a linked checking account.

DonaganTop AnswererA credit card allows you to purchase something without paying for it until later. A debit card immediately pays for a purchase with money in a linked checking account. -

QuestionCan I pay my cable bill with a prepaid card?

DonaganTop AnswererProbably. Only the cable company can tell you for sure.

DonaganTop AnswererProbably. Only the cable company can tell you for sure.

References

- ↑ http://www.poverty-action.org/blog/could-you-manage-your-finances-without-bank-account

- ↑ http://www.poverty-action.org/blog/could-you-manage-your-finances-without-bank-account

- ↑ http://www.poverty-action.org/blog/could-you-manage-your-finances-without-bank-account

- ↑ http://www.bankrate.com/finance/personal-finance/how-do-money-orders-work.aspx

- ↑ http://www.bankrate.com/finance/personal-finance/how-do-money-orders-work.aspx

- ↑ https://www.nerdwallet.com/blog/banking/money-orders/

- ↑ http://www.bankrate.com/finance/personal-finance/how-do-money-orders-work.aspx

- ↑ http://www.bankrate.com/finance/personal-finance/how-do-money-orders-work.aspx

- ↑ https://www.nerdwallet.com/blog/banking/money-orders/

- ↑ http://www.bankrate.com/finance/personal-finance/how-do-money-orders-work.aspx

- ↑ https://www.paypal.com/bm/cgi-bin/webscr?cmd=xpt/account/DCIntro-outside

- ↑ http://www.offthegridnews.com/financial/3-simple-steps-to-surviving-without-a-bank-account/

- ↑ http://www.offthegridnews.com/financial/3-simple-steps-to-surviving-without-a-bank-account/

- ↑ https://www.accountnow.com/

- ↑ http://www.offthegridnews.com/financial/3-simple-steps-to-surviving-without-a-bank-account/